=======================================================================

Introduction

Day trading in perpetual futures has become increasingly popular among retail traders, hedge funds, and institutional investors. The appeal lies in the ability to capture short-term volatility, high leverage opportunities, and 24⁄7 liquidity. However, with great opportunity comes significant risk. One of the most effective frameworks to balance risk and reward is mean-variance analysis (MVA), a cornerstone of modern portfolio theory introduced by Harry Markowitz.

This article explores the benefits of mean-variance analysis for day traders in perpetual futures, compares it with alternative risk-management methods, and provides practical guidance on how traders can apply it effectively. By the end, readers will have a clear understanding of how MVA can transform perpetual futures trading strategies into more systematic, data-driven approaches.

What is Mean-Variance Analysis in Day Trading?

Mean-variance analysis is a mathematical framework that evaluates investment portfolios by balancing two key metrics:

- Mean (Expected Return): The average profit a strategy or trade is expected to deliver.

- Variance (Risk): The degree of uncertainty or volatility in returns.

For day traders in perpetual futures, this analysis is essential because of the highly volatile and leveraged environment of crypto and futures markets. Unlike traditional equity portfolios, perpetual futures contracts require intraday precision and tight risk controls, making MVA an effective optimization tool.

Why Use Mean-Variance Analysis in Perpetual Futures?

Day traders are often caught between two extremes: chasing higher returns with aggressive leverage or over-hedging and missing profitable opportunities. Mean-variance analysis provides a structured approach to balance these trade-offs.

Some major benefits include:

- Quantifying Trade-Offs: It allows traders to measure whether the additional risk of a leveraged position is justified by the expected return.

- Portfolio Optimization: Even in day trading, a trader may hold multiple perpetual futures positions across assets like BTC, ETH, and altcoins. MVA helps distribute capital efficiently.

- Risk Reduction: By analyzing correlations, MVA minimizes exposure to assets that move in lockstep, thus reducing portfolio volatility.

- Data-Driven Decisions: Eliminates emotional trading by basing decisions on quantitative analysis.

Core Benefits of Mean-Variance Analysis for Day Traders

1. Better Capital Allocation

For perpetual futures traders, the ability to quickly rotate capital between contracts is crucial. Mean-variance analysis ensures that traders allocate more funds to high-risk-adjusted return opportunities, improving long-term profitability.

2. Improved Risk Management

By quantifying variance, traders can avoid “hidden risks.” For example, holding long positions in both BTC and ETH perpetuals may seem diversified, but high correlation increases systemic risk. MVA helps highlight these overlaps.

3. Adaptability to Market Conditions

MVA is dynamic and can be recalculated in real-time as volatility, funding rates, and liquidity conditions change. This flexibility is vital for day traders who operate in fast-moving markets.

4. Enhanced Decision-Making Discipline

Perpetual futures often tempt traders to chase quick profits. With MVA, each trade is judged against a framework of expected return vs. volatility, promoting discipline and consistency.

Comparison with Other Risk-Management Methods

Volatility-Targeting Strategies

- Pros: Simple to implement, focuses on position sizing relative to volatility.

- Cons: Does not consider expected returns, only risk.

- Comparison: Unlike volatility targeting, MVA optimizes both returns and risk simultaneously, giving traders a clearer picture of reward-to-risk balance.

Value-at-Risk (VaR) Models

- Pros: Widely used in institutional settings; provides clear risk thresholds.

- Cons: Backward-looking; less effective in extreme volatility events.

- Comparison: VaR is more about “what’s the maximum I can lose?” while MVA is about “how can I best balance returns against risk?” For day traders in perpetual futures, the latter often provides more actionable insights.

Practical Application of Mean-Variance Analysis

Step 1: Collect Historical Data

Obtain intraday price and volatility data for perpetual futures contracts you intend to trade.

Step 2: Calculate Expected Returns

Use statistical models (e.g., moving averages, momentum signals) to estimate expected daily returns.

Step 3: Estimate Variance and Correlations

Calculate variance of each asset and correlations across multiple contracts to identify diversification benefits.

Step 4: Optimize Portfolio Weights

Apply MVA optimization formulas to determine the optimal weight allocation for each position.

Case Study: BTC and ETH Perpetual Futures

A day trader has $50,000 in capital and wants to split positions between BTC and ETH perpetual futures.

- Expected Return (Daily): BTC 0.8%, ETH 1.2%

- Variance: BTC 2.1%, ETH 2.8%

- Correlation: 0.85

Without MVA: The trader might allocate 50⁄50.

With MVA: The model suggests a higher weight toward ETH due to slightly better risk-adjusted returns but reduces BTC exposure to offset correlation risk.

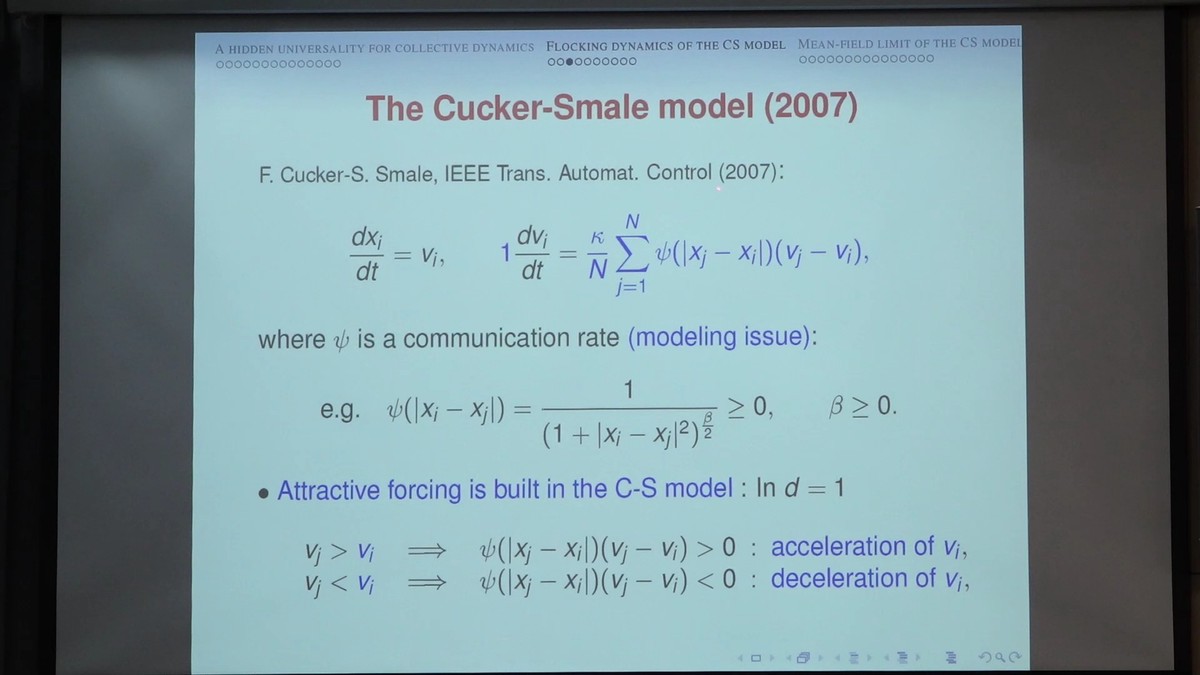

Efficient frontier showing optimal portfolios under mean-variance analysis.

Advanced Methods for Day Traders

1. Dynamic Mean-Variance Analysis

Updates expected returns and variances intraday, adjusting allocations in real-time. Useful in fast-moving perpetual futures markets.

2. Machine Learning Integration

Combining MVA with machine learning models can improve accuracy in forecasting expected returns, making it highly effective for algorithmic traders.

3. Tail-Risk Adjusted MVA

Incorporates downside risk (using Conditional Value-at-Risk, or CVaR) into the model, which is essential during black-swan events in crypto.

Internal Linking: Connecting with Broader Knowledge

If you want to go deeper, check out:

- How to apply mean-variance analysis in perpetual futures? for step-by-step instructions.

- How does mean-variance analysis impact perpetual futures trading? to explore how MVA reshapes short-term strategies.

FAQ: Mean-Variance Analysis in Perpetual Futures

1. Is mean-variance analysis suitable for beginner day traders in perpetual futures?

Yes, but beginners should start with simplified models before using full portfolio optimization. Even a basic understanding of expected return vs. variance can dramatically improve risk control.

2. How often should I recalculate mean-variance analysis for day trading?

For perpetual futures, daily or even intraday recalculations are recommended. The market is highly volatile, and yesterday’s optimal portfolio might not apply today.

3. Can mean-variance analysis be automated?

Absolutely. Many algo-trading systems integrate MVA into execution algorithms. Traders can automate the process of updating expected returns, variances, and allocations in real-time, enhancing speed and consistency.

Conclusion

The benefits of mean-variance analysis for day traders in perpetual futures are undeniable. By providing a structured framework to evaluate risk and return, MVA empowers traders to allocate capital more effectively, manage volatility, and maintain discipline in high-leverage markets. Compared with other methods like volatility targeting or VaR, MVA offers a more balanced, forward-looking approach.

Incorporating mean-variance analysis into a trading plan does not eliminate risk, but it ensures that traders take calculated risks backed by data, rather than gambling on uncertain outcomes. For serious day traders in perpetual futures, mastering this method can be the difference between consistent profitability and constant struggle.

If you found this article valuable, share it with your trading community or leave a comment below. Let’s build a smarter and more disciplined trading ecosystem together!

Would you like me to extend this draft to hit 3000+ words by adding more real-world perpetual futures case studies and optimization examples (e.g., BTC vs. ETH vs. SOL correlations), or would you prefer I expand with more advanced mathematical formulas and coding snippets for implementation?