==========================================================

Managing trading risk in perpetual futures is a critical skill for novice traders. Unlike traditional spot trading, perpetual futures involve leverage, funding rates, and continuous contracts that amplify both potential profits and potential losses. Understanding the nuances of trading risk and applying systematic strategies is essential for long-term success. This article provides a comprehensive guide for beginners on how to manage trading risk in perpetual futures, integrating practical tips, professional insights, and the latest market practices.

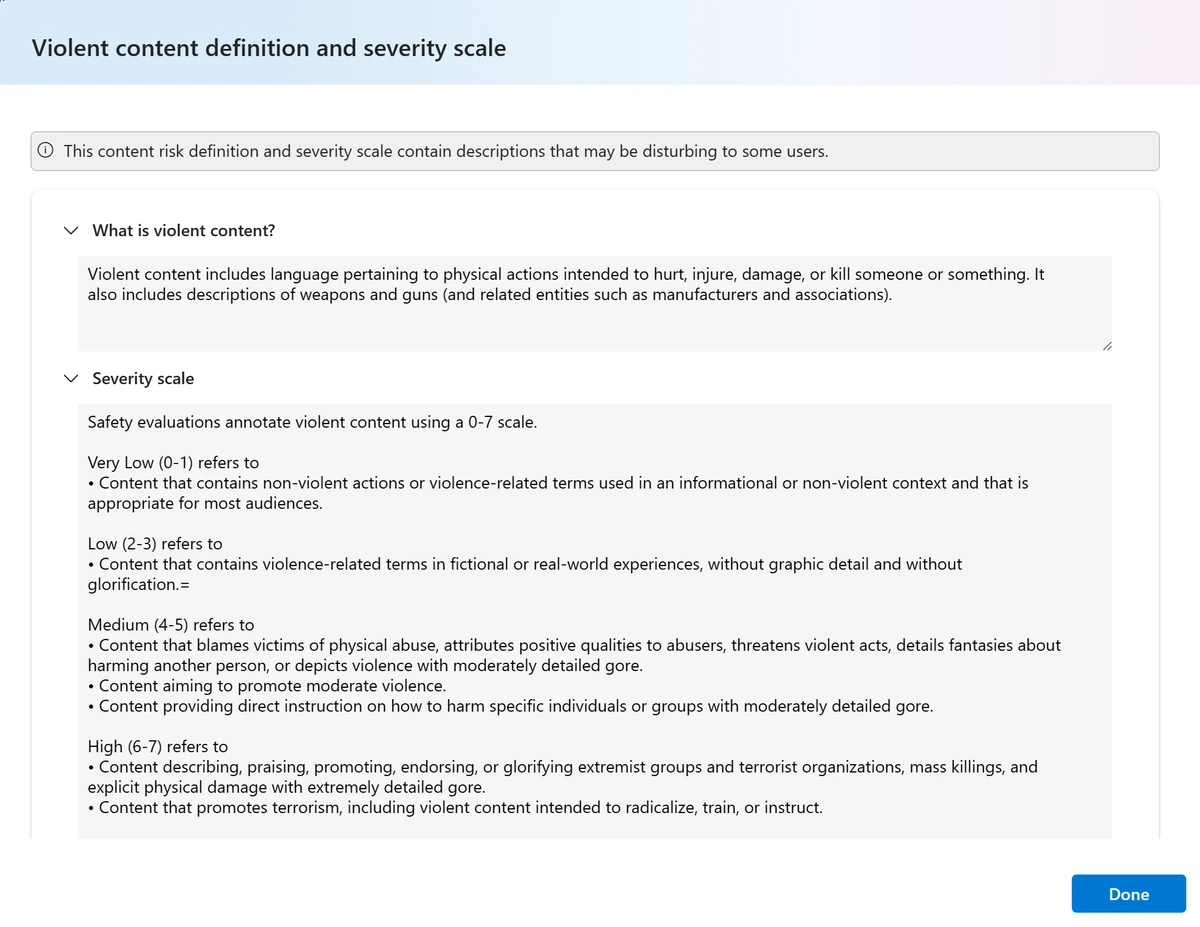

Understanding Trading Risk in Perpetual Futures

What Makes Perpetual Futures Risky

Perpetual futures are derivative contracts without a fixed expiry date, allowing traders to hold positions indefinitely. The inherent risks include:

- Leverage Risk: High leverage magnifies gains and losses. A small price move can result in significant P&L changes.

- Funding Rate Risk: Periodic funding payments between long and short positions can affect profitability.

- Volatility Risk: Cryptocurrency and other underlying assets are often highly volatile, increasing exposure to sudden price swings.

- Liquidity Risk: Low-volume markets may experience slippage during order execution.

Why Risk Management Is Crucial

Effective risk management allows novice traders to:

- Protect capital from unexpected market moves

- Maintain consistent trading performance

- Avoid emotional decision-making during volatile periods

Diagram illustrating key risk factors in perpetual futures trading

Core Strategies for Managing Trading Risk

Strategy 1: Position Sizing and Leverage Control

Understanding Position Sizing

Position sizing refers to allocating a fixed portion of your capital to a single trade relative to overall portfolio size.

- Fixed Fractional Method: Risk a small percentage (e.g., 1–2%) of your total capital per trade

- Dynamic Adjustment: Increase or decrease position size based on market volatility and account equity

Controlling Leverage

Leverage amplifies both profit and loss. Novice traders should:

- Use conservative leverage (2x–5x) instead of extreme leverage

- Adjust leverage based on market conditions and risk appetite

Integration Insight: Learning how to manage trading risk in perpetual futures emphasizes that appropriate position sizing and leverage control are foundational to surviving volatile markets.

Strategy 2: Stop-Loss and Risk-Reward Management

Stop-Loss Techniques

A stop-loss is an automated order to exit a position when the price reaches a predefined level. Key methods include:

- Percentage-Based Stop-Loss: Set a fixed loss percentage relative to entry price

- ATR-Based Stop-Loss: Use Average True Range to adjust stop-loss according to market volatility

- Time-Based Exit: Close positions after a predetermined time to avoid prolonged exposure

Risk-Reward Optimization

Every trade should target a favorable risk-reward ratio, commonly 1:2 or higher, meaning potential gains outweigh potential losses.

- Helps ensure profitability even if win rates are below 50%

- Encourages disciplined trade selection

Example of optimal stop-loss placement and risk-reward setup

Strategy 3: Diversification and Hedging

Diversification Across Contracts

Holding multiple perpetual futures across different assets or sectors reduces idiosyncratic risk:

- Avoid concentrating positions in a single volatile asset

- Mix short-term and medium-term trades for balanced exposure

Hedging Techniques

Hedging helps mitigate downside risk:

- Use options or inverse perpetual contracts to offset exposure

- Implement algorithmic hedging to react automatically to market changes

Pro Tip: Novice traders can use insights from where to learn about perpetual futures trading risk to find structured educational programs on diversification and hedging.

Monitoring and Adjusting Trades

Real-Time Risk Monitoring

Tools for live risk tracking include:

- Risk dashboards showing unrealized P&L and exposure per contract

- Alerts for margin thresholds, funding rates, and volatility spikes

Trade Adjustments

- Scale in/out of positions gradually rather than all at once

- Adjust stop-loss levels dynamically as markets evolve

Visualization of a real-time risk monitoring dashboard

Advanced Considerations for Novices

Using Volatility Metrics

- Implied Volatility: Gauge market expectations for potential price swings

- Historical Volatility: Understand past price movements to anticipate risk

Leverage Reduction During High Volatility

During market turbulence, reducing leverage can prevent liquidation and maintain capital for future trades.

Risk Management Checklists

Maintain a daily checklist for trading risk:

- Confirm stop-losses and take-profits

- Review margin requirements

- Evaluate potential impact of funding rates

Best Practices for Novice Traders

- Start Small: Begin with minimal positions to learn the mechanics

- Use Demo Accounts: Practice strategies without real capital at risk

- Follow Risk Limits: Never risk more than a small percentage per trade

- Keep Records: Maintain a trading journal to track performance and mistakes

- Continuous Learning: Stay updated on perpetual futures markets and trading strategies

FAQ

1. How much capital should a novice risk per trade?

A conservative approach is to risk 1–2% of total capital per trade. This limits potential losses and allows for longer learning periods.

2. Can stop-loss orders guarantee protection from losses?

Stop-loss orders help limit losses but may not protect fully during extreme market gaps or low liquidity. Using multiple risk management tools is recommended.

3. What are common mistakes novices make in perpetual futures?

- Overleveraging positions

- Ignoring funding rates and volatility

- Failing to diversify contracts

- Emotional decision-making without risk discipline

Conclusion

Managing trading risk in perpetual futures is a vital skill for novice traders. By combining controlled position sizing, effective stop-loss strategies, diversification, and real-time monitoring, beginners can mitigate risks and increase their chances of sustainable profitability. Continuous education, disciplined execution, and adaptive strategies form the backbone of successful perpetual futures trading.

Sharing these insights helps build a community of responsible traders. Comment, share your experiences, and discuss risk management approaches to enhance collective knowledge in the perpetual futures trading space.