===========================================

Scenario analysis has become a critical tool in modern finance and trading, allowing professionals to anticipate potential outcomes and make data-driven decisions. Its practical applications range from risk management to portfolio optimization, helping traders, analysts, and investors prepare for market uncertainties. This article explores how scenario analysis works, its real-world applications, and strategies to implement it effectively.

Understanding Scenario Analysis

What Is Scenario Analysis?

Scenario analysis is a method of evaluating how different hypothetical situations could impact financial performance. It involves defining multiple scenarios — best-case, worst-case, and base-case — and analyzing potential outcomes based on various assumptions.

Key Features:

- Involves multiple scenarios rather than a single forecast

- Helps quantify risks and potential rewards

- Integrates both quantitative and qualitative factors

Practical Insight: Scenario analysis is widely used in risk management, especially for derivatives and perpetual futures, to assess potential market shocks.

Why Scenario Analysis Is Important

Scenario analysis allows investors to prepare for volatility and uncertainty, making it an essential component of strategic planning.

Benefits Include:

- Identifying hidden risks in portfolios

- Informing hedging strategies

- Improving decision-making under uncertainty

Embedded Link: Explore why scenario analysis is important in trading to understand its impact on financial decision-making.

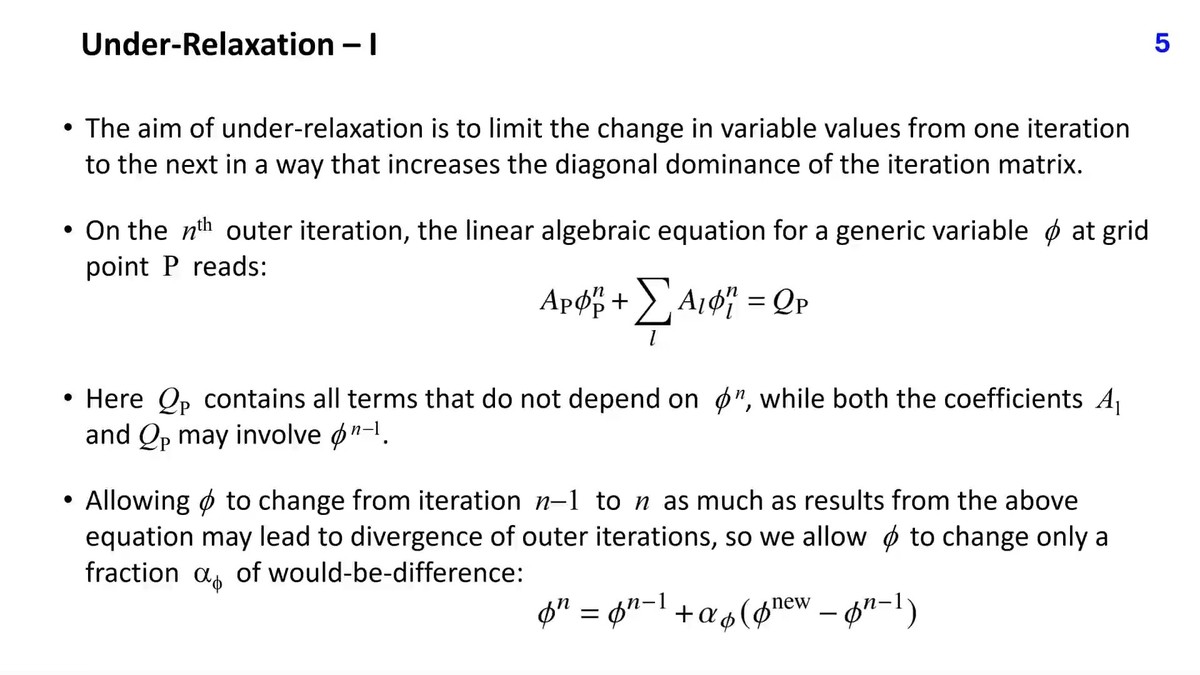

Methods of Scenario Analysis

Method 1: Deterministic Scenario Analysis

Deterministic scenario analysis involves manually setting specific parameters and observing outcomes. This method is straightforward but requires careful assumptions.

Steps:

- Define key market variables (e.g., interest rates, asset prices, volatility)

- Create scenarios (optimistic, pessimistic, realistic)

- Model the impact on portfolio or strategy

Pros: Simple, easy to communicate results

Cons: May oversimplify complex markets

Method 2: Stochastic Scenario Analysis

Stochastic scenario analysis uses statistical simulations, such as Monte Carlo methods, to generate thousands of possible outcomes.

Steps:

- Define probability distributions for input variables

- Run simulations to generate outcome ranges

- Analyze the probability of gains and losses

Pros: Captures a wide range of possibilities

Cons: Computationally intensive, requires data expertise

Comparison of deterministic vs. stochastic scenario analysis approaches.

Applying Scenario Analysis in Trading

Scenario Analysis for Risk Management

Scenario analysis enables traders to anticipate losses and optimize capital allocation.

Techniques:

- Stress testing portfolios under extreme conditions

- Adjusting leverage and exposure based on projected risk

- Integrating with stop-loss and hedging strategies

Embedded Link: Learn how to integrate scenario analysis with risk management to enhance trading resilience.

Scenario Analysis for Strategy Optimization

By modeling different market conditions, traders can optimize entry and exit points, volatility exposure, and trading strategies.

Applications Include:

- Testing algorithmic trading models under varying market conditions

- Evaluating derivatives positions in perpetual futures

- Identifying opportunities in underperforming markets

Pros: Improves strategic foresight

Cons: Requires accurate data and realistic assumptions

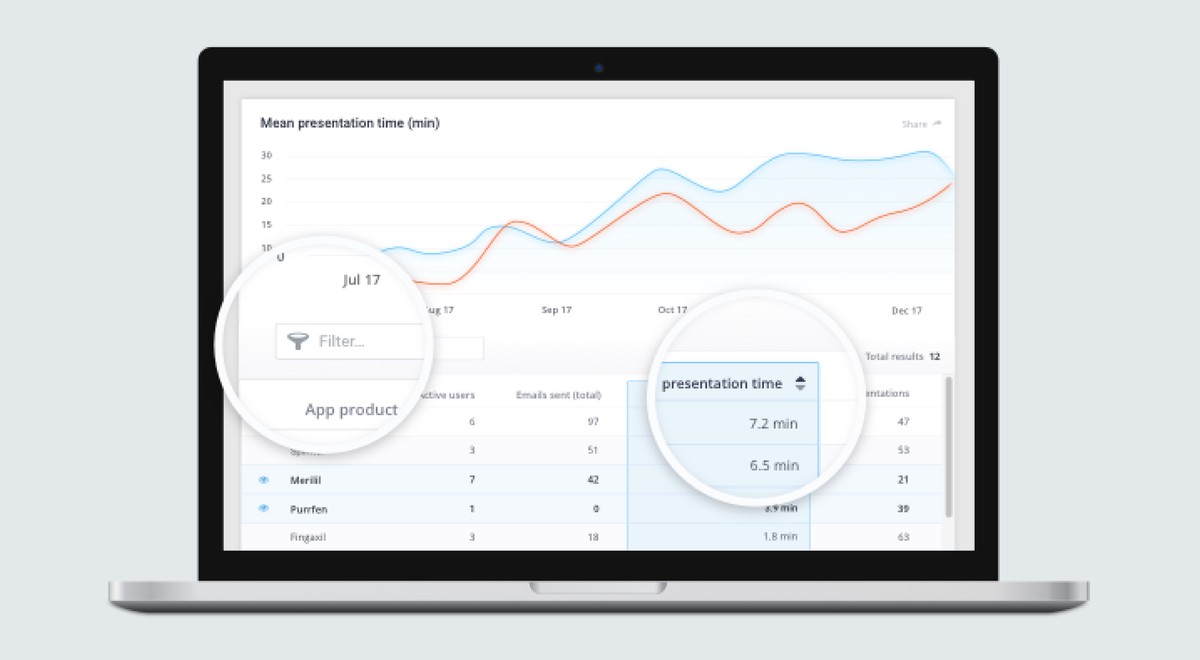

Scenario Analysis in Institutional Applications

Portfolio Stress Testing

Large institutions apply scenario analysis to assess portfolio robustness against macroeconomic shifts, geopolitical events, or interest rate changes.

Example:

- Evaluating equity and bond exposure during economic downturns

- Testing liquidity scenarios in stressed market conditions

Regulatory Compliance

Financial regulators often require scenario analysis for risk reporting, ensuring institutions maintain adequate capital buffers.

Practical Insight: Many hedge funds and banks integrate scenario analysis into quantitative risk frameworks for compliance and decision support.

Example of institutional scenario analysis dashboard showing potential losses under different market shocks.

Advanced Scenario Analysis Techniques

Multi-Factor Scenario Modeling

Multi-factor models incorporate several economic and market variables simultaneously, providing a holistic view of potential outcomes.

Factors May Include:

- Interest rate changes

- Volatility spikes

- Correlated asset movements

Scenario Optimization

Advanced traders use scenario analysis not just for risk assessment, but also for optimizing trading strategies by identifying conditions under which strategies perform best.

Techniques:

- Backtesting strategies across multiple scenarios

- Sensitivity analysis to determine critical variables

- Adaptive strategy adjustments in real time

Practical Tips for Implementing Scenario Analysis

- Start Simple: Begin with deterministic scenarios before moving to stochastic models.

- Use Reliable Data: Accurate historical and real-time data improves the quality of outcomes.

- Document Assumptions: Clearly define assumptions for transparency and reproducibility.

- Combine with Other Tools: Integrate scenario analysis with portfolio management and hedging frameworks.

Step-by-step process for implementing scenario analysis in trading strategies.

FAQ

1. How to perform scenario analysis in perpetual futures?

Identify key variables such as funding rates, leverage, and market volatility. Create best-case, base-case, and worst-case scenarios, then simulate the potential impact on positions and capital requirements.

2. Where to find resources for scenario analysis?

Resources include financial modeling textbooks, online courses, professional webinars, and platforms offering stress-testing tools and Monte Carlo simulation capabilities.

3. How does scenario analysis improve trading strategies?

By evaluating potential outcomes under different market conditions, traders can adjust strategies, manage risk, and optimize capital allocation, enhancing both profitability and resilience.

Conclusion

Scenario analysis is a powerful, practical tool that provides traders and institutions with insights into market risks and opportunities. Whether applied through deterministic models or stochastic simulations, it supports informed decision-making, risk mitigation, and strategic optimization. By integrating scenario analysis into daily trading and portfolio management, market participants can better navigate uncertainty, protect capital, and exploit opportunities.

Engage with this content, share your insights, and discuss scenario analysis strategies to further enhance trading performance.

Key applications and benefits of scenario analysis in financial trading and risk management.