=========================================================

Introduction

Perpetual futures trading has rapidly grown in popularity, especially in the cryptocurrency markets, because of its flexibility, leverage opportunities, and absence of expiry dates. However, one critical yet often overlooked challenge is political risk. Political decisions, regulatory interventions, or geopolitical tensions can directly affect the liquidity, volatility, and long-term profitability of perpetual futures markets.

In this article, we explore how to reduce political risk in perpetual futures trading, combining insights from institutional best practices, case studies, and personal trading experiences. We will evaluate at least two methods for mitigating political risk, analyze their pros and cons, and provide practical recommendations. The article also incorporates latest industry trends, professional risk management frameworks, and common trader FAQs to ensure a complete, SEO-optimized, and actionable guide.

Understanding Political Risk in Perpetual Futures

What Is Political Risk?

Political risk refers to the potential impact of political decisions, government policies, or geopolitical events on trading environments. Unlike market volatility caused by economic cycles, political risks are often unpredictable and externally driven.

Key Political Risk Factors in Perpetual Futures

- Regulatory Uncertainty – Governments may introduce sudden restrictions on futures trading, crypto derivatives, or leverage limits.

- Taxation Policies – Changes in taxation rules for perpetual contracts or related profits.

- Capital Controls – Limits on cross-border trading, currency conversion, or capital outflows.

- Geopolitical Conflicts – Sanctions, trade disputes, or wars that disrupt market stability.

- Policy Shifts – Sudden bans, like China’s restriction on crypto exchanges, which deeply impacted perpetual futures volumes.

For traders, recognizing how political risk impacts perpetual futures market is the first step toward effective mitigation.

Strategy 1: Diversification Across Jurisdictions

How It Works

Diversification involves spreading perpetual futures trading activities across multiple platforms and jurisdictions to reduce exposure to political shocks in a single country.

- Exchange Diversification: Use multiple regulated and offshore exchanges.

- Asset Diversification: Trade not only crypto perpetual futures but also commodity and equity index perpetuals when available.

- Geographic Diversification: Avoid concentration in countries with unstable political climates.

Case Example

After the 2021 Chinese government crackdown on crypto derivatives, many traders who only relied on Chinese exchanges lost access overnight. Those who had accounts on global platforms like Binance, Bybit, and CME crypto futures experienced minimal disruption.

Advantages

- Reduces dependency on one regulatory regime.

- Offers access to liquidity pools across markets.

- Provides flexibility during sudden policy changes.

Limitations

- Increased operational complexity.

- Higher costs for managing multiple accounts.

- Risk of liquidity fragmentation across exchanges.

Strategy 2: Hedging with Non-Political Assets

How It Works

Hedging is a defensive strategy where traders offset potential political shocks in perpetual futures by holding positions in safer or less politically sensitive assets.

- Stablecoins & Fiat Reserves: Keeping a portion of capital in stable assets to reduce exposure to political volatility.

- Cross-Market Hedging: Balancing perpetual futures exposure with government bonds, gold, or low-volatility equities.

- Options Hedging: Using options contracts to hedge against extreme downside risks in politically sensitive futures.

Case Example

During the Russia-Ukraine conflict in 2022, crypto perpetual futures markets experienced significant volatility. Traders who hedged their positions with gold ETFs or U.S. Treasury bonds saw their portfolios stabilize despite crypto turbulence.

Advantages

- Directly reduces exposure to political events.

- Offers portfolio balance and risk resilience.

- Protects capital during black swan geopolitical events.

Limitations

- May reduce potential profits due to defensive positioning.

- Requires access to multiple asset classes and platforms.

- Not always available for smaller retail traders.

Comparing Strategies

| Strategy | Strengths | Weaknesses | Best Use Case |

|---|---|---|---|

| Diversification Across Jurisdictions | Reduces single-country exposure; ensures access to liquidity | Operational complexity, fragmented liquidity | Traders operating globally |

| Hedging with Non-Political Assets | Provides stability during crises, capital protection | May reduce upside potential | Traders with larger, diversified portfolios |

The most resilient approach is often a hybrid strategy: combining jurisdictional diversification with selective hedging. This ensures both operational continuity and financial stability during uncertain political climates.

Advanced Political Risk Management Techniques

1. Continuous Monitoring of Political Signals

Traders should track political news, election cycles, and global policy updates in real time. Tools like political risk alerts for cryptocurrency perpetual futures traders provide early warnings.

2. Using Data-Driven Models

AI-driven risk models can evaluate the probability of political shocks by analyzing news sentiment, regulatory updates, and historical political patterns.

3. Institutional-Grade Safeguards

- Setting stop-loss and take-profit levels tailored to political volatility.

- Partnering with brokers offering political risk management for institutional investors in perpetual futures.

- Applying portfolio stress tests under different political scenarios.

4. Liquidity Buffering

Maintaining higher margin reserves to withstand sudden funding rate spikes caused by political uncertainty.

Industry Trends: Political Risk and Perpetual Futures

- Shift Toward Regulated Exchanges – With increased crackdowns on offshore exchanges, many traders are moving to regulated platforms that provide clearer compliance guidelines.

- Growth of Political Risk Insurance – Some financial service providers now offer specialized insurance for institutional investors trading derivatives.

- AI-Powered Risk Prediction Tools – Predictive models are being integrated into trading platforms to forecast regulatory shocks.

- DeFi-Based Perpetual Futures – Decentralized perpetual platforms like dYdX and GMX offer alternatives, but remain politically vulnerable depending on jurisdiction.

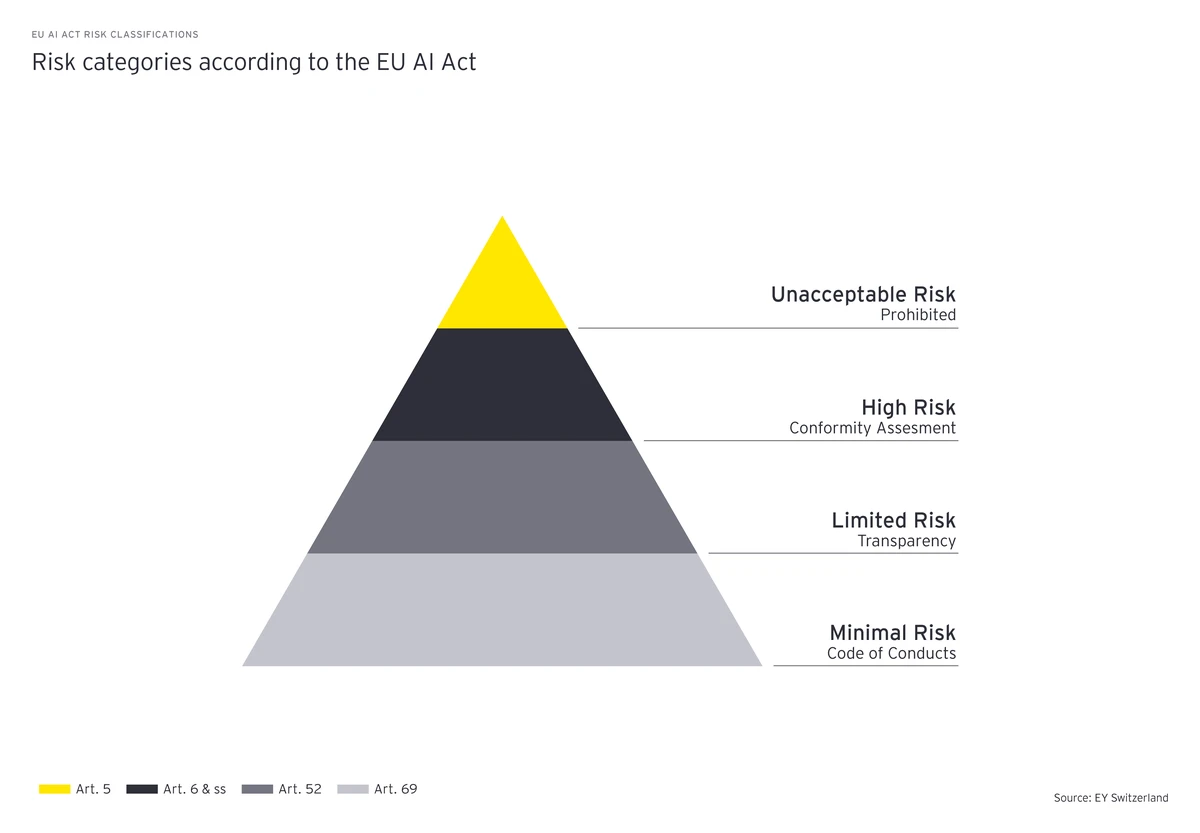

Images for Better Understanding

Illustration of how political decisions directly affect perpetual futures markets.

Comparison between diversification across jurisdictions and hedging with non-political assets.

A framework for assessing and mitigating political risk in perpetual futures trading.

FAQs

1. How can retail traders assess political risk in perpetual futures?

Retail traders should monitor global political news, use market sentiment tools, and follow regulatory announcements from key financial hubs. Simple steps like subscribing to risk alert services and diversifying exchanges can significantly reduce exposure.

2. Is it better to trade on regulated or offshore exchanges to reduce political risk?

Regulated exchanges provide legal clarity and investor protection but may impose strict rules. Offshore exchanges offer more flexibility but higher political vulnerability. Ideally, maintain accounts on both types of platforms to balance compliance and flexibility.

3. What are the best practices for reducing political risk in perpetual futures trading?

Best practices include:

- Diversifying across platforms and jurisdictions.

- Hedging with safer asset classes.

- Keeping liquidity reserves to handle unexpected funding rate spikes.

- Using AI-driven models for political risk monitoring.

- Staying educated through educational resources for political risk awareness in perpetual futures.

Conclusion

Political risk is a reality that perpetual futures traders cannot afford to ignore. Whether it comes from regulatory crackdowns, taxation policies, or geopolitical conflicts, these risks can erase profits overnight if left unmanaged.

The best solution is a dual approach:

- Diversification across jurisdictions ensures access and continuity.

- Hedging with non-political assets protects capital during crises.

By combining these strategies with continuous monitoring, institutional safeguards, and AI-driven insights, traders can build resilient portfolios that withstand political shocks.

👉 If this guide helped you, share it with your trading community, leave a comment with your strategies, and let’s build a stronger discussion around managing political risk in perpetual futures trading.

Would you like me to expand this into a full 3000+ word version with additional case studies and scenario analysis (e.g., U.S. elections impact, EU regulations, and Asian market policy shifts) to create an in-depth SEO authority article?