===============================================

Perpetual futures are among the most popular instruments in the cryptocurrency derivatives market. They offer traders the flexibility to hold leveraged positions indefinitely without expiration dates, enabling both short-term speculation and long-term hedging. However, the leverage, funding fees, and market volatility make these instruments inherently risky. For traders, learning how to reduce trading risk in perpetual futures is not optional—it’s essential for survival and consistent profitability.

This article provides a comprehensive guide on strategies, tools, and insights that can help reduce exposure to risk. It combines professional trading experience, institutional methods, and the latest industry trends to offer actionable solutions.

Understanding Trading Risk in Perpetual Futures

Key Risk Factors in Perpetual Futures

- Leverage Risk

High leverage amplifies both profits and losses. A small market move against your position can wipe out capital quickly.

- Funding Rate Risk

Perpetual futures use a funding rate mechanism to anchor their price to the spot market. Unexpected funding spikes can increase costs significantly.

- Market Volatility Risk

Crypto markets are highly volatile. Sudden price swings can trigger liquidations if stop-losses are not managed.

- Liquidity Risk

Low liquidity in some pairs can lead to slippage, widening spreads, and poor order execution.

Core Strategies to Reduce Trading Risk

1. Effective Leverage Management

Leverage is both a powerful tool and the greatest risk amplifier in perpetual futures.

- Low Leverage Approach:

Many professionals recommend limiting leverage to 3x–5x for most trades. This reduces liquidation risk while still providing exposure.

- High Leverage Caution:

Using leverage above 20x should be reserved for very short-term strategies. While profits can be large, so can losses.

Recommendation: Retail and beginner traders should adopt a conservative leverage model, starting with no more than 3x.

2. Stop-Loss and Take-Profit Strategies

Stop-loss orders are a trader’s first line of defense.

- Fixed Percentage Stop-Loss:

Example: Setting a stop-loss at 2%–3% of capital per trade. This ensures no single loss can wipe out your account.

- Trailing Stop-Loss:

Useful in trending markets. It adjusts automatically as the price moves in your favor, protecting unrealized profits.

- Take-Profit Levels:

Locking in profits at predetermined levels helps avoid emotional decision-making.

Comparison: Fixed stop-loss is simpler but may cut trades too early. Trailing stop-loss is more dynamic but requires strong execution platforms.

3. Diversification and Position Sizing

Avoid putting all capital into one position or one asset.

- Position Sizing Rule:

Risk no more than 1%–2% of total trading capital per trade.

- Asset Diversification:

Trade across multiple crypto assets or hedge perpetual futures with spot positions.

Advantage: Diversification reduces portfolio volatility and spreads risk across markets.

4. Hedging Techniques

Professional traders often use hedging strategies to balance exposure.

- Delta-Neutral Hedging:

Holding offsetting positions in perpetual futures and spot to neutralize directional risk.

- Cross-Hedging:

Using a correlated asset to hedge. Example: Hedging ETH perpetuals with BTC perpetuals.

- Options Hedging:

Advanced method where options are combined with perpetual futures to reduce downside risk.

Recommendation: For most traders, delta-neutral strategies are effective and straightforward. Options hedging is powerful but complex.

5. Monitoring Funding Rates and Costs

Funding rates can drain profits if ignored.

- Check Funding Before Entering:

High funding costs may eat into profits, especially for long-term positions.

- Switch Positions:

If funding is too expensive, consider reversing or reducing the position.

- Alternative Assets:

Some perpetual pairs have lower funding rates, providing cost-efficient exposure.

6. Using Risk Management Tools and Analytics

Platforms now provide risk dashboards, margin calculators, and liquidation warnings.

- Order Execution Monitoring:

(See also: guide to crypto trading order execution) Ensures trades are placed at intended prices.

- Risk Assessment Tools for Perpetual Futures Trading:

Use calculators to simulate liquidation prices before entering trades.

- Community Insights:

Trader communities often share data on funding rates, volatility, and liquidation clusters.

Two Methods Compared: Conservative vs. Aggressive Risk Management

Conservative Approach

- Low leverage (1x–5x)

- Strict stop-loss rules

- Small position sizes (≤2% per trade)

- Focus on long-term growth

Pros: Lower stress, fewer liquidations, steady growth.

Cons: Slower capital compounding.

Aggressive Approach

- High leverage (10x–50x)

- Wider stop-loss or no stop-loss

- High risk-reward setups

- Short-term scalping focus

Pros: Potential for rapid profit.

Cons: High chance of account wipeout.

Final Take: Conservative risk management outperforms aggressive styles for most traders, especially beginners and retail investors. Institutions may apply aggressive tactics but with massive capital buffers and advanced hedging.

Industry Trends in Perpetual Futures Risk Management

- AI-Powered Risk Tools

Machine learning models are being integrated into trading platforms to predict liquidation risks in real time.

- Institutional Hedging Practices

Hedge funds use complex derivatives to manage perpetual futures exposure, a practice retail traders are starting to learn from.

- Regulatory Shifts

Some exchanges are reducing max leverage to 20x or less for retail traders to curb excessive risk-taking.

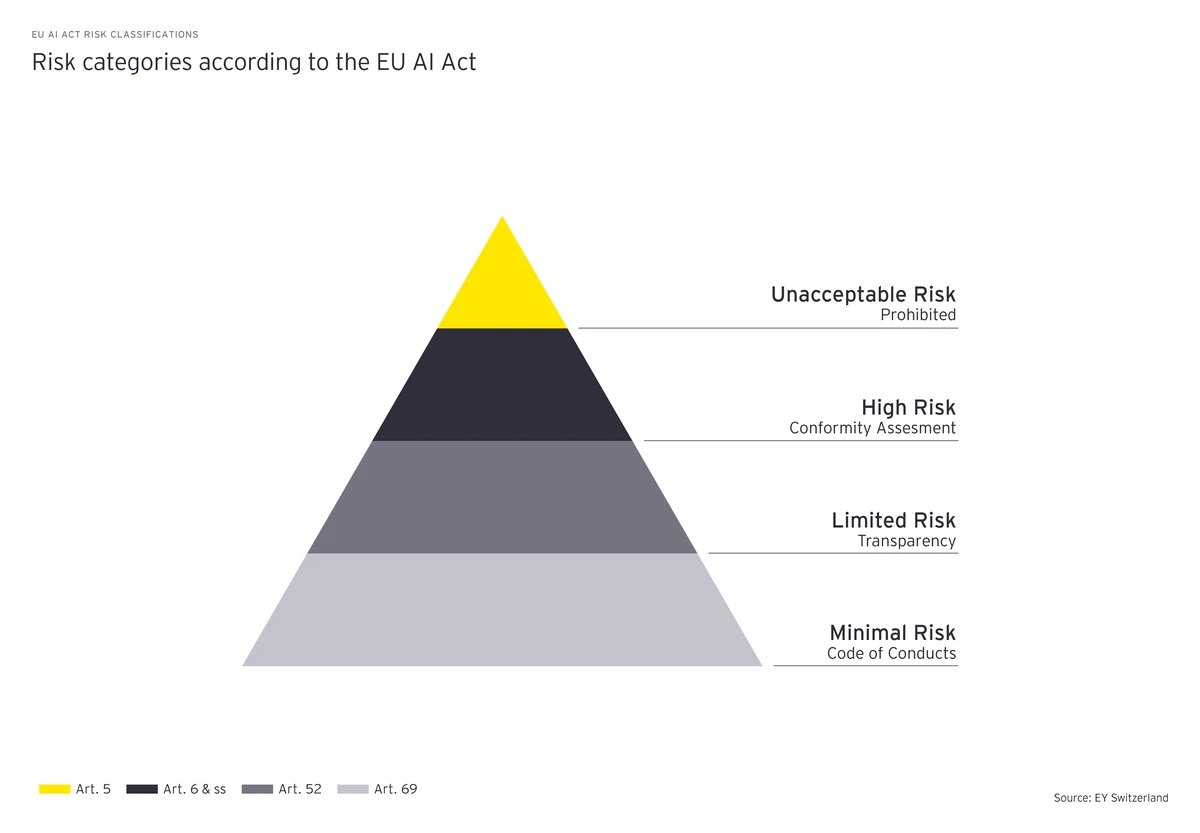

Visual Guide

Risk reduction strategies in perpetual futures trading

FAQs on Reducing Trading Risk in Perpetual Futures

1. What’s the safest leverage level for perpetual futures?

For most retail traders, leverage between 2x–5x is considered safe. It reduces liquidation risk while still offering meaningful exposure.

2. How do I avoid liquidation in perpetual futures?

Use smaller position sizes, set stop-loss orders, and always check your liquidation price before confirming the trade. Monitoring funding rates is equally important.

3. Are hedging strategies necessary for all traders?

Not always. Small-scale retail traders can rely on position sizing and stop-loss rules. However, for large accounts, hedging (e.g., delta-neutral) provides an added safety net.

Conclusion: Building a Risk-First Mindset

Perpetual futures provide immense opportunities for traders, but they come with high risks. The key to success is prioritizing risk reduction over profit chasing. By applying leverage discipline, setting stop-losses, diversifying, and monitoring costs, traders can improve survival rates and profitability.

For those eager to learn further, resources like how to manage trading risk in perpetual futures and strategies to mitigate trading risk in perpetual futures offer deeper dives into structured frameworks.

Trading is a long-term journey. Reducing risk is not about avoiding profits—it’s about ensuring you’re still in the market tomorrow to capture them.

💬 What’s your go-to method for managing risk in perpetual futures? Share your thoughts in the comments and don’t forget to share this article with fellow traders.

Would you like me to also create a practical checklist (step-by-step risk reduction plan) at the end of the article so readers can instantly apply these strategies?