=========================================

Introduction

In modern finance, performance evaluation goes beyond raw returns. Investors, fund managers, and analysts need standardized tools to measure risk-adjusted performance across different portfolios and strategies. One of the most reliable and widely used metrics is the Sharpe Ratio. For financial analysts, mastering Sharpe Ratio facts is essential to evaluate investments, compare trading systems, and identify where risk management can be optimized.

This comprehensive guide explores everything financial analysts need to know about the Sharpe Ratio—from its definition and calculation to advanced applications in professional trading. We will analyze multiple strategies that can improve or distort Sharpe Ratio interpretation, compare it with other performance metrics, and provide practical tools and case studies to enhance decision-making.

What Is the Sharpe Ratio?

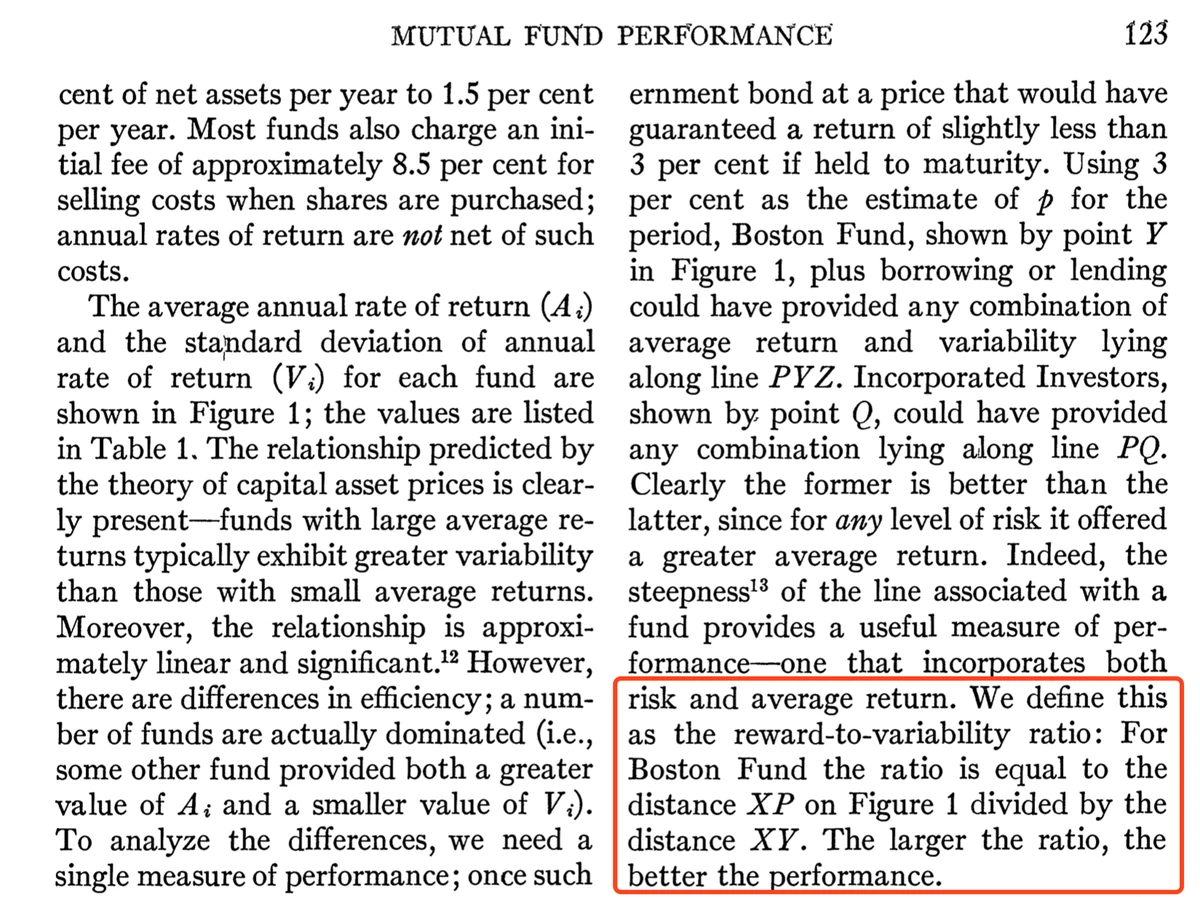

The Sharpe Ratio, developed by Nobel laureate William F. Sharpe, measures the excess return of an investment per unit of risk. It is expressed as:

Sharpe Ratio=Rp−RfσpSharpe\ Ratio = \frac{R_p - R_f}{\sigma_p}Sharpe Ratio=σpRp−Rf

Where:

- RpR_pRp = Portfolio or strategy return

- RfR_fRf = Risk-free rate (e.g., U.S. Treasury yield)

- σp\sigma_pσp = Standard deviation of portfolio returns

A higher Sharpe Ratio indicates better risk-adjusted performance. A negative ratio suggests that the risk-free asset outperformed the investment after adjusting for volatility.

Why Sharpe Ratio Matters for Financial Analysts

Financial analysts frequently use the Sharpe Ratio to:

- Compare Investment Options – Evaluate whether higher returns are justified by higher risks.

- Standardize Performance – Create a common benchmark across equities, bonds, futures, and crypto strategies.

- Risk Management – Identify strategies with poor volatility-adjusted returns that may need rebalancing.

- Institutional Reporting – Provide fund managers and investors with a clear and trusted performance indicator.

Core Sharpe Ratio Facts Every Analyst Should Know

1. A “Good” Sharpe Ratio Threshold

- < 1.0 → Suboptimal, risk-adjusted returns.

- 1.0 – 1.99 → Acceptable but moderate performance.

- 2.0 – 2.99 → Strong performance.

- ≥ 3.0 → Exceptional performance, often only achievable by highly optimized or market-neutral strategies.

2. Impact of Time Horizon

The Sharpe Ratio changes depending on whether returns are measured daily, monthly, or annually. Annualization requires multiplying by the square root of the time factor, which can inflate results if volatility clustering is ignored.

3. Sensitivity to Non-Normal Distributions

Sharpe Ratio assumes returns follow a normal distribution. In reality, many assets—particularly futures and crypto—show fat tails and skewness. Analysts must complement Sharpe with additional metrics like Sortino Ratio or Value-at-Risk.

4. Influence of Leverage

Leverage can artificially increase returns but also amplifies volatility. While the Sharpe Ratio adjusts for volatility, excessive leverage may mask tail risks. This is particularly relevant when analyzing hedge funds or crypto perpetual futures strategies.

Methods to Evaluate Sharpe Ratio Effectively

Method 1: Benchmark Comparison

Comparing Sharpe Ratios across strategies helps determine which system provides superior risk-adjusted returns. For example, comparing a high-frequency futures strategy against a buy-and-hold index fund reveals whether active management truly adds value.

Pros:

- Easy to interpret.

- Useful for client reporting.

Cons:

- Requires careful choice of benchmark.

- Misleading if benchmarks have different volatility structures.

Method 2: Stress Testing and Scenario Analysis

Instead of only relying on historical returns, financial analysts stress test Sharpe Ratios under different volatility regimes—e.g., bull markets, bear markets, and crisis periods.

Pros:

- More realistic.

- Highlights performance resilience.

Cons:

- Requires sophisticated simulation models.

- Sensitive to assumptions.

Recommended Approach

The best practice is to combine benchmarking with scenario analysis. This ensures the Sharpe Ratio is not taken at face value but contextualized within market conditions.

Sharpe Ratio in Futures and Algorithmic Trading

Financial analysts in futures trading frequently discuss how to calculate Sharpe Ratio in perpetual futures to assess algorithmic performance. Futures and derivatives often involve high leverage and volatility, making Sharpe a key measure of sustainability.

Additionally, many institutional traders emphasize what is the importance of Sharpe Ratio in futures trading—as it provides a transparent method to compare systematic trading models that may otherwise look incomparable due to different leverage exposures.

Comparing Sharpe Ratio with Other Metrics

| Metric | Focus | Strengths | Weaknesses |

|---|---|---|---|

| Sharpe Ratio | Risk-adjusted return | Widely accepted, simple calculation | Assumes normal returns |

| Sortino Ratio | Downside risk only | Focuses on “bad volatility” | Ignores upside volatility |

| Information Ratio | Active return vs benchmark | Measures active manager skill | Requires accurate benchmark |

| Calmar Ratio | Return vs max drawdown | Good for drawdown-sensitive strategies | Ignores volatility outside drawdowns |

Practical Case Study: Sharpe Ratio in Action

A hedge fund running two strategies reports:

- Strategy A (Equity Long-Short): Sharpe Ratio = 1.8

- Strategy B (Crypto Futures Arbitrage): Sharpe Ratio = 2.7

At first glance, Strategy B seems superior. However, further analysis reveals:

- Strategy A maintained stable performance across all volatility regimes.

- Strategy B’s ratio dropped to 0.8 during extreme market stress.

This example highlights why Sharpe must always be contextualized with scenario analysis and secondary risk metrics.

Common Misconceptions About Sharpe Ratio

- “High Sharpe means low risk” – Not always true; it just means returns per unit of volatility are higher. Tail risks may remain.

- “Sharpe Ratio is static” – Ratios fluctuate significantly depending on timeframes and market conditions.

- “Sharpe Ratio replaces all metrics” – It is a starting point, not a comprehensive risk model.

FAQ: Sharpe Ratio Facts for Financial Analysts

1. What affects Sharpe Ratio calculation in futures?

Factors include leverage, margin requirements, contract size, volatility clustering, and how returns are annualized. Futures Sharpe Ratios can be overstated if leverage risks are not fully considered.

2. How can analysts improve Sharpe Ratios in trading strategies?

Improvement comes from reducing volatility without sacrificing returns. Techniques include portfolio diversification, hedging, using options overlays, and refining algorithmic entry/exit rules.

3. Why is Sharpe Ratio crucial for professional reporting?

Investors and institutions prefer Sharpe because it provides a simple, comparable measure of performance. It allows analysts to communicate complex strategies in a straightforward risk-adjusted framework.

Conclusion

The Sharpe Ratio remains one of the most essential tools for financial analysts, offering a clear, standardized view of risk-adjusted returns. While it is not flawless, understanding its strengths, limitations, and contextual applications makes it invaluable in portfolio evaluation, futures trading, and algorithmic performance measurement.

By combining Sharpe Ratio with scenario analysis and complementary metrics, analysts can provide investors with deeper insights and more resilient recommendations.

Final Thoughts

If you found this article on Sharpe Ratio facts for financial analysts useful, share it with your colleagues, discuss your insights in the comments, and contribute to building better-informed investment practices.

Sharpe Ratio performance evaluation framework for financial analysts