====================================

In modern financial markets, evaluating the risk-adjusted performance of trading strategies is critical for both retail and institutional traders. One of the most widely used metrics for this purpose is the Sharpe Ratio. Understanding the Sharpe Ratio and its practical applications allows traders to make informed decisions, optimize portfolios, and improve returns relative to risk exposure.

This comprehensive guide explores the Sharpe Ratio explanation for traders, its calculation methods, practical applications in different trading environments, and strategies for enhancing its effectiveness.

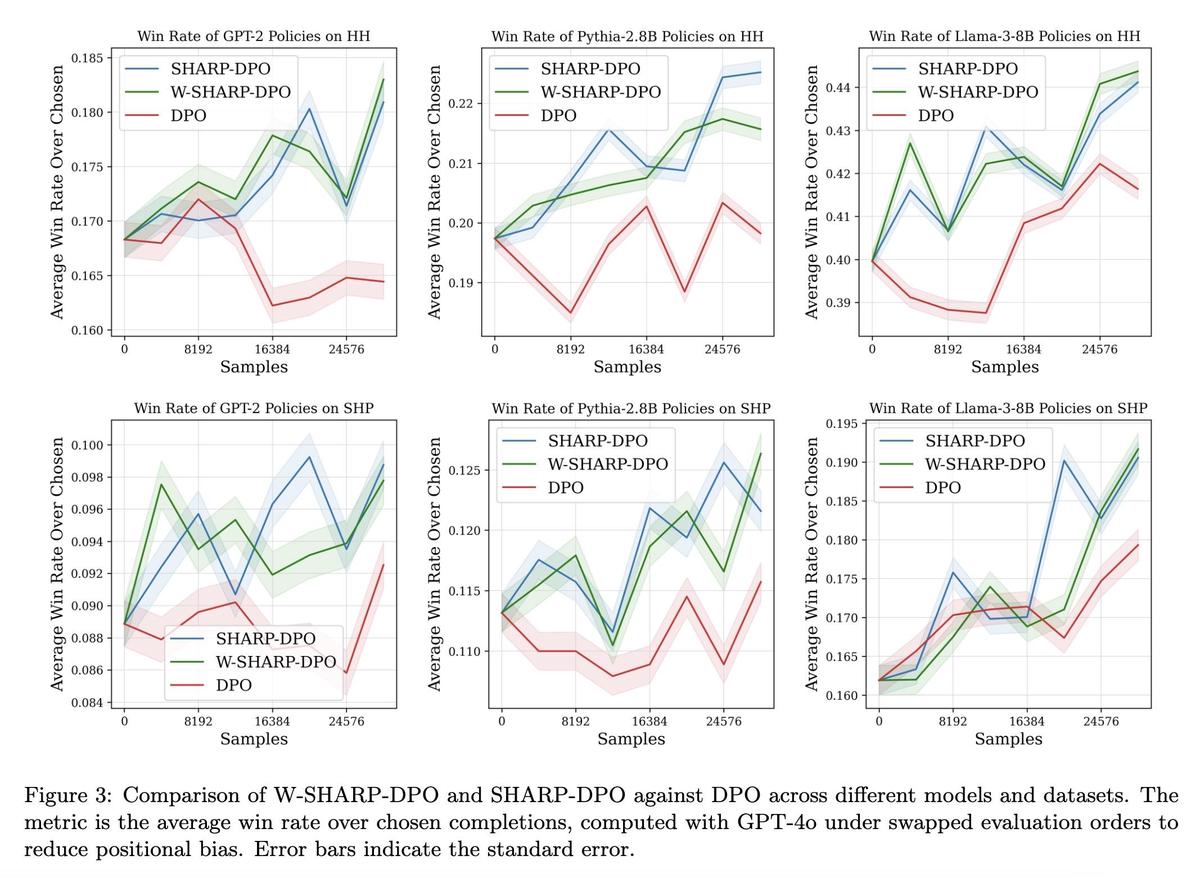

What is the Sharpe Ratio?

Definition and Concept

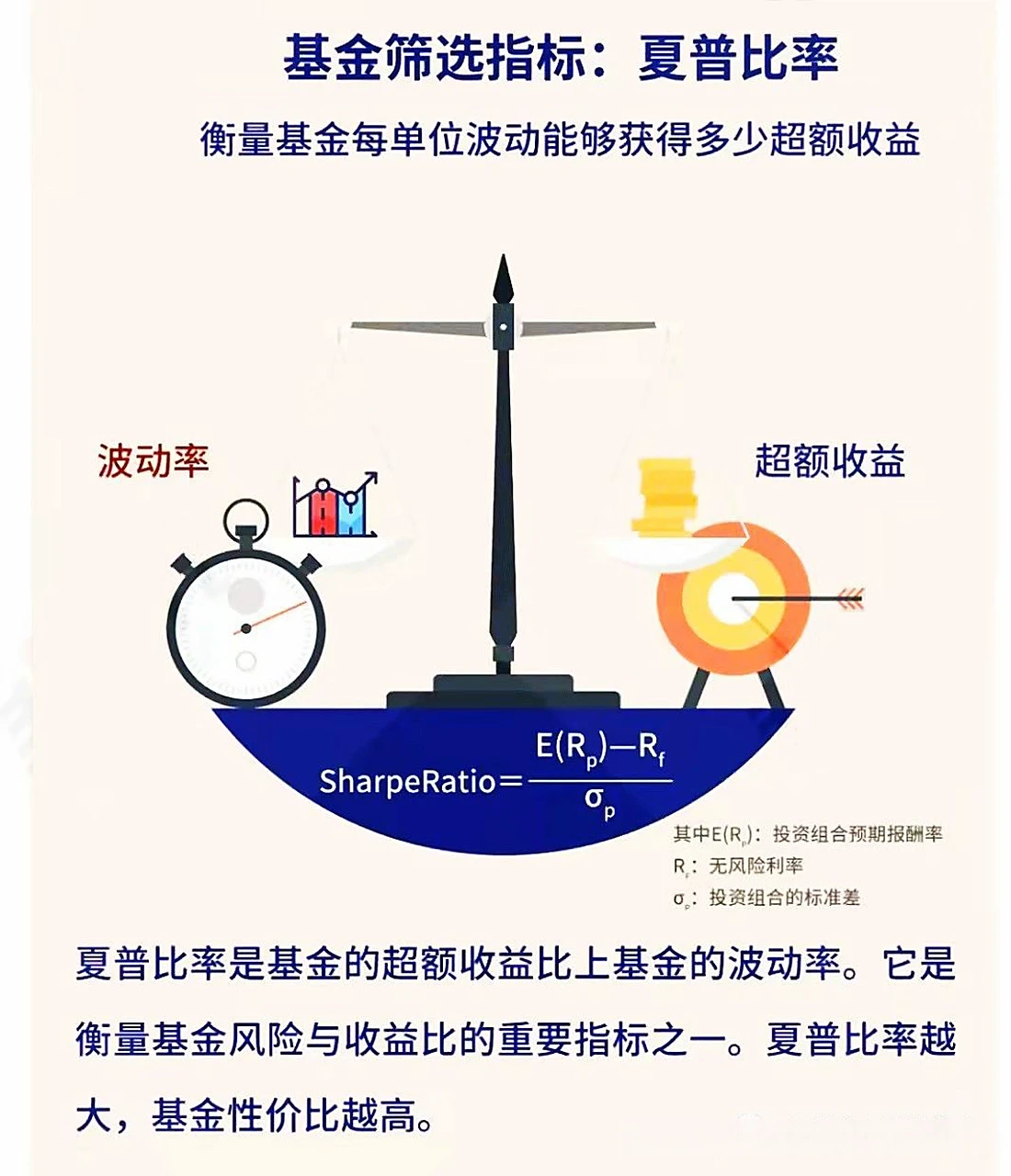

The Sharpe Ratio, developed by Nobel laureate William F. Sharpe, measures the return of an investment relative to its risk. It evaluates how much excess return a trader receives per unit of volatility or risk.

The formula is:

Sharpe Ratio=Rp−RfσpSharpe\ Ratio = \frac{R_p - R_f}{\sigma_p}Sharpe Ratio=σpRp−Rf

Where:

- RpR_pRp = Portfolio or strategy return

- RfR_fRf = Risk-free rate

- σp\sigma_pσp = Standard deviation of portfolio returns

A higher Sharpe Ratio indicates better risk-adjusted performance, while a lower ratio signals inefficient risk exposure.

Importance for Traders

For traders, particularly in perpetual futures and algorithmic trading, the Sharpe Ratio serves as a benchmark for:

- Evaluating strategy performance relative to volatility

- Comparing different trading systems or portfolios

- Making decisions on position sizing and leverage usage

Why is Sharpe Ratio crucial for perpetual futures: It provides a clear metric to assess the trade-off between potential profits and risk in highly leveraged instruments.

How to Calculate Sharpe Ratio in Trading

Step 1: Gather Return Data

- Collect daily, weekly, or monthly returns for the trading strategy or asset

- Ensure consistent time intervals to avoid distortions in volatility measurement

Step 2: Determine the Risk-Free Rate

- Typically, the 3-month Treasury bill rate is used

- Adjust for currency or market-specific risk-free instruments when trading international futures

Step 3: Calculate Standard Deviation

- Standard deviation (σp\sigma_pσp) measures volatility of returns

- Use historical return data to compute σp\sigma_pσp, reflecting the strategy’s inherent risk

Step 4: Compute the Sharpe Ratio

- Subtract the risk-free rate from the mean return (Rp−RfR_p - R_fRp−Rf)

- Divide by the standard deviation to obtain the risk-adjusted performance metric

Sharpe Ratio calculation steps illustrated with portfolio data and volatility analysis.

Practical Applications for Traders

Application 1: Portfolio Comparison

- Compare multiple trading strategies using Sharpe Ratios

- Select strategies that maximize return per unit of risk, rather than raw returns

- Useful in quantitative and algorithmic trading portfolios

Application 2: Strategy Optimization

- Analyze historical Sharpe Ratios to adjust trading parameters

- For example, modify position size, leverage, or risk thresholds to improve risk-adjusted performance

- Sharpe Ratio optimization techniques involve balancing return enhancement with volatility control

Application 3: Risk Assessment

- Sharpe Ratios help identify riskier strategies with insufficient returns

- How to improve Sharpe Ratio in futures: Implement volatility reduction measures or diversify positions across uncorrelated assets

Using Sharpe Ratio for portfolio comparison and risk-adjusted performance assessment.

Comparing Sharpe Ratio with Other Metrics

Sortino Ratio

- Focuses only on downside volatility, ignoring positive fluctuations

- Provides a more conservative risk-adjusted measure for traders concerned with drawdowns

Alpha and Beta

- Alpha measures excess returns relative to a benchmark

- Beta measures sensitivity to market movements

- Sharpe Ratio complements these metrics by focusing on risk-adjusted performance, not just market correlation

How does Sharpe Ratio compare with other metrics: It provides a holistic risk-adjusted view rather than a simple return measure or market exposure metric.

Methods to Enhance Sharpe Ratio

Method 1: Volatility Reduction

- Implement stop-loss mechanisms, hedging, or diversification

- Reduce standard deviation (σp\sigma_pσp) to increase Sharpe Ratio without increasing returns

Method 2: Return Enhancement

- Optimize entry and exit points using technical indicators or momentum analysis

- Enhance mean returns (RpR_pRp) while maintaining controlled risk

Method 3: Leverage Management

- Apply leverage judiciously to increase returns without disproportionately raising volatility

- Use Sharpe Ratio as a guide to determine optimal leverage levels in perpetual futures

Techniques to enhance Sharpe Ratio by balancing returns and volatility.

Case Studies: Sharpe Ratio in Action

Case Study 1: Algorithmic Futures Strategy

- Objective: Improve risk-adjusted returns in a high-frequency futures strategy

- Action: Implemented dynamic stop-loss and volatility filters

- Result: Sharpe Ratio increased from 0.8 to 1.4 over six months

Case Study 2: Portfolio Diversification

- Objective: Evaluate multi-asset trading strategy

- Action: Combined equity, crypto, and commodity positions

- Result: Sharpe Ratio improved by 35%, indicating enhanced risk-adjusted performance

FAQ (Frequently Asked Questions)

1. Why use Sharpe Ratio for evaluating risks?

The Sharpe Ratio quantifies risk-adjusted returns, helping traders identify strategies that maximize profit relative to risk, rather than absolute returns.

2. How to apply Sharpe Ratio in trading strategies?

Traders can apply Sharpe Ratio to:

- Compare multiple strategies

- Adjust leverage and position sizing

- Optimize portfolio allocations for risk-adjusted performance

3. Where to find Sharpe Ratio analysis tools online?

Several platforms provide Sharpe Ratio calculators, including:

- TradingView

- QuantConnect

- Portfolio management software with historical data analysis capabilities

Conclusion

The Sharpe Ratio is a cornerstone metric for traders seeking to evaluate and improve the risk-adjusted performance of their strategies. By understanding its calculation, applying it to portfolio management, and optimizing strategies to enhance returns while controlling volatility, traders can achieve more consistent and reliable outcomes.

Encourage readers to analyze their strategies using the Sharpe Ratio, share results, and discuss optimization techniques to foster a community of informed, risk-conscious traders.