The Sortino ratio tools for retail investors in perpetual futures are becoming increasingly valuable in today’s volatile crypto and derivative markets. For individual traders and small-scale investors, understanding and applying the Sortino ratio provides a critical edge in risk-adjusted performance evaluation. This comprehensive guide explores the fundamentals of the Sortino ratio, reviews practical tools for retail investors, compares different calculation methods, and reveals actionable strategies to improve results in perpetual futures trading.

Understanding the Sortino Ratio in Perpetual Futures

The Sortino ratio is a risk-adjusted performance metric that focuses on downside risk, making it more relevant for perpetual futures than traditional measures like the Sharpe ratio. Unlike the Sharpe ratio, which penalizes all volatility, the Sortino ratio only considers negative deviations, aligning with an investor’s primary concern: avoiding losses.

Formula of the Sortino Ratio

\[ \text{Sortino Ratio} = \frac{R_p - R_f}{\text{Downside Deviation}} \]

Where:

- \(R_p\) = Portfolio or strategy return (e.g., perpetual futures trading results)

- \(R_f\) = Risk-free rate (e.g., U.S. Treasury yield)

- Downside Deviation = Standard deviation of negative returns below a specified minimum acceptable return (MAR)

Why It Matters for Perpetual Futures

- Leverage Sensitivity: Perpetual futures amplify both gains and losses. Focusing on downside deviation gives a clearer picture of risk.

- High Volatility Markets: Crypto perpetual futures often experience extreme price swings, making traditional volatility measures less informative.

- Retail Investor Needs: Small investors typically prioritize protecting capital over maximizing returns, aligning with the Sortino ratio’s emphasis on losses.

Key Advantages of Using Sortino Ratio Tools

Retail investors benefit from Sortino ratio tools in several ways:

- Objective Risk Analysis: Quantifies the relationship between returns and downside risk.

- Strategy Comparison: Helps identify which perpetual futures strategies produce the best risk-adjusted returns.

- Performance Tracking: Allows ongoing monitoring to ensure trading decisions remain within acceptable risk parameters.

Popular Sortino Ratio Tools for Retail Investors

Retail investors can access a variety of tools to calculate and analyze the Sortino ratio for perpetual futures:

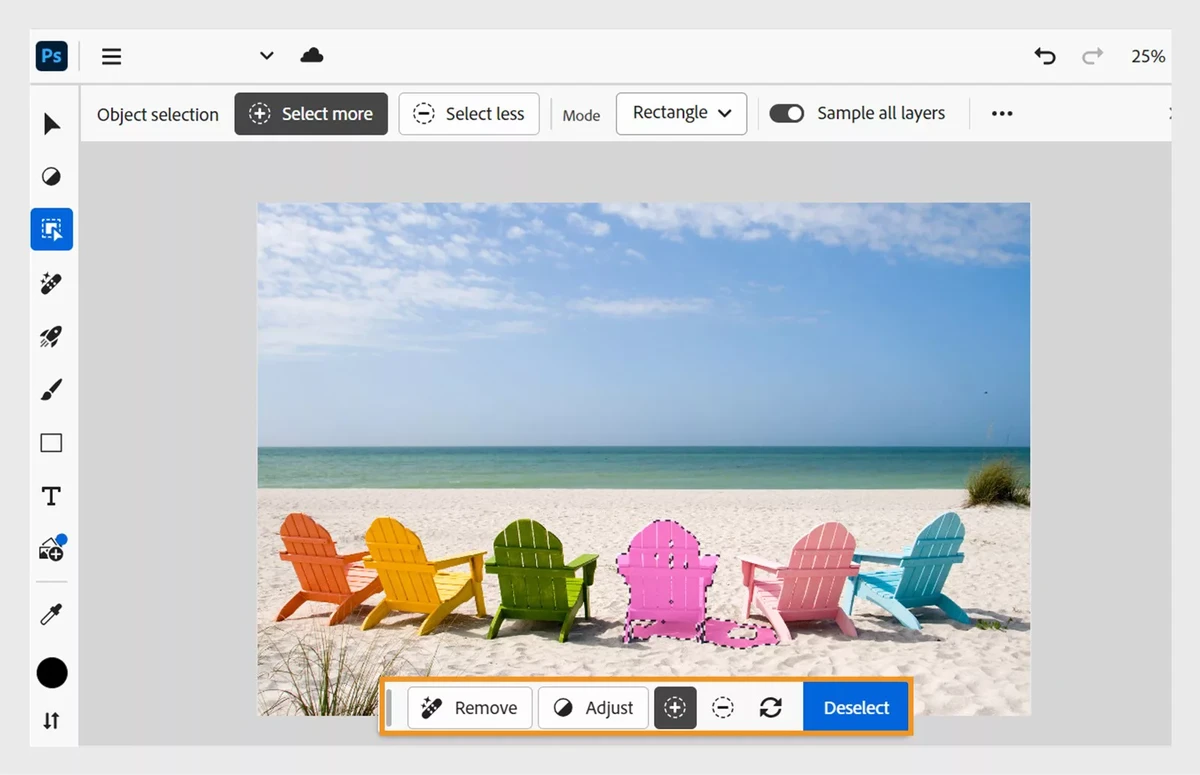

1. TradingView with Custom Indicators

TradingView allows users to create or import custom scripts that calculate the Sortino ratio for any trading strategy applied to perpetual futures pairs like BTC/USDT or ETH/USDT.

Pros:

- Easy integration with existing charting tools.

- Real-time data updates.

Cons:

- Requires scripting knowledge for custom indicators.

TradingView interface displaying a Sortino ratio indicator applied to a perpetual futures strategy.

2. Python-Based Jupyter Notebooks

Retail investors comfortable with coding can use Python libraries such as pandas and numpy to calculate Sortino ratios for backtested perpetual futures strategies.

Pros:

- Complete customization.

- High accuracy using historical data.

Cons:

- Requires programming skills.

- Not ideal for real-time analysis.

3. Dedicated Online Calculators

Web-based platforms offer online tools for Sortino ratio in perpetual futures that require only basic input such as returns data and minimum acceptable return (MAR).

Pros:

- User-friendly for non-technical investors.

- Quick calculations without setup.

Cons:

- Limited analytical depth.

- Potential privacy concerns when uploading trading data.

Methods for Calculating Sortino Ratio: A Comparison

Retail investors typically choose between two main methods for Sortino ratio calculation:

Method 1: Historical Return Analysis

Uses historical trading data to calculate returns and downside deviation.

Advantages:

- Simple to implement.

- Good for backtesting perpetual futures strategies.

Disadvantages:

- Relies heavily on past performance.

- May not capture current market dynamics.

Method 2: Monte Carlo Simulation

Simulates thousands of potential return paths to estimate downside risk.

Advantages:

- Accounts for future uncertainty.

- Useful for strategies involving high leverage.

Disadvantages:

- Requires computational resources.

- More complex to set up.

| Feature | Historical Analysis | Monte Carlo Simulation |

|---|---|---|

| Ease of Use | ★★★★★ Easy | ★★ Requires coding |

| Accuracy in High Volatility | ★★★ | ★★★★★ Excellent |

| Data Requirements | Low | High |

Recommendation:

Retail investors new to perpetual futures should start with historical analysis. Advanced traders seeking precise risk modeling can explore Monte Carlo simulations for greater accuracy.

Improving Sortino Ratio in Perpetual Futures Strategies

To enhance Sortino ratio performance, retail investors should focus on:

- Reducing Downside Volatility: Apply stop-loss orders and trailing stops to limit negative returns.

- Optimizing Leverage: Avoid excessive leverage to minimize downside deviation.

- Diversification: Trade multiple perpetual futures contracts to spread risk.

- Dynamic Position Sizing: Adjust trade sizes based on market conditions.

For detailed calculations, learn how to calculate Sortino ratio for perpetual futures to ensure accurate and consistent results across strategies.

Real-World Use Case: Applying Sortino Ratio in Perpetual Futures

A retail investor trading BTC perpetual futures on Binance backtested a long-short strategy over 12 months:

- Average Annual Return: 22%

- Downside Deviation: 8%

- Sortino Ratio: (0.22 – 0.03) / 0.08 ≈ 2.37

A Sortino ratio above 2.0 indicates excellent risk-adjusted performance, validating the strategy’s efficiency.

Advanced Strategies for Experienced Traders

Professional traders often incorporate advanced Sortino ratio strategies for perpetual futures into their quantitative models:

- Dynamic MAR adjustment based on market volatility.

- Integrating Sortino ratio with machine learning algorithms to predict downside risk.

- Using rolling window calculations to adapt to changing market conditions.

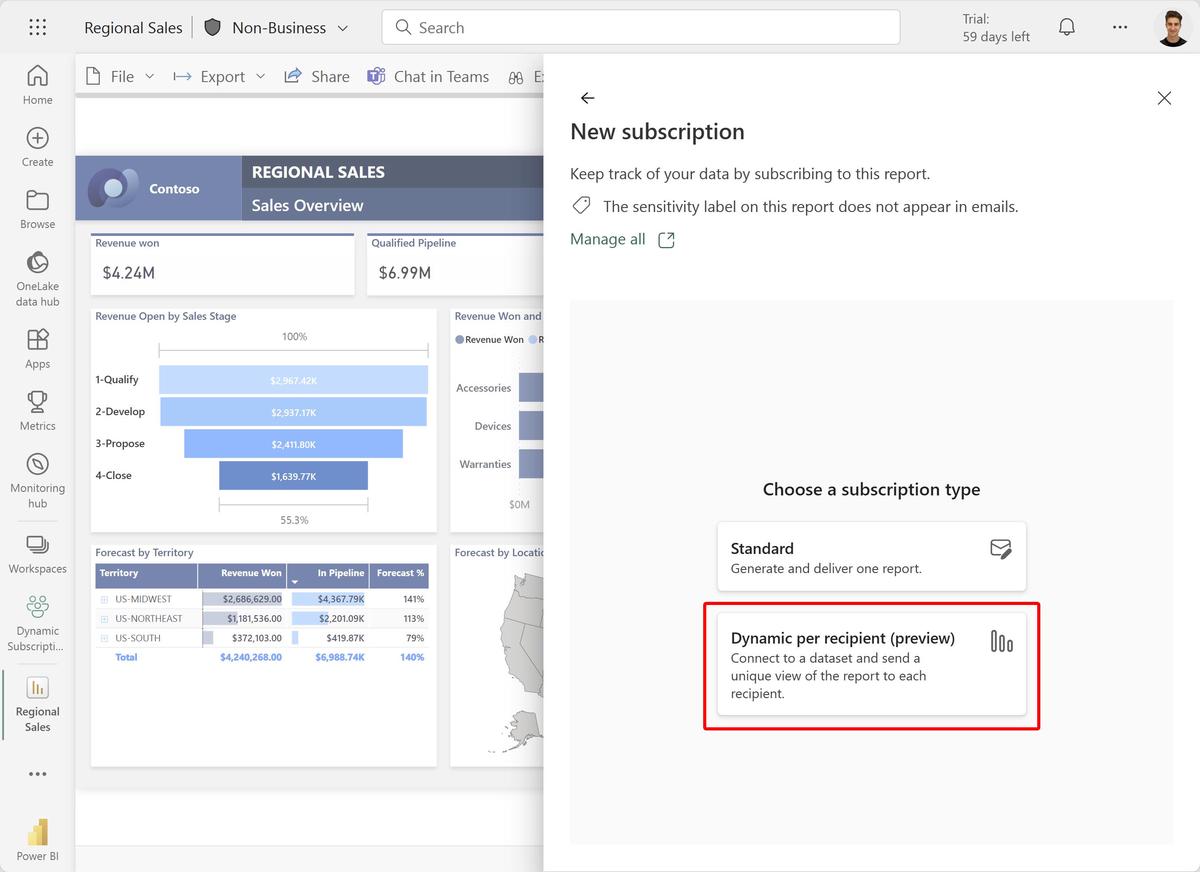

Latest Industry Trends and Tools

The growth of decentralized finance (DeFi) and algorithmic trading platforms is reshaping how retail investors access Sortino ratio analytics:

- DeFi Analytics Platforms: Offer decentralized risk metrics, including Sortino ratios, for on-chain perpetual futures.

- AI-Powered Bots: Provide automated Sortino ratio calculations and real-time optimization recommendations.

- Mobile Apps: Deliver instant Sortino ratio updates and alerts for retail investors on the go.

AI-powered dashboard displaying live Sortino ratio analytics for multiple perpetual futures contracts.

FAQ: Sortino Ratio Tools for Retail Investors

1. What is a good Sortino ratio for perpetual futures?

A Sortino ratio above 1.5 is generally considered acceptable for retail investors. A ratio above 2.0 signals strong risk-adjusted returns.

2. How does the Sortino ratio differ from the Sharpe ratio?

The Sortino ratio only penalizes downside risk, making it more relevant for leveraged products like perpetual futures where negative returns pose greater threats than overall volatility.

3. Can retail investors improve their Sortino ratio without coding?

Yes. Many platforms provide no-code tools and calculators that enable retail investors to analyze risk-adjusted returns without programming knowledge.

Final Thoughts and Social Sharing

The Sortino ratio tools for retail investors in perpetual futures empower traders to make data-driven decisions and better manage downside risk. Whether using online calculators, custom TradingView indicators, or Python-based simulations, the key is consistent application and continuous optimization.

💡 Join the Discussion:

Have you tried using Sortino ratio tools in your perpetual futures trading? Share your experience or favorite platforms in the comments below.

If this guide helped you understand the Sortino ratio, share it with fellow investors to help them improve their risk-adjusted trading performance.