Sovereign risk is a crucial consideration for anyone trading futures, particularly for beginners venturing into markets influenced by government policies and geopolitical events. Understanding sovereign risk can safeguard traders from unexpected losses and enhance long-term trading strategies. This guide provides a detailed overview of sovereign risk, practical strategies for mitigation, and tools for continuous monitoring.

Understanding Sovereign Risk

What is Sovereign Risk?

Sovereign risk refers to the possibility that a government might default on its financial obligations or implement policies that negatively impact markets, including currency, bonds, and futures. For futures traders, sovereign risk can influence pricing, volatility, and liquidity.

Key Factors Affecting Sovereign Risk:

- Government debt levels and fiscal health

- Political stability and policy changes

- Central bank interventions and monetary policy

- Trade disputes and international sanctions

- Government debt levels and fiscal health

Importance of Sovereign Risk for Beginners

For beginners, ignoring sovereign risk can lead to unexpected losses, especially when trading futures tied to foreign currencies, commodities, or indices. Understanding these risks provides a foundation for informed decision-making and effective risk management.

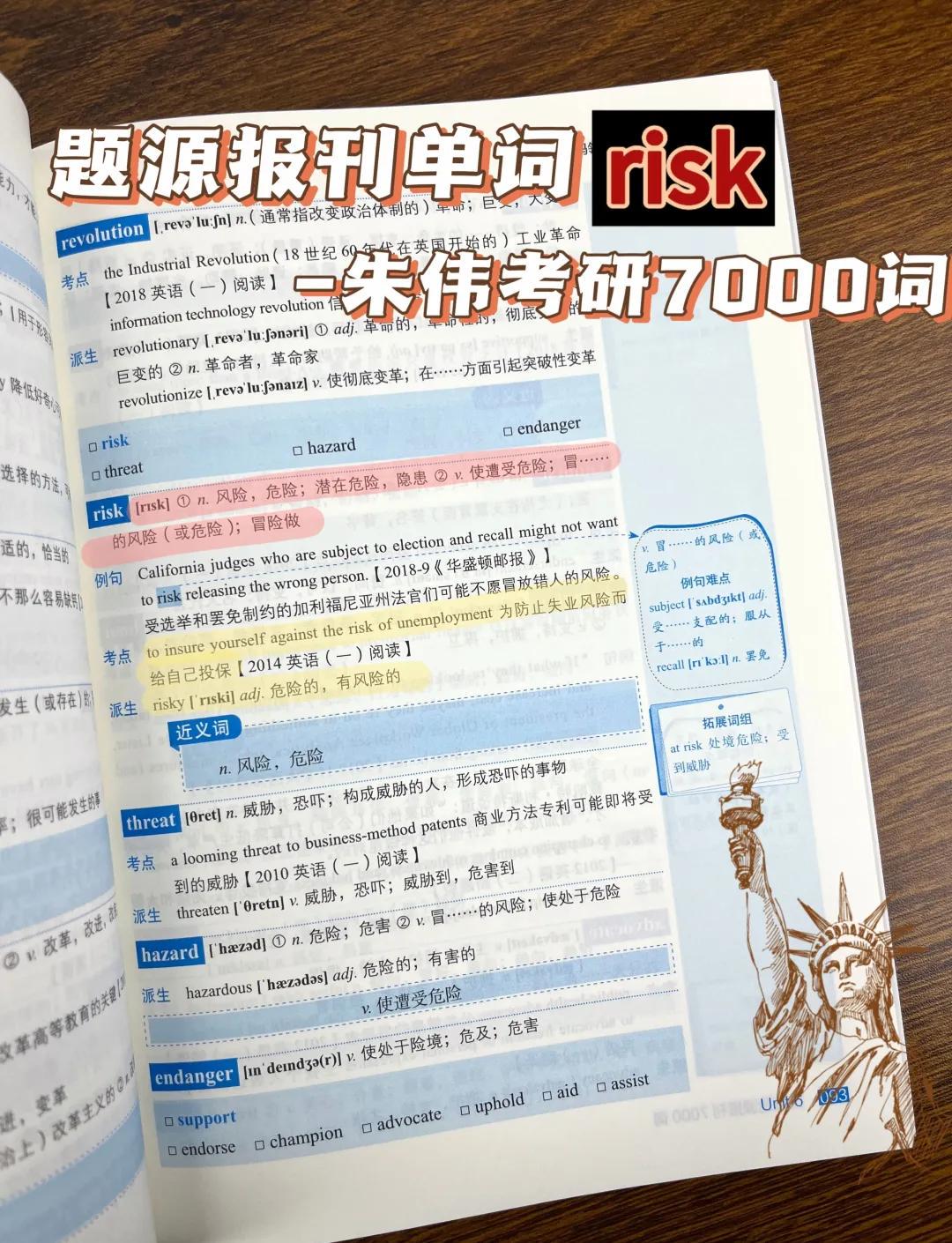

Illustration of how sovereign events can affect futures market pricing

How Sovereign Risk Impacts Futures Trading

Price Volatility

Sovereign events often trigger sharp price movements in futures markets. For instance, a government default or sudden policy change can drastically alter commodity or currency futures prices.

- Example: A country announcing trade restrictions may cause oil or metal futures linked to that region to spike or drop dramatically.

Liquidity Concerns

During periods of high sovereign risk, liquidity may decrease as market participants hesitate to trade, increasing spreads and execution risk.

Hedging Challenges

Traders may struggle to hedge effectively because traditional models might not account for geopolitical risks, resulting in gaps between expected and actual returns.

Beginner traders should explore how sovereign risk affects perpetual futures trading to gain insight into risk management techniques.

Strategies to Manage Sovereign Risk

Strategy 1: Diversification Across Regions

- Approach: Spread positions across multiple countries and asset classes to reduce exposure to a single government’s policies.

- Pros: Mitigates the impact of localized events.

- Cons: Requires broader market knowledge and monitoring.

- Example: Pairing U.S. futures contracts with European or Asian contracts to balance risk.

Strategy 2: Using Derivatives for Hedging

- Approach: Utilize options, futures, or swaps to hedge against potential sovereign events.

- Pros: Provides targeted protection against adverse movements.

- Cons: Costs associated with hedging instruments may reduce profitability.

- Example: Buying protective options against currency fluctuations in emerging markets.

Comparison of diversification vs. derivative-based hedging approaches

Tools and Frameworks for Beginners

Risk Assessment Models

- Sovereign risk ratings from agencies such as Moody’s, S&P, and Fitch provide quantitative insight into country risk.

- Risk metrics include default probability, debt-to-GDP ratio, and credit spreads.

Monitoring and Alerts

- Platforms like Bloomberg Terminal and Refinitiv offer real-time alerts for policy changes, defaults, or geopolitical events.

- Beginners can track these alerts to adjust futures positions proactively.

Practical Risk Framework

- Identify countries impacting your trading portfolio.

- Evaluate their current fiscal and political environment.

- Implement diversification or hedging strategies accordingly.

- Continuously monitor risk metrics and adjust positions.

Tools for monitoring sovereign risk in futures are invaluable for developing a disciplined trading routine.

Best Practices for Beginners

- Educate on Macroeconomics: Understand global events, interest rates, and policy changes.

- Integrate Risk Metrics: Use sovereign risk scores in trading algorithms or manual strategies.

- Start Small: Limit exposure to highly volatile regions until familiar with sovereign risk dynamics.

- Combine with Technical Analysis: Use volume, price trends, and technical indicators to complement sovereign risk insights.

FAQs

1. Why study sovereign risk in futures trading?

Sovereign risk directly affects futures pricing, liquidity, and volatility. Beginners who understand these risks can make informed decisions, avoid large losses, and design effective hedging strategies.

2. How can beginners mitigate sovereign risk?

By diversifying positions across multiple countries, using derivative hedges, and monitoring sovereign risk ratings, beginners can reduce the potential impact of adverse government policies or events.

3. Where can traders find reliable sovereign risk information?

Traders can access sovereign risk reports from rating agencies (Moody’s, S&P), specialized platforms like Bloomberg, and research papers focused on geopolitical and fiscal risks. Beginners should also consider training courses to better interpret and apply this data.

Conclusion

Sovereign risk is essential knowledge for futures beginners, influencing price behavior, liquidity, and market stability. By understanding its impact, leveraging risk assessment tools, and applying diversification or hedging strategies, traders can navigate futures markets more effectively. Continuous learning, monitoring, and practical application are key to integrating sovereign risk management into a sustainable trading approach.

Visual guide to assessing and mitigating sovereign risk for new traders

Share your experiences and strategies for managing sovereign risk in futures! Comment, discuss, and forward this guide to help other traders build stronger risk awareness.