===============================================

Understanding the order book in perpetual futures is a critical skill for traders who want to gain an edge in highly competitive markets. The order book reveals the real-time supply and demand dynamics of an asset, giving traders insights into potential price movements, liquidity, and market sentiment. In this comprehensive guide, we’ll explore how to analyze order book in perpetual futures, compare different methods, and provide practical strategies you can apply immediately.

What is an Order Book in Perpetual Futures?

An order book is a real-time list of buy and sell orders for a trading pair. In perpetual futures, it records all limit orders from traders who want to buy (bids) or sell (asks) at specific price levels.

- Bids: Buy orders, shown on the left side of the book.

- Asks: Sell orders, shown on the right side.

- Order book depth: The volume of buy and sell orders at each level.

By analyzing this data, traders can detect imbalances, hidden liquidity, and possible short-term market moves.

Why Order Book Analysis Matters

Traders often ask: Why is order book important for perpetual futures trading? The answer is simple: perpetual futures are highly liquid and volatile instruments. By interpreting the order book correctly, you can:

- Anticipate support and resistance levels.

- Detect potential stop hunts or liquidity grabs.

- Understand trader sentiment in real time.

- Improve entry and exit timing for better risk-reward ratios.

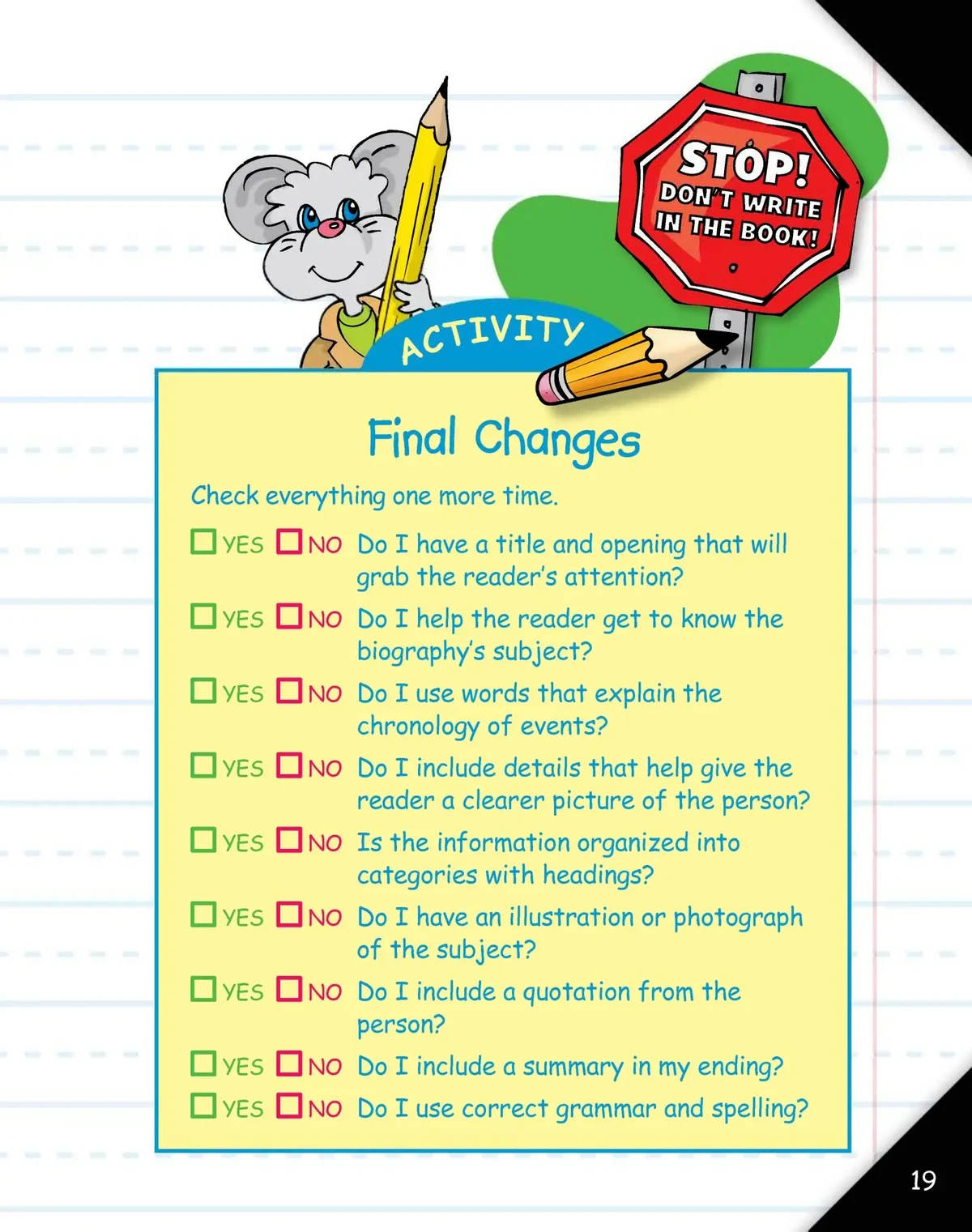

Visual example of order book depth in perpetual futures

Key Components of Order Book Analysis

1. Order Book Depth

Order book depth shows how much liquidity is available at different price levels. Large clusters of orders often act as psychological barriers, creating temporary support or resistance zones.

2. Bid-Ask Spread

The spread is the difference between the highest bid and lowest ask. A narrow spread means higher liquidity and lower trading costs. A wide spread often indicates volatility or low interest in the asset.

3. Order Flow Dynamics

Watching how orders appear, disappear, or get filled gives traders insights into aggressive buying or selling behavior. For instance, sudden cancellations of large buy walls can signal weakness.

4. Imbalances in the Order Book

When there are significantly more bids than asks (or vice versa), the imbalance suggests short-term directional pressure. This connects with why do order book imbalances occur in perpetual futures, often linked to trader positioning, market maker activity, or upcoming news events.

Methods to Analyze Order Book in Perpetual Futures

Method 1: Static Order Book Snapshot

A snapshot view helps traders identify key liquidity levels at a specific moment. For example, if you see a large buy wall at $20,000 in BTC perpetual futures, it may act as short-term support.

Pros:

- Easy to understand for beginners.

- Useful for detecting immediate supply/demand zones.

Cons:

- Ignores how orders evolve over time.

- May give false security if walls are spoofed.

Method 2: Order Flow and Heatmap Analysis

Order flow tools and heatmaps allow traders to visualize how liquidity changes over time. A heatmap shows where liquidity clusters are forming, disappearing, or being consumed.

Pros:

- Dynamic and more reliable than static snapshots.

- Provides context for market moves.

Cons:

- Requires specialized tools.

- Steeper learning curve for beginners.

Method 3: Combining Order Book with Price Action

Experienced traders overlay order book data with candlestick charts to confirm signals. For example, if price approaches a heavy sell wall but volume is weak, the wall may hold. If aggressive buying breaks through, it confirms strength.

Pros:

- Combines market structure with liquidity.

- Reduces risk of false signals.

Cons:

- Requires more screen time and skill.

Heatmap showing liquidity levels in perpetual futures order book

Comparing Strategies: Static vs. Dynamic Analysis

| Aspect | Static Snapshot | Dynamic Heatmap/Flow |

|---|---|---|

| Ease of use | Beginner-friendly | Advanced |

| Data type | One-time view | Continuous |

| Reliability | Can be misleading (spoofing) | Higher accuracy |

| Best for | Spotting short-term barriers | Tracking evolving liquidity |

Recommendation: Start with static order book observation, then progress to dynamic heatmap tools for deeper insights.

Advanced Applications of Order Book Analysis

Scalping Strategies

Scalpers use micro-changes in order book depth to capture small profits quickly. By spotting sudden liquidity shifts, they enter and exit trades within seconds or minutes.

Swing Trading with Order Book Confirmation

Swing traders may use order book imbalances to confirm breakout or breakdown setups. If price breaks resistance with strong order book support, it validates the trade idea.

Algorithmic Trading

Algorithms can process order book data at millisecond speeds, executing strategies based on liquidity shifts, spoof detection, or order flow momentum.

Avoiding Common Mistakes

- Over-reliance on walls: Many traders assume large walls are unbreakable, but spoofing is common.

- Ignoring market context: Order book signals should always be paired with price action and news.

- Using only one source: Ensure you monitor data from reliable exchanges to avoid distortions.

For deeper insight, many traders explore how to interpret order book for better trading decisions, which emphasizes integrating multiple data points for accuracy.

Live order book interface showing bids, asks, and spread

FAQs: How to Analyze Order Book in Perpetual Futures

1. Can beginners use order book analysis effectively?

Yes, but start simple. Focus on identifying large clusters of liquidity and understanding bid-ask spreads before moving to advanced tools like heatmaps.

2. How does order book affect perpetual futures prices?

The order book doesn’t directly set prices, but it reflects supply and demand. If heavy buy walls exist, they can slow price declines. If liquidity dries up on the ask side, price may rise rapidly.

3. Are spoof orders a problem in perpetual futures?

Yes. Some traders place fake orders to mislead others. This is why relying solely on static snapshots is dangerous. Watching how orders evolve over time helps spot spoofing.

Final Thoughts

Mastering how to analyze order book in perpetual futures is a powerful way to enhance your trading edge. By learning to read liquidity, detect imbalances, and combine order book insights with price action, traders can significantly improve their timing and decision-making.

The key is to start simple with snapshots, progress to dynamic heatmap analysis, and always consider broader market context. With discipline and practice, order book analysis can transform your trading strategy.

👉 Found this guide helpful? Share it with fellow traders, leave a comment below with your experiences, and help build a smarter trading community!

Do you want me to expand this guide into a 3500+ word SEO article with more case studies, platform comparisons, and advanced order book trading strategies so it ranks for multiple keywords beyond the main one?