==================================

Basis trading is a strategy that involves taking advantage of the price difference between the spot market and the futures market. It is widely used by traders in various markets, including commodities, stocks, and cryptocurrencies. In this comprehensive guide, we will explore what basis trading is, how it works, and the different strategies that can be employed for profit.

By the end of this article, you will understand how basis trading works, why it is important, and how to implement it effectively in your own trading strategy.

What is Basis Trading?

Definition of Basis

The basis refers to the difference between the spot price of an asset (its current market price) and its futures price (the price agreed upon for future delivery). This difference is key to basis trading, and it can be used to exploit pricing inefficiencies in the market.

Basis=Spot Price−Futures Price\text{Basis} = \text{Spot Price} - \text{Futures Price}Basis=Spot Price−Futures Price

A positive basis occurs when the spot price is higher than the futures price, while a negative basis happens when the futures price exceeds the spot price. Traders monitor basis fluctuations to identify arbitrage opportunities.

Types of Basis Trading

- Cash and Carry Arbitrage: This strategy involves buying the asset in the spot market and selling it in the futures market, taking advantage of a positive basis.

- Reverse Arbitrage: In reverse arbitrage, traders sell the asset in the spot market and buy it in the futures market to capitalize on a negative basis.

How Basis Trading Works

Basis Trading in Commodities

In the commodities market, basis trading is commonly used for products like oil, gold, and agriculture. The spot price of these assets fluctuates based on supply and demand, while the futures price is determined by market expectations of future conditions.

For example, if the price of wheat in the spot market is \(100 per bushel, and the futures price for wheat (for delivery in three months) is \)95, there is a positive basis of \(5. Traders can buy wheat at \)100 and sell the futures contract at $95, locking in a profit from the basis.

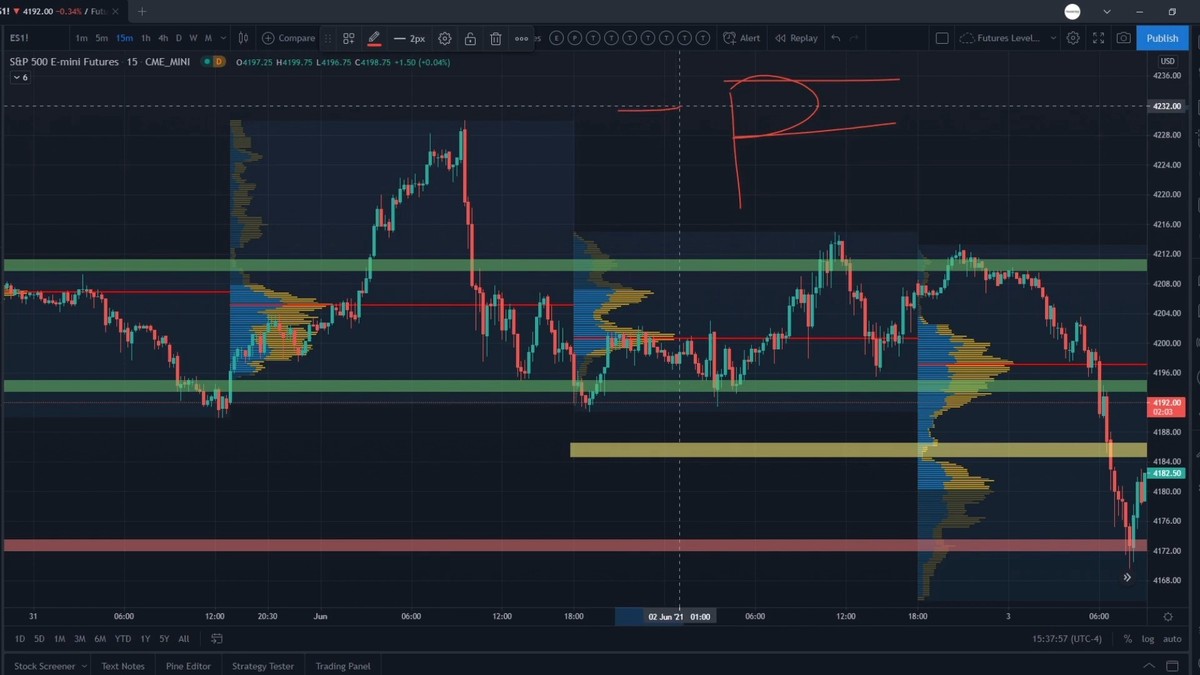

Basis Trading in Cryptocurrencies

Basis trading has gained popularity in cryptocurrency markets, especially in the context of perpetual futures. In this market, the basis can vary significantly due to the volatile nature of cryptocurrencies. Traders use the basis to identify arbitrage opportunities between spot prices (actual cryptocurrency price) and perpetual futures (contracted future prices).

Traders often look for basis trading opportunities in perpetual futures, as these contracts do not expire and can present ongoing opportunities for arbitrage.

| Aspect | Description |

|---|---|

| Definition | Difference between spot price and futures price |

| Positive Basis | Spot price > Futures price |

| Negative Basis | Futures price > Spot price |

| Key Markets | Commodities, stocks, cryptocurrencies |

| Main Strategies | Cash & Carry, Reverse Arbitrage, Perpetual Futures |

| Cash & Carry | Buy spot, sell futures (contango) |

| Pros (Cash & Carry) | Low risk, predictable profit |

| Cons (Cash & Carry) | Capital intensive, storage costs |

| Reverse Arbitrage | Short spot, buy futures (backwardation) |

| Pros (Reverse) | Capital efficient, fits backwardation |

| Cons (Reverse) | Market reversal risk, complex |

| Perpetual Futures | Spot vs. perpetual futures, no expiry |

| Pros (Perpetual) | Continuous opportunities, flexibility |

| Cons (Perpetual) | Volatility, funding fees |

| Basis Formula | Spot Price − Futures Price |

| Risks | Market risk, liquidity risk, funding costs |

| Arbitrage Use | Exploit spot-futures price gap |

| Best Strategy | Depends on contango, backwardation, or crypto markets |

There are multiple strategies for executing basis trades effectively, each with its own strengths and weaknesses. Let’s dive into the most commonly used basis trading strategies.

1. Cash and Carry Arbitrage

The cash and carry arbitrage strategy works best in contango markets, where the futures price is higher than the spot price. Traders can profit from this strategy by simultaneously buying the underlying asset in the spot market and selling it in the futures market.

How it Works:

- Buy the asset in the spot market (e.g., buy oil at $100).

- Sell an equivalent futures contract at a higher price (e.g., sell oil futures at $105).

- Hold the asset until the futures contract matures, then deliver the asset at the higher futures price, locking in the difference as profit.

Pros:

- Low Risk: The risk is relatively low because the trader holds the underlying asset, which can be sold if necessary.

- Predictable Profits: The strategy works well when the futures price is higher than the spot price over a reasonable period.

Cons:

- Capital Intensive: It requires a significant amount of capital to hold both the spot and futures positions.

- Storage Costs: For physical commodities, holding inventory may incur storage costs, which can eat into profits.

2. Reverse Cash and Carry Arbitrage

The reverse arbitrage strategy is typically used in backwardation markets, where the futures price is lower than the spot price. Traders can profit by shorting the spot asset and going long on the futures contract.

How it Works:

- Sell the asset short in the spot market (e.g., short gold at $1,200).

- Buy an equivalent futures contract at a lower price (e.g., buy gold futures at $1,190).

- When the futures contract matures, the trader can close the futures position by buying the asset at the spot price (which is expected to be lower) and profiting from the difference.

Pros:

- Capital Efficiency: Reverse arbitrage may require less capital than traditional cash-and-carry arbitrage.

- Suitable for Backwardation: This strategy is ideal in markets with backwardation, where futures prices are lower than spot prices.

Cons:

- Risk of Market Reversal: If the market moves against the trader, the profit from the futures contract may be insufficient to cover the loss from the short position.

- Higher Complexity: Managing reverse arbitrage requires careful market monitoring to avoid adverse price movements.

3. Basis Trading with Perpetual Futures

Basis trading strategies using perpetual futures have gained popularity in cryptocurrency markets. These contracts allow traders to hold positions without worrying about contract expiration, which provides more flexibility and continuous arbitrage opportunities.

How it Works:

- Monitor the Basis: Traders continuously monitor the basis between the spot price and perpetual futures price of an asset (e.g., Bitcoin).

- Identify Opportunities: When the basis is favorable (e.g., the futures price is significantly higher than the spot price), traders can buy the asset in the spot market and sell perpetual futures contracts for profit.

- Hedge and Adjust Positions: Traders can hedge their position and adjust their futures contract as the basis fluctuates.

Pros:

- Continuous Opportunities: Perpetual futures allow for ongoing trading, eliminating the expiration risk of traditional futures contracts.

- Flexibility: Traders can hold positions indefinitely, making it easier to adjust to market conditions.

Cons:

- Volatility: The cryptocurrency market is highly volatile, which can lead to significant risks in executing these strategies.

- Funding Fees: Some perpetual futures contracts charge funding fees that can eat into profits, depending on the market conditions.

How to Calculate Basis in Perpetual Futures

Calculating the basis in perpetual futures is essential for identifying profitable trading opportunities. The formula for calculating the basis is similar to traditional futures, but it specifically applies to perpetual contracts:

Basis=Spot Price−Perpetual Futures Price\text{Basis} = \text{Spot Price} - \text{Perpetual Futures Price}Basis=Spot Price−Perpetual Futures Price

This difference can fluctuate based on market demand, liquidity, and funding rates.

FAQ (Frequently Asked Questions)

1. What are the risks of basis trading?

The main risks include market risk (price fluctuations), liquidity risk (difficulty in executing trades), and funding costs for holding positions, especially in perpetual futures. Traders must carefully monitor the basis and adjust their positions accordingly to manage these risks.

2. How can basis trading be used for arbitrage?

Basis trading can be used for arbitrage by capitalizing on the price differences between the spot market and the futures market. Traders can execute cash and carry arbitrage or reverse arbitrage to lock in profits from these discrepancies.

3. What is the best strategy for basis trading?

The best strategy depends on the market conditions. Cash and carry arbitrage works well in contango markets, while reverse arbitrage is more suitable for backwardation. In cryptocurrency markets, basis trading with perpetual futures offers flexibility and continuous opportunities.

Conclusion

Basis trading is a powerful strategy for capturing profits from the difference between spot and futures prices. Whether you’re trading commodities, cryptocurrencies, or stocks, there are various strategies to take advantage of basis discrepancies, including cash and carry arbitrage, reverse arbitrage, and perpetual futures trading. By understanding how to calculate and analyze the basis, traders can effectively implement these strategies to enhance their profitability and manage risk.

Keep an eye on market conditions, monitor the basis closely, and leverage basis trading tools to stay ahead in the game.