=========================================================================

In financial markets, especially in futures and perpetual futures, understanding basis volatility analysis is crucial for making informed trading decisions. Basis, defined as the difference between the spot price of an asset and its futures price, plays a significant role in determining trading strategies, risk management, and arbitrage opportunities. This article will delve into the concept of basis volatility analysis, its importance in trading, and how to use it effectively for market analysis.

What is Basis and Basis Volatility?

Understanding Basis

Basis refers to the difference between the spot price (the current market price of an asset) and the futures price (the agreed-upon price for future delivery). It is a critical concept in futures trading, particularly for perpetual futures, where there is no expiry date.

Formula for Basis:

Basis=Spot Price−Futures Price\text{Basis} = \text{Spot Price} - \text{Futures Price}Basis=Spot Price−Futures Price

What is Basis Volatility?

Basis volatility refers to the fluctuations or changes in the basis over time. This volatility is essential because it can indicate shifts in market sentiment, potential arbitrage opportunities, and changing risk factors. A highly volatile basis suggests significant price discrepancies between the spot and futures markets, which could lead to profitable trading opportunities or higher risk.

Importance of Basis Volatility in Futures and Perpetual Futures Trading

In perpetual futures trading, where contracts are renewed continuously, the basis can fluctuate frequently. Monitoring basis volatility helps traders anticipate price movements, identify trends, and manage risks effectively.

Key Reasons Why Basis Volatility Matters:

- Arbitrage Opportunities: Traders can exploit differences between the spot and futures market to generate risk-free profits when the basis becomes volatile.

- Market Sentiment Indicators: Sudden changes in the basis can be indicative of shifts in market sentiment, often predicting price reversals or significant trends.

- Risk Management: By analyzing basis volatility, traders can adjust their hedging strategies and limit exposure to sudden market shocks.

- Price Predictions: Understanding the behavior of basis volatility aids in predicting future price movements, helping traders make better entry and exit decisions.

| Section | Key Points |

|---|---|

| Definition | Excel modeling = using Excel tools for trading analysis and decision-making. |

| Benefits | Easy to use, customizable, advanced VBA, real-time data, strong visualization. |

| Statistical Functions | AVERAGE, STDEV, CORREL, LINEST for price, volatility, correlation. |

| Financial Functions | PMT, FV, RATE for ROI, growth, leveraged positions. |

| Charts | Line (trends), Candlestick (sentiment), Scatter (correlation), Histogram (risk). |

| Risk Tools | VaR (loss estimate), Monte Carlo (scenarios), Solver (portfolio optimization). |

| Backtesting | Import historical data, use IF/VLOOKUP, calculate win rate, P/L ratio, drawdown. |

| Manual Modeling Pros | Full control, customizable, low cost. |

| Manual Modeling Cons | Time-consuming, advanced skills, not for HFT. |

| Automated Pros | Real-time data, trade automation, efficient for HFT. |

| Automated Cons | Setup needed, third-party reliance, extra costs. |

| Common Functions | AVERAGE, STDEV, LINEST, PMT for trading analysis. |

| Improvement Tips | Backtest, optimize with Solver, apply VaR, automate tasks. |

There are several techniques for analyzing basis volatility. The two most popular methods are statistical models and technical analysis. Below, we explore these methods, along with their advantages and disadvantages.

1. Statistical Models for Basis Volatility

Implied Volatility Models

Implied volatility is a metric used to gauge the market’s expectations of future volatility, derived from option pricing models. Traders can apply this concept to analyze basis volatility by studying the implied volatility of the futures contracts.

Pros:

- Helps predict future volatility.

- Provides insights into market expectations.

- Helps predict future volatility.

Cons:

- May not accurately predict short-term volatility shifts.

- Relies heavily on market assumptions.

- May not accurately predict short-term volatility shifts.

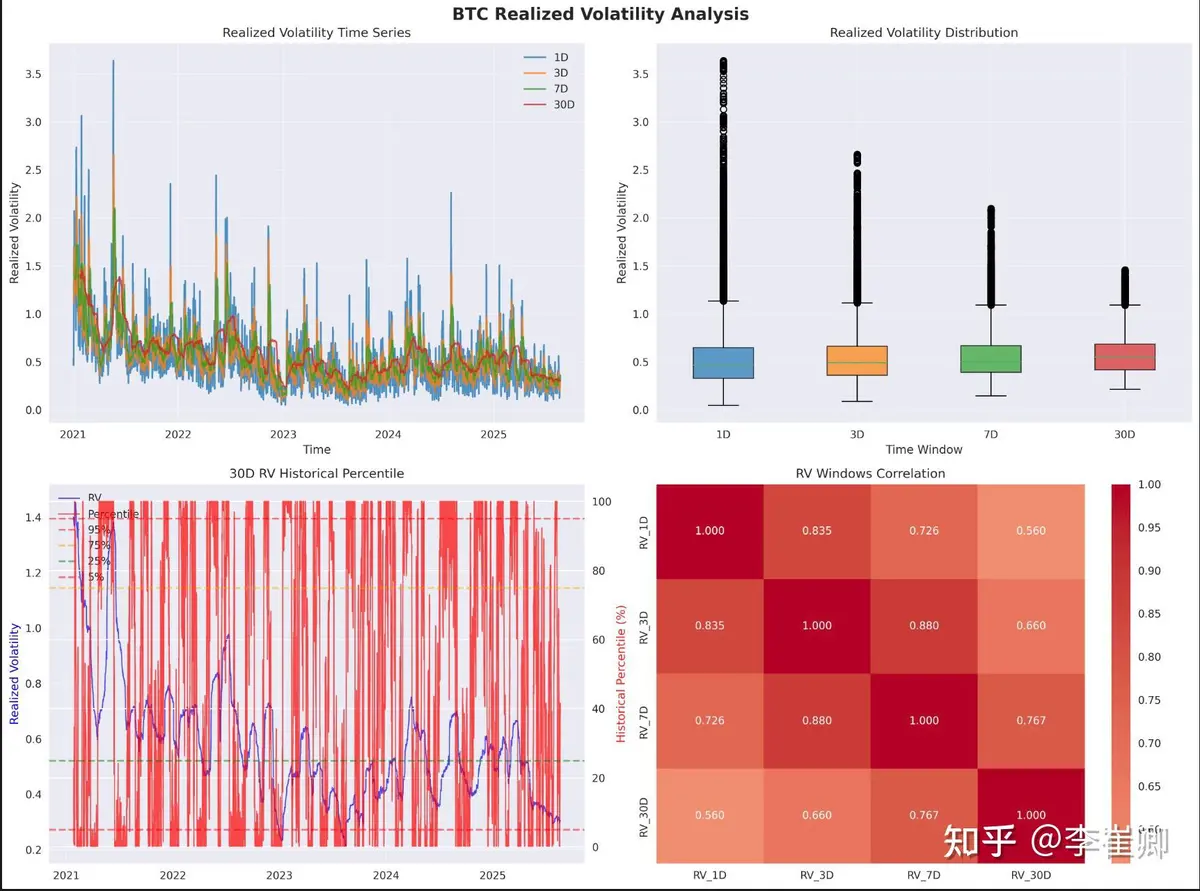

Historical Volatility Analysis

This approach uses historical price data to measure the standard deviation of price changes over a specific period. It provides a historical view of how volatile the basis has been, allowing traders to make decisions based on past price behavior.

Pros:

- Backed by data, providing a clear, objective view of past market conditions.

- Allows for comparisons between different assets or timeframes.

- Backed by data, providing a clear, objective view of past market conditions.

Cons:

- Does not account for future volatility factors.

- May not be suitable for rapidly changing markets.

- Does not account for future volatility factors.

2. Technical Analysis for Basis Volatility

Technical analysis involves studying historical price movements and identifying trends, support, resistance levels, and other market indicators to predict future price behavior.

Bollinger Bands for Basis Volatility

Bollinger Bands are widely used for identifying periods of high and low volatility. By applying this tool to the basis (spot and futures difference), traders can visually observe when the basis becomes unusually volatile.

Pros:

- Simple and effective in identifying extreme volatility.

- Easy to implement with most trading platforms.

- Simple and effective in identifying extreme volatility.

Cons:

- Can produce false signals during low-volatility periods.

- Requires ongoing adjustment for changing market conditions.

- Can produce false signals during low-volatility periods.

Moving Average Convergence Divergence (MACD)

The MACD can also be applied to basis volatility analysis by studying the convergence and divergence of moving averages. When the basis fluctuates significantly, the MACD can highlight whether the trend will continue or reverse.

Pros:

- Good for spotting momentum shifts.

- Provides early warnings of potential changes in market direction.

- Good for spotting momentum shifts.

Cons:

- Lagging indicator, meaning it reacts to market movements rather than predicts them.

- Lagging indicator, meaning it reacts to market movements rather than predicts them.

Comparing Basis Volatility Analysis Methods

Both statistical models and technical analysis offer valuable insights into basis volatility, but they come with their pros and cons. The best approach depends on the trader’s goals, risk tolerance, and time horizon.

| Method | Pros | Cons |

|---|---|---|

| Implied Volatility Models | Predicts future volatility, gives market sentiment insights | Can be inaccurate in the short-term |

| Historical Volatility | Data-driven, objective, compares timeframes | Does not predict future volatility |

| Bollinger Bands | Easy to implement, identifies high/low volatility | False signals during calm markets |

| MACD | Spot momentum shifts early, tracks trend reversals | Can lag behind actual price movements |

Best Approach for Traders

For traders, combining both statistical and technical methods is often the best strategy. Historical volatility analysis provides a strong foundation for understanding past behavior, while technical indicators like Bollinger Bands and MACD can be used to make actionable predictions in real-time.

Using Basis Volatility in Arbitrage Strategies

Basis volatility is particularly useful in arbitrage strategies, where traders capitalize on price differences between spot and futures markets. By analyzing basis volatility, traders can identify when the basis is unusually wide, signaling potential arbitrage opportunities.

Key Steps in Arbitrage Using Basis Volatility:

- Monitor Basis Trends: Regularly track the basis to identify when it deviates significantly from historical norms.

- Set Arbitrage Triggers: Define specific threshold values for when to enter or exit arbitrage trades based on basis volatility.

- Execute Trades: When basis volatility signals a profitable opportunity, take simultaneous positions in the spot and futures markets to lock in a risk-free profit.

Example of basis volatility in perpetual futures markets, showing an arbitrage opportunity.

Frequently Asked Questions (FAQ)

1. What factors influence basis volatility?

Basis volatility is influenced by several factors, including market sentiment, supply and demand dynamics, geopolitical events, and the liquidity of the asset. Events like earnings reports, economic data releases, and global news can all impact the spot and futures price relationship.

2. How do I calculate basis volatility?

To calculate basis volatility, track the difference between the spot price and the futures price over time. Calculate the standard deviation of this difference to measure its volatility. Statistical software or financial tools can simplify this process.

3. How can I use basis volatility in my trading strategy?

Traders can use basis volatility to anticipate market movements and adjust positions accordingly. For example, if the basis volatility is high, it may indicate a market correction or significant price shift, prompting traders to hedge their positions or look for arbitrage opportunities.

Conclusion

Basis volatility analysis is an essential tool for futures traders, offering insights into market behavior, potential arbitrage opportunities, and risk management strategies. By understanding the methods of analyzing basis volatility and integrating them into trading strategies, traders can enhance their decision-making and increase their profitability. Whether you are a beginner or an experienced trader, mastering the art of basis volatility will be invaluable in navigating the complexities of futures markets.

If you found this article helpful, please share it with your peers, comment below, or ask any further questions. Let’s continue to discuss how basis volatility influences your trading decisions!