=====================================

Canceling stop orders in futures is a critical skill for traders who want to adapt quickly to market changes. Stop orders help manage risk and automate entries or exits, but leaving them active for too long—or forgetting to cancel them—can result in unintended trades. Knowing how to cancel stop orders in futures effectively ensures you stay in control of your strategy and avoid costly mistakes.

This comprehensive guide explains multiple methods to cancel stop orders, compares their pros and cons, and provides best practices for different trader profiles, from beginners to professionals.

What Is a Stop Order in Futures?

A stop order in futures is an instruction to buy or sell a contract once the price reaches a predetermined level (the stop price). Once triggered, the order becomes a market order or limit order, depending on how it is set.

For example:

- A stop-loss order protects against excessive losses.

- A stop-entry order automates entry when the market moves in your favor.

Understanding how does stop order work in futures helps traders appreciate why canceling or modifying them is sometimes necessary.

Why Cancel Stop Orders?

Canceling stop orders may be required for several reasons:

- Market conditions change – Price action invalidates your setup.

- Risk management – You decide to exit earlier than planned.

- Strategy adjustment – You want to replace an existing stop with a better one.

- Avoid unintended execution – Leaving a stop active can cause trades after you’ve already closed your position.

Methods to Cancel Stop Orders in Futures

1. Cancel Directly from the Trading Platform

Most trading platforms allow you to cancel stop orders with a single click.

Steps:

- Log into your account.

- Navigate to the “Open Orders” or “Active Orders” section.

- Select the stop order you want to cancel.

- Click “Cancel” or “Modify/Cancel.”

Pros:

- Quick and easy.

- Works across all major brokers.

Cons:

- Requires manual action.

- Risk of forgetting if managing multiple accounts.

2. Cancel Through Mobile Apps

Mobile trading apps provide flexibility to cancel stop orders on the go.

Pros:

- Great for active traders monitoring multiple markets.

- Push notifications can remind you of active stops.

Cons:

- Smaller screen may lead to misclicks.

- Requires stable internet connection.

3. Cancel via API or Automated Systems

For algorithmic traders, stop orders can be managed programmatically via broker APIs.

Example:

- Use a Python script connected to the broker’s API to cancel all stop orders when certain conditions are met.

Pros:

- Efficient for high-frequency traders.

- Allows bulk cancellation.

Cons:

- Requires technical knowledge.

- System errors can delay execution.

4. Broker-Assisted Cancellation

In rare cases, if your platform is down or you face technical issues, you can call your broker directly to request cancellation.

Pros:

- Reliable backup option.

- Essential during outages.

Cons:

- Slower than online methods.

- May incur additional fees.

Comparing Strategies: Manual vs. Automated Cancellation

Manual Cancellation

- Best for retail traders and beginners.

- Provides control and flexibility.

- Risk: Human error and missed cancellations.

Automated/API-Based Cancellation

- Best for algorithmic traders and institutions.

- Reduces human error and manages multiple markets.

- Risk: Technical failures or poorly coded scripts.

Recommendation: For most traders, a combination of manual oversight with automated alerts is the optimal balance.

Best Practices for Canceling Stop Orders

- Set alerts: Use platform alerts to remind you of active stop orders.

- Review daily: Make it a routine to check open orders before the market opens and after it closes.

- Use protective layers: Pair stop orders with trailing stops or conditional orders for better risk control.

- Avoid over-automation: Even if you automate, always monitor for system glitches.

Real-World Example

A futures day trader sets a stop-loss at 4,200 on the S&P 500 E-mini contract. The market rallies sharply, and the trader closes the position at 4,280. If they forget to cancel the stop order, a sudden drop back to 4,200 could trigger an unnecessary short position.

This demonstrates why canceling unused stop orders is as important as placing them correctly.

Advanced Insights: Automating Stop Order Management

As trading technology evolves, platforms offer features like stop order optimization techniques, allowing traders to set conditions for automatic cancellation. For example:

- Cancel stops once the target profit is achieved.

- Cancel stops when volatility drops below a certain threshold.

Traders who explore how to modify stop orders in futures often combine modification and cancellation strategies for greater efficiency.

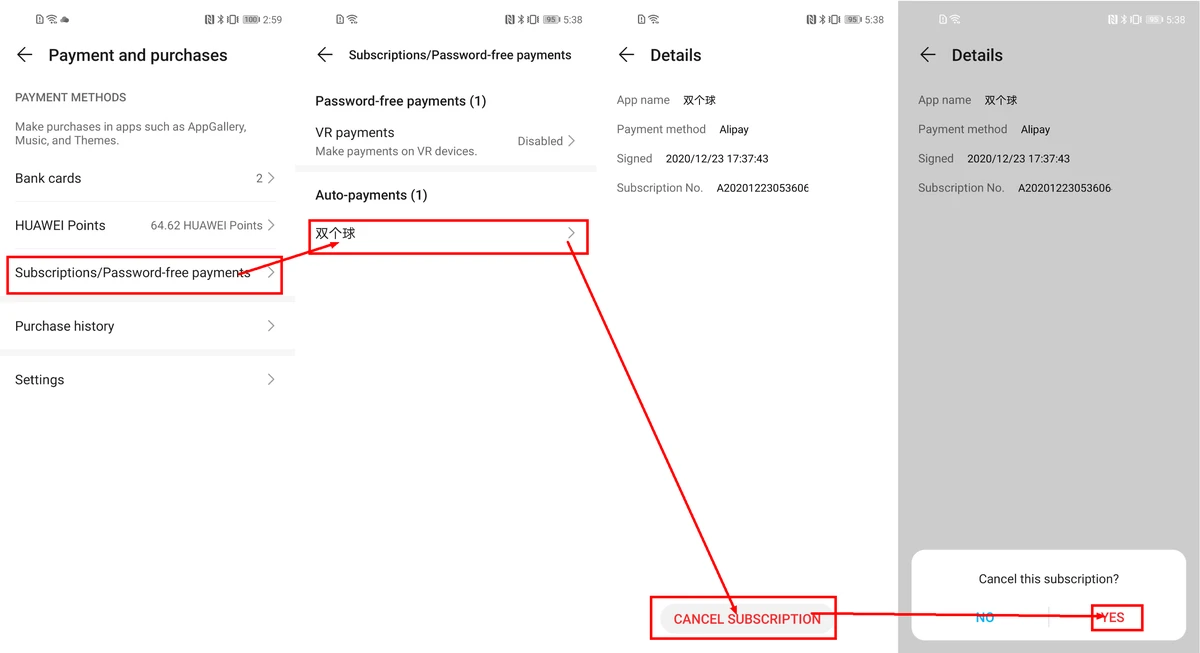

Visual Guides

Canceling stop orders on a futures trading platform

Manual vs. automated cancellation workflow

FAQ: Common Questions About Canceling Stop Orders in Futures

1. Can I cancel a stop order anytime?

Yes. Stop orders can be canceled at any time before they are triggered. Once triggered, they become market or limit orders and can no longer be canceled.

2. What happens if I forget to cancel a stop order?

If you forget to cancel, it may execute later and open a new position you did not intend to hold. Always check your open orders daily.

3. Is canceling a stop order free?

In most cases, yes. Brokers generally do not charge for canceling pending orders. However, always check your broker’s policy.

4. Can automated systems cancel stop orders for me?

Yes. Through APIs or platform automation, you can program automatic cancellation rules. This is common in institutional trading.

Final Thoughts

Knowing how to cancel stop orders in futures is as important as knowing how to place them. Whether you rely on manual methods, mobile apps, or automated systems, the key is consistent monitoring and clear risk management practices.

For beginners, manual cancellation via platforms or mobile apps is sufficient. Professionals and algorithmic traders benefit from automation with API integration. The best approach depends on your trading style and technical capabilities.

If you found this guide helpful, share it with fellow traders and leave a comment with your own strategies for managing stop orders.

Do you want me to also prepare a checklist-style infographic (step-by-step cancel process) so you can use it as a quick reference or share it with your trading group?