==================================================================

Managing risk effectively is crucial in futures trading, and stop orders serve as one of the most powerful tools for traders. Knowing how to modify stop orders in futures allows investors to optimize risk management, protect profits, and adapt to market volatility. This guide provides a comprehensive overview of techniques, strategies, and best practices for modifying stop orders in futures markets, suitable for beginners and professional traders alike.

Understanding Stop Orders in Futures

What Are Stop Orders?

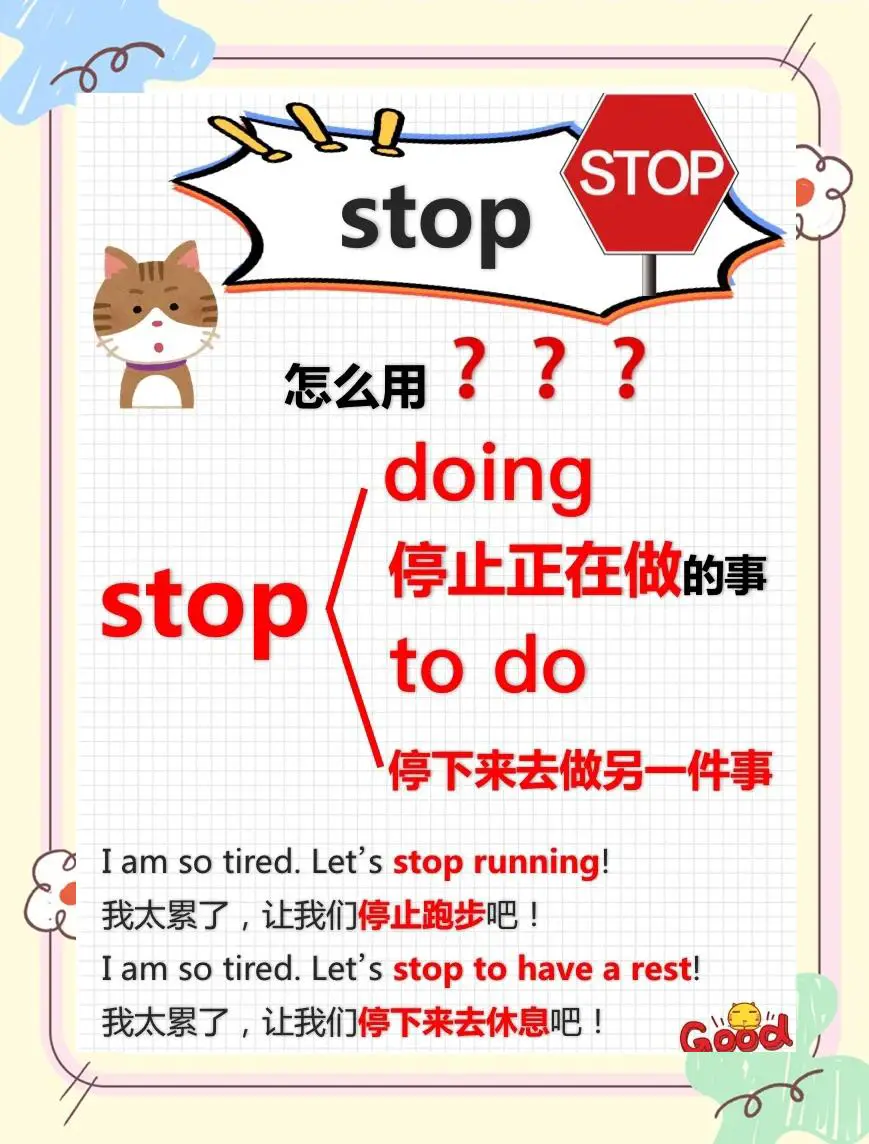

Stop orders are pre-set instructions to buy or sell a futures contract once the price reaches a specified level. They are designed to limit losses or lock in profits.

- Stop-Loss Order: Automatically exits a losing trade to prevent further loss.

- Stop-Limit Order: Triggers a limit order when the stop price is reached.

Understanding these variations is essential before attempting to modify any stop orders.

Stop orders act as automated safety nets in futures trading, protecting capital from adverse market movements.

Importance of Stop Orders

Stop orders are critical for:

- Protecting against sudden market reversals.

- Automating risk management to remove emotional bias.

- Maintaining discipline in trading strategies.

Resources like why stop orders are important in futures provide additional insights into their significance.

Methods to Modify Stop Orders in Futures

Method 1: Manual Adjustment

Manual modification involves changing the stop price directly within your trading platform.

Steps for Manual Modification

- Access your active positions.

- Select the stop order to modify.

- Update the stop price according to your revised risk tolerance.

- Confirm the changes to ensure execution.

Advantages:

- Complete control over stop levels.

- Easy to adjust based on real-time market conditions.

Drawbacks:

- Requires constant monitoring.

- Susceptible to delays or errors during volatile periods.

Method 2: Automated Adjustment Using Conditional Orders

Advanced platforms allow traders to automate stop order modifications based on market conditions.

Implementation Techniques

- Trailing Stop: Automatically adjusts the stop price as the market moves in favor of the trade.

- Conditional Stop Scripts: Pre-programmed rules modify stops when specific indicators or thresholds are met.

Advantages:

- Reduces emotional trading errors.

- Ideal for active day traders and swing traders.

Drawbacks:

- Requires technical knowledge or software integration.

- May be impacted by sudden gaps in futures prices.

Automated stop orders like trailing stops help traders lock in profits while managing risk dynamically.

Internal Link Integration: For beginners, resources such as stop orders for beginners in futures and best stop order strategies for traders offer practical guidance.

Best Practices for Modifying Stop Orders

Regularly Review Stop Levels

Stop orders should align with your current market outlook and account risk. Avoid setting them too tight to prevent premature exits.

Align Stops with Strategy

Different strategies require different stop approaches:

- Day Trading: Tight stops to minimize intraday losses.

- Swing Trading: Wider stops to accommodate market fluctuations.

- Hedge Fund Strategies: Strategic stops based on portfolio exposure and leverage.

Risk Management Considerations

- Determine maximum acceptable loss per trade.

- Consider market liquidity and volatility when adjusting stops.

- Ensure modifications are documented and part of a comprehensive trading plan.

Common Pitfalls and How to Avoid Them

Over-Adjusting Stops

Constantly moving stops can lead to unnecessary exits. Establish rules for when adjustments are justified.

Ignoring Slippage

During fast-moving markets, execution may occur at prices worse than the stop. Use limit stops carefully to manage this risk.

Platform Limitations

Not all trading platforms support advanced stop modifications. Verify capabilities such as trailing stops or conditional orders before implementation.

Understanding common mistakes helps traders optimize stop order effectiveness.

Case Studies of Effective Stop Modifications

Case Study 1: Trailing Stop in High Volatility Futures

A trader used trailing stops to lock in profits on a crude oil futures position. As the market rallied, the stop moved upward automatically, resulting in a profitable exit without manual intervention.

Case Study 2: Manual Stop Adjustment During Market Correction

During an unexpected market pullback, a discretionary trader modified stop-loss levels manually, limiting losses and maintaining overall portfolio stability.

Frequently Asked Questions (FAQ)

Q1: Can I modify a stop order after it is triggered?

A: No, once a stop order is executed, it becomes a market or limit order. Modifications apply only to pending or active stop orders.

Q2: How do trailing stops differ from regular stops in futures?

A: Trailing stops adjust automatically with favorable price movements, while regular stops remain fixed at a pre-determined level.

Q3: What is the best method for beginners to modify stop orders?

A: Start with manual adjustments and set conservative stop levels. As experience grows, consider automated trailing stops for more dynamic risk management.

Conclusion

Knowing how to modify stop orders in futures is essential for effective risk management and disciplined trading. By combining manual adjustments with automated techniques such as trailing stops, traders can protect profits, reduce losses, and maintain flexibility in volatile markets. Continuous learning and adherence to best practices ensure long-term success in futures trading.

Engage With Us: Share your experiences with stop orders, discuss strategies with other traders, or forward this guide to help others optimize their risk management techniques.

A structured workflow ensures stop orders are modified systematically to match trading objectives.