===============================

Trading with leverage in futures or crypto markets can be highly rewarding — but also extremely risky if not properly managed. One of the most important tools traders use is cross margin, which allows all available balance in a trading account to cover margin requirements across multiple positions. To use it safely, traders need a clear cross margin checklist template that ensures they cover risk, strategy, and technical requirements before opening or managing trades. This guide will provide a detailed breakdown of what a comprehensive checklist should look like, how to build it, and why it’s essential for traders of all levels.

What Is Cross Margin?

Definition and Function

Cross margin is a margin mode where the entire available balance in a trader’s account is used to prevent liquidation of open positions. Unlike isolated margin, which only uses a specific amount allocated to a position, cross margin spreads risk across the whole account.

Why It Matters

Using cross margin strategically helps traders:

- Avoid premature liquidation.

- Manage multiple correlated positions efficiently.

- Maximize capital efficiency by pooling margin resources.

This is exactly why cross margin is important in perpetual futures trading, especially for professional traders handling complex portfolios.

Why Use a Cross Margin Checklist Template

1. Prevent Emotional Decisions

By following a pre-defined checklist, traders reduce impulsive decisions that could lead to losses.

2. Standardize Trading Routines

A checklist creates consistency, whether you’re trading crypto, forex, or futures.

3. Improve Risk Management

It ensures traders evaluate leverage, margin requirements, and liquidation risks before entering trades.

Key Elements of a Cross Margin Checklist Template

1. Account Preparation

- Verify total available balance.

- Ensure funds are distributed properly across stablecoins or collateral assets.

- Review withdrawal restrictions if margin is used.

2. Leverage Selection

- Confirm leverage settings (e.g., 5x, 10x).

- Evaluate how cross margin affects leverage when multiple positions are open.

- Consider lower leverage to reduce liquidation risk.

3. Risk Assessment

- Calculate potential drawdown scenarios.

- Set maximum portfolio risk (e.g., no more than 5% of account equity per trade).

- Use volatility measures (ATR, implied volatility) to define entry size.

4. Position Management

- Define stop-loss and take-profit levels in advance.

- Use trailing stops for trending markets.

- Track open interest and funding rates for perpetual contracts.

5. Diversification

- Avoid over-concentration in a single asset.

- Spread positions across uncorrelated instruments.

- Use correlation checks to prevent double exposure.

6. Exit Planning

- Pre-plan exit triggers based on price, time, or risk metrics.

- Automate exit orders when possible to avoid slippage.

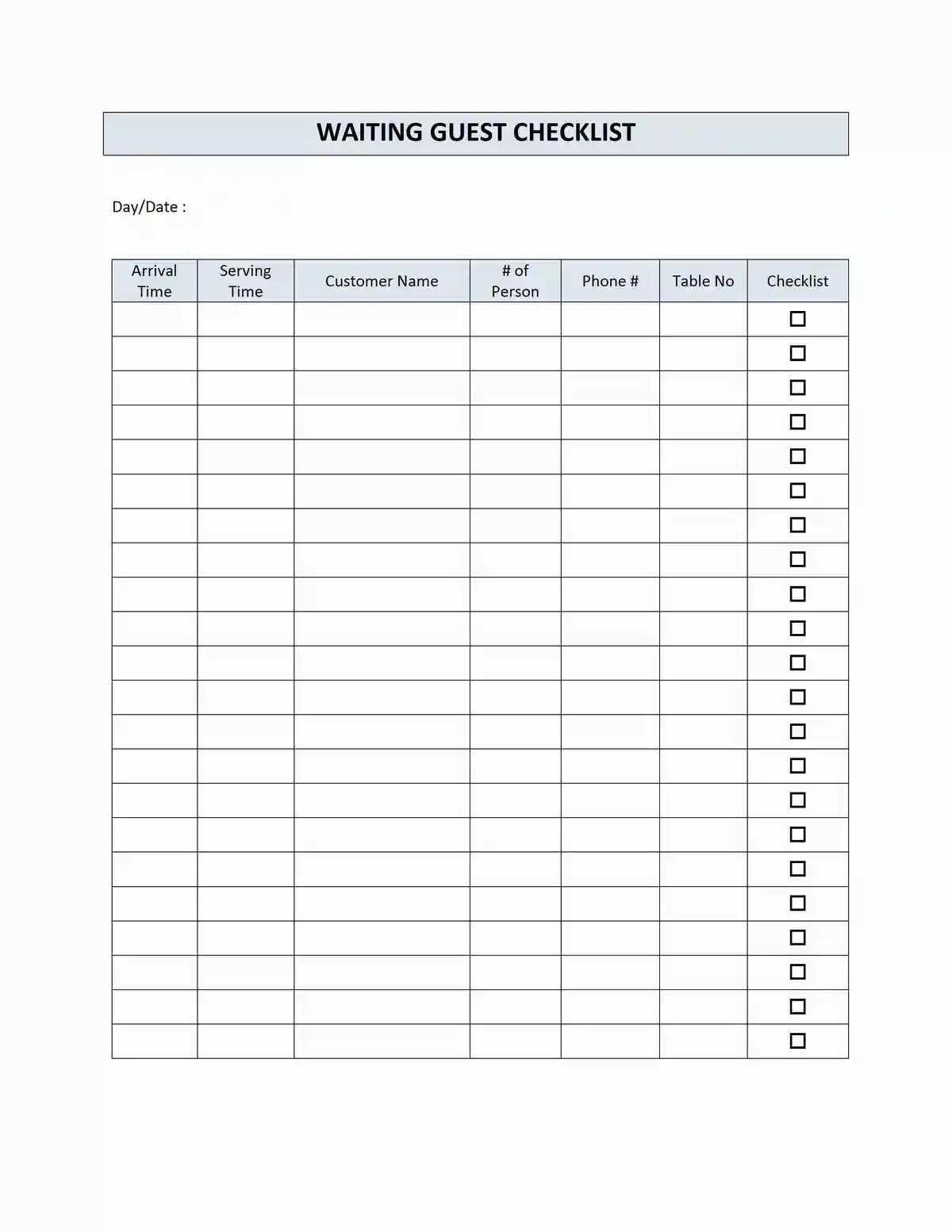

Example: Cross Margin Checklist Template

| Step | Task | Completed (✔/✘) | Notes |

|---|---|---|---|

| 1 | Verify account balance | ||

| 2 | Confirm leverage setting | ||

| 3 | Assess margin requirements | ||

| 4 | Calculate max risk exposure | ||

| 5 | Define stop-loss/take-profit | ||

| 6 | Check correlations between positions | ||

| 7 | Diversify across assets | ||

| 8 | Automate exit strategies | ||

| 9 | Monitor funding rates | ||

| 10 | Review portfolio daily |

Cross margin risk management workflow

Strategies for Cross Margin Usage

Method 1: Conservative Approach

- Use low leverage (2x–5x).

- Limit exposure to a few trades at once.

- Focus on major liquid pairs (BTC, ETH).

Pros: Lower liquidation risk, suitable for beginners.

Cons: Smaller potential profits compared to aggressive strategies.

Method 2: Aggressive Approach

- Use higher leverage (10x–20x).

- Open multiple correlated positions simultaneously.

- Employ frequent intraday trading.

Pros: Higher profit potential in volatile markets.

Cons: Increased liquidation risk if one trade goes against you.

Which Is Better?

For most traders, the conservative approach is more sustainable. However, advanced traders with strong strategies and hedging experience may benefit from the aggressive approach if they strictly follow their cross margin checklist template.

Industry Trends in Cross Margin

- AI-driven Risk Tools: Platforms now integrate AI to auto-adjust margin allocation.

- Mobile Margin Management: Traders can adjust cross margin settings via mobile apps in real time.

- Institutional Adoption: Hedge funds increasingly use cross margin to manage multi-asset portfolios.

This aligns with how does cross margin affect leverage, as institutional-grade tools provide dynamic calculations that adjust leverage based on market volatility.

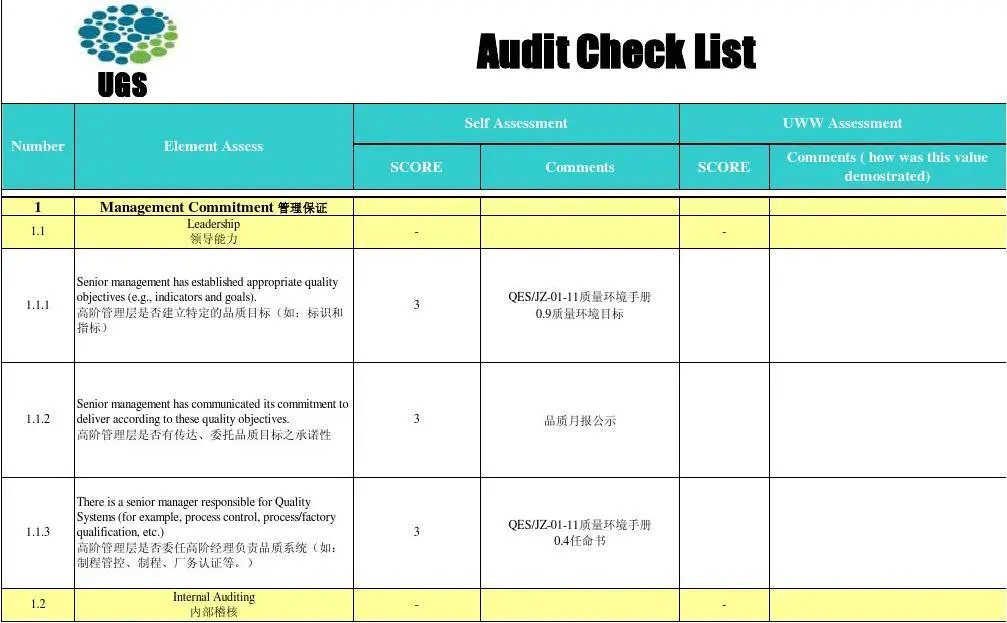

Visual Example

Comparison of decision-making between cross margin and isolated margin

Internal Knowledge Connection

For traders still learning, it’s essential to review guides on how to use cross margin in perpetual futures and understand the mechanics of margin allocation before risking real funds. Another useful resource is understanding how to calculate cross margin requirements, which ensures traders avoid unexpected liquidations.

FAQ: Cross Margin Checklist Template

1. What is the biggest risk of using cross margin?

The main risk is account-wide liquidation. Since your entire balance covers open positions, a major adverse move in one trade could wipe out the account. That’s why a structured checklist is vital.

2. How often should I update my cross margin checklist?

At least once every quarter, or sooner if your trading style, platform features, or market conditions change. Regular updates ensure the checklist remains relevant and effective.

3. Can beginners use cross margin safely?

Yes, but only with conservative leverage (under 5x) and strict adherence to a checklist. Beginners should start with demo accounts or small balances before scaling up.

Conclusion

A cross margin checklist template is more than just a tool — it’s a trader’s safeguard against liquidation and overexposure. By standardizing steps such as balance verification, leverage assessment, risk evaluation, and exit planning, traders can create discipline and consistency in their approach.

If you trade futures or crypto, building and following your own checklist is not optional — it’s essential.

Now, I’d love to hear from you: Do you already use a checklist when trading with cross margin, or are you planning to create one after reading this guide? Share your thoughts below, and don’t forget to pass this article to fellow traders who could benefit from a safer approach to cross margin trading.

Would you like me to create a ready-to-download PDF template of this cross margin checklist so you can print and use it directly in your trading routine?