=========================================================

In the fast-paced world of cryptocurrency and futures trading, risk management tools can make the difference between sustainable profits and total liquidation. One of the most misunderstood but powerful tools is cross margin, and with the rising interest in online education, many traders are now searching for a cross margin seminar online to build their skills. This detailed guide explores what traders can expect from online seminars, strategies discussed in them, and how to apply cross margin effectively in real markets.

What Is Cross Margin?

Cross margin is a margin mode where all funds in a trader’s account are shared across open positions. Unlike isolated margin, which limits risk to a specific trade, cross margin ensures that available balance is used to prevent liquidation.

For example, if you are trading BTC/USDT futures with cross margin, unrealized profits from ETH/USDT can automatically cover losses in BTC/USDT. This provides flexibility and reduces the risk of early liquidation.

Why Join a Cross Margin Seminar Online?

1. Expert-Led Training

Seminars are typically hosted by seasoned traders or platform specialists who share their knowledge on how cross margin influences risk in perpetual futures and demonstrate practical applications.

2. Interactive Learning

Unlike static tutorials, live online seminars often include Q&A sessions, live demos, and cross margin practice quizzes to test your understanding.

3. Convenience and Accessibility

Since they are online, traders worldwide can participate without geographical barriers, and many seminars offer recordings for later review.

Key Topics Covered in Online Cross Margin Seminars

1. How Cross Margin Works

- Explanation of balance pooling across trades.

- Real-world case studies on preventing liquidation.

2. Risk and Reward in Cross Margin

- How to calculate risk when multiple positions are linked.

- Tools such as a cross margin calculator tool to manage exposure.

3. Practical Strategies for Beginners and Experts

- Cross margin strategy for beginner traders (conservative position sizing, low leverage).

- Advanced cross margin techniques for expert traders (hedging, correlation analysis).

Cross margin allows account equity to cover losses across multiple positions, reducing the chance of forced liquidation.

Two Major Strategies for Using Cross Margin

Strategy 1: Conservative Multi-Asset Trading

How It Works

- Trade different assets (e.g., BTC, ETH, and LTC) under cross margin.

- Use lower leverage (2x–5x) to reduce risks.

- Set stop-losses for every trade.

Pros

- Reduces risk of liquidation by balancing gains and losses.

- Good entry point for beginners.

Cons

- Limits profit potential due to lower leverage.

- Requires constant monitoring of multiple assets.

Strategy 2: Hedging with Cross Margin

How It Works

- Open long positions in spot markets while shorting futures under cross margin.

- Use unrealized gains to offset potential losses.

- Works especially well in volatile markets.

Pros

- Protects capital during unpredictable price swings.

- Advanced risk management for institutional traders.

Cons

- Complex execution requiring experience.

- Fees can reduce net profit if not managed properly.

Comparing the Two Strategies

| Criteria | Conservative Multi-Asset | Hedging With Cross Margin |

|---|---|---|

| Best For | Beginners, retail traders | Experienced, hedge funds |

| Risk Level | Low | Medium to High |

| Profit Potential | Moderate | Higher (if executed well) |

| Execution Complexity | Simple | Advanced |

Tools and Resources Often Shared in Seminars

- Cross margin step by step guide

- Cross margin trading strategy PDF

- Cross margin live demo session with real-time platform walkthrough

- Cross margin software tools for portfolio management

- Templates like a cross margin checklist to ensure safe execution

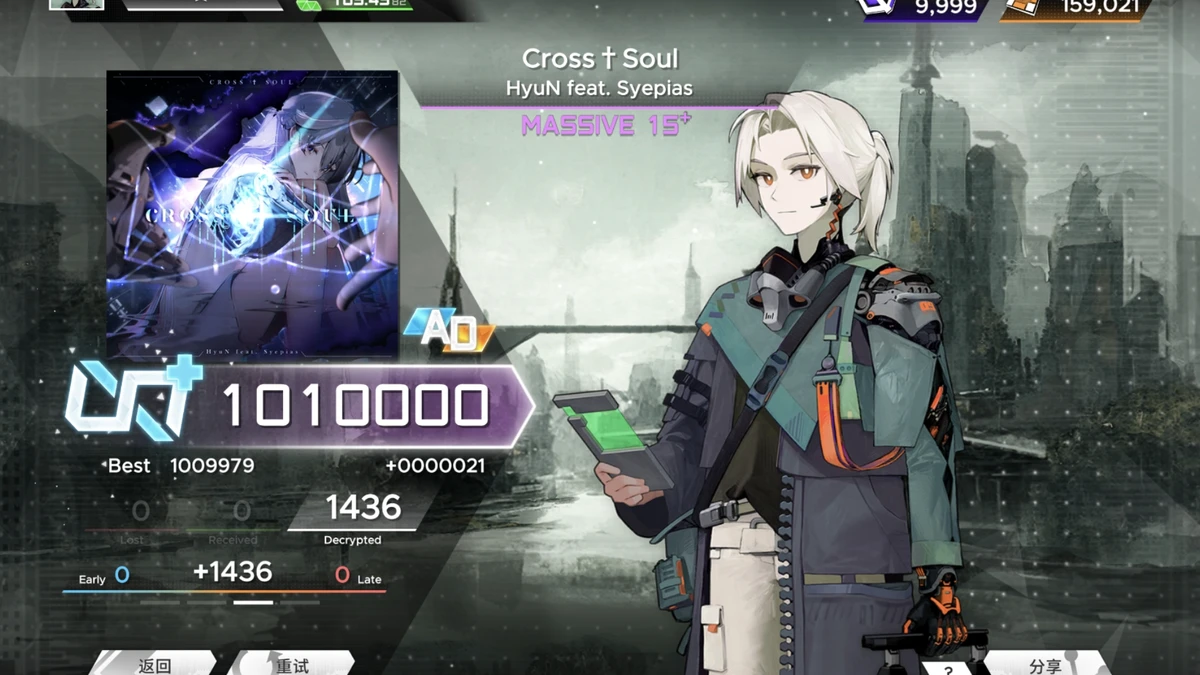

A trading platform interface showcasing cross margin features.

Personal Experience: Why Online Seminars Work

Having attended multiple cross margin seminar online events, I found that live Q&A sessions are the most valuable. While pre-recorded tutorials explain the basics, interactive seminars allow traders to ask nuanced questions like:

- “How does cross margin affect leverage during market spikes?”

- “When should I choose cross margin over isolated margin?”

Trainers often demonstrate with where to find cross margin features in trading platforms, making the learning immediately actionable.

Best Practices for Applying Cross Margin After a Seminar

- Start Small: Test cross margin with small capital before scaling up.

- Use Tools: Rely on calculators and margin ratio trackers.

- Monitor Continuously: Since all positions are linked, one bad trade can drain your account.

- Combine With Risk Management: Never risk more than 1–2% of total equity per trade.

FAQs on Cross Margin

1. What’s the main difference between cross margin and isolated margin?

Cross margin uses all account funds to support positions, lowering liquidation risk but linking trades together. Isolated margin limits risk to a single position but increases the chance of liquidation if that trade fails.

2. Who should attend a cross margin seminar online?

Both beginners and professionals benefit. Beginners learn cross margin tips for cryptocurrency traders, while experts gain advanced hedging techniques and insights into institutional strategies.

3. How do I calculate cross margin requirements?

Platforms often provide automated calculators. However, understanding margin ratio is key:

- Margin Ratio = (Used Margin + Unrealized Losses) ÷ Account Equity

If the ratio exceeds platform thresholds, liquidation can occur.

Conclusion

Attending a cross margin seminar online equips traders with actionable knowledge, practical tools, and strategies to manage risk effectively. Whether you’re a beginner learning conservative methods or an expert exploring hedging strategies, seminars provide valuable insights.

If you found this guide useful, share it with fellow traders, and leave a comment below about your experience with cross margin or online seminars. Let’s build a smarter trading community together. 🚀