Cross Margin Software Tools: Revolutionizing Risk Management in Perpetual Futures Trading

Cross margin software tools have become indispensable for traders, especially in the realm of perpetual futures trading. These tools help traders effectively manage their margin across multiple positions, offering flexibility, reducing risk exposure, and optimizing the use of available capital. In this article, we will explore what cross margin is, its benefits, and how to leverage cross margin software tools to maximize your trading potential.

What is Cross Margin in Trading?

Cross margin refers to the practice of using the balance from a trader’s entire margin account to meet the margin requirements for any open position. Unlike isolated margin, where the margin is limited to a specific position, cross margin allows traders to use their entire margin balance to cover potential losses. This results in higher leverage and better capital efficiency, especially for traders dealing with multiple positions simultaneously.

Key Features of Cross Margin

- Higher Leverage: By pooling the available margin across multiple positions, traders can use their margin more efficiently.

- Reduced Liquidation Risk: Since the margin is shared, positions that might otherwise be liquidated due to insufficient funds can remain open.

- Greater Capital Efficiency: Traders can utilize more of their capital, reducing the need for constant margin top-ups.

How Does Cross Margin Work in Perpetual Futures?

In perpetual futures trading, cross margin allows traders to maintain positions over longer periods with minimal capital requirements. The cross margin feature enables more efficient risk management by distributing the margin across positions instead of locking funds into individual positions. The software calculates the margin requirements for all open positions and adjusts them dynamically based on market fluctuations.

How Cross Margin Impacts Leverage and Risk Management

- Leverage Adjustments: The leverage provided is adjusted automatically based on the total margin in the account, making it easier for traders to manage larger positions.

- Dynamic Margin Calculation: With market changes, the margin for each position is recalculated in real time. This ensures traders always meet the margin requirements across all positions.

Cross Margin vs. Isolated Margin: Which One to Choose?

Cross margin and isolated margin each have their pros and cons. Understanding these differences is critical for traders who want to optimize their strategies.

Cross Margin

Advantages:

- Higher leverage across positions

- Easier risk management across multiple trades

- More capital efficiency

- Higher leverage across positions

Disadvantages:

- Risk of higher exposure to losses since all positions are tied to a single margin pool

- More complex to manage for beginners

- Risk of higher exposure to losses since all positions are tied to a single margin pool

Isolated Margin

Advantages:

- Limits risk to a single position

- Easier to manage for less experienced traders

- Limits risk to a single position

Disadvantages:

- Lower leverage and capital efficiency

- Higher risk of liquidation if a position’s margin is insufficient

- Lower leverage and capital efficiency

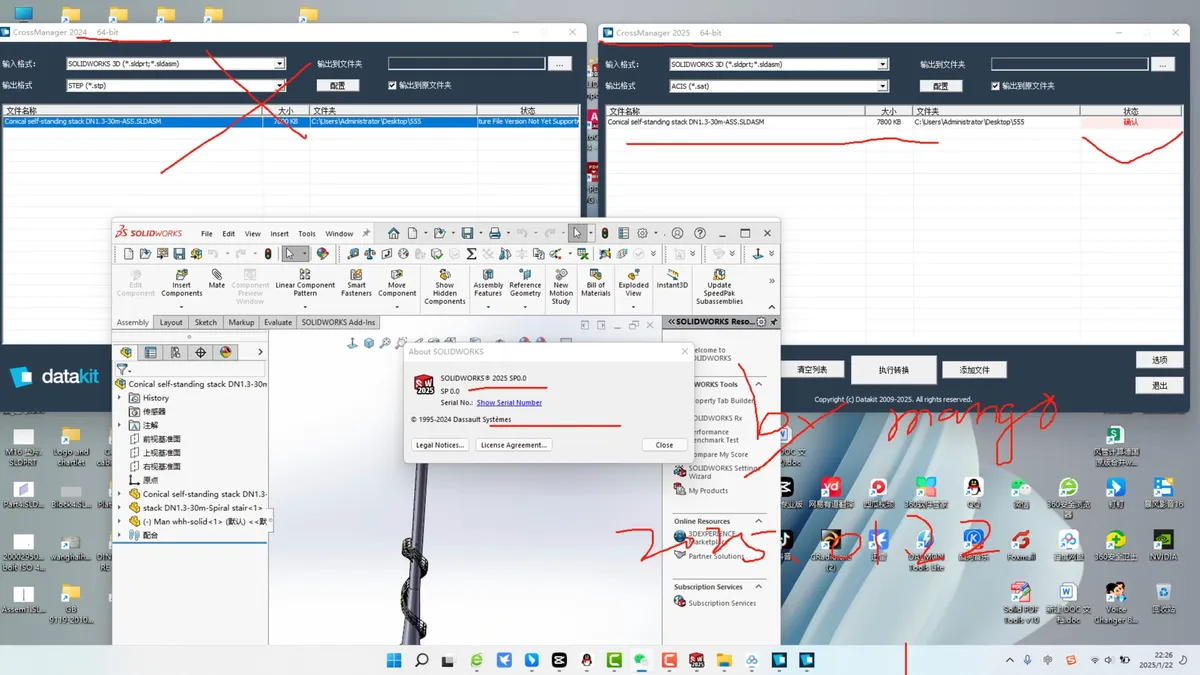

Best Cross Margin Software Tools

Several software tools offer cross margin features that can help traders manage their risks efficiently. These tools are equipped with advanced margin management features, real-time analytics, and intuitive user interfaces.

1. TradingView: A Comprehensive Tool for Margin Analysis

TradingView provides detailed analysis tools for margin trading, including cross margin features that allow users to monitor their leverage across positions. It also provides real-time charting and risk management analytics.

2. MetaTrader 5 (MT5): Advanced Margin Management Features

MT5 is widely used for forex, stocks, and crypto trading. Its advanced cross margin features enable traders to manage multiple assets with ease and adjust margin requirements dynamically.

3. Binance Futures: Advanced Cross Margin for Perpetual Futures

Binance Futures offers one of the most popular cross margin tools for perpetual futures trading. It provides users with enhanced capital efficiency and reduced liquidation risk. The platform allows users to allocate funds across different positions and manage their risk seamlessly.

4. Bybit: Powerful Cross Margin Software for Crypto Traders

Bybit’s cross margin software allows traders to use a single margin pool for all their open positions, making it an ideal choice for cryptocurrency traders. The software also provides real-time risk management tools to minimize liquidation risk.

How to Choose the Right Cross Margin Software Tool

When selecting a cross margin software tool, traders should consider the following factors:

- Ease of Use: Look for platforms with intuitive interfaces and easy-to-understand margin management features.

- Risk Management: Opt for software with real-time risk management analytics and automatic margin adjustments.

- Platform Security: Ensure the platform is secure, with strong encryption and reliable customer support.

Advanced Strategies for Cross Margin Trading

For advanced traders, leveraging cross margin can lead to greater capital efficiency and improved risk management. Here are some strategies:

1. Using Cross Margin for Hedging

Traders can use cross margin to open positions in different markets, hedging their risks across various assets. By maintaining a balanced portfolio, they can reduce the impact of market volatility.

2. Dynamic Margin Rebalancing

This strategy involves using cross margin to dynamically rebalance positions based on market trends. For example, traders can allocate more margin to high-confidence positions and less to risky ones.

3. Automated Cross Margin Strategies

Automated systems can help manage cross margin by adjusting leverage and positions dynamically based on predefined rules, making trading more efficient and less prone to human error.

FAQs about Cross Margin Software Tools

1. How do I calculate cross margin requirements?

Cross margin requirements are typically calculated based on the total available margin in your account and the margin requirements for each open position. Software tools can automatically calculate this for you in real-time.

2. Is cross margin suitable for beginners?

Cross margin can be complex and risky for beginners because it ties all positions to a single margin pool. Beginners might prefer isolated margin until they gain more experience.

3. What are the risks of using cross margin?

The main risk is that a loss in one position can affect other positions if the available margin is insufficient. This could lead to liquidation of other positions if not managed properly.

Conclusion

Cross margin software tools are a powerful resource for professional traders and investors looking to optimize capital efficiency and manage risk in perpetual futures trading. By choosing the right platform and implementing effective strategies, traders can gain better leverage and minimize their exposure to market fluctuations. Whether you are a beginner or an experienced trader, understanding how to effectively use cross margin is essential for success in today’s trading environment.