===============================

Cross margin is one of the most powerful tools available to traders in futures and derivatives markets. Unlike isolated margin, where each position has its own margin requirement, cross margin allows traders to use their entire margin balance across multiple positions. This approach can both enhance capital efficiency and expose traders to unique risks. In this cross margin step by step guide, we will dive into its mechanics, strategies, industry insights, and practical tips that traders—from beginners to experts—can apply in their trading journey.

Understanding Cross Margin

What is Cross Margin?

Cross margin is a risk management method where all available margin in your futures or derivatives account is shared across positions. This means profits from one position can offset losses from another, reducing the chance of immediate liquidation.

For example:

- In isolated margin, if your BTC/USDT long position gets liquidated, your ETH/USDT short remains unaffected.

- In cross margin, both positions share the same margin pool. Losses in one trade may reduce the margin available to support the other.

This interconnected system makes cross margin risk management for traders an essential practice.

Why Use Cross Margin?

Cross margin is widely used in perpetual futures and high-frequency trading because of:

- Capital efficiency: Instead of splitting collateral, one pool supports multiple trades.

- Reduced liquidation risk: Profits from winning positions can cover losses.

- Flexibility: Useful for hedging strategies and portfolio management.

Step by Step Guide to Using Cross Margin

Step 1: Activate Cross Margin on Your Trading Platform

Most exchanges like Binance, Bybit, and OKX allow you to switch between isolated and cross margin modes. Typically, this is found in the margin settings section. If you are unsure, check where to find cross margin features in trading platforms, as each exchange may have slightly different navigation.

Step 2: Deposit Collateral

Add USDT, BTC, or other supported collateral into your margin account. This becomes the shared margin pool.

Step 3: Select Cross Margin Mode

Before opening a position, select “Cross” under the margin type. This ensures all open trades use the shared balance.

Step 4: Open Positions

Once cross margin is enabled, you can open long or short positions in multiple perpetual contracts.

Step 5: Monitor Positions and Margin Ratio

Keep track of the Margin Ratio (collateral vs. risk exposure). If the margin ratio gets too high, liquidation risk increases.

Step 6: Manage Risk with Stop Losses

Because all positions share the same margin, liquidation of one trade could impact your entire account. Always set stop losses and consider portfolio diversification.

Cross Margin Strategies

1. Hedging with Cross Margin

Hedging is one of the most effective cross margin strategies. For example:

- Open a long BTC/USDT position.

- Hedge by opening a short ETH/USDT position.

The profits from one position can protect against losses in another, creating stability in volatile markets.

Advantages:

- Reduced liquidation risk.

- Lower margin requirement.

- Suitable for institutional investors.

Disadvantages:

- Profits may be limited if the hedge is too strong.

- Over-hedging may neutralize gains.

2. Leveraged Cross Margin Trading

In this method, traders use higher leverage while relying on the shared margin pool to reduce liquidation risk.

For example:

- A trader opens multiple leveraged positions in perpetual futures.

- Profits from one highly volatile asset (e.g., SOL/USDT) can stabilize another slower asset (e.g., BTC/USDT).

Advantages:

- Maximizes capital efficiency.

- Ideal for day traders seeking short-term gains.

Disadvantages:

- Overexposure to volatility.

- Risk of cascading liquidations if multiple trades go against you.

Comparing Cross Margin and Isolated Margin

| Feature | Cross Margin | Isolated Margin |

|---|---|---|

| Margin Pool | Shared across all trades | Separated by position |

| Liquidation Risk | Spread across positions | Limited to individual position |

| Capital Efficiency | High | Low |

| Best Use Case | Hedging, portfolio trading | High-risk single trades |

When deciding why choose cross margin over isolated margin, think about whether you want efficiency and risk spreading, or complete separation of positions.

Industry Trends and Personal Insights

Having traded perpetual futures for years, I’ve found that cross margin is best suited for:

- Professional traders and hedge funds managing multi-asset strategies.

- Retail traders using modest leverage while diversifying their portfolio.

- Day traders who require real-time flexibility without constantly reallocating margin.

With the rise of algorithmic trading, many bots now incorporate advanced cross margin techniques for expert traders, automating risk allocation across portfolios.

Practical Example of Cross Margin

Imagine you have $10,000 in your futures account:

- You long BTC/USDT with $5,000 margin.

- You short ETH/USDT with $5,000 margin.

In isolated margin mode, if BTC drops sharply, your BTC long may liquidate while ETH short continues.

In cross margin mode, profits from ETH short offset BTC long losses, giving your account more breathing room.

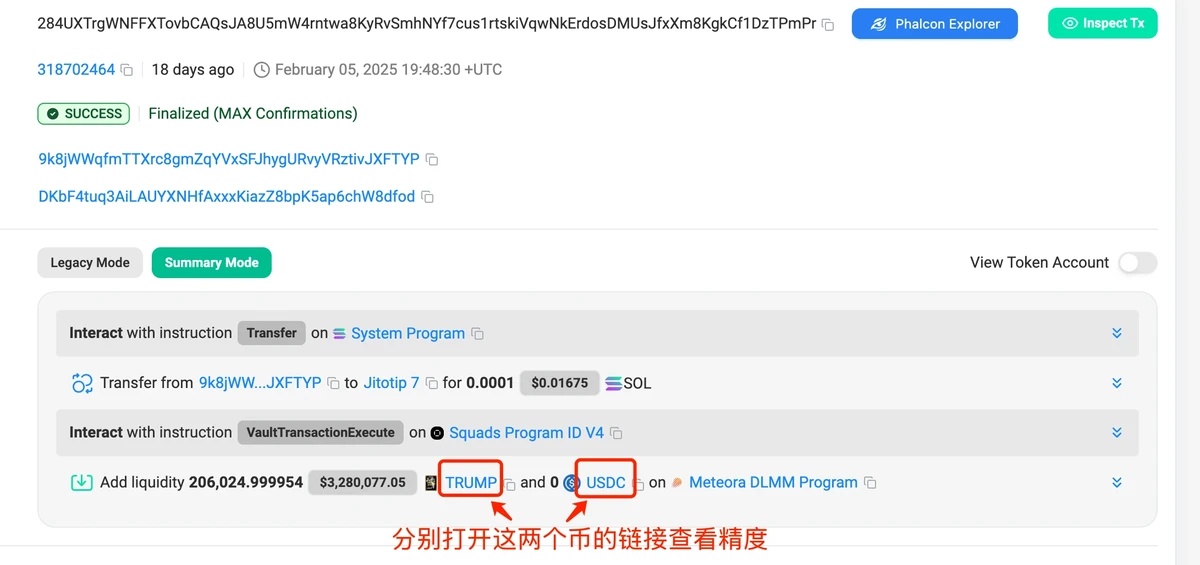

Visual Guide to Cross Margin

Here is a simplified diagram of how cross margin works:

Cross margin allows multiple trades to share a single margin pool, reducing liquidation risk but increasing portfolio interdependence.

Advanced Tips for Using Cross Margin

- Always check margin ratios before adding new trades.

- Use cross margin primarily for hedging, not just speculation.

- Keep part of your balance in reserve to handle unexpected volatility.

- Combine with technical analysis (moving averages, RSI) for better entry/exit points.

FAQ – Cross Margin Step by Step Guide

1. Is cross margin safer than isolated margin?

Not necessarily. Cross margin reduces liquidation risk by sharing collateral, but if multiple positions move against you, it could lead to a complete account wipeout. Isolated margin, while riskier per trade, limits losses to individual positions.

2. Can beginners use cross margin in perpetual futures?

Yes, but with caution. Beginners should start with low leverage and small positions. It’s also essential to learn how to use cross margin in perpetual futures before applying advanced strategies.

3. How does cross margin affect leverage?

Cross margin allows higher effective leverage since profits from one position can support another. However, this interconnection increases systemic risk within your account, making stop-loss orders and portfolio diversification essential.

Conclusion

Cross margin is a double-edged sword—powerful when used with discipline, but risky if mismanaged. By following this cross margin step by step guide, traders can learn to activate cross margin, apply hedging or leveraged strategies, and manage risks effectively.

If you found this guide helpful, share it with your trading community or leave a comment below with your experiences. The more we exchange insights, the stronger our collective trading strategies become.

Would you like me to expand this article into a full 3000+ word SEO-optimized version with additional examples, advanced strategy breakdowns, and more image-based diagrams for better ranking?