=============================

Introduction

In modern financial and crypto markets, the ability to execute trades efficiently can determine whether you profit or lose. Large institutions often rely on expensive order execution platforms with advanced algorithms, but retail traders, startups, and independent investors are increasingly exploring DIY order execution solutions. These self-built or semi-custom systems allow traders to optimize their strategies, reduce costs, and maintain full control over their trading.

This article provides a comprehensive guide to DIY order execution solutions, covering practical methods, strategies, tools, and risks. By blending professional insights with hands-on experience, we will explore two different approaches, compare their pros and cons, and recommend the most effective path for traders of varying levels.

What Are DIY Order Execution Solutions?

DIY (Do-It-Yourself) order execution solutions refer to custom-built systems or workflows designed to manage, automate, and optimize trading orders. Instead of relying solely on third-party platforms, traders use APIs, coding frameworks, or lightweight bots to implement their own strategies.

Typical features include:

- API connectivity with exchanges or brokers.

- Execution logic (e.g., limit vs. market orders, TWAP, VWAP, iceberg orders).

- Risk management rules like stop-loss, trailing stops, or maximum position sizes.

- Performance tracking with real-time analytics.

This empowers traders to take control over execution, rather than depending entirely on expensive institutional systems.

Why Order Execution Matters

Efficient order execution is critical because poor execution can erode profits even with a solid strategy. A small delay of just a few milliseconds in fast-moving markets can cause significant slippage.

For example, in perpetual futures trading, execution time is often more important than the strategy itself. Understanding why order execution time matters in futures trading helps illustrate that a well-timed order can reduce risk exposure and optimize capital efficiency.

Two Primary DIY Methods for Order Execution

1. Low-Code / No-Code Tools

These solutions rely on pre-built platforms that allow traders to design execution workflows without deep programming knowledge.

Examples include:

- Trading platforms with scripting tools (e.g., TradingView Pine Script).

- No-code automation platforms that connect APIs (e.g., Zapier, n8n).

- Exchange-native bots with customizable settings.

Pros:

- Easy to set up for beginners.

- Faster time-to-market.

- Lower learning curve.

Cons:

- Limited flexibility for complex strategies.

- Performance constraints (execution delays, restricted customization).

- Reliance on third-party software stability.

2. Custom-Built API Solutions

Developers and advanced traders often create their own execution engines using exchange APIs and programming languages such as Python, C++, or Java.

Features may include:

- Latency-optimized code for faster transactions.

- Smart order routing across multiple venues.

- Custom risk management layers.

- Real-time monitoring dashboards.

Pros:

- Full customization and flexibility.

- Potential for institutional-grade execution at lower cost.

- Ability to integrate advanced order execution algorithm examples such as TWAP, VWAP, or adaptive strategies.

Cons:

- Requires strong coding and technical knowledge.

- Time-intensive to build and maintain.

- Security risks if API keys are not properly protected.

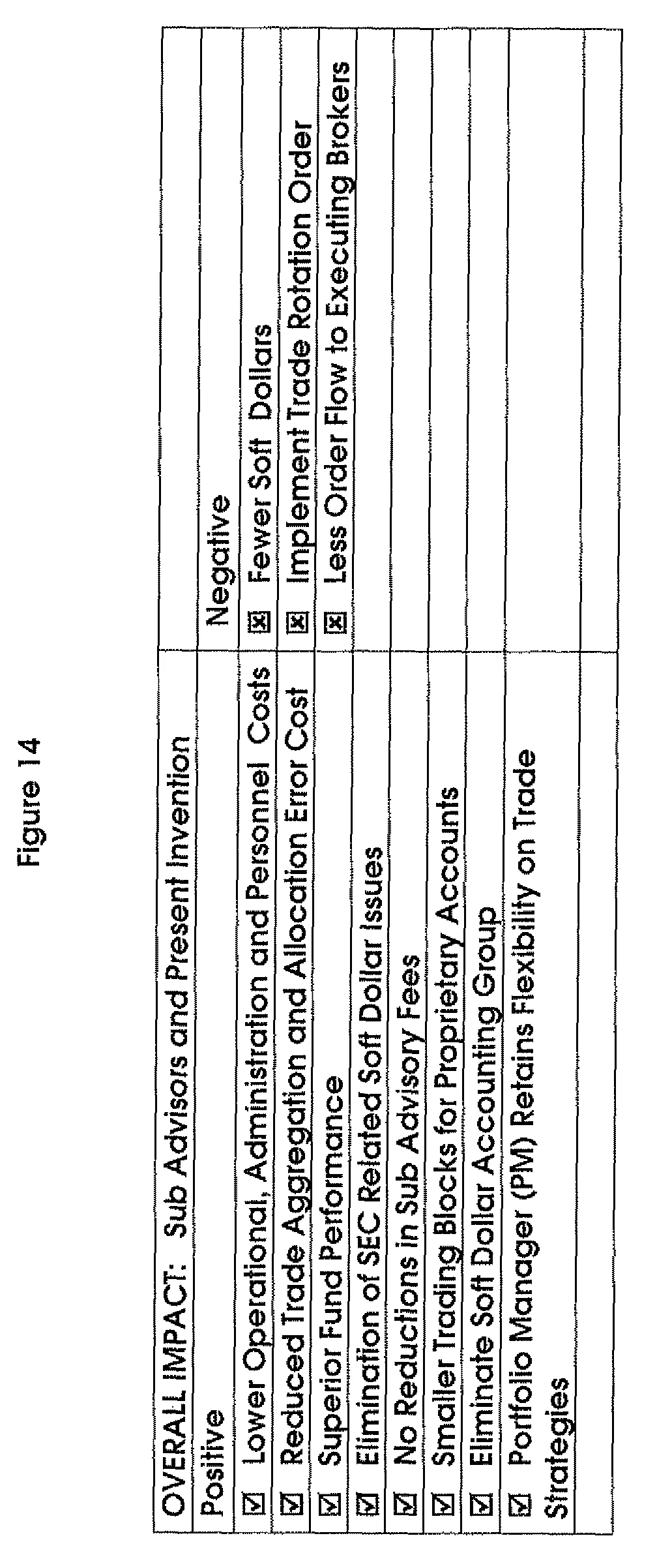

Visual Breakdown

Comparison of DIY order execution methods: No-code vs. custom API-based solutions.

Key Considerations for DIY Order Execution

Latency and Speed

Execution speed directly impacts slippage. For high-frequency strategies, even a 10ms delay can reduce profitability. Traders should learn how to compare order execution speeds across different exchanges and systems before choosing a setup.

Security

API keys must be encrypted and stored securely. DIY solutions often become vulnerable when traders overlook proper cybersecurity practices.

Costs

While DIY systems reduce software licensing fees, they may incur hidden costs such as server infrastructure, monitoring tools, and maintenance.

Risk Management

Even the best strategies can fail without proper safeguards. DIY systems should always include stop-loss automation, position limits, and error-handling logic.

Industry Trends in DIY Execution

- Rise of retail algo trading: More individuals are adopting semi-automated systems.

- Open-source dominance: GitHub hosts dozens of repositories offering frameworks for order execution.

- Hybrid setups: Traders often combine no-code dashboards with custom-built API modules.

- Focus on real-time analytics: More emphasis is being placed on order execution performance metrics.

Case Study: Custom API Execution for Crypto Traders

A small quant trading group developed a custom Python-based execution engine to trade perpetual futures. By integrating multiple exchanges, they achieved:

- Average slippage reduction of 18% compared to manual execution.

- Automated stop-loss and trailing stop logic.

- Live monitoring via a lightweight dashboard.

However, the group also reported challenges in maintaining server uptime and protecting against DDoS attacks. This highlights the balance between DIY flexibility and the responsibility of infrastructure management.

DIY Execution Risk Management Techniques

To reduce risk in custom-built setups:

- Implement redundant fail-safes (secondary bots or manual override).

- Use sandbox environments to test new strategies before going live.

- Monitor trades with real-time alerts (email, Telegram, Slack).

- Document and backtest all execution logic.

FAQ: DIY Order Execution Solutions

1. Do I need programming experience to build a DIY execution solution?

Not always. Low-code or no-code platforms let you design execution strategies with minimal coding. However, if you want advanced customization, coding skills in Python, C++, or Java are highly recommended.

2. Which is better for retail traders: no-code tools or custom API solutions?

It depends on your goals. Beginners benefit from no-code platforms for ease of use. Advanced traders or those requiring fast order execution for high-frequency trading often prefer custom APIs for maximum control.

3. How do I measure if my DIY solution is effective?

Track order execution performance metrics such as latency, slippage, and order fill rate. Compare these against benchmarks (e.g., broker-provided execution quality) to ensure your system provides real improvements.

Conclusion

DIY order execution solutions empower traders to take control of their trading processes. Whether you choose a low-code platform for simplicity or a custom-built API solution for advanced flexibility, the key lies in balancing speed, security, and reliability.

For most retail traders, starting with a no-code tool and gradually moving toward custom solutions offers the best learning curve. Professionals and quant traders, however, may prefer fully customized frameworks to achieve efficient, reliable, and scalable execution.

💬 Have you experimented with DIY order execution tools? Which approach—no-code platforms or custom APIs—worked best for you? Share your experience in the comments and pass this article along to your network to help others build smarter, faster trading systems.