==========================================

Sell walls are a common phenomenon in cryptocurrency and futures markets. For retail and professional traders alike, facing a large sell wall can be intimidating—it may seem like the price can never move higher, no matter how much buying pressure builds. This article explores easy solutions for dealing with sell walls, why they occur, and how traders can adapt their strategies to maintain profitability.

We will also compare different approaches, provide practical tips, and include detailed FAQs to help traders navigate this recurring challenge with confidence.

What Is a Sell Wall?

A sell wall occurs when a large order (or multiple stacked sell orders) is placed on an order book at a specific price level, creating resistance to upward price movement. Traders see a “wall” of liquidity that must be consumed before the asset can break higher.

Sell walls are particularly relevant in perpetual futures markets, where leverage and large position sizes amplify their impact on price discovery.

Why Do Sell Walls Form?

- Institutional control: Large players create sell walls to slow down or reverse bullish momentum.

- Psychological barriers: Retail traders often hesitate to buy when they see heavy resistance in the order book.

- Liquidity management: Market makers use sell walls to provide liquidity and protect positions.

- Manipulation tactics: Some walls are “spoofs,” placed temporarily to influence trader behavior before being removed.

Understanding how sell wall affects price in perpetual futures is critical: a strong wall can cap rallies, trigger liquidations, and create frustration among retail traders.

Easy Solutions for Dealing with Sell Walls

1. Break the Wall with Collective Momentum

Sometimes, consistent buying pressure eventually eats through the sell wall. Traders who believe in strong fundamentals or bullish catalysts can hold positions and wait for the wall to be absorbed.

Pros:

- Profits are amplified once the wall breaks.

- Works well in trending markets with high volume.

Cons:

- Requires patience.

- Risky if the wall represents genuine institutional selling.

2. Avoid Direct Confrontation: Trade Around the Wall

Instead of buying into resistance, traders can look for opportunities in nearby assets or timeframes. For example, when Bitcoin faces a sell wall, altcoins may rally as capital rotates.

Pros:

- Reduces frustration.

- Diversifies risk exposure.

Cons:

- Misses potential breakout profits.

- Requires active monitoring of correlated assets.

3. Analyze the Intent: Real vs. Fake Walls

Not all sell walls are real. Some vanish when price approaches. Traders can use order book analysis tools to detect spoofing.

Pros:

- Helps avoid falling for manipulation.

- Increases confidence in trading decisions.

Cons:

- Requires experience and reliable software.

- Difficult for beginners to differentiate.

4. Use Layered Entry Orders

Placing staggered buy orders below the sell wall allows traders to capture dips without emotional reactions.

Pros:

- Reduces FOMO and impulsive entries.

- Enhances execution efficiency.

Cons:

- Price may never retrace to your entry.

- Requires strong discipline.

5. Follow Institutional Footprints

Professional traders often monitor where large players place sell walls. Knowing why traders monitor sell walls in perpetual futures helps retail traders align with smarter money rather than fighting it.

Comparing Two Core Strategies

Strategy 1: Aggressive Breakthrough Approach

- Method: Buy heavily into the wall, expecting it to break.

- Advantages: High returns if successful.

- Disadvantages: High risk if the wall strengthens or price reverses.

Strategy 2: Adaptive Patience Approach

- Method: Wait for confirmation that the wall is weakening before entering.

- Advantages: Safer, avoids capital losses from failed breakouts.

- Disadvantages: May miss sharp moves when walls suddenly vanish.

Recommendation: The Adaptive Patience Approach is better suited for retail traders. While less exciting, it minimizes unnecessary losses and builds consistency.

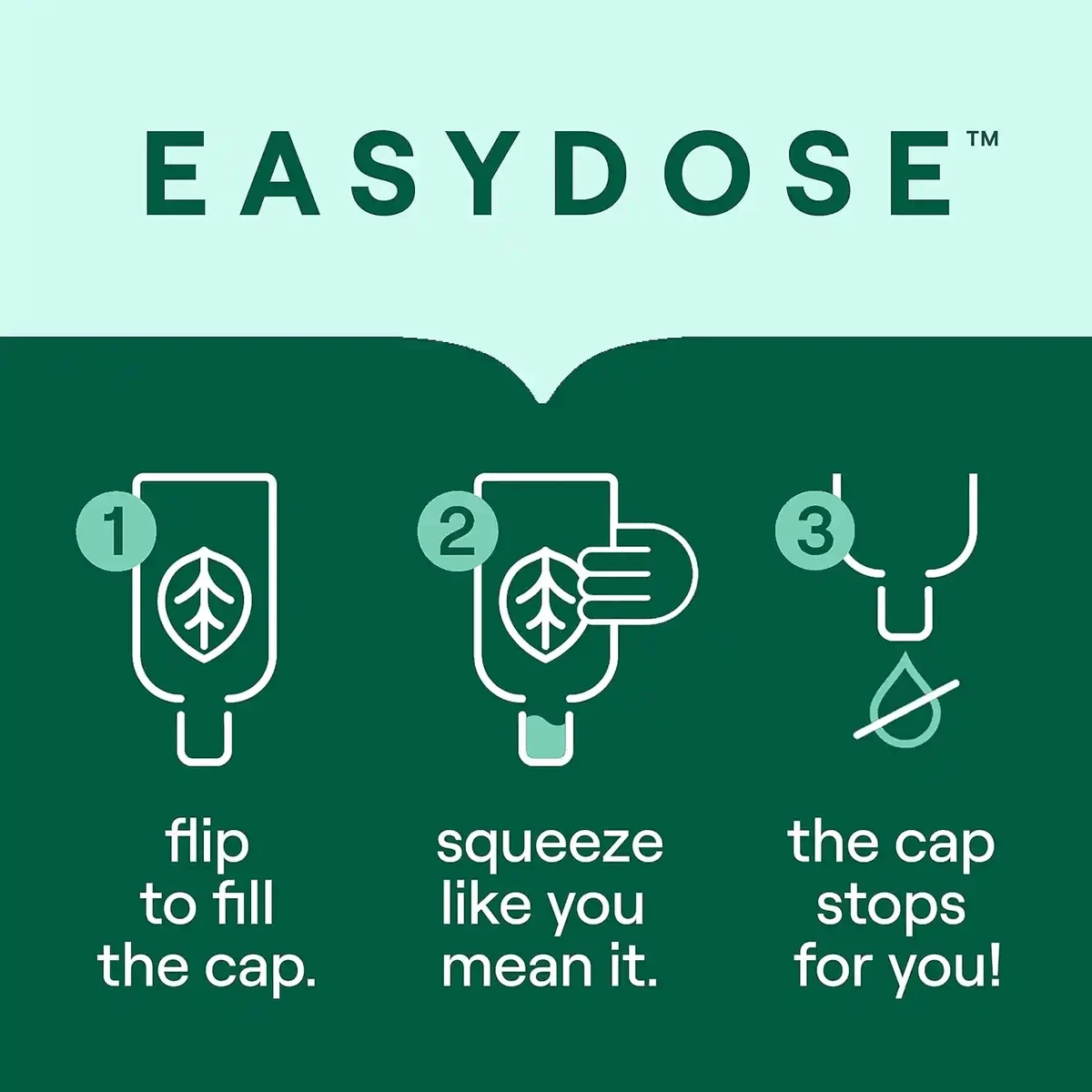

Visual Example: Sell Wall on an Order Book

Sell walls often appear as large red clusters on order book depth charts, signaling strong resistance.

Advanced Tips for Managing Sell Walls

- Track liquidity zones: Watch for repeated price rejections around the same level.

- Combine with technical analysis: Sell walls often align with Fibonacci levels, moving averages, or previous highs.

- Monitor funding rates in perpetual futures: Overheated long positions make sell walls more impactful.

- Stay flexible: Shift strategies if the wall persists longer than expected.

Case Insight: How to React to a Sell Wall in Perpetual Futures

When a sell wall appears in perpetual futures, traders must decide between:

- Waiting for absorption (good when funding is neutral).

- Shorting against the wall (effective in bearish conditions).

- Avoiding the trade (best for risk-averse traders).

This choice depends on liquidity, trend direction, and market sentiment.

FAQ: Easy Solutions for Dealing with Sell Walls

1. How do I know if a sell wall is real or fake?

A real sell wall remains in place as price approaches, often tied to institutional strategies. A fake wall (spoof) disappears before execution. Advanced order book tracking tools and consistent observation help detect authenticity.

2. Should retail traders ever try to break through a sell wall?

It depends on volume and context. If the market is trending strongly upward with high liquidity, attempting to ride through a wall can be profitable. However, beginners should avoid direct confrontation and instead wait for confirmation.

3. How long do sell walls last in perpetual futures?

Duration varies. Some last only minutes (spoofs), while others persist for hours or days. In general, genuine sell walls dissolve when opposing liquidity grows strong enough or when institutional traders adjust strategies.

Conclusion

Dealing with sell walls is an essential skill for traders in crypto and perpetual futures markets. By understanding their purpose, recognizing manipulation, and applying easy solutions for dealing with sell walls, traders can make more informed decisions and avoid unnecessary losses.

The best approach for most retail traders is to remain patient, use layered entries, and confirm whether the wall is genuine before taking action. Over time, building this discipline helps transform frustrating market barriers into opportunities for smarter trading.

If you found these insights useful, share this article with your trading network and leave a comment with your experience battling sell walls—your story could help another trader avoid costly mistakes.

Do you want me to create a step-by-step sell wall detection checklist (with visual examples) that retail traders can use daily to quickly evaluate order books?