==============================================================

When it comes to perpetual futures trading, one of the most overlooked but critical aspects is trading fees. Whether you are a beginner exploring derivatives or an experienced high-frequency trader, understanding fees can significantly improve your net profitability. This guide explores FAQs on trading fees in perpetual futures, explains fee structures in detail, compares strategies to minimize them, and answers the most common questions traders ask.

Understanding Perpetual Futures Trading Fees

What Are Perpetual Futures Fees?

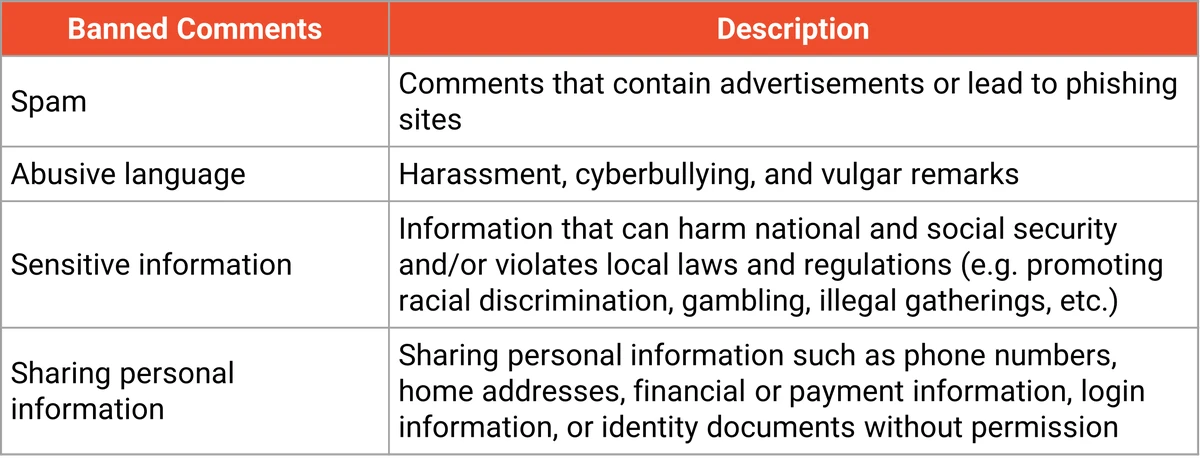

Perpetual futures trading fees are the costs traders pay to enter and exit positions. These usually include:

- Maker Fees: Charged when you provide liquidity by placing limit orders.

- Taker Fees: Charged when you take liquidity by executing against existing orders.

- Funding Rates: Periodic payments between long and short traders to keep prices aligned with spot markets.

- Hidden Fees: Can include settlement costs, API usage fees, or withdrawal fees if you move funds frequently.

Why Fees Matter for Traders

Trading fees directly eat into profit margins. For scalpers and day traders executing dozens or hundreds of trades daily, a difference of just 0.01% per trade can result in thousands of dollars annually. This is why many traders actively research where to find the lowest trading fees and optimize their execution strategy.

Breakdown of fees in a perpetual futures trade including maker/taker fees and funding

Different Fee Structures Across Exchanges

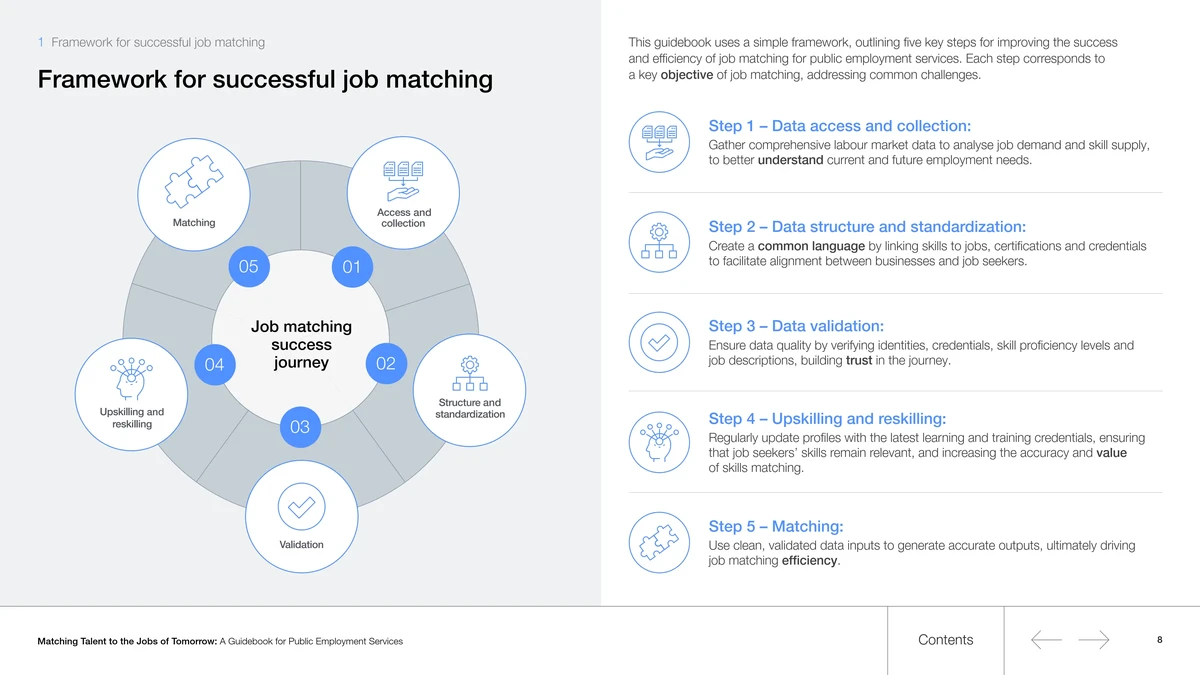

Tiered Fee Models

Most major exchanges use a tiered fee model where fees decrease as trading volume increases. For example:

- Tier 1: < $1M monthly volume → 0.05% taker, 0.02% maker

- Tier 2: \(1M–\)10M monthly volume → 0.04% taker, 0.015% maker

Flat Fee Models

Some newer platforms offer flat, low-fee models or even zero trading fees for market makers to attract liquidity.

Funding Rate Differences

Funding rates vary by exchange and can be positive or negative depending on market conditions. Knowing how trading fees impact profits in futures also means monitoring funding payments, which can outweigh trading fees during volatile periods.

Two Key Strategies to Reduce Trading Fees

Strategy 1: Use Maker Orders Whenever Possible

By placing limit orders, you often qualify for lower maker fees (sometimes even rebates).

Pros:

- Lower fees or rebates can significantly improve returns

- Encourages better discipline and planning

Cons:

- Risk of non-execution if the market moves quickly

- Requires monitoring and active order management

Strategy 2: Trade on Low-Fee or Zero-Fee Exchanges

Exchanges compete aggressively on fees. Some platforms offer near-zero fees, especially for high-volume traders.

Pros:

- Immediate reduction in trading costs

- Some exchanges offer additional rebates for market makers

Cons:

- Must assess exchange reputation and liquidity

- Hidden costs (slippage, wider spreads) may negate savings

Example of cumulative fee savings using maker orders and volume discounts over 3 months

How to Calculate Trading Fees Accurately

Understanding how to calculate trading fees correctly is key to strategy design.

- Identify Position Size: Calculate the notional value of your trade.

- Apply Maker/Taker Rate: Multiply notional value by fee rate.

- Include Funding Costs: If you hold overnight, add/subtract funding payments.

- Annualize Impact: Estimate monthly or yearly effect on PnL.

Practical Tips to Optimize Trading Fees

- Use API-based execution: Automates order placement and increases precision in targeting maker fees.

- Join VIP tiers: Many exchanges offer volume-based discounts and loyalty programs.

- Monitor funding rates: Switch between long/short positions to receive funding instead of paying it.

- Consider trade frequency: Reducing overtrading can cut fees and improve net returns.

Recommended Approach

For most active traders, combining maker order execution with choosing a low-fee exchange yields the best results. While funding rates cannot always be avoided, aligning positions with favorable funding can turn costs into income.

FAQ (Frequently Asked Questions)

1. Are maker fees always cheaper than taker fees?

Generally yes, but not always. Some exchanges charge identical fees for makers and takers or even offer negative maker fees (rebates). Always review the specific exchange’s fee schedule before trading.

2. How do funding rates affect my trading fees?

Funding rates are separate from trading fees but still impact profitability. A positive funding rate means longs pay shorts; a negative rate means shorts pay longs. For swing traders, funding payments can exceed entry/exit fees if positions are held for multiple days.

3. Can I completely avoid trading fees?

Not entirely. Even zero-fee exchanges often have hidden costs like withdrawal fees or wider spreads. The best solution is to optimize strategies to minimize fees and use fee rebates where available rather than avoiding fees altogether.

Comparison of trading fees across major perpetual futures exchanges (2025 data)

Final Thoughts

Understanding and managing trading fees is one of the easiest ways to boost profitability without taking on more risk. This is especially true for scalpers, day traders, and algorithmic traders executing a high number of trades.

If you found this comprehensive guide on FAQs on trading fees in perpetual futures helpful, share it with fellow traders and comment below with your favorite strategy for minimizing trading costs. Your feedback helps us refine and share even better insights for the trading community.

Would you like me to add a detailed fee calculator spreadsheet template for perpetual futures traders so readers can plug in their own numbers and compare platforms easily? This could make the article more practical and actionable.