===============================================

High-frequency trading (HFT) thrives on speed, precision, and automation. Among the most critical components of any HFT strategy is fast order execution for high-frequency trading, which can make the difference between consistent profitability and costly slippage. In today’s fragmented and highly competitive trading landscape, traders must focus not only on algorithm design but also on execution efficiency. This comprehensive guide explores execution mechanics, compares methods, and offers actionable strategies to optimize performance.

Why Fast Order Execution Matters in High-Frequency Trading

The Role of Speed in HFT

High-frequency trading depends on capturing tiny inefficiencies in markets. Profits often come from sub-second opportunities. Even microsecond delays in order routing can erode edge and result in missed trades.

Market Impact and Slippage

Slow execution introduces slippage—the difference between expected and actual execution prices. In volatile markets, this slippage compounds, reducing profitability.

Competitive Advantage

With more firms deploying advanced algorithms, execution speed itself has become a competitive differentiator. Firms with superior infrastructure consistently outpace compe*****s.

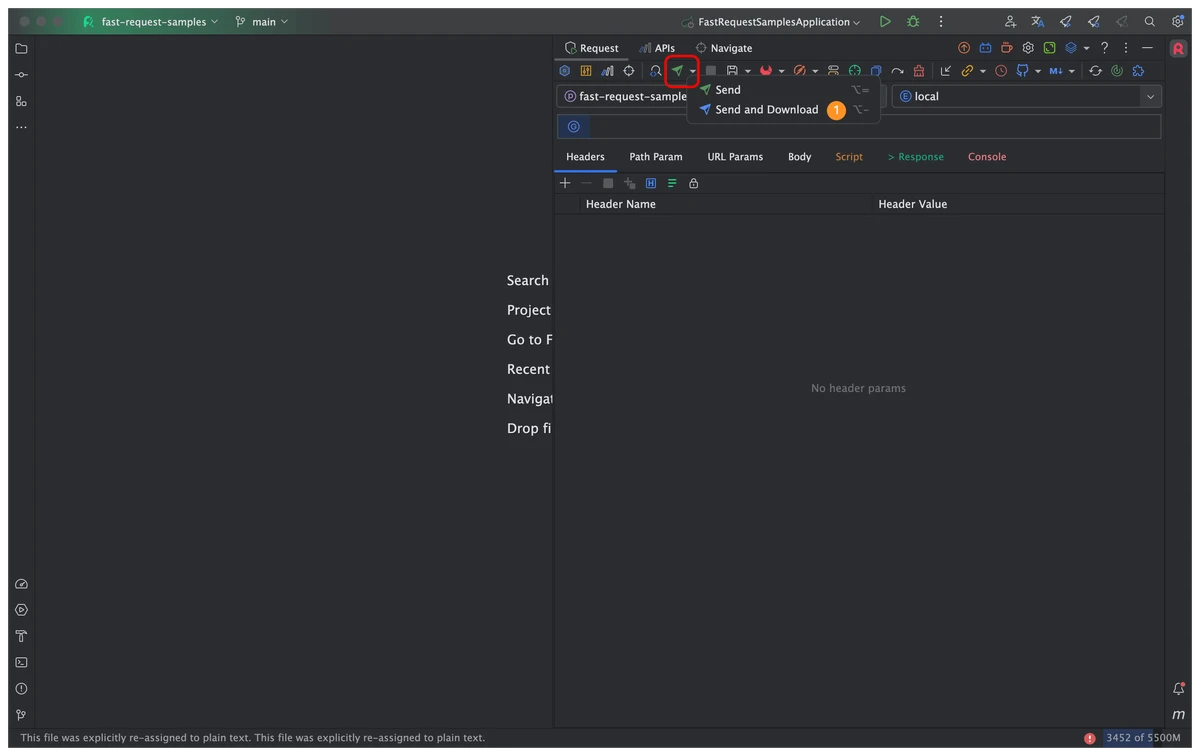

Order execution speed comparison between different infrastructures

Key Components of Fast Order Execution

1. Network Infrastructure

Low-latency networks, direct market access (DMA), and proximity hosting near exchange servers reduce execution times. Fiber-optic and microwave communication systems further minimize delays.

2. Order Routing Algorithms

Execution algorithms determine how and where to place orders. Smart Order Routers (SOR) distribute orders across venues for optimal fill rates.

3. Hardware Optimization

High-performance servers with field-programmable gate arrays (FPGAs) enable hardware-level order processing, cutting latency down to nanoseconds.

4. Software and Code Efficiency

Algorithms coded in low-level languages (like C++) outperform high-level scripting in execution-critical environments.

Methods to Enhance Order Execution

Method 1: Proximity Hosting and Colocation

Placing servers physically close to exchange data centers minimizes data travel time.

- Advantages: Significant reduction in latency, consistent performance.

- Disadvantages: High cost, limited to specific exchanges.

Method 2: Smart Order Routing (SOR)

SOR dynamically chooses the best venue for order execution.

- Advantages: Improves fill rates, reduces slippage across fragmented markets.

- Disadvantages: Complexity in tuning routing logic, occasional over-optimization.

Method 3: Hardware Acceleration with FPGAs

FPGAs bypass traditional software execution pipelines.

- Advantages: Ultra-low latency, deterministic performance.

- Disadvantages: Requires specialized hardware expertise, higher upfront investment.

Comparison of methods to enhance order execution speed in HFT

Recommended Best Approach

For most professional HFT firms, a hybrid approach works best: colocation for latency, SOR for liquidity optimization, and FPGA acceleration for ultra-critical strategies.

Evaluating Execution Performance

Measuring execution effectiveness is just as important as achieving speed. Traders need to assess multiple dimensions of execution.

Performance Metrics

- Latency: Time between order submission and execution confirmation.

- Fill Rate: Percentage of submitted orders fully executed.

- Slippage: Deviation from expected execution price.

- Market Impact: Influence of large orders on price movement.

Tools for Evaluation

Many firms leverage in-house monitoring tools alongside exchange-provided data. Understanding how to analyze order execution performance is crucial for iterative improvement.

Practical Applications in High-Frequency Trading

Arbitrage Opportunities

Execution speed is vital when exploiting price discrepancies across markets. Without fast execution, arbitrage edges vanish instantly.

Liquidity Provisioning

Market makers provide liquidity by placing and canceling orders rapidly. Efficient order execution reduces exposure to adverse selection.

Risk Mitigation

Fast execution allows rapid liquidation in volatile markets, protecting against significant losses.

Challenges in Achieving Fast Execution

- Regulatory Restrictions: Rules on fair market access can limit latency advantages.

- Infrastructure Costs: Colocation and FPGA deployment are capital-intensive.

- Diminishing Returns: As latency races approach nanoseconds, marginal gains become expensive.

Industry Trends and Future Outlook

- AI-Enhanced Execution: Machine learning models optimize routing decisions dynamically.

- Decentralized Market Structures: Growth of crypto markets requires adapting execution systems.

- Cross-Asset Execution: Integrating futures, equities, and crypto into unified execution platforms.

AI-enhanced execution systems for the future of trading

Internal Linking for Extended Learning

When optimizing execution systems, traders should also consider how to improve order execution in perpetual futures, particularly in crypto markets where latency-sensitive arbitrage is prevalent. Similarly, professionals evaluating infrastructure should explore how to compare order execution speeds across exchanges and venues to determine the best fit for their strategies.

FAQ: Fast Order Execution for High-Frequency Trading

1. What is the most effective way to reduce order execution latency?

The most effective solution is colocation with the exchange’s servers, paired with optimized networking and FPGA hardware acceleration. This combination cuts latency to microsecond or nanosecond levels.

2. How can traders measure the effectiveness of their execution strategies?

Key metrics include latency, slippage, fill rate, and market impact. Consistently tracking these with automated reporting tools allows strategists to adjust algorithms and infrastructure over time.

3. Is fast order execution only relevant for institutional HFT firms?

No. While institutions gain the most from cutting-edge infrastructure, retail traders and smaller funds can still benefit from execution improvements such as optimized routing, broker selection, and efficient order types.

Conclusion

Fast order execution for high-frequency trading is a cornerstone of success in today’s competitive landscape. From colocation and FPGA acceleration to smart routing and AI-enhanced execution, traders have multiple tools to sharpen their edge. The best strategies blend infrastructure, software, and evaluation techniques into a cohesive execution framework.

If you found this guide helpful, share it with your network, comment with your experiences in execution optimization, and join the discussion on best practices in high-frequency trading.