=============================================================================

Funding rates play a pivotal role in the world of perpetual futures trading, determining the cost of holding a leveraged position. Understanding funding rate trends is essential for making informed decisions, minimizing risks, and maximizing returns. In this article, we’ll delve into the concept of funding rates, how they are determined, their impact on perpetual futures, and effective strategies for analyzing and utilizing them.

We will cover the following topics:

- What is the funding rate?

- How is the funding rate calculated?

- Why funding rates change and what causes them?

- How funding rates affect perpetual futures and trading strategies.

- Methods for analyzing funding rates and trends.

- Common strategies for managing funding rate risks.

By the end of this guide, you’ll have a solid understanding of how to analyze funding rate trends, use them for trading strategies, and make data-driven decisions.

What is the Funding Rate?

Definition of Funding Rate

The funding rate is a periodic payment exchanged between long and short traders in perpetual futures contracts. It is typically paid every 8 hours on most exchanges. When the funding rate is positive, long traders pay short traders, and when the funding rate is negative, short traders pay long traders. This rate ensures that the price of a perpetual futures contract stays in line with the underlying asset’s spot price.

Key Components of the Funding Rate:

- Interest Rate: Reflects the cost of borrowing the underlying asset.

- Premium/Discount: Accounts for the difference between the spot price and the perpetual futures price.

The funding rate ensures that perpetual futures contracts do not drift too far from the spot market price. It is a key mechanism for balancing supply and demand in the futures market.

How Is the Funding Rate Determined?

1. Price Deviation Between Perpetual Futures and Spot Price

The primary factor affecting the funding rate is the price difference between the perpetual futures contract and the spot market. If the futures price is above the spot price, the funding rate tends to be positive, as long traders are more willing to pay to maintain their position. If the futures price is below the spot price, the funding rate is negative, favoring short traders.

2. Market Sentiment and Leverage

Market sentiment plays a crucial role in determining funding rates. When traders are overly bullish, the demand for long positions increases, driving the funding rate up. Conversely, if the market sentiment is bearish and short positions are in demand, the funding rate becomes negative.

- High leverage can also amplify the impact of funding rates, as traders borrow more to maintain positions, increasing the cost of holding the contract.

3. Liquidity and Exchange Policies

Different exchanges have their own funding rate policies. The liquidity of the asset being traded also impacts the rate, with more liquid assets generally having lower funding rates. Exchanges may adjust their funding rates to align with market conditions and maintain a balanced trading environment.

Why Do Funding Rates Change?

Market Conditions

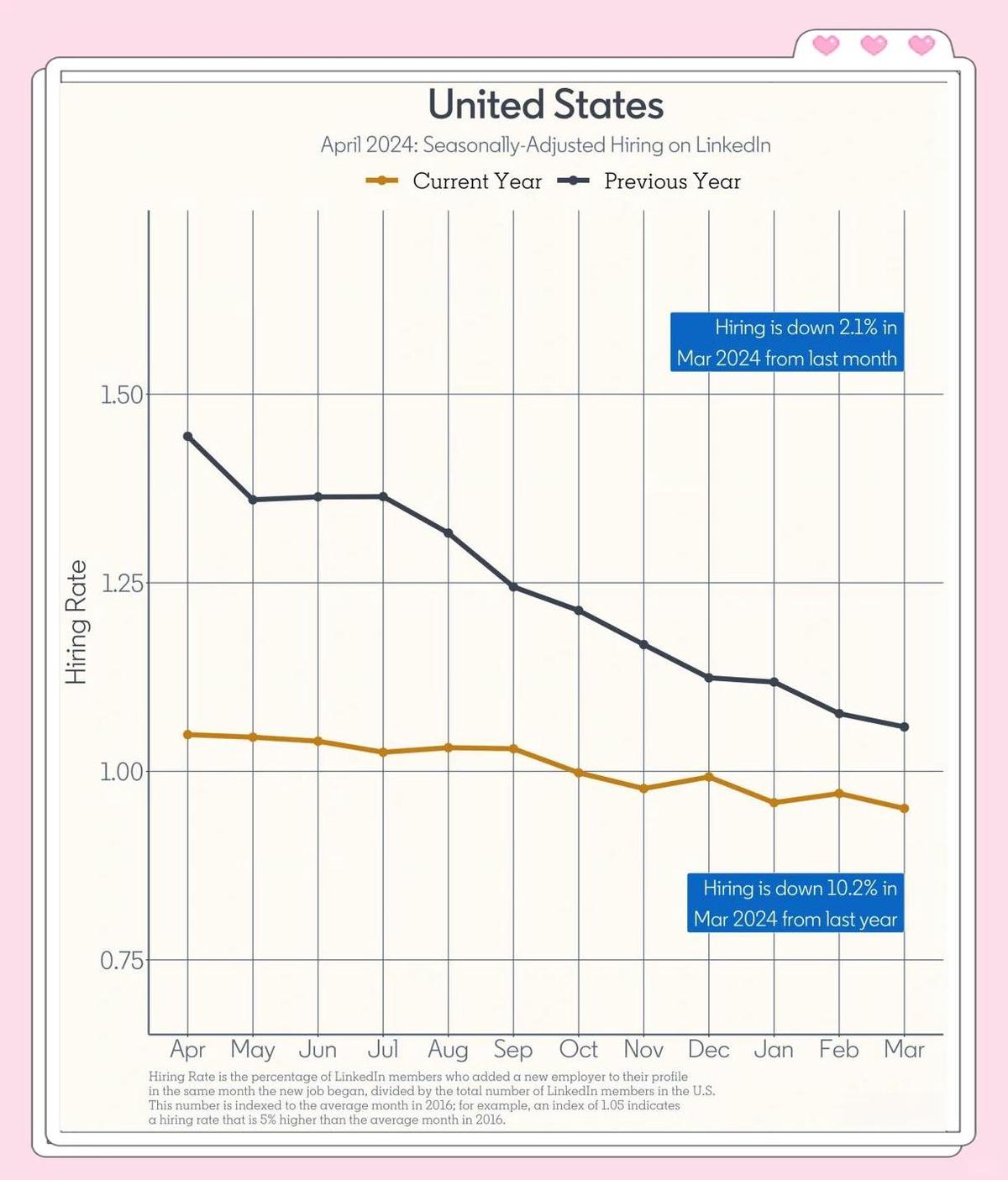

Funding rates are dynamic and change based on market conditions such as supply and demand and market volatility. During periods of high volatility, funding rates can fluctuate significantly.

- Bullish Market: When the market is rising, long positions become more desirable, leading to higher funding rates.

- Bearish Market: Conversely, when the market is falling, short positions may dominate, leading to negative funding rates.

Liquidity Shifts

Liquidity also influences the funding rate. When liquidity is low, the funding rate can become more volatile. A drop in liquidity may cause significant price deviations, prompting higher funding rates to maintain equilibrium.

External Factors

External factors, such as regulatory changes, economic announcements, or unexpected geopolitical events, can cause sudden changes in funding rates. For example, during major financial news or events, traders might rush to adjust their positions, which can significantly impact the funding rate.

How Funding Rates Affect Perpetual Futures

1. Cost of Holding a Position

The funding rate directly impacts the cost of holding a perpetual futures position. A positive funding rate means long positions are paying short positions, increasing the cost of holding a long position. In contrast, a negative funding rate benefits long traders, as short traders are required to pay them.

Example:

If the funding rate is 0.01% per 8 hours and a trader holds a position worth \(10,000, they will pay \)1 per 8 hours if the rate is positive. However, if the rate is negative, they would receive that payment instead.

2. Influence on Market Sentiment

Funding rates can be a strong indicator of market sentiment. High funding rates are often associated with bullish market conditions, while negative funding rates signal bearish sentiment.

Traders often use funding rates as a signal to enter or exit the market, as they can provide insight into the market’s overall direction. A consistently high funding rate might indicate an overheated market, while a consistently low or negative rate could suggest a reversal is imminent.

How to Analyze Funding Rate Trends

1. Using Funding Rate Data

To analyze funding rate trends, traders must track data across multiple exchanges. Fortunately, many exchanges provide real-time funding rate data on their platforms. Additionally, third-party services and websites offer funding rate charts that display trends across different time frames, helping traders identify shifts in market sentiment.

Key Steps:

- Track multiple exchanges: Compare funding rates across exchanges to detect discrepancies and arbitrage opportunities.

- Monitor historical data: Use historical funding rate data to identify long-term trends.

- Assess correlation with price movements: Analyze how funding rates correlate with asset price movements to gauge the market’s expectations.

2. Identifying Funding Rate Volatility

High volatility in funding rates can signal market uncertainty. Traders should analyze funding rate fluctuations and adjust their strategies accordingly. Volatility analysis tools can help predict when a significant funding rate change might occur.

Funding Rate Strategies for Traders

1. Arbitrage Strategies

Arbitrage strategies involve exploiting differences in funding rates across exchanges. Traders can profit by buying on an exchange with a negative funding rate and selling on one with a positive funding rate, or vice versa.

- Pros: Lower risk, as trades are generally low-latency and executed almost instantaneously.

- Cons: Requires significant capital and speed to be effective.

2. Hedging Strategies

Hedging with funding rates involves using the rate to offset losses in other positions. For example, traders can hedge their long positions by opening short positions on a separate contract or exchange with favorable funding rates.

- Pros: Helps mitigate the risk of funding rate fluctuations.

- Cons: Requires precise calculations and execution, which may be challenging for beginners.

3. Directional Trading Based on Funding Rate Trends

Traders can also use funding rate trends to predict price movements and make directional bets. If the funding rate remains consistently positive, traders may anticipate continued bullish market conditions, while consistently negative funding rates could indicate bearish trends.

- Pros: Can align with broader market trends.

- Cons: Risk of false signals, particularly during volatile periods.

FAQ: Funding Rate Analysis

1. How do I calculate the funding rate?

The funding rate is generally calculated based on the interest rate of the underlying asset and the premium/discount of the perpetual futures contract. Most exchanges provide this rate as part of their trading interface, along with details on when payments are made (e.g., every 8 hours).

2. Why do funding rates fluctuate?

Funding rates fluctuate due to market sentiment, liquidity conditions, and the price difference between the perpetual futures and spot markets. During high volatility, the funding rate tends to rise, reflecting increased demand for long or short positions.

3. How can I monitor funding rate trends?

You can monitor funding rate trends by checking real-time data on your trading platform or using third-party websites that aggregate funding rate data from multiple exchanges. This allows you to analyze the rate’s movement over time and make more informed trading decisions.

Conclusion

The funding rate is a critical factor in the perpetual futures market, influencing the cost of holding positions and reflecting market sentiment. By analyzing funding rate trends and using strategies such as arbitrage, hedging, and directional trading, traders can gain a competitive advantage. Understanding funding rate data and monitoring fluctuations can help traders make better decisions, reduce risks, and maximize profits.

Stay informed and incorporate funding rate analysis into your trading strategy to enhance your success in the dynamic world of perpetual futures.