========================================================================

Introduction

In the world of perpetual futures trading, one of the most important concepts to master is the funding rate. For beginners, the term may sound complex, but at its core, it is simply a mechanism that keeps the price of perpetual contracts close to the spot market price. This funding rate analysis report provides a comprehensive breakdown of how funding rates work, why they matter, and how traders and investors can use them as a powerful tool for risk management and strategy development.

By the end of this guide, you will not only understand how to interpret funding rate trends but also gain insight into practical strategies, industry practices, and tools for better decision-making.

What is Funding Rate?

The funding rate is a periodic payment exchanged between long and short traders in perpetual futures markets. Its primary function is to anchor the perpetual futures contract price to the underlying spot market.

- Positive Funding Rate → Longs pay shorts. This indicates that the contract is trading at a premium compared to the spot price.

- Negative Funding Rate → Shorts pay longs. This suggests that the contract is trading at a discount relative to the spot price.

This mechanism incentivizes balance in the market and prevents divergence from real-world asset pricing.

Importance of Funding Rate Analysis

Funding rates are more than just numbers; they are signals of market sentiment, liquidity dynamics, and trader positioning. Understanding them is essential because:

- They impact profitability: A trader holding a position across multiple funding intervals must account for funding costs or gains.

- They reveal market bias: Consistently high positive rates show bullish enthusiasm, while negative rates reveal bearish dominance.

- They create opportunities: Smart traders can build strategies around funding rate arbitrage or hedging.

For example, understanding how funding rate affects perpetual futures is critical to designing sustainable leverage strategies.

Methods of Funding Rate Analysis

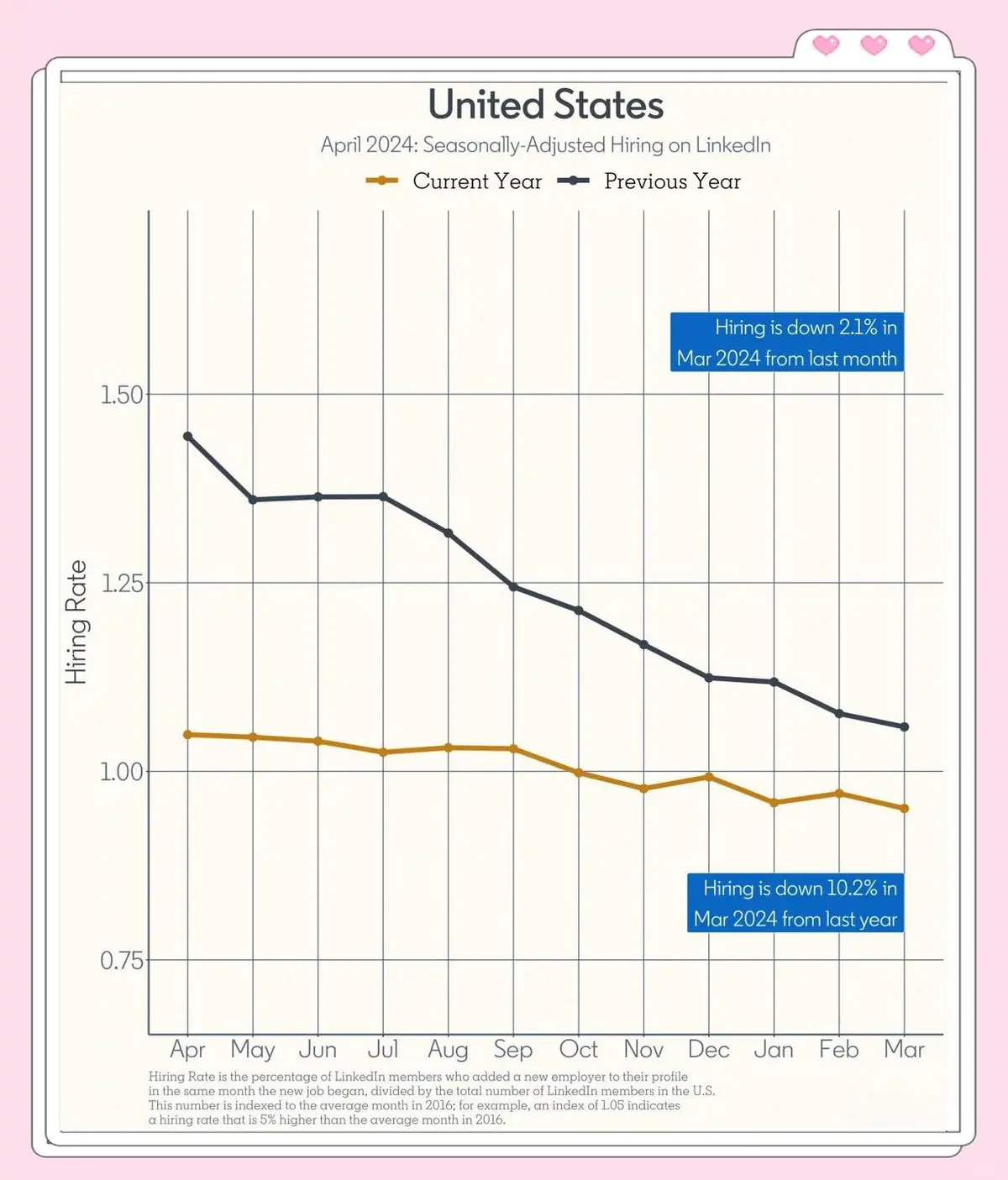

1. Historical Trend Analysis

By looking at funding rate historical data, traders can identify patterns. For instance:

- Spikes in funding rate often precede corrections.

- Sustained negative rates may signal capitulation and potential reversal.

Advantages:

- Provides context for current funding levels.

- Useful for spotting long-term patterns.

Disadvantages:

- Past performance doesn’t guarantee future outcomes.

- Requires large datasets and statistical skills.

Historical funding rate trends show how extreme values often align with market turning points.

2. Real-Time Monitoring Tools

Modern trading platforms and data providers allow traders to monitor funding rate across multiple exchanges. Real-time dashboards highlight rate disparities that can be exploited for arbitrage.

Advantages:

- Instant access to market dynamics.

- Helps identify arbitrage or hedging opportunities quickly.

Disadvantages:

- Can be overwhelming for beginners.

- Requires fast execution to capture fleeting opportunities.

A sample funding rate monitoring dashboard consolidates data from multiple exchanges.

Comparing Strategies Based on Funding Rate

Strategy 1: Directional Trading with Funding Considerations

Traders use funding rates as confirmation signals. For example:

- Entering short positions when funding rates are extremely high.

- Going long when rates are deeply negative.

Pros:

- Simple to implement.

- Aligns with sentiment extremes.

Cons:

- Can fail in trending markets where high funding persists.

- Risk of false reversals.

Strategy 2: Hedging and Arbitrage

Professional traders exploit differences in funding rates across exchanges. A common setup is:

- Long perpetual futures on an exchange with negative funding.

- Short on another with lower or positive funding.

Pros:

- Market-neutral and risk-reducing.

- Generates steady returns in volatile conditions.

Cons:

- Requires large capital.

- Demands fast execution and low fees.

For beginners, a hybrid approach often works best: use funding rate as a confirmation tool for directional trades, but hedge long-term exposure through arbitrage when feasible.

Key Metrics and Tools for Funding Rate Analysis

1. Funding Rate Calculation Tools

Platforms often provide funding rate calculation tools that let traders estimate future costs or returns for open positions. This helps with position sizing and risk planning.

2. Volatility Adjusted Analysis

Combining funding rates with volatility metrics gives a better picture of whether extreme rates are sustainable or likely to revert.

3. Exchange Comparison Reports

Not all exchanges calculate funding rates the same way. Regular funding rate comparison for exchanges helps identify which venues are more favorable for specific strategies.

Common Pitfalls Beginners Should Avoid

- Ignoring Funding Costs in Leverage Trades

A high leverage long can lose profitability if funding is excessively positive over multiple cycles.

- Chasing Arbitrage Without Experience

Execution risks and hidden fees often wipe out profits for beginners.

- Over-Reliance on Funding Signals

Funding rate is a sentiment tool, not a guaranteed predictor. Always combine it with technical or fundamental analysis.

Industry Trends in Funding Rate Analysis

- Machine Learning Forecasting

Analysts now use predictive models for funding rate predictions for traders, factoring in liquidity, order book depth, and volatility.

- Integration with Portfolio Risk Management

Institutional investors incorporate funding costs into broader funding rate risk management frameworks, ensuring portfolios remain hedged.

- Retail Education Growth

More platforms now provide funding rate educational resources to beginners, reflecting its growing importance in crypto literacy.

AI models are increasingly used for funding rate forecasting.

FAQ: Funding Rate Analysis Report

1. How often are funding rates updated?

Most exchanges update funding rates every 8 hours, though some platforms allow customization. This means holding a leveraged position overnight can incur multiple funding payments.

2. Can funding rates remain extreme for long periods?

Yes. In strong bull runs, positive rates can remain high for weeks. In bearish conditions, negative rates dominate. Traders should avoid assuming immediate mean reversion.

3. How do I find the best funding rate opportunities?

Use dashboards that consolidate rates across multiple exchanges. Combine this with strategies like how to calculate funding rate to ensure profitability after fees.

Conclusion

Funding rate analysis is not just a technical exercise—it is a gateway to understanding market sentiment, positioning, and liquidity flows. This funding rate analysis report demonstrates how both beginners and professionals can benefit from historical trend analysis, real-time monitoring, and strategy integration.

Whether you are a short-term scalper, a long-term hedger, or an institutional trader, funding rate knowledge empowers you to manage costs, uncover arbitrage, and enhance decision-making.

If you found this report insightful, share it with fellow traders, leave a comment with your experiences, and join the conversation. The more we exchange insights, the stronger our trading community becomes.