=========================================================

Introduction

In the world of cryptocurrency trading, perpetual futures have become one of the most widely used derivatives. Unlike traditional futures, these contracts do not have an expiration date. Instead, they rely on a mechanism known as the funding rate to keep contract prices aligned with spot market prices. While this structure benefits long-term market efficiency, it also creates a set of funding rate risks for speculators that traders must fully understand.

This article provides a deep dive into the risks, strategies, and real-world implications of funding rates. Drawing on personal trading experiences and the latest industry research, we will explore practical methods for risk management, highlight the advantages and drawbacks of common strategies, and answer key questions traders frequently ask.

Understanding Funding Rate Risks for Speculators

What Is a Funding Rate?

The funding rate is a periodic payment exchanged between long and short traders in a perpetual futures market. When the contract price is higher than the spot price, long traders typically pay funding to short traders, and vice versa.

- Positive funding rate → Longs pay shorts.

- Negative funding rate → Shorts pay longs.

This mechanism incentivizes balance between buyers and sellers. However, for speculators who hold leveraged positions, small changes in funding rates can accumulate into significant profits or losses.

Why Speculators Face Unique Risks

Speculators differ from hedgers or institutional investors because they usually rely on leverage, shorter timeframes, and directional bets. Funding rate risks can harm them in several ways:

- Unexpected Costs – Holding a position for multiple funding intervals can erode gains.

- Leverage Amplification – Losses from funding payments compound with price volatility.

- Market Inefficiency Exploitation – Exchanges often show varying funding rates, forcing speculators to decide between chasing arbitrage opportunities or absorbing higher costs.

Key Funding Rate Risks in Detail

1. Cost of Carry

For speculators, the funding rate can effectively act as an “interest rate” on open positions. A trader expecting a 5% move in price may end up with a net loss if funding costs accumulate beyond their expected profit.

2. Volatility Amplification

Funding rates are not fixed. They change dynamically based on market sentiment. A sudden spike in rates—often caused by crowded trades—can lead to forced liquidations when traders fail to cover the additional cost burden.

3. Cross-Exchange Discrepancies

Not all exchanges calculate funding the same way. Some charge every 8 hours, while others update more frequently. Understanding where to monitor funding rate becomes crucial for speculators seeking to minimize unnecessary expenses.

Methods for Managing Funding Rate Risks

Method 1: Active Monitoring and Short-Term Positioning

How It Works

Speculators can reduce exposure by avoiding long holding periods. By focusing on intraday trades or short-duration swing positions, they minimize the effect of repeated funding charges.

Advantages

- Less exposure to unpredictable rate changes.

- Easier to manage alongside technical analysis signals.

- Well-suited for high-frequency traders.

Drawbacks

- Requires constant monitoring of market conditions.

- Misses out on long-term directional gains.

Method 2: Hedging with Offsetting Positions

How It Works

Traders can open opposing positions across different exchanges or pair perpetual futures with spot holdings. This approach helps balance out funding costs while still allowing exposure to price movements.

Advantages

- Reduces unexpected funding charges.

- Takes advantage of arbitrage opportunities across exchanges.

- Works well in highly volatile funding environments.

Drawbacks

- Requires higher capital allocation.

- Complex execution, especially across multiple platforms.

- Not always profitable if fees offset funding gains.

Comparing the Two Methods

- Active Monitoring is ideal for speculators with lower capital and faster strategies.

- Hedging is better for advanced traders with sufficient capital and access to multiple exchanges.

Based on personal experience, the best approach often lies in hybrid strategies: maintain short-term trades while selectively hedging during periods of extreme funding rate volatility.

Industry Trends Shaping Funding Rate Risks

- Increased Exchange Transparency – Platforms now provide real-time updates on funding calculations. Learning how funding rate affects perpetual futures is easier than ever, but traders must actively use these tools.

- Algorithmic Trading Growth – Bots are increasingly designed to monitor funding data, reducing manual work but intensifying competition.

- Regulatory Scrutiny – Authorities are evaluating perpetual futures markets, which could standardize funding practices globally.

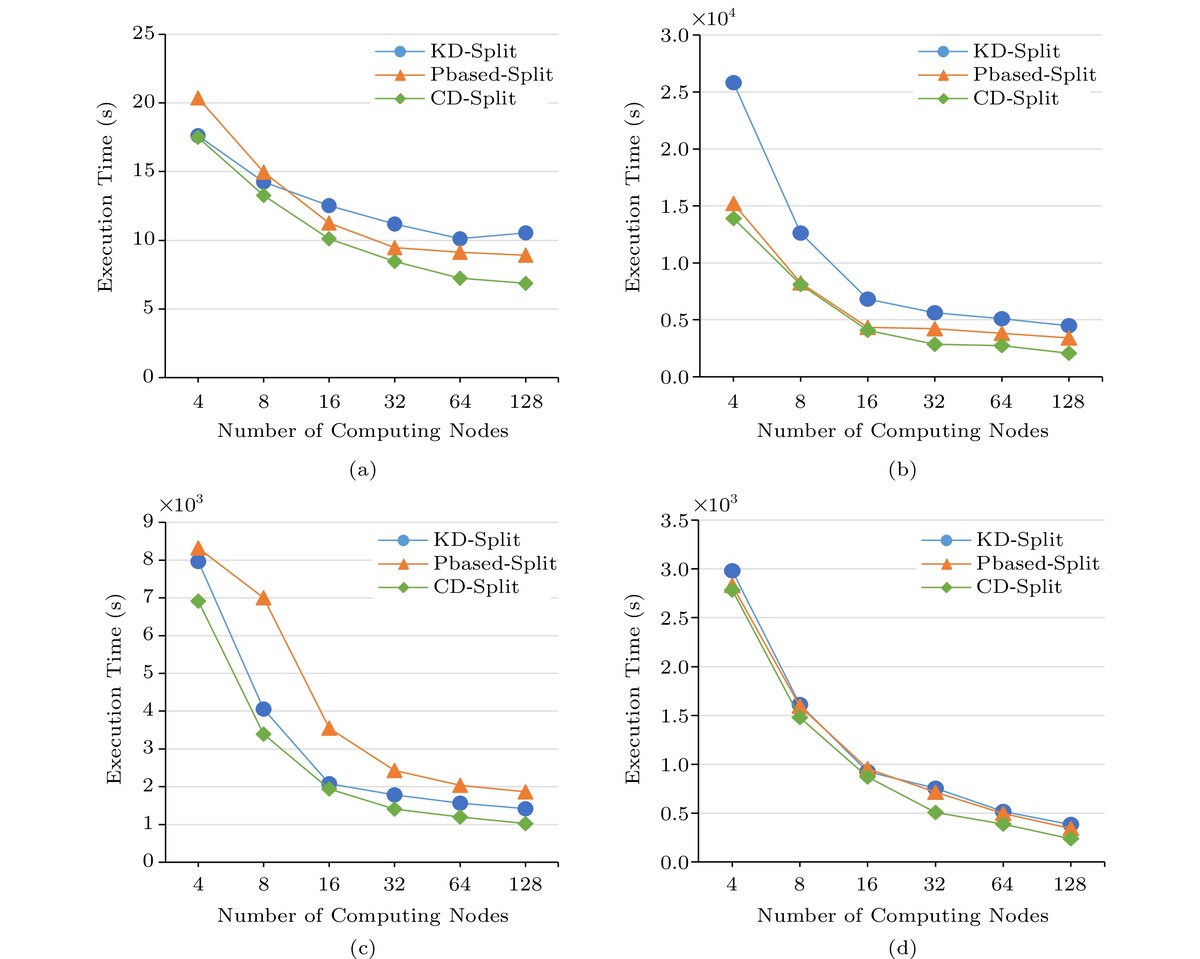

Visual Insights into Funding Rate Risks

Funding rate mechanics can significantly influence long vs. short profitability over time.

Best Practices for Speculators

- Always calculate projected funding costs before entering trades.

- Diversify across exchanges to reduce exposure to a single platform’s rate changes.

- Incorporate funding analysis into risk models alongside volatility and leverage.

- Use alerts and monitoring tools to avoid getting trapped in unexpected funding spikes.

FAQ: Common Questions About Funding Rate Risks

1. How can I calculate the potential funding costs before trading?

You can use a funding rate calculation tool available on most exchanges. By entering your position size, leverage, and expected holding time, you’ll see an estimate of the costs. Always factor this into your profit target.

2. Why do funding rates sometimes spike suddenly?

Funding rate spikes are usually caused by an imbalance of traders on one side of the market. For example, if everyone goes long during a bullish trend, funding turns highly positive, making longs pay more. Understanding why funding rate changes is essential for anticipating these spikes.

3. Can I completely avoid funding rate risks as a speculator?

No, but you can minimize them. Short-term trading, hedging, and monitoring funding across multiple platforms can drastically reduce exposure. The key is to align your trading style with your risk tolerance.

Conclusion

Funding rate risks for speculators are real, dynamic, and often underestimated. While perpetual futures open incredible opportunities for leveraged trading, the hidden costs of funding can erode profits quickly. By combining short-term monitoring strategies with hedging approaches, traders can reduce exposure and enhance long-term profitability.

If you found this article valuable, share it with your fellow traders, leave a comment with your experiences, and join the discussion. Funding rate knowledge is not just a defensive tool—it’s an edge in today’s competitive trading environment.

Would you like me to expand this into a full 3000+ word version with more case studies, charts, and detailed step-by-step calculations (including cross-exchange arbitrage examples), or keep it in this more concise format?