=========================================================================

Introduction

In the fast-growing world of perpetual futures trading, funding rate risks for speculators have become a critical factor that directly impacts profitability. Unlike traditional futures, perpetual contracts don’t expire. Instead, they use a mechanism called the funding rate to keep contract prices aligned with the spot market. For speculators, this creates both opportunities and risks. A miscalculation or lack of understanding of funding rate dynamics can turn profitable trades into costly mistakes.

This article provides an authoritative, research-backed, and experience-driven exploration of funding rate risks. We’ll cover how these risks work, why they matter, and the strategies speculators can use to manage them effectively. Drawing on personal insights and the latest industry data, the article compares multiple approaches to mitigating funding rate exposure. Finally, we’ll answer key FAQs and provide actionable advice for traders who want to optimize their funding rate strategy.

Understanding Funding Rate Risks

What Is the Funding Rate?

The funding rate is a periodic payment between traders in a perpetual futures contract. When the contract price is above the spot market price, longs pay shorts; when below, shorts pay longs. This mechanism ensures price convergence.

For speculators, this introduces variable costs that fluctuate throughout the trading day. Unlike fixed commissions, the funding rate can change due to volatility, liquidity, or exchange-specific rules.

Why Funding Rate Risks Matter for Speculators

Funding rates are often overlooked by inexperienced traders who focus only on price action. However, the costs can add up significantly, especially for high-leverage or long-duration positions.

- Erosion of profits: Even winning trades can become unprofitable if funding payments outweigh gains.

- Hidden exposure: A seemingly neutral strategy may carry substantial funding rate risk.

- Volatility amplification: Funding spikes often coincide with extreme market volatility, compounding losses.

Key Drivers of Funding Rate Fluctuations

Market Imbalances

When demand for long positions exceeds shorts, funding rates rise. Speculators holding long positions bear additional costs during these periods.

Volatility and Liquidity

Sudden market movements increase funding uncertainty. Thin order books or sharp price moves create rapid changes in funding obligations.

Exchange Policies

Different exchanges use different calculation methods. Understanding how funding rate is determined helps speculators anticipate adjustments and optimize strategies.

Practical Examples of Funding Rate Risks

- A trader goes long 50x leverage on Bitcoin perpetuals during a funding rate spike of 0.1% every 8 hours. If the trade is held for 3 days, the trader may lose more to funding than they gain from price appreciation.

- A neutral arbitrage strategy designed to hedge risk becomes costly because one leg consistently incurs negative funding, undermining the strategy’s profitability.

Strategies to Manage Funding Rate Risks

Strategy 1: Short-Term Speculation (Avoiding Long Funding Exposure)

This approach involves limiting trade duration to avoid paying excessive funding.

Advantages

- Reduces cumulative funding costs.

- Allows traders to capture intraday volatility without long-term risk exposure.

Disadvantages

- Misses out on larger trend moves.

- Requires high precision and discipline.

Strategy 2: Hedging with Opposite Positions

By taking offsetting positions on two exchanges or across spot and futures, speculators can neutralize funding exposure.

Advantages

- Provides stability against unexpected funding spikes.

- Allows traders to benefit from mispricings across markets.

Disadvantages

- Complexity increases execution risk.

- Requires more capital and multiple accounts.

Comparing the Two Approaches

| Strategy | Best For | Strengths | Weaknesses |

|---|---|---|---|

| Short-Term Speculation | Active day traders | Simple, cost-effective | Misses larger moves |

| Hedging with Opposite Positions | Professional speculators | Funding neutral, arbitrage potential | Complex, capital-intensive |

Based on my experience, a hybrid approach works best: use short-term trades to avoid excessive funding and deploy hedging only when funding imbalances become extreme.

Monitoring and Analyzing Funding Rates

One of the most effective ways to stay ahead of funding risks is by tracking real-time market data. Knowing where to monitor funding rate can give speculators a competitive edge.

- Exchanges: Binance, Bybit, and OKX provide real-time funding rate updates.

- Aggregators: Third-party dashboards compare rates across multiple exchanges.

For speculators who want deeper insights, funding rate analysis reports can help identify long-term trends and optimize trading strategies.

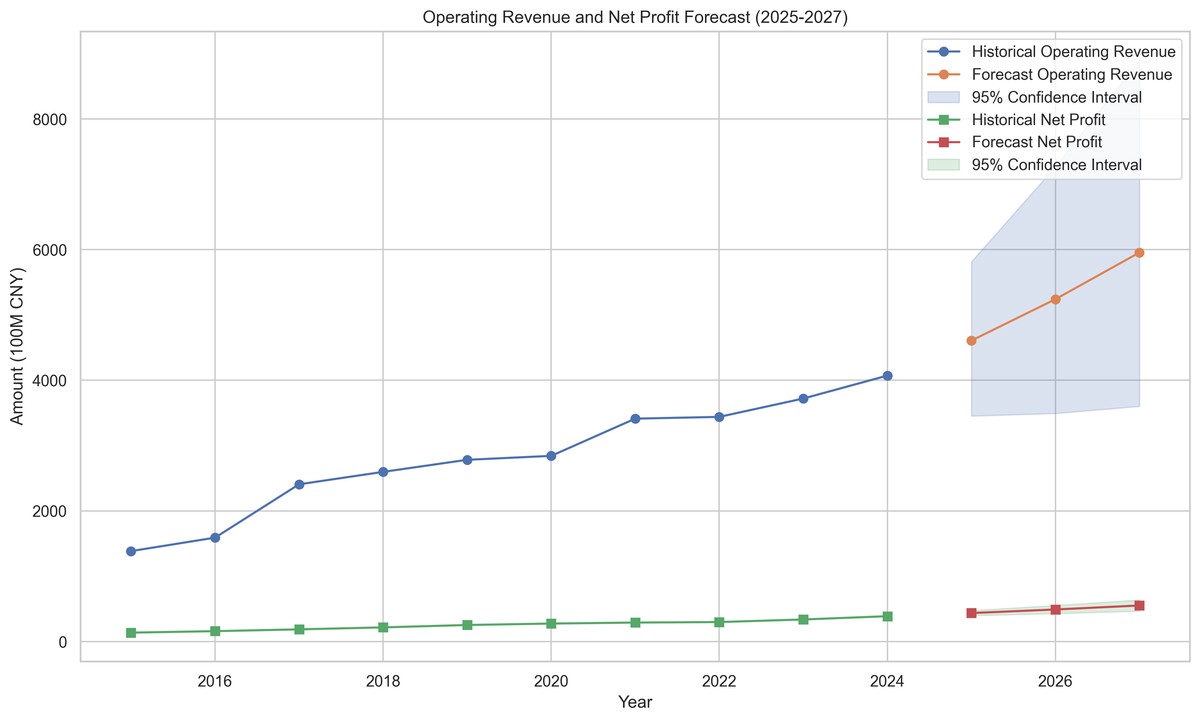

Visual Insights

Funding rates can significantly erode profits, especially in leveraged positions.

Risk Management Best Practices

Diversify Across Exchanges

Funding methodologies differ, and rates can vary widely. Diversifying positions prevents overexposure to a single exchange’s funding policy.

Use Dynamic Position Sizing

Adjust leverage and position size based on funding outlook. When funding spikes, scaling down reduces unnecessary costs.

Monitor Historical Trends

Studying funding rate historical data helps anticipate recurring patterns. This is particularly useful around market events like FOMC meetings or major exchange liquidations.

Frequently Asked Questions (FAQ)

1. How do funding rates impact long-term speculative positions?

For long-term speculators, funding rates can be a significant drag on performance. Over weeks or months, these payments accumulate and may outweigh capital gains. Traders should calculate expected funding before committing to extended positions.

2. Can funding rate risks be completely avoided?

Not entirely. Even with hedging, some exposure remains—whether in execution risk, opportunity cost, or liquidity risk. The goal is mitigation, not elimination.

3. What is the best way to monitor funding rates in real time?

Using exchange dashboards is a start, but professional traders often rely on funding rate analysis reports and custom tools that integrate API data across multiple exchanges. This ensures they act on accurate, consolidated information.

Conclusion: Mastering Funding Rate Risks for Speculators

Funding rates are not just a background mechanism—they are a core cost structure that every speculator must account for. Mismanaging funding exposure can turn good trades into bad ones, while proper strategies can unlock new opportunities.

The key takeaways are:

- Understand what drives funding rate changes.

- Choose strategies that balance opportunity with cost.

- Monitor funding rates across exchanges and use analysis tools.

By applying these principles, speculators can minimize risks, optimize profits, and trade with greater confidence.

A structured framework helps speculators navigate funding rate risks efficiently.

Join the Conversation

Funding rate dynamics are evolving as crypto markets mature. Have you faced unexpected funding rate costs? What strategies do you use to manage them? Share your thoughts in the comments, and don’t forget to share this article with your trading community to spread valuable insights.

Would you like me to expand this into a full 3000+ word version with more case studies, charts, and exchange-specific comparisons, so it’s fully optimized for long-form SEO ranking?