===================================================

Futures investment offers traders the opportunity to leverage capital and gain significant market exposure. However, understanding exposure in futures investment is crucial for managing risk and maximizing returns. This article provides a comprehensive exploration of exposure strategies, methods to quantify and manage exposure, and practical guidance for both retail and institutional investors.

Understanding Exposure in Futures

What is Exposure in Futures Trading?

Exposure in futures refers to the total market value of positions held by an investor relative to their account size. It represents potential profit or loss from market movements. Properly managing exposure allows traders to optimize returns while mitigating risk.

Key metrics include:

- Notional Value: Total market value of futures contracts held

- Leverage Ratio: Relationship between margin and total position size

- Delta Exposure: Sensitivity of futures position to underlying asset price changes

Internal Link: Understanding why exposure is important in perpetual futures trading helps explain its influence on risk and return management.

Methods to Gain and Manage Exposure

Method 1: Linear Exposure through Direct Futures Contracts

Description: Buying or selling futures contracts directly creates a linear exposure to the underlying asset.

Advantages:

- Simple to implement and understand

- Immediate exposure to price movements

- Suitable for short-term trading strategies

Disadvantages:

- High leverage can magnify losses

- Requires active monitoring to avoid margin calls

Method 2: Synthetic Exposure via Derivatives

Description: Using options, swaps, or spread strategies to replicate futures exposure.

Advantages:

- Allows tailored risk profiles and hedging

- Can limit downside risk while maintaining upside potential

- Flexibility in creating directional or non-directional exposure

Disadvantages:

- More complex, requiring advanced knowledge

- Additional costs due to options premiums and trading fees

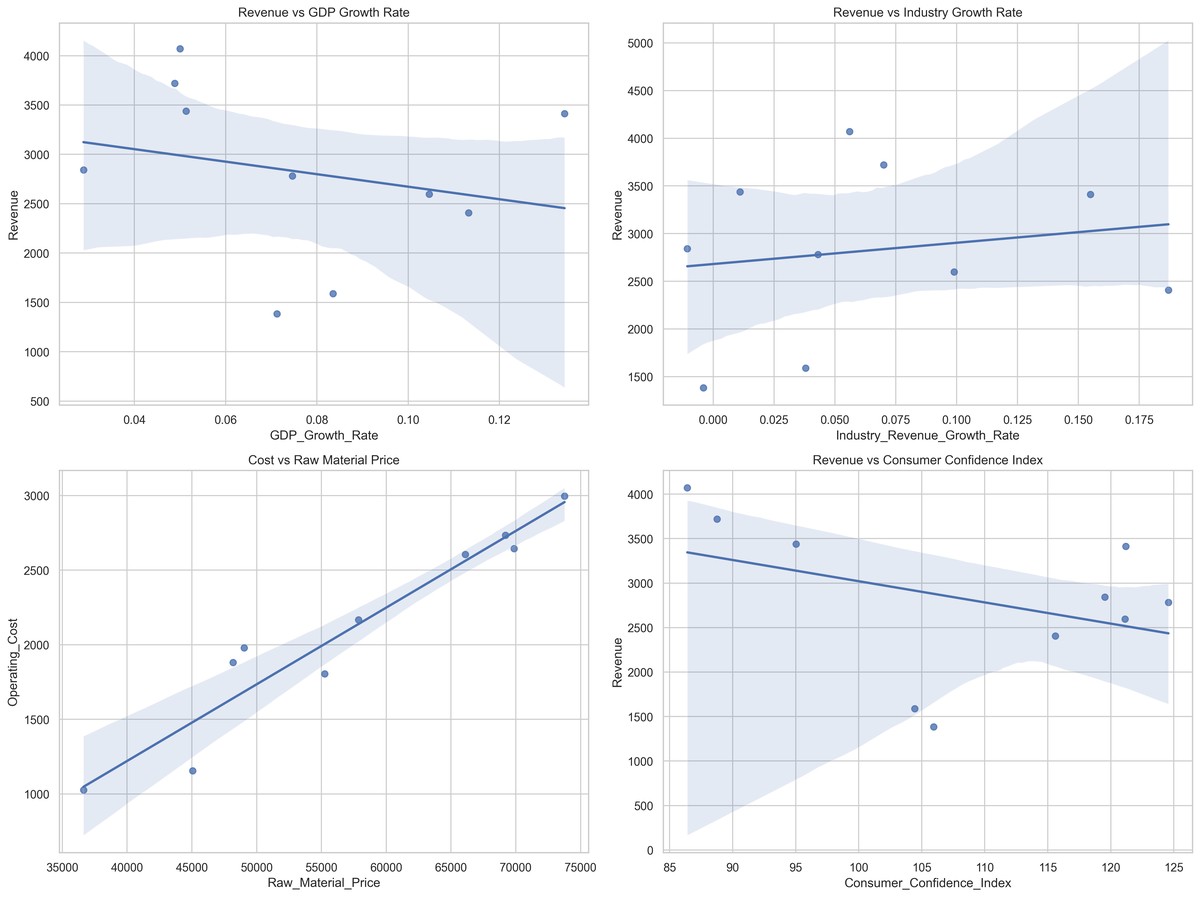

Comparison of linear versus synthetic exposure strategies in futures investment.

Quantifying Exposure

Calculating Notional and Margin Requirements

- Notional Value Formula:

Notional Value=Contract Size×Number of Contracts×Price of Underlying\text{Notional Value} = \text{Contract Size} \times \text{Number of Contracts} \times \text{Price of Underlying}Notional Value=Contract Size×Number of Contracts×Price of Underlying

- Margin Requirement: Ensures sufficient capital is allocated to maintain positions. It is influenced by volatility and leverage.

Risk Metrics Related to Exposure

- Value-at-Risk (VaR): Estimates potential loss under normal market conditions

- Stress Testing: Simulates extreme scenarios to evaluate impact on positions

- Delta and Gamma Sensitivity: Measures exposure to price changes in underlying assets and options

Internal Link: Learning where to access exposure analytics for perpetual futures enables traders to make data-driven decisions using advanced quantitative tools.

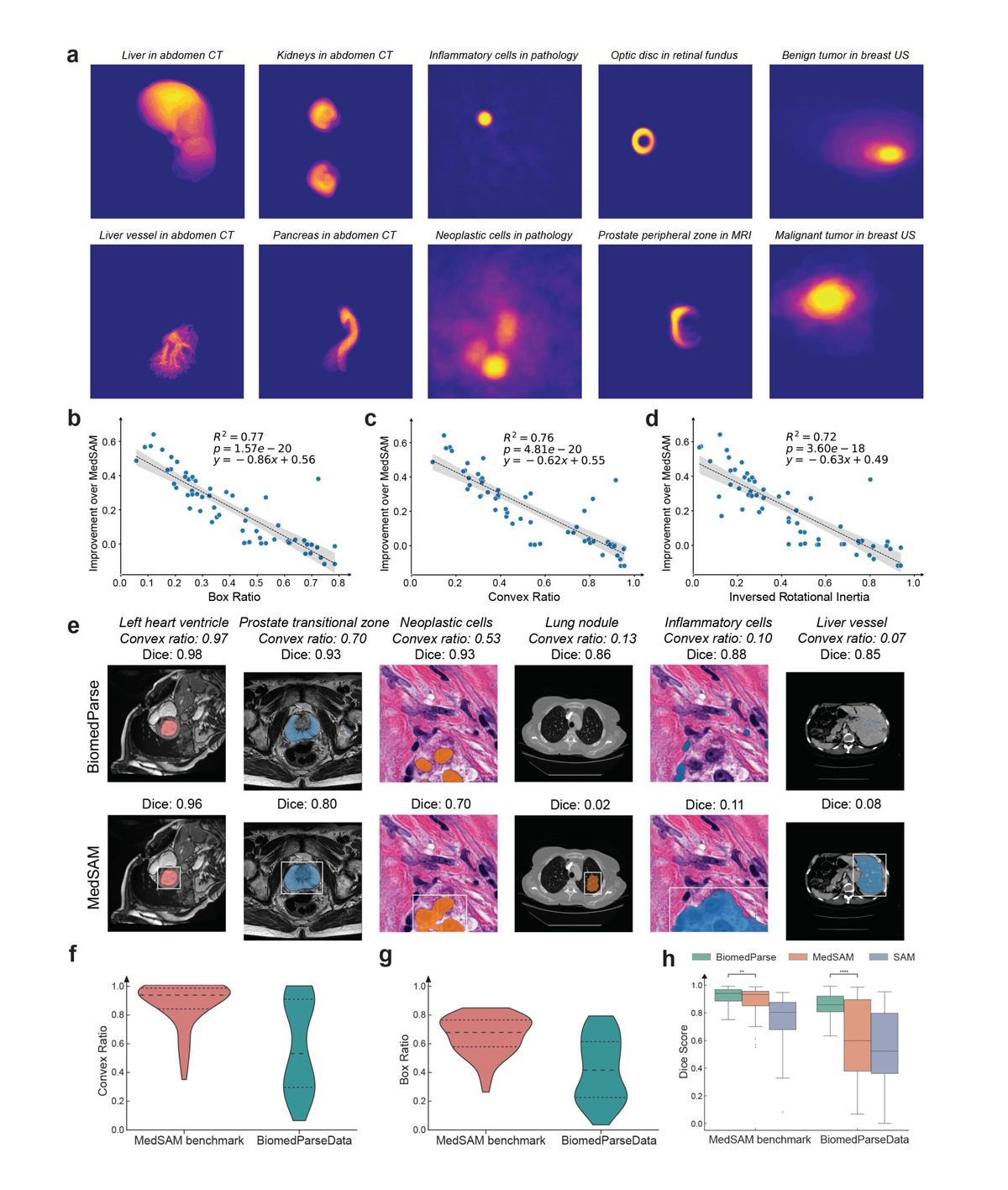

Strategies for Managing Exposure

Diversification Across Contracts

Spreading investments across multiple futures contracts reduces concentration risk. For example, a combination of equity index, commodity, and interest rate futures can mitigate adverse movements in a single market.

Dynamic Adjustment of Position Size

Adjusting futures positions based on volatility and account size helps maintain optimal exposure. Traders often use volatility scaling to avoid over-leveraging during high-risk periods.

Hedging Techniques

- Using Options: Protective puts can limit downside while maintaining exposure

- Cross-Market Hedges: Offsetting risk in correlated markets to stabilize overall exposure

Illustration of exposure management methods, including diversification, hedging, and dynamic position sizing.

Practical Insights for Different Investors

Retail Traders

- Focus on simple linear exposure with conservative leverage

- Use stop-loss orders and risk limits to prevent catastrophic losses

- Start with liquid, well-understood contracts

Institutional Investors

- Utilize complex synthetic strategies for tailored risk-return profiles

- Implement systematic models to monitor and rebalance exposure

- Apply stress tests and scenario analysis to safeguard portfolios

Advanced Tools for Exposure Analysis

Real-Time Analytics Platforms

- Trading platforms like Bloomberg Terminal, Refinitiv Eikon, or specialized futures software provide exposure tracking, scenario modeling, and alert systems.

Automated Risk Management Systems

- AI-driven systems can dynamically adjust exposure based on market conditions, volatility, and account metrics.

Example of a futures exposure analytics dashboard showing real-time P&L, margin usage, and risk metrics.

FAQs

1. How do I start managing exposure in futures as a beginner?

Start with small positions, monitor account leverage, and focus on liquid contracts. Use stop-loss orders and gradually integrate hedging techniques.

2. Can exposure strategies improve returns in high volatility markets?

Yes. Properly calibrated exposure allows traders to capitalize on price movements while controlling downside risk. Diversification and synthetic strategies are particularly effective.

3. What are the common mistakes in exposure management?

- Over-leveraging positions without sufficient margin

- Ignoring correlation between contracts

- Failing to adjust exposure during high volatility periods

Conclusion

An in-depth analysis of exposure in futures investment is vital for optimizing returns and managing risk. By understanding linear and synthetic exposure methods, quantifying risk, and applying strategic controls, traders can enhance their decision-making.

Combining advanced analytics, risk management systems, and practical strategies ensures both retail and institutional investors can navigate futures markets successfully.

Summary infographic showing exposure calculation, management strategies, and tools for futures investors.