===========================================================

Volatility has always been a double-edged sword for institutional investors. On one hand, it provides opportunities for alpha generation; on the other hand, it can magnify risks and destabilize portfolios if not managed correctly. Understanding the impact of volatility on institutional investors’ strategies is essential for asset managers, hedge funds, pension funds, and insurance companies that deploy capital across global markets.

This guide explores how volatility influences institutional decision-making, compares common strategies, and provides practical frameworks for adapting to dynamic market conditions.

Understanding Volatility in Institutional Context

What Is Volatility?

Volatility measures the degree of variation in asset prices over time, typically expressed through metrics like standard deviation or implied volatility indexes (e.g., VIX). For institutional investors, volatility is not merely “noise”—it is a reflection of uncertainty, risk appetite, and liquidity conditions.

Why Volatility Matters for Institutions

- Risk Management: Institutions must manage volatility to meet fiduciary duties.

- Capital Allocation: Volatile environments influence sector rotation and asset diversification.

- Performance Benchmarking: Relative performance versus benchmarks often changes with volatility regimes.

In futures markets, why is volatility important in perpetual futures trading becomes evident as price swings directly affect margin requirements, leverage, and risk exposure—factors that institutional traders must manage daily.

Historical VIX levels showing spikes during crises and calm periods in stable markets.

How Institutional Investors Measure and Interpret Volatility

Historical vs. Implied Volatility

- Historical Volatility (HV): Based on past price movements.

- Implied Volatility (IV): Derived from options pricing, reflecting market expectations.

Institutions typically blend both measures for forward-looking strategies.

Volatility Regimes

Institutions categorize volatility environments as low, medium, or high regime to adjust allocation models. For example, in a high-volatility regime, they may reduce equity exposure and increase fixed income or hedging instruments.

Tools Used by Professionals

- GARCH Models: For volatility forecasting.

- Monte Carlo Simulations: For stress testing.

- Volatility Indexes (VIX, VSTOXX, VXFXI): Market sentiment indicators.

In practice, institutions also rely on data services such as where to find volatility data for perpetual futures, enabling them to model real-time risks across asset classes.

Strategies Institutional Investors Use to Manage Volatility

Strategy 1: Diversification and Asset Rotation

- Approach: Allocate capital across equities, bonds, commodities, and alternatives.

- Pros: Reduces single-market exposure, stabilizes returns.

- Cons: Correlations often rise in crises, diminishing effectiveness.

Strategy 2: Volatility Targeting and Risk Parity

- Approach: Adjust portfolio leverage and exposure based on target volatility levels.

- Pros: Systematic, data-driven, reduces drawdowns.

- Cons: Can lead to forced deleveraging in market shocks.

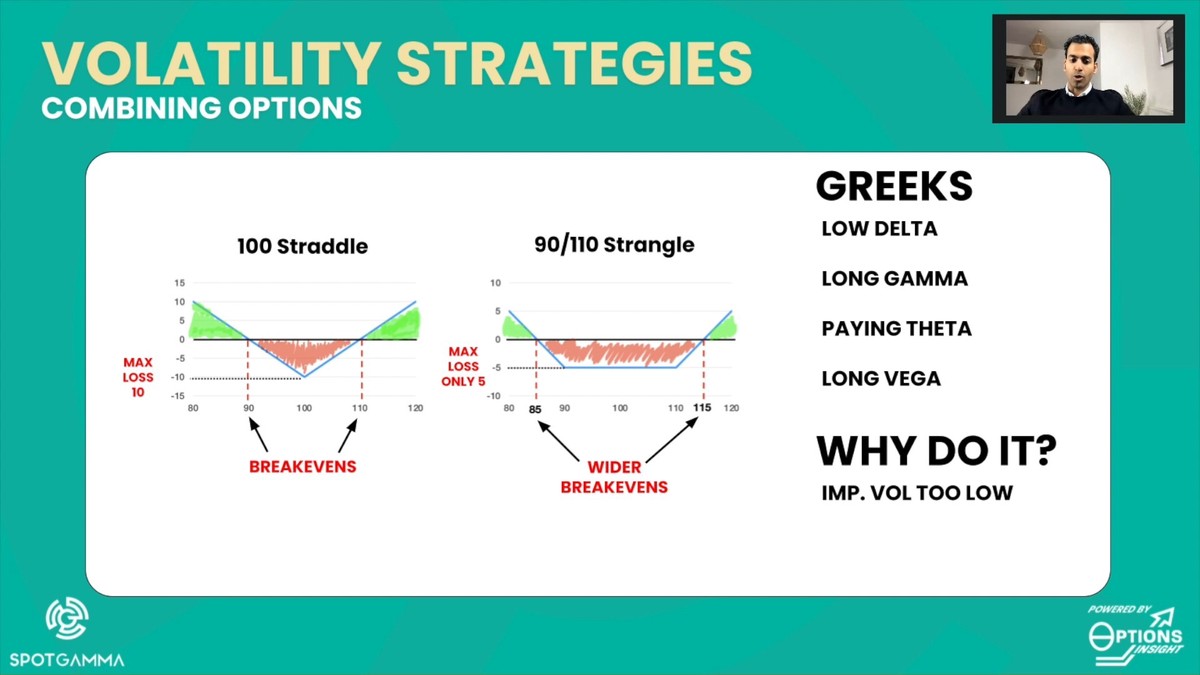

Strategy 3: Hedging with Derivatives

- Approach: Use options, futures, and swaps to hedge downside risk.

- Pros: Provides insurance against extreme moves.

- Cons: Costly, especially during periods of elevated implied volatility.

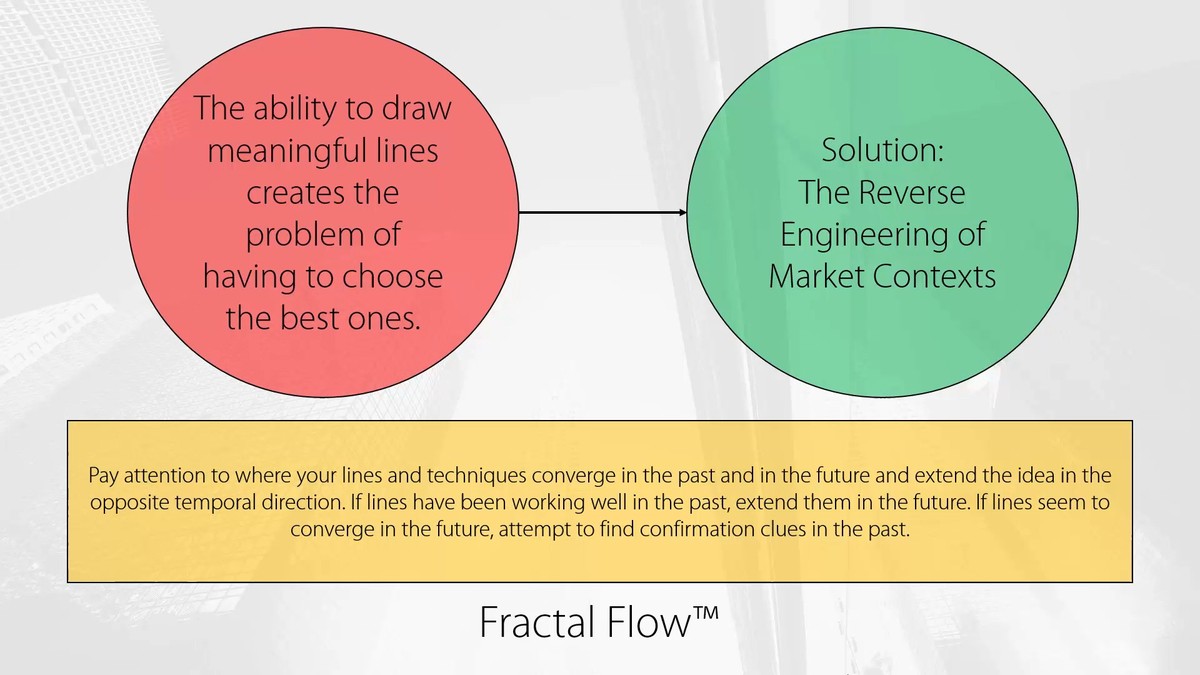

Strategy 4: Opportunistic Volatility Trading

- Approach: Exploit volatility mispricings through volatility arbitrage, dispersion trading, or long-vol strategies.

- Pros: Potential to generate uncorrelated returns.

- Cons: Requires specialized expertise and infrastructure.

Institutional portfolio allocation shifts during different volatility regimes.

Comparing Volatility Strategies

| Strategy | Best Use Case | Advantages | Drawbacks |

|---|---|---|---|

| Diversification & Rotation | Stable to medium volatility | Easy to implement, long-term stability | Less effective in global crises |

| Volatility Targeting / Risk Parity | All regimes | Systematic, reduces tail risk | Leverage unwinds amplify drawdowns |

| Derivatives Hedging | High-volatility environments | Direct downside protection | Expensive during stress periods |

| Opportunistic Volatility Trading | High-frequency & hedge funds | Generates alpha in volatile markets | Requires complex modeling and execution |

Based on institutional practice, volatility targeting combined with selective hedging often delivers the best balance between cost and effectiveness.

The Role of Technology in Volatility Management

- Quantitative Models: AI-driven volatility forecasting tools.

- Execution Algorithms: Reduce slippage in volatile conditions.

- Risk Platforms: Real-time monitoring dashboards for portfolio managers.

Machine learning is increasingly applied to how to predict volatility in perpetual futures, allowing institutions to stay ahead of market swings and allocate capital more efficiently.

Personal Insights and Industry Trends

From my experience consulting with asset managers, institutions are moving away from static diversification and toward dynamic risk-based frameworks. The rise of volatility-linked ETFs, systematic hedging strategies, and machine-learning-driven forecasting indicates a structural shift in how institutions perceive and adapt to volatility.

Hedge funds, in particular, are increasingly incorporating volatility arbitrage and dispersion trading strategies, while pension funds and insurers emphasize capital preservation through hedging overlays.

Frequently Asked Questions (FAQ)

1. How does volatility affect institutional portfolio construction?

Volatility directly influences asset allocation models. Higher volatility leads to risk reduction, increased hedging, and preference for defensive assets such as bonds or alternatives.

2. Do institutional investors always avoid volatility?

Not necessarily. While pension funds and insurers often mitigate volatility, hedge funds may actively seek it to generate alpha through volatility arbitrage, option writing, or dispersion strategies.

3. What is the best way to hedge volatility risks?

The best approach depends on cost and objectives. Options are effective but expensive; volatility targeting reduces exposure systematically; combining both often provides optimal protection.

Conclusion

The impact of volatility on institutional investors’ strategies is profound, shaping portfolio construction, risk management, and performance outcomes. Institutions must decide whether to hedge, embrace, or systematically manage volatility depending on mandates and market conditions.

With advances in data analytics, AI models, and derivatives markets, institutional investors are more equipped than ever to navigate volatility effectively.

👉 How does your organization adapt to volatility? Share your insights in the comments and forward this guide to colleagues who could benefit from a deeper understanding of institutional volatility strategies.