===========================================================

Volatility is one of the most critical factors influencing financial markets, and it has significant implications for institutional investors. These investors, including hedge funds, pension funds, and mutual funds, manage large sums of capital and must navigate the complex landscape of market fluctuations to achieve stable returns. The ability to measure and manage volatility is essential for protecting portfolios and making informed investment decisions. This article explores the impact of volatility on institutional investors’ strategies, examining how volatility influences investment decisions, risk management, and long-term goals.

What is Volatility and Why Does it Matter for Institutional Investors?

Volatility refers to the degree of variation in the price of an asset or market index over time. High volatility indicates that prices can change rapidly in either direction, while low volatility suggests a more stable market. For institutional investors, volatility presents both opportunities and risks. Understanding volatility is crucial for developing effective trading strategies, optimizing portfolio performance, and ensuring risk-adjusted returns.

Types of Volatility

- Historical Volatility: This measures past price fluctuations of an asset over a specific period. Institutional investors often use historical volatility to forecast future price movements and assess risk.

- Implied Volatility: Implied volatility is derived from the market prices of options and reflects the market’s expectations of future price movement. It is crucial for pricing options and derivatives.

- Volatility Index (VIX): Known as the “fear gauge,” the VIX measures expected volatility in the S&P 500 index. High VIX values often indicate heightened uncertainty and potential market corrections.

For institutional investors, monitoring these volatility indicators helps make decisions about asset allocation, hedging, and adjusting risk exposure.

How Volatility Affects Institutional Investors’ Strategies

Institutional investors face unique challenges when navigating volatility, as they must balance the pursuit of returns with the preservation of capital. Volatility impacts several key areas of their strategies:

1. Risk Management and Diversification

Institutional investors rely on diversification to mitigate risk and manage volatility. By spreading investments across different asset classes, sectors, and geographical regions, they can reduce the impact of volatility in any single market.

Volatility and Asset Allocation:

- High Volatility Periods: During periods of high volatility, institutional investors often shift towards safer assets like government bonds or cash equivalents to protect their portfolios from large losses.

- Low Volatility Periods: In stable market conditions, institutional investors may increase exposure to riskier assets like equities or commodities to capture higher returns.

Diversification, however, does not fully eliminate risk. During extreme market conditions, even diversified portfolios may experience significant drawdowns, highlighting the importance of volatility management.

2. Hedging Against Volatility

Institutional investors use various financial instruments to hedge against volatility, ensuring that their portfolios are protected from adverse market movements. Common hedging strategies include options, futures, and volatility-based exchange-traded products (ETPs).

Hedging Strategies:

- Options: Institutional investors may use options contracts to protect against downside risk. For instance, purchasing put options allows them to profit from a decline in asset prices, mitigating the impact of volatility.

- Futures Contracts: Futures are used to lock in prices for assets, such as commodities or indices, allowing investors to hedge against future volatility in these markets.

- Volatility Funds: Some institutional investors allocate capital to volatility-focused ETFs or mutual funds, which track indices like the VIX and help protect portfolios during periods of extreme market fluctuation.

Hedging strategies are not foolproof and can incur costs, but they provide essential tools for managing volatility exposure.

3. Impact on Investment Horizons and Liquidity Management

Volatility can also influence the investment horizon of institutional investors. While some funds may have long-term investment goals, volatility can prompt short-term adjustments to asset allocation, especially when markets become unpredictable.

Short-Term Adjustments:

- Market Timing: In highly volatile markets, institutional investors may attempt to time the market to take advantage of price swings. However, this approach is often challenging and requires sophisticated models to predict market movements accurately.

- Liquidity Needs: High volatility may trigger a surge in investor redemptions, especially for mutual funds and pension funds that are subject to withdrawals. To manage liquidity, institutional investors may liquidate some of their holdings during periods of market stress to meet redemption requests.

4. Asset Pricing and Volatility Forecasting

Asset pricing is significantly influenced by volatility. Institutional investors rely on volatility forecasting models to price options, assess asset risks, and predict future returns. These models use historical price data, market sentiment, and macroeconomic indicators to forecast expected volatility.

Volatility Forecasting Techniques:

- GARCH Models (Generalized Autoregressive Conditional Heteroskedasticity): GARCH models are commonly used to predict volatility by analyzing past asset returns and the conditional variance of these returns.

- Implied Volatility Models: Implied volatility, derived from option prices, helps institutional investors anticipate market expectations and adjust their strategies accordingly.

Accurate volatility forecasting allows institutional investors to make data-driven decisions and adjust their portfolios in anticipation of market changes.

Strategies for Institutional Investors to Manage Volatility

Institutional investors employ several strategies to cope with volatility while maximizing returns. Here are some of the most commonly used approaches:

1. Dynamic Hedging

Dynamic hedging involves continuously adjusting hedge positions in response to changes in market conditions. Institutional investors use this strategy to maintain a balance between risk and return as volatility fluctuates.

Key Components of Dynamic Hedging:

- Regular Rebalancing: Adjusting hedge positions frequently to ensure that the portfolio remains within acceptable risk levels.

- Real-Time Risk Monitoring: Using advanced risk analytics tools to track volatility and market movements in real time, ensuring quick responses to sudden market shifts.

Dynamic hedging requires sophisticated risk management systems and constant monitoring of market conditions, making it suitable for large institutional investors.

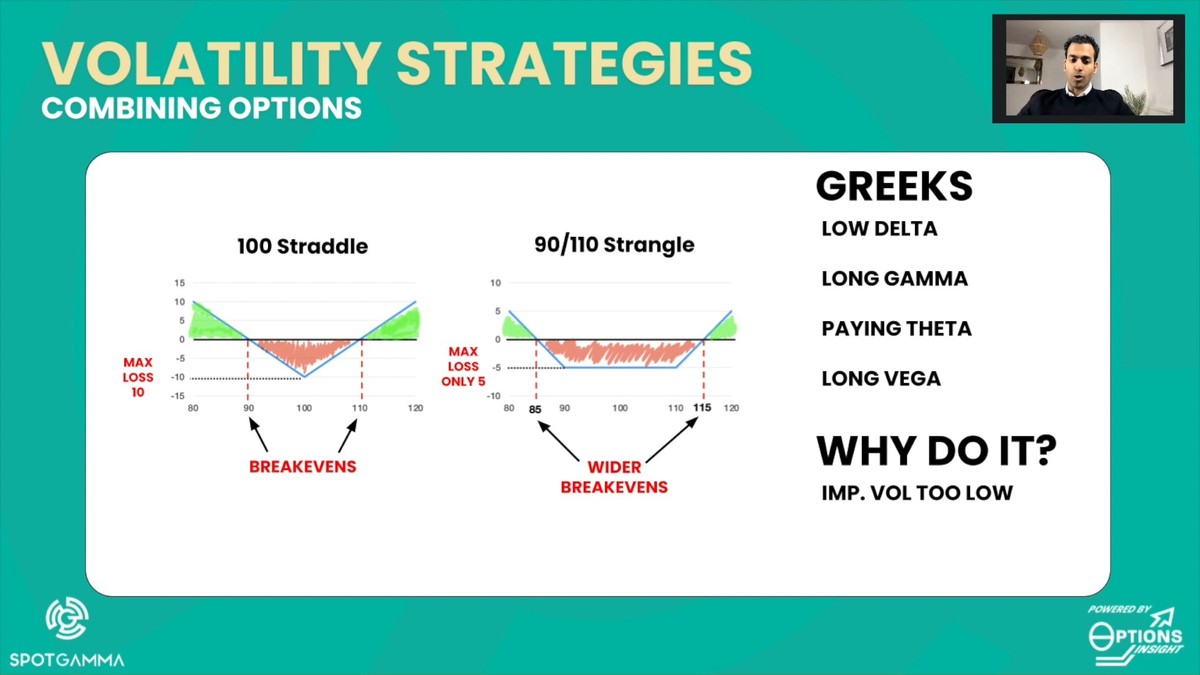

2. Volatility Arbitrage

Volatility arbitrage is a strategy that capitalizes on differences between implied volatility and realized volatility. Institutional investors engage in volatility arbitrage by purchasing or selling options based on mispricing in the market, thus exploiting volatility inefficiencies.

How Volatility Arbitrage Works:

- Implied vs. Realized Volatility: When implied volatility is higher than realized volatility, investors may sell options, expecting that volatility will decrease. Conversely, if implied volatility is lower than realized volatility, they may purchase options to profit from the increase in volatility.

This strategy can be highly profitable in volatile markets but requires precise timing and access to sophisticated quantitative models.

3. Tail Risk Hedging

Tail risk refers to the risk of extreme market events, such as financial crashes or black swan events. Institutional investors can mitigate tail risk by using specialized hedging instruments that protect against rare but catastrophic events.

Tail Risk Hedge Instruments:

- Put Options: Buying deep out-of-the-money put options provides protection against large declines in asset prices, particularly during market downturns.

- Credit Default Swaps (CDS): CDS can be used to hedge against the risk of default by counterparties, especially in volatile credit markets.

Tail risk hedging is particularly useful for institutional investors managing large portfolios and aiming to protect capital during market crises.

FAQ: Common Questions on Volatility and Institutional Investors

Q1: How does volatility affect long-term investment strategies?

Answer: While long-term investors are less impacted by short-term volatility, extreme volatility can still affect their asset pricing and lead to larger-than-expected drawdowns. Institutional investors may need to adjust their asset allocation to reduce exposure to volatile assets during turbulent periods.

Q2: What tools can institutional investors use to predict volatility?

Answer: Tools such as GARCH models, implied volatility data, and volatility forecasting techniques based on market sentiment and macroeconomic factors can help institutional investors predict future volatility and adjust their strategies accordingly.

Q3: How can institutional investors manage liquidity during volatile periods?

Answer: Institutional investors can manage liquidity by maintaining a cash buffer, using derivative instruments to hedge positions, and implementing dynamic risk management techniques that allow for quick adjustments to portfolio allocations in response to market movements.

Conclusion

Volatility is an inherent feature of financial markets, and its impact on institutional investors’ strategies is profound. By employing sophisticated risk management techniques, diversifying assets, and using volatility-based hedging tools, institutional investors can navigate volatile markets while striving to meet their long-term objectives. As market conditions evolve, understanding and managing volatility will continue to be a cornerstone of institutional investment strategies.