============================================================================

In the rapidly evolving world of cryptocurrency and perpetual futures trading, institutional investors frequently leverage advanced strategies to manage market impact and optimize their positions. One such critical tactic is the use of sell walls—large pending sell orders that can influence market price behavior. Understanding how institutional investors utilize sell walls provides essential insights for traders, analysts, and market enthusiasts looking to navigate high-volume trading environments effectively. This article explores methodologies, practical applications, and strategic considerations for leveraging sell walls in institutional trading.

Understanding Sell Walls in Cryptocurrency Markets

What Is a Sell Wall?

A sell wall is a significant limit order or a series of orders placed at a specific price level intended to prevent an asset’s price from rising above that level. In perpetual futures and spot markets, sell walls can act as a psychological and technical barrier, influencing market participants’ behavior.

Key Points:

- Represents substantial liquidity at a price point.

- Can indicate resistance levels or institutional positioning.

- Often used as part of strategic execution to manage large trades without drastically moving the market.

Why Sell Walls Matter for Institutional Investors

Institutional investors handle large capital and must carefully manage market impact. Sell walls provide a mechanism to:

- Control execution timing: Avoid slippage from large market orders.

- Signal market depth: Offer insight into support/resistance for trade planning.

- Manage risk: Mitigate the potential of sudden price spikes during liquidation or accumulation.

Core Methods for Utilizing Sell Walls

1. Strategic Placement of Sell Walls

Institutional investors often place sell walls tactically to influence market perception and manage their own exposure. This includes:

Techniques:

- Layered Orders: Placing multiple smaller sell orders at incremental price levels to create a perceived wall without revealing full exposure.

- Dynamic Adjustment: Continuously modifying order size and price in response to market flow to maintain optimal positioning.

Advantages:

- Reduces the risk of market slippage.

- Provides flexibility in managing large orders discreetly.

Limitations:

- Requires sophisticated monitoring tools.

- Potential to signal intentions to observant market participants.

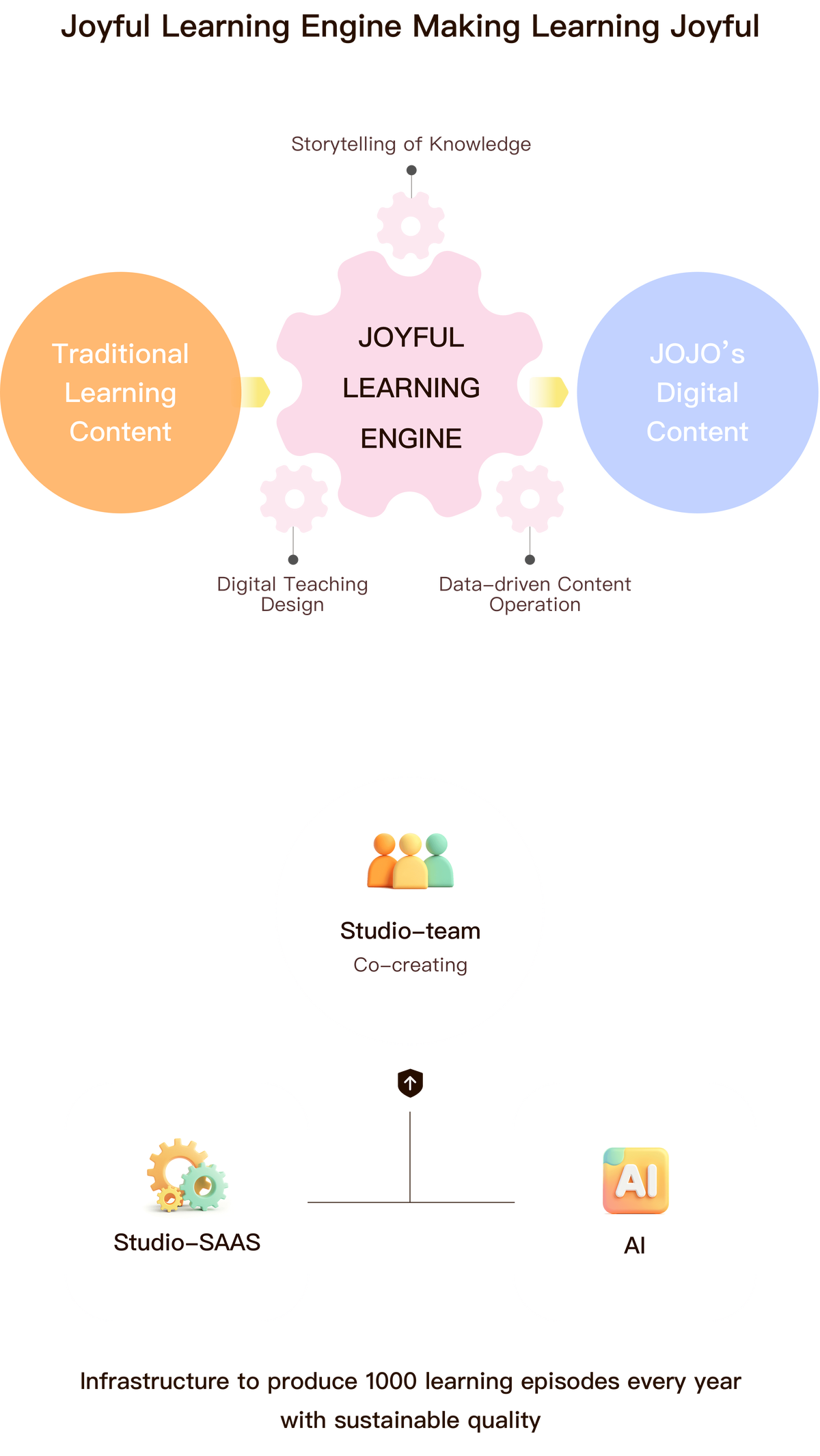

Visualization of layered sell wall orders influencing market resistance.

2. Passive Market Impact Mitigation

Another method involves using sell walls to passively influence market activity, effectively guiding price movement without aggressive intervention.

Approaches:

- Liquidity Buffering: Setting sell walls to absorb short-term buying pressure and prevent rapid price spikes.

- Price Consolidation: Encouraging stabilization around key technical levels by strategically positioning sell orders.

Advantages:

- Maintains market stability and reduces volatility risk.

- Supports orderly execution of large institutional trades.

Disadvantages:

- Requires real-time market analytics to ensure wall efficacy.

- May not prevent aggressive retail traders from triggering price movements.

Tools and Analytics for Sell Wall Strategies

How to Identify a Sell Wall in Perpetual Futures

Institutional investors use specialized analytics platforms to detect and monitor sell walls effectively. Key functionalities include:

- Order Book Visualization: Real-time heatmaps displaying volume clusters at specific price levels.

- Market Depth Metrics: Quantitative measurements of liquidity concentration.

- Historical Analysis: Examining past sell wall behavior to anticipate market reactions.

Sell Wall Analysis Tools for Quantitative Analysts

Quantitative tools can assist in modeling sell wall impacts on trading strategies:

- Order Flow Algorithms: Analyze large order movements and their potential effect on price.

- Backtesting Platforms: Test hypothetical wall placements against historical price action.

- Alert Systems: Notify traders when sell wall dynamics are shifting significantly.

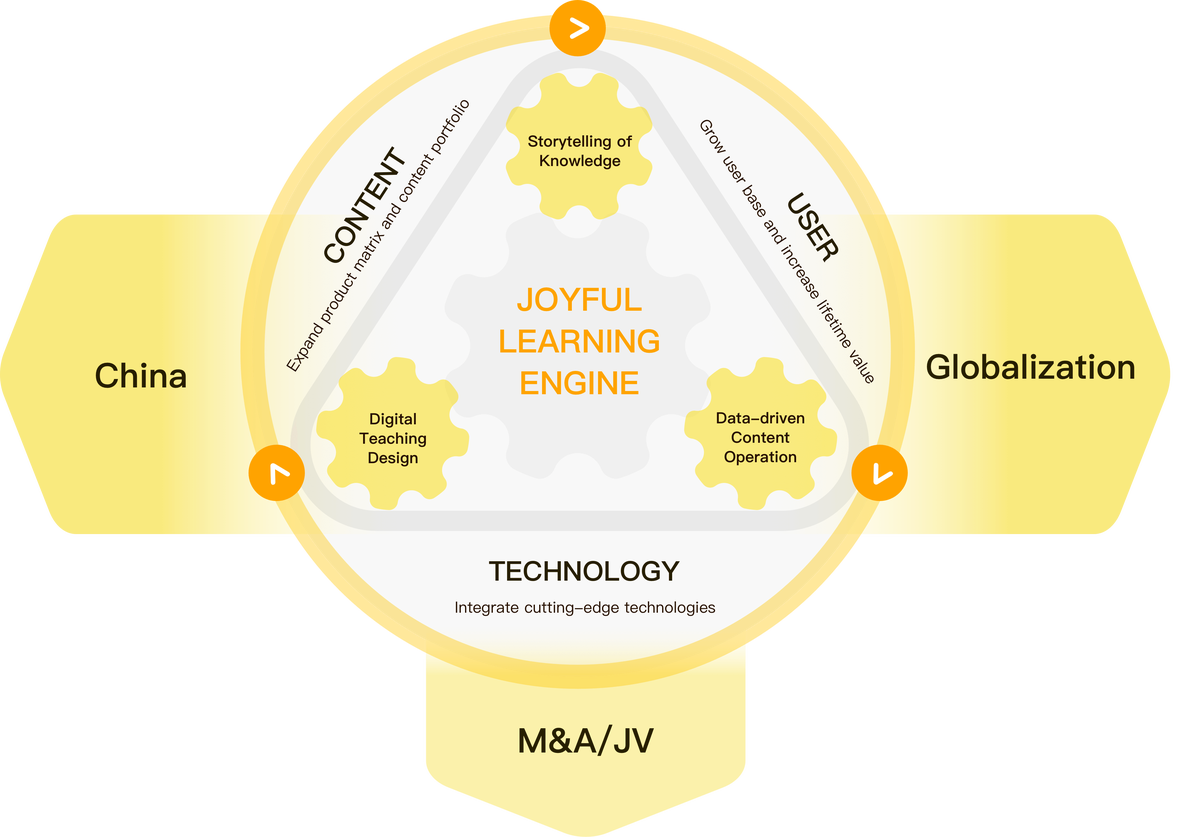

Example of order book heatmap showing large sell walls influencing price levels.

Comparative Analysis of Sell Wall Strategies

| Strategy | Advantages | Limitations |

|---|---|---|

| Layered Sell Walls | Reduces market slippage, discreet execution | Requires monitoring, can signal intentions |

| Passive Impact Mitigation | Stabilizes market, protects large trades | Dependent on real-time data, may not prevent aggressive moves |

Recommendation: Combining both tactical placement and passive mitigation provides optimal control, allowing institutional investors to execute trades efficiently while minimizing market disruption.

Advanced Applications for Institutional Traders

Hedging and Risk Management

Sell walls serve as a hedging tool against short-term market volatility. By setting strategic resistance points, investors can protect portfolios against adverse price swings and maintain execution efficiency.

Portfolio Optimization

Sell walls can be integrated into portfolio strategies to balance liquidity needs with market exposure, ensuring that large positions are gradually realized without creating unintended market impact.

Predictive Insights

Analyzing patterns of sell wall behavior can help anticipate market sentiment and identify potential breakout or reversal scenarios, providing a tactical edge for professional trading desks.

Practical Tips for Institutional Investors

- Continuous Monitoring: Track market depth and liquidity trends to adjust sell walls dynamically.

- Data Integration: Incorporate order book analytics, trade history, and sentiment data for holistic analysis.

- Discretion: Avoid overexposing institutional intentions by layering orders subtly.

- Testing: Backtest different wall placements to evaluate potential market impact.

- Automation: Utilize algorithmic systems to place, adjust, and remove walls efficiently.

FAQ: Sell Wall Methodologies

1. How long do sell walls typically last in perpetual futures?

Sell walls may persist for minutes to hours depending on market activity and institutional strategy. Monitoring real-time order book data is essential for assessing wall durability.

2. How do sell walls affect retail traders?

Large sell walls can create psychological resistance, discouraging retail traders from aggressive buying. This can stabilize price temporarily, but sudden removals can trigger rapid price adjustments.

3. What tools help analyze sell wall impact?

Order book visualization software, market depth indicators, and algorithmic backtesting platforms are commonly used by institutional and quantitative analysts to assess sell wall effectiveness.

Conclusion

Sell walls are a sophisticated instrument used by institutional investors to manage market impact, optimize execution, and enhance risk management. By combining strategic placement and passive impact mitigation, investors can achieve precise control over large trades while maintaining market stability. Mastering sell wall methodologies is essential for professional traders and analysts seeking an edge in cryptocurrency and perpetual futures markets.

Encourage engagement: share your experiences with sell wall strategies in the comments below, and forward this guide to colleagues or fellow traders to improve collective market understanding.

Illustration of institutional sell wall strategy, showing layered orders, market monitoring, and execution optimization.