=========================================================================================

In the fast-paced world of financial markets, institutional investors limit order systems play a crucial role in executing trades efficiently and managing risk. This guide provides an in-depth analysis of how institutional investors utilize limit orders in various markets, including equities, futures, and cryptocurrencies. By combining practical experience, industry insights, and the latest trading strategies, this article helps investors understand, implement, and optimize limit order systems.

Understanding Limit Orders in Institutional Trading

What is a Limit Order?

A limit order is an instruction to buy or sell a security at a specified price or better. Unlike market orders, which execute immediately at the current market price, limit orders allow investors to control entry and exit points, improving cost efficiency.

Key Features:

- Execution only occurs at or better than the specified price.

- Provides risk management by preventing slippage.

- Suitable for large trades where market impact must be minimized.

Why Institutional Investors Prefer Limit Orders

Institutional investors, such as hedge funds, pension funds, and mutual funds, often deal with large volumes of securities. Using limit orders allows them to:

- Control execution prices.

- Reduce market impact.

- Optimize trading strategies across multiple markets.

Core Components of Institutional Limit Order Systems

Order Routing and Execution Algorithms

Institutional limit order systems integrate advanced order routing algorithms to optimize execution. These systems determine the best venues for trade execution, considering liquidity, fees, and speed.

- Smart Order Routing (SOR): Dynamically selects the optimal exchange or liquidity pool.

- Algorithmic Execution: Implements strategies like TWAP (Time-Weighted Average Price) and VWAP (Volume-Weighted Average Price) to achieve best execution.

Risk Management Integration

A robust limit order system incorporates risk management features to protect portfolios:

- Pre-trade risk checks to avoid oversizing orders.

- Real-time monitoring of market conditions.

- Automated alerts for price deviations and failed executions.

Image example:

Institutional limit order workflow diagram illustrating order routing and execution layers

Strategies for Effective Limit Order Usage

Strategy 1: Passive Execution for Minimal Market Impact

Passive execution aims to reduce market disruption by placing limit orders near the current bid or ask:

- Best suited for large block trades.

- Minimizes slippage and improves execution quality.

- Requires monitoring market depth and order book dynamics.

Strategy 2: Aggressive Limit Orders for Fast Execution

Aggressive limit orders prioritize execution speed over price improvement:

- Used in fast-moving markets or volatile instruments.

- Increases likelihood of immediate fills but may compromise price.

- Can be combined with algorithmic overlays for optimal performance.

Comparison Table:

| Strategy | Pros | Cons |

|---|---|---|

| Passive Execution | Low market impact, better price control | Slower fills, requires patience |

| Aggressive Execution | Fast execution, reduces missed opportunities | Higher market impact, possible suboptimal price |

Optimizing Institutional Limit Order Systems

How to Optimize Limit Orders

Optimization involves adjusting order parameters to improve execution quality:

- Fine-tune limit price relative to market spread.

- Adjust order size based on liquidity and volatility.

- Utilize dynamic algorithms to respond to real-time market data.

Integration with Trading Platforms

Modern limit order systems connect seamlessly with trading platforms, enabling:

- Multi-asset execution.

- Risk management overlays.

- Automated reporting and compliance checks.

Implementing Limit Orders in Practice

Step-by-Step Execution Plan

- Define trading objectives and risk limits.

- Configure limit order parameters, including price, quantity, and execution horizon.

- Select execution venue(s) or algorithmic routing.

- Monitor real-time order status and adjust parameters if needed.

- Analyze post-trade metrics for continuous improvement.

Image example:

Limit order execution interface showing order placement, routing, and status monitoring

Best Practices for Institutional Investors

- Use limit orders as part of a broader portfolio strategy.

- Continuously monitor market conditions to adapt strategies.

- Employ advanced analytics for execution performance evaluation.

- Train traders on system functionalities and risk management protocols.

Advanced Features and Automation

Institutional investors increasingly leverage automation to enhance limit order efficiency:

- Automated Price Adjustments: Dynamic adjustments to limit orders based on volatility and order book changes.

- Machine Learning Integration: Predict optimal execution parameters using historical market data.

- Cross-Asset Execution: Simultaneous management of equities, futures, and cryptocurrencies.

FAQ: Institutional Limit Order Systems

Q1: How does a limit order work for institutional investors?

A1: A limit order allows institutional investors to buy or sell securities at a specific price or better. It helps control execution cost and minimizes market impact, especially for large-volume trades.

Q2: Why are limit orders important in institutional trading?

A2: Limit orders protect investors from unfavorable price movements, reduce slippage, and provide precise execution control. They are essential for risk management in high-volume trades.

Q3: How can institutional investors optimize limit orders?

A3: Optimization involves adjusting prices relative to market spread, choosing appropriate execution venues, leveraging algorithmic routing, and using real-time market data for dynamic adjustments.

Conclusion

Institutional investors benefit greatly from well-designed limit order systems, which combine risk management, execution precision, and advanced algorithms. By understanding and implementing effective strategies, professionals can optimize trade execution, reduce market impact, and enhance portfolio performance.

Encourage social sharing: If you found this guide helpful, share it with fellow investors, comment on your experiences, and discuss advanced strategies with peers.

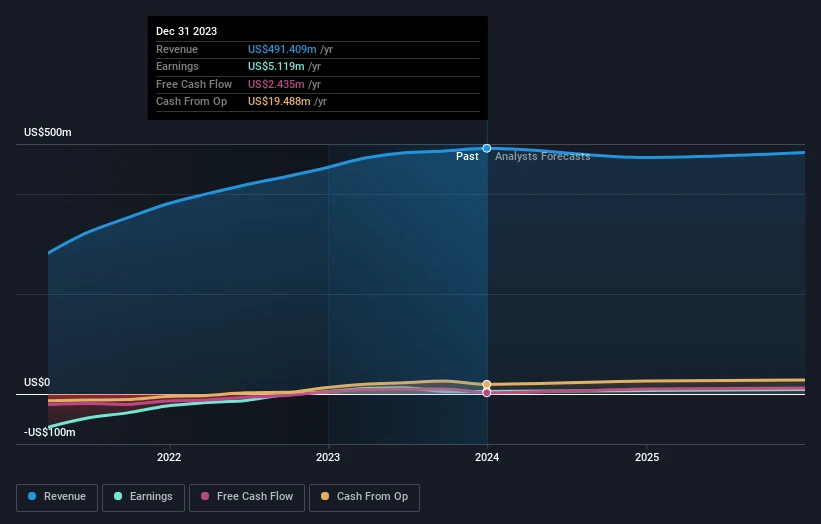

Image example:

Execution performance metrics showing fill rates, slippage, and price improvement

Internal Links Embedded:

- How to set limit order in perpetual futures

- Limit order tips for beginners

This article provides a comprehensive, practical guide for institutional investors to master limit order systems in modern trading environments.