Perpetual derivatives, particularly perpetual futures, have become a cornerstone for active crypto and traditional derivatives traders. While offering high leverage and continuous trading opportunities, these instruments carry significant risk. Understanding investor insights on loss in perpetual derivatives is essential for minimizing exposure, improving risk management, and enhancing overall trading performance.

This article explores the mechanisms behind losses, practical strategies for mitigating them, and key insights drawn from experienced investors.

Understanding Perpetual Derivatives

What Are Perpetual Futures?

Perpetual futures are derivative contracts without a set expiration date, allowing traders to hold positions indefinitely. Unlike traditional futures, these contracts rely on funding rates to anchor prices to spot markets.

Key Features

- Continuous trading without expiry

- High leverage options for amplified gains or losses

- Funding payments between long and short positions

Why Loss Occurs in Perpetual Futures

Losses in perpetual derivatives often stem from:

- Market volatility causing sudden adverse price movements

- Over-leveraging leading to liquidation

- Funding rate miscalculations

- Emotional trading and lack of strategic planning

Understanding why does loss occur in perpetual futures is fundamental for every trader to craft effective mitigation strategies.

Illustration of price fluctuations and funding impact in perpetual derivatives

Key Factors Contributing to Loss

Leverage and Margin

How Leverage Amplifies Loss

- Leverage magnifies both gains and losses.

- Small price changes can trigger significant margin calls.

Margin Management Strategies

- Setting conservative leverage limits

- Maintaining buffer capital to prevent forced liquidation

Market Volatility

- Sudden swings in crypto or equity markets can trigger large losses.

- Correlation with external market events amplifies risk.

Funding Rates

- Positive or negative funding impacts net profit/loss.

- Misalignment with market trends can erode gains quickly.

Strategies to Mitigate Loss

1. Risk Management and Stop-Loss Techniques

Implementation

- Use automatic stop-loss orders to limit downside

- Adjust positions dynamically according to market conditions

Pros and Cons

- Pros: Immediate risk containment, automated control

- Cons: May trigger prematurely in volatile markets

2. Position Sizing and Leverage Control

- Calculate optimal trade size relative to account balance

- Limit exposure per position to reduce catastrophic losses

Case Study

An experienced investor reduced leverage from 20x to 5x, cutting potential liquidation losses by over 75% during a volatile market week.

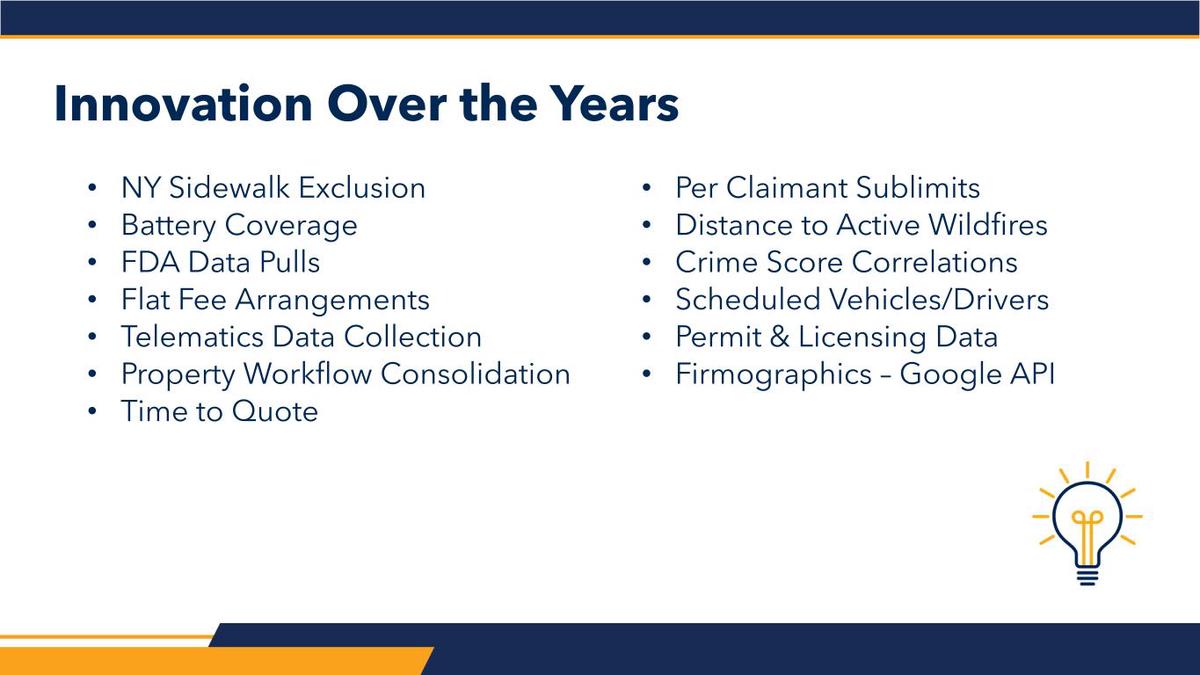

3. Diversification Across Perpetual Markets

- Spread positions across multiple contracts or assets

- Reduces concentration risk and exposure to single-market movements

Example of diversified positions in crypto perpetual contracts

4. Advanced Hedging Strategies

- Use correlated contracts to hedge downside risk

- Options or spot positions can offset potential losses in leveraged positions

These approaches are consistent with advanced strategies for loss control in futures employed by professional traders.

Insights from Experienced Investors

Behavioral Lessons

- Avoid overconfidence and emotional trading

- Document trading decisions to identify recurring mistakes

Quantitative Approaches

- Utilize backtesting and statistical models to anticipate potential losses

- Monitor historical volatility and funding trends

Institutional Insights

- Hedge funds employ strict risk metrics and loss thresholds

- Automated risk management tools help minimize exposure in real-time

Tools and Resources for Loss Management

- Automated stop-loss and margin alerts

- Loss mitigation dashboards and reporting software

- Analytical platforms for funding and volatility monitoring

Dashboard example for monitoring perpetual derivatives loss metrics

Common Mistakes Leading to Loss

Beginner Pitfalls

- Excessive leverage usage

- Ignoring funding rates

- Chasing positions during volatile swings

Intermediate Errors

- Poor risk allocation

- Failure to diversify

- Overtrading in highly correlated markets

Advanced Challenges

- Misinterpreting hedging strategies

- Overconfidence in automated systems without monitoring

FAQ – Investor Insights on Loss in Perpetual Derivatives

Q1: How can loss be avoided in perpetual contracts?

A1: Implement strict risk management, adjust leverage appropriately, diversify positions, and use stop-loss and hedging strategies to reduce exposure.

Q2: Where is loss most significant in perpetual futures?

A2: Losses tend to be highest during periods of extreme volatility, with highly leveraged positions, or in markets with misaligned funding rates.

Q3: What are beginner mistakes causing loss in perpetual futures?

A3: Common errors include excessive leverage, ignoring funding costs, emotional trading, and lack of stop-loss orders. Structured education and simulation can help prevent these mistakes.

Q4: How is loss calculated in perpetual futures?

A4: Loss is determined by the difference between entry price and exit price, multiplied by position size and adjusted for leverage, including funding rate costs.

Conclusion

Investors navigating perpetual derivatives must recognize the inherent risks of loss and adopt structured strategies to mitigate them. By leveraging investor insights on loss in perpetual derivatives, combining position sizing, stop-loss techniques, diversification, and advanced hedging, traders can protect capital while capitalizing on the opportunities these instruments offer.

Effective risk management, ongoing education, and disciplined execution remain the pillars of success in perpetual derivatives trading.