Introduction: Why Investor Insights Matter

Perpetual derivatives have rapidly become one of the most traded instruments in modern financial markets, particularly in the cryptocurrency sector. Unlike traditional futures, perpetual contracts have no expiry date, making them highly liquid but also highly volatile. This dual nature leads to both opportunities and risks, with losses being one of the most pressing concerns for investors. Understanding investor insights on loss in perpetual derivatives is not only a way to enhance decision-making but also a key to developing sustainable strategies in this complex market.

In this article, we will analyze common causes of loss, compare different strategies investors use to mitigate risk, and provide practical recommendations backed by industry trends and personal trading experience. We will also embed real-world investor perspectives, data analysis, and frequently asked questions to ensure a complete guide for both novice and experienced market participants.

Understanding Loss in Perpetual Derivatives

What Are Perpetual Derivatives?

Perpetual derivatives are contracts that track the price of an underlying asset, most often cryptocurrencies like Bitcoin or Ethereum. Unlike standard futures, these contracts do not expire, which means traders can hold them indefinitely. Their pricing mechanism relies heavily on a funding rate system, which ensures that contract prices align with spot market values.

Why Losses Occur in Perpetual Contracts

Losses can occur due to a variety of factors:

- High Leverage: Amplifies both profits and losses, often wiping out positions in a short time.

- Funding Rate Mismanagement: Investors holding positions during unfavorable funding rates can see costs accumulate over time.

- Market Volatility: Sudden price swings in cryptocurrencies create unavoidable liquidation risks.

- Psychological Factors: Overconfidence, panic selling, and lack of discipline often magnify losses.

A useful related resource is: why does loss occur in perpetual futures, which breaks down these loss mechanisms in further detail.

Key Investor Insights: Lessons from Experience

Insight 1: Overleveraging Is the Most Common Mistake

Based on my personal experience and countless case studies, new traders often chase quick profits using leverage as high as 50x or even 100x. While such leverage can produce extraordinary gains, it also leads to immediate liquidation if the market moves slightly against the position. Seasoned investors stress the importance of moderate leverage (2x–5x), combined with strict stop-loss placement.

Insight 2: Funding Rate Arbitrage Can Backfire

Some investors attempt to exploit funding rate discrepancies between exchanges. While this is a sophisticated strategy, it carries its own risks. If market sentiment shifts suddenly, positions held for arbitrage can quickly turn into loss-making trades.

Insight 3: Risk Diversification Is Critical

Relying solely on perpetual derivatives without balancing exposure in spot markets, options, or hedging instruments often results in outsized losses. Professional investors recommend spreading exposure across different instruments to cushion against unexpected volatility.

Comparing Two Popular Strategies to Manage Loss

Strategy 1: Stop-Loss and Position Sizing

- How It Works: Traders set predefined price points at which their positions will close automatically, minimizing the risk of catastrophic loss. Position sizing ensures no single trade consumes more than a set percentage of portfolio capital.

- Advantages: Protects against major liquidation events, enforces trading discipline.

- Disadvantages: Can trigger prematurely during high volatility, leading to missed profit opportunities.

Strategy 2: Hedging with Options or Spot Positions

- How It Works: Investors take opposite positions in correlated markets (e.g., holding Bitcoin while shorting perpetual contracts). This cushions exposure and reduces net risk.

- Advantages: Provides a natural insurance against volatility, reduces emotional stress.

- Disadvantages: Hedging reduces net returns and requires deeper capital reserves.

For more tactical approaches, consider reading how to minimize loss in perpetual futures, which outlines actionable steps investors can apply immediately.

Industry Trends Affecting Loss Management

Institutional Adoption of Risk Tools

Hedge funds and proprietary trading firms are increasingly using advanced algorithmic strategies to manage exposure. These strategies rely on real-time risk metrics and automated liquidation protection, which retail traders often lack.

Emergence of AI-Powered Trading Platforms

Machine learning models now assist in predicting volatility clusters and funding rate fluctuations. These predictive insights help investors enter and exit markets with higher confidence, reducing loss potential.

Regulation and Market Maturity

As regulatory clarity improves, exchanges are expected to implement stricter margin and liquidation rules, potentially lowering systemic risks for investors.

Case Study: Learning from a $10,000 Loss

A retail investor entered a long Bitcoin perpetual position with 50x leverage, believing market sentiment was bullish. Within hours, a sudden 2% dip caused liquidation, wiping out the $10,000 position. The investor later reflected that using smaller leverage and strict stop-loss placement would have preserved capital. This case emphasizes the critical importance of discipline and risk control over market speculation.

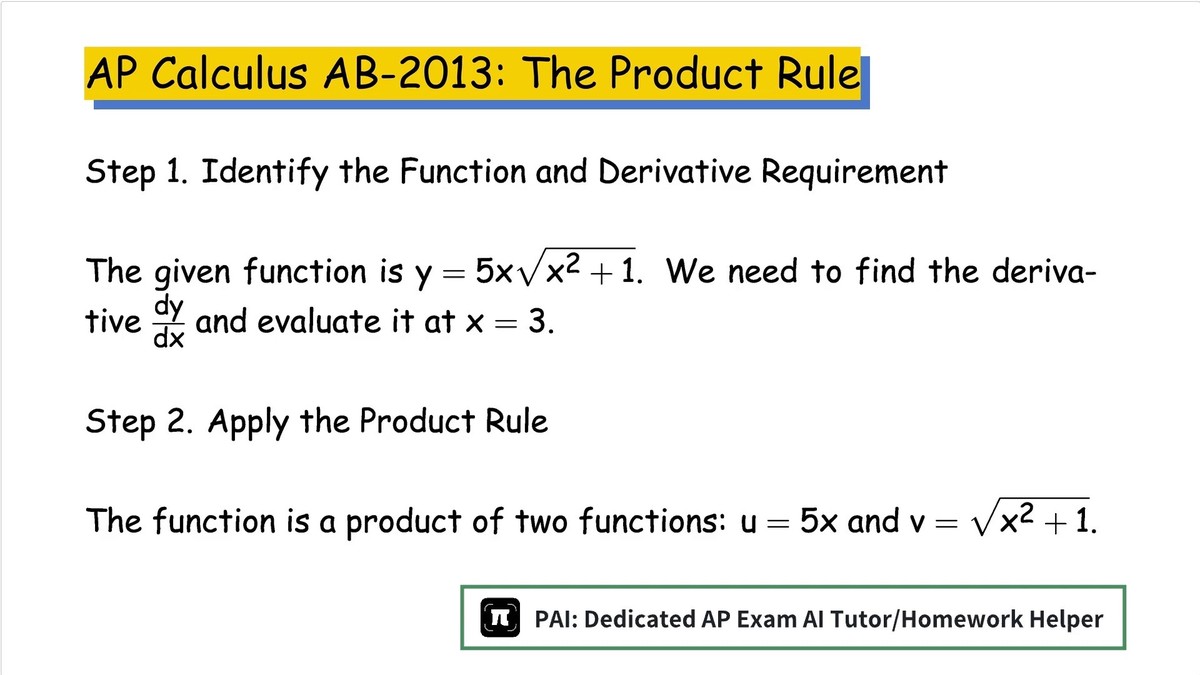

Visual Breakdown of Risk Management

Factors influencing investor losses in perpetual derivatives.

FAQ: Common Questions About Loss in Perpetual Derivatives

1. How can small retail investors protect themselves from major losses?

Start with low leverage, use stop-losses, and allocate only a small portion of your portfolio to perpetual derivatives. Retail traders should also avoid trading during highly volatile news events.

2. Why do professional traders lose less than beginners?

Professionals follow strict rules, use advanced analytical tools, and diversify their exposure. Beginners often overtrade, lack discipline, and fail to account for funding rate costs.

3. What’s the best strategy to recover from a significant loss?

Avoid revenge trading. Instead, analyze the cause of the loss, revise your trading plan, and re-enter the market with smaller position sizes. Documenting each trade in a journal can also prevent repeating mistakes.

Conclusion: Turning Insights into Action

The most valuable investor insights on loss in perpetual derivatives highlight the importance of discipline, risk management, and diversification. While perpetual contracts offer unique opportunities, they demand heightened awareness of funding rates, leverage, and market volatility.

By combining practical tools such as stop-loss strategies with hedging and institutional-level insights, traders can significantly reduce losses while maintaining profit potential.

Visual representation of layered strategies to manage risk in perpetual trading.

Final Thoughts: Share Your Experience

What strategies have you used to manage loss in perpetual derivatives? Share your experiences in the comments below and spread this article with fellow traders to enhance collective learning.

If you found value here, don’t forget to share this guide on social platforms to help more investors build stronger strategies.