Navigating leveraged trading can be daunting for risk-averse investors. While leverage amplifies potential returns, it also increases exposure to losses. Isolated margin—a risk management feature in futures and perpetual trading—offers a way to control losses and protect capital. This comprehensive guide explores isolated margin strategies, comparing approaches, evaluating benefits, and providing actionable advice for investors seeking controlled risk exposure.

Understanding Isolated Margin

What Is Isolated Margin?

Isolated margin is a type of margin allocation where only a specific portion of capital is used to support a trade. Unlike cross margin, which links all account funds to positions, isolated margin confines risk to the allocated margin.

- Controlled Exposure: Losses are limited to the isolated margin allocation.

- Flexibility: Traders can adjust margin per position without affecting the rest of the account.

- Risk Management: Prevents liquidation of unrelated positions during adverse market movements.

Internal Link Reference: Learning how to use isolated margin in perpetual futures is essential for understanding practical application and capital protection.

How Isolated Margin Works

- Allocate Margin Per Position: Only the assigned funds are at risk.

- Adjust Leverage: Traders can choose high or low leverage based on confidence and market conditions.

- Liquidation Management: If the position moves against the trader, only the isolated margin is lost, protecting other positions.

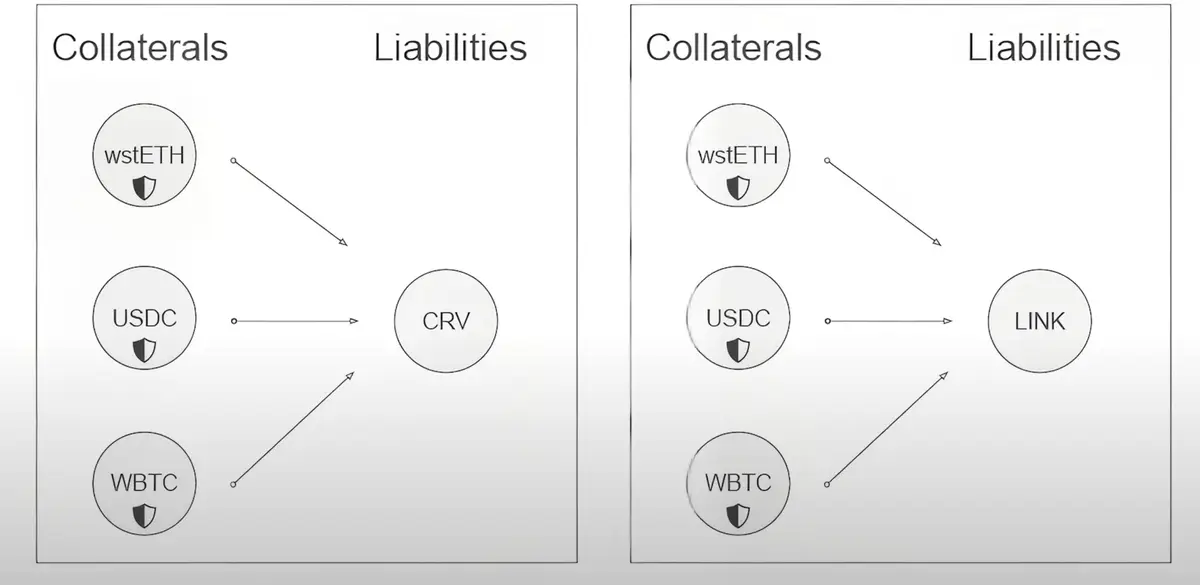

Comparison between isolated margin and cross margin highlighting risk containment

Strategies for Risk-Averse Investors

1. Conservative Leverage Allocation

Concept

Limiting leverage while using isolated margin minimizes the risk of substantial losses. A typical approach includes:

- Using 2x to 5x leverage per position.

- Allocating only a small fraction (5–10%) of total capital per trade.

- Continuously monitoring market volatility indicators.

Advantages

- Reduces likelihood of margin calls.

- Maintains liquidity for additional trades or hedges.

- Ideal for long-term, risk-conscious investors.

Limitations

- Lower leverage can limit potential returns.

- Requires careful position sizing to remain profitable in low-volatility markets.

2. Strategic Hedging with Isolated Margin

Concept

Hedging involves offsetting positions to reduce overall portfolio risk. Using isolated margin enhances hedging efficiency by segregating risk per hedge.

- Step 1: Open a core position in a primary asset.

- Step 2: Hedge with an inverse or correlated asset using isolated margin.

- Step 3: Adjust margin allocation as market conditions shift.

Advantages

- Mitigates losses without jeopardizing other trades.

- Enables simultaneous experimentation with multiple strategies.

Limitations

- Hedging costs and funding fees can reduce net gains.

- Requires advanced knowledge of market correlations.

Internal Link Reference: Understanding how to manage risks with isolated margin ensures these strategies remain effective for risk-averse profiles.

Practical Tips for Using Isolated Margin

Setting Margin Limits

- Determine maximum exposure per trade.

- Avoid allocating excessive funds to a single position.

- Monitor margin utilization in real-time dashboards.

Regular Portfolio Reviews

- Track position performance and adjust isolated margin as necessary.

- Reallocate margin from underperforming trades to higher-probability setups.

Leverage Adjustment Based on Market Volatility

- Increase isolated margin during low-volatility periods to capitalize on trends.

- Reduce exposure when volatility spikes to limit potential losses.

Step-by-step workflow for risk-averse investors managing isolated margin positions

Advanced Isolated Margin Techniques

Partial Liquidation Strategy

- Set stop-loss orders at strategic levels to trigger partial liquidation rather than full position closure.

- Preserves remaining margin while limiting losses.

Diversified Asset Allocation

- Allocate isolated margin across uncorrelated assets.

- Helps reduce portfolio-wide risk without impacting other positions.

Monitoring Funding Rates

- For perpetual futures, funding payments affect profitability.

- Positive or negative rates may require margin adjustment to maintain optimal exposure.

Comparing Strategies: Conservative Leverage vs Hedging

| Strategy | Advantages | Disadvantages | Best Use Case |

|---|---|---|---|

| Conservative Leverage | Reduces risk, simple implementation | Lower potential gains | Risk-averse investors focusing on steady returns |

| Hedging with Isolated Margin | Protects positions, allows experimentation | Higher costs, complexity | Experienced traders managing multi-asset portfolios |

Recommendation: For most risk-averse investors, combining conservative leverage with isolated-margin hedging provides optimal risk-adjusted performance while maintaining capital protection.

Platforms and Tools

Recommended Platforms

- Binance Futures: Offers robust isolated margin controls and risk monitoring.

- Bybit: User-friendly interface with flexible margin allocation per trade.

- FTX Derivatives: Advanced charting and automated risk management tools.

Analytical Tools

- Position Trackers: Monitor margin allocation and exposure.

- Volatility Indicators: Guide leverage adjustment.

- Margin Calculators: Estimate isolated margin requirements per trade.

FAQs: Isolated Margin for Risk-Averse Investors

Q1: How does isolated margin protect my account?

A1: Isolated margin confines potential losses to the allocated funds per position, preventing liquidation of unrelated trades and safeguarding overall account capital.

Q2: Can beginners use isolated margin effectively?

A2: Yes. Beginners can start with small allocations and low leverage, gradually increasing exposure as they gain experience and confidence in managing trades.

Q3: What is the difference between isolated and cross margin?

A3: Cross margin shares all account funds across positions, risking the entire account if one position liquidates. Isolated margin limits risk to the specific trade, ideal for risk-averse investors.

Q4: How should I adjust isolated margin during high volatility?

A4: Reduce margin allocation and leverage to limit potential losses, while keeping enough capital to participate in profitable opportunities when volatility subsides.

Conclusion

Isolated margin offers a powerful tool for risk-averse investors seeking controlled exposure in leveraged trading. By combining conservative leverage, strategic hedging, and advanced risk management techniques, investors can protect capital, optimize returns, and navigate volatile markets with confidence. Regular monitoring, margin adjustment, and diversification are key to long-term success.

Engage with peers, share your isolated margin strategies, and contribute to trading communities to refine techniques and ensure sustainable, low-risk performance.