===================================================

Introduction

In the fast-paced world of perpetual futures trading, understanding market depth is crucial for informed decision-making and effective risk management. Market depth provides a real-time snapshot of buy and sell orders, revealing liquidity, potential price movements, and trading opportunities. This guide will explore how to understand market depth in perpetual futures, discuss practical strategies, and compare different approaches to maximize trading efficiency.

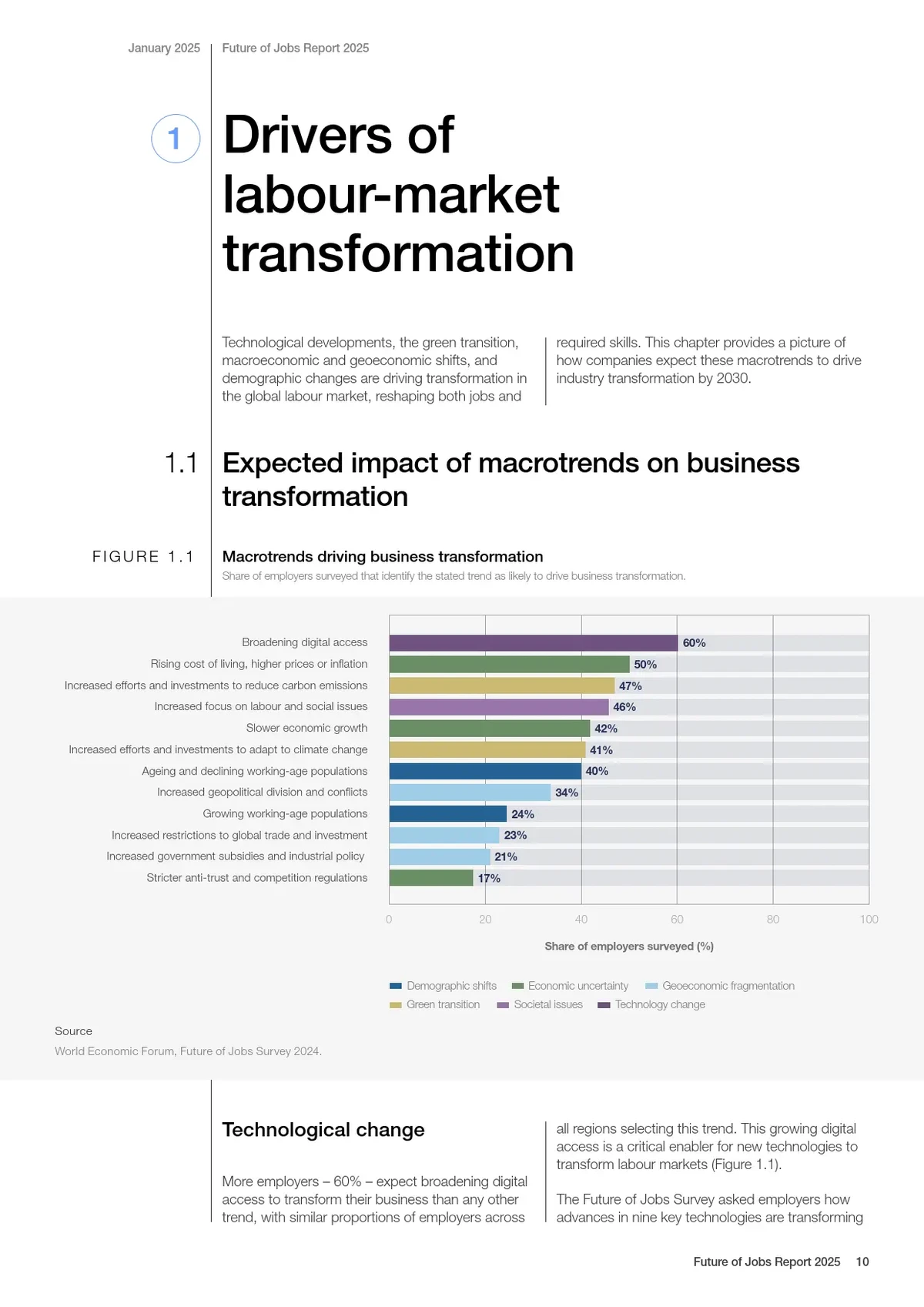

What is Market Depth?

Definition and Importance

Market depth, also known as the order book, refers to the list of buy and sell orders at various price levels for a given asset. It shows the volume of orders waiting to be executed and provides insight into supply and demand dynamics.

Key Features:

- Displays bid and ask prices with respective quantities.

- Highlights liquidity levels for each price point.

- Enables traders to anticipate potential price support and resistance.

Understanding market depth is essential because it allows traders to:

- Gauge market sentiment in real-time.

- Identify price levels with high liquidity that may prevent slippage.

- Strategically enter or exit positions based on supply-demand dynamics.

Market depth visualization showing bid and ask levels in perpetual futures

Methods to Analyze Market Depth

Method 1: Visual Order Book Analysis

Overview

Visual order book analysis involves examining the live order book on trading platforms. Traders can observe large buy or sell walls, which may indicate strong support or resistance.

Advantages:

- Immediate insight into liquidity and market pressure.

- Useful for identifying potential breakout or reversal points.

Limitations:

- Requires constant monitoring in volatile markets.

- Can be misleading due to hidden orders or spoofing.

Best Practices

- Focus on cumulative volume at each price level.

- Compare order book depth across multiple exchanges to detect discrepancies.

- Combine with price charts for contextual analysis.

Example of a perpetual futures order book showing bid and ask concentrations

Method 2: Market Depth Indicators

Overview

Technical tools and indicators can help quantify market depth for algorithmic or manual trading. Popular indicators include:

- Depth Ratio: Compares total buy vs. sell volume.

- Liquidity Heatmaps: Visualize clusters of orders across price levels.

- Order Flow Analysis: Tracks execution of orders to detect trends.

Advantages:

- Provides quantitative metrics for better decision-making.

- Reduces reliance on subjective visual interpretation.

Limitations:

- Requires experience to interpret accurately.

- Indicators may lag in extremely volatile conditions.

Integration Example

Traders can combine market depth indicators with perpetual futures strategies, such as momentum or mean reversion, to optimize trade entries and exits.

Visualization of depth ratio and liquidity heatmap for perpetual futures

Practical Strategies for Using Market Depth

Strategy 1: Identifying Support and Resistance Levels

Market depth helps traders identify price levels with significant buy or sell orders, which often act as support or resistance:

- Support: Large buy walls preventing further price decline.

- Resistance: Large sell walls capping upward movement.

Implementation Tips:

- Place limit orders near strong support to reduce risk.

- Use stop-loss slightly below buy walls for added protection.

Strategy 2: Detecting Market Manipulation

Market depth can reveal spoofing or temporary order imbalances:

- Spoofing: Large fake orders intended to move the market.

- Liquidity shifts: Sudden disappearance of large orders may indicate potential volatility.

Mitigation Techniques:

- Avoid relying solely on order book visuals; use confirmed price action.

- Cross-check depth across multiple exchanges for consistency.

Example of analyzing support, resistance, and potential spoofing in market depth

Advanced Market Depth Techniques

Using Market Depth for Algorithmic Trading

Professional traders leverage real-time depth data to inform trading algorithms:

- Order flow algorithms: Execute trades based on changes in market depth.

- Liquidity detection: Avoid slippage by analyzing available volumes before placing large orders.

Benefits:

- Enhances execution precision.

- Reduces market impact for high-volume trades.

Combining Market Depth with Technical Analysis

Integrating depth analysis with indicators such as VWAP, moving averages, and RSI provides a more robust trading approach. This combination improves:

- Timing of entries and exits.

- Risk-adjusted position sizing.

- Detection of trend reversals in perpetual futures markets.

Tools and Platforms

Where to Access Market Depth Charts for Perpetual Futures

Popular exchanges and tools provide depth data:

- Binance Futures: Real-time order book and depth charts.

- Bybit: Visual heatmaps and order book snapshots.

- TradingView: Integrates market depth indicators with charts.

Software Solutions for Real-Time Market Depth

- Depth Monitoring Tools: Provide alerts for sudden liquidity changes.

- API Access: Enables integration of depth data into automated strategies.

- Advanced Analytics Platforms: Offer historical order book analysis and trend predictions.

Comparative Analysis of Strategies

| Method | Advantages | Limitations | Best Use Case |

|---|---|---|---|

| Visual Order Book | Immediate insight; easy to interpret | Can be misleading; needs constant monitoring | Day traders; short-term decisions |

| Market Depth Indicators | Quantitative; objective | Requires technical knowledge; may lag | Professional traders; algorithmic strategies |

| Combined Approach | Robust; supports decision-making | Complex; requires multiple tools | High-frequency and institutional trading |

FAQ

1. Why is market depth important in perpetual futures?

Market depth reveals liquidity and potential price barriers. Understanding it helps traders anticipate price movements, reduce slippage, and manage risk effectively.

2. Where to find market depth data for perpetual futures?

Reliable sources include exchange platforms like Binance Futures, Bybit, and TradingView, which provide live order books, heatmaps, and API data for algorithmic integration.

3. How to use market depth for trading perpetual futures?

Traders can identify support/resistance levels, detect spoofing, and integrate depth indicators into algorithms to optimize trade timing and reduce risk exposure.

Conclusion

Understanding market depth in perpetual futures is crucial for traders seeking a competitive edge. By combining visual order book analysis, quantitative indicators, and strategic integration with technical analysis, traders can enhance execution, reduce risk, and optimize trading outcomes. Whether you are a beginner or an advanced trader, mastering market depth is an essential skill for long-term success in perpetual futures markets.

Comprehensive overview of tools and strategies for understanding market depth