============================================================================

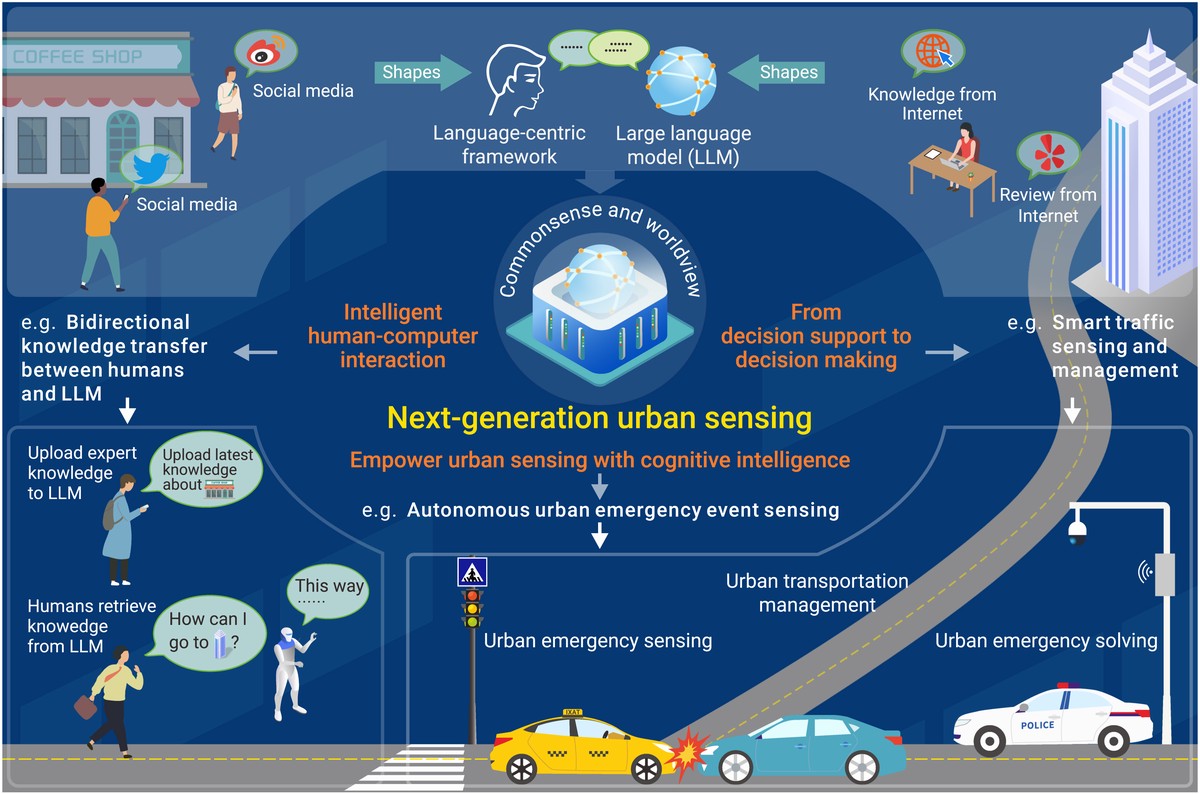

Market depth is one of the most powerful tools available to traders in perpetual futures markets. Understanding how to read and interpret market depth can provide critical insights into supply and demand, liquidity, and potential price movements. This guide dives deep into the strategies, tools, and best practices for leveraging market depth effectively in perpetual futures trading.

Understanding Market Depth in Perpetual Futures

What is Market Depth?

Market depth refers to the quantity of buy and sell orders at various price levels in a trading market. In the context of perpetual futures, it reveals how much liquidity exists at each price point, allowing traders to anticipate price movements and potential market reactions.

- Bid Side: Shows all current buy orders and their respective sizes.

- Ask Side: Shows all current sell orders and their respective sizes.

- Spread: The difference between the highest bid and lowest ask, a key indicator of market liquidity.

Embedding internal link: For beginners, refer to “How to understand market depth in perpetual futures” to grasp the fundamentals.

Importance of Market Depth

Market depth helps traders:

- Identify strong support and resistance levels

- Detect potential price reversals

- Optimize trade execution by avoiding slippage

- Evaluate overall market liquidity

Visualization of a typical perpetual futures market depth chart, showing bid and ask sizes at different price levels.

Tools and Platforms for Market Depth Analysis

Real-Time Market Depth Tools

High-quality platforms provide live updates of bid and ask levels, offering traders actionable insights into market conditions. Popular options include:

- Exchange-Integrated Depth Charts: Directly on exchanges like Binance or Bybit.

- Third-Party Trading Platforms: Tools such as TradingView or Bookmap that provide enhanced visualization and filtering.

Key Features to Look For:

- Depth heatmaps for quick liquidity visualization

- Aggregated order book views

- Historical depth snapshots for trend analysis

Advanced Software Solutions

Professional traders often use software solutions that integrate market depth with algorithmic strategies, enabling automated execution based on depth changes.

Examples:

- Real-time API access for order book data

- AI-driven depth analysis for predictive modeling

- Customizable alerts when significant depth changes occur

Embedding internal link: For detailed execution, see “Where to get real-time market depth in perpetual futures” for accessing live depth data efficiently.

Strategies for Trading Using Market Depth

Strategy 1: Liquidity-Based Scalping

Scalping involves executing small, frequent trades to capture minor price movements. Market depth is crucial for:

- Timing entry and exit points

- Determining where liquidity is concentrated

- Avoiding market impact by placing orders where sufficient depth exists

Pros:

- High frequency of potential gains

- Immediate feedback on market behavior

Cons:

- Requires constant monitoring

- Sensitive to rapid depth changes

Example of using market depth to identify optimal scalping entry and exit points.

Strategy 2: Order Flow Anticipation

Order flow strategies analyze the imbalance between bid and ask volumes to predict short-term price movements:

- Buy Pressure: Large bids may indicate potential upward movement.

- Sell Pressure: Large asks suggest potential downward pressure.

- Depth Shifts: Sudden changes in depth can signal institutional trading activity.

Pros:

- Allows proactive positioning ahead of market moves

- Can be combined with technical analysis for confirmation

Cons:

- Misinterpretation of spoofing orders may lead to losses

- Requires advanced understanding of market microstructure

Best Practices for Using Market Depth

- Monitor Depth Continuously: Rapid changes can occur in volatile markets.

- Combine with Technical Indicators: Depth insights work best when paired with volume, trend, and momentum indicators.

- Avoid Overreliance: Depth is one tool among many; integrate it with risk management strategies.

- Understand Exchange Nuances: Depth data may vary across platforms, impacting analysis accuracy.

Advanced Tip: Depth Heatmap Analysis

Depth heatmaps allow traders to visualize liquidity clusters, helping identify potential breakout or reversal zones. This method enhances the accuracy of scalping and order flow strategies.

Comparing Market Depth Strategies

| Strategy | Best For | Advantages | Challenges |

|---|---|---|---|

| Liquidity-Based Scalping | Short-term traders | High-frequency gains, immediate insights | Requires continuous monitoring, high market sensitivity |

| Order Flow Anticipation | Intermediate to advanced traders | Proactive positioning, combines well with TA | Risk of false signals, needs advanced interpretation |

Recommendation:

Traders can combine both strategies—using scalping for micro-movements and order flow analysis for larger positioning—to optimize perpetual futures trading performance.

FAQ: Market Depth in Perpetual Futures

Q1: How reliable is market depth in predicting price movements?

A1: Market depth provides valuable insights but should be used alongside technical analysis and risk management. Sudden large orders or spoofing can temporarily distort the depth.

Q2: Can beginners use market depth effectively?

A2: Yes, by starting with visualization tools like depth charts or heatmaps, beginners can gradually learn to interpret liquidity and order imbalances without overcomplicating trades.

Q3: How often should traders update their depth-based strategy?

A3: In volatile markets, continuous monitoring is ideal. Adjust strategies based on observed depth shifts, major order placements, and evolving market conditions.

Conclusion

Using market depth effectively is a powerful approach to trading perpetual futures. By understanding bid-ask imbalances, identifying liquidity clusters, and applying strategies like scalping and order flow anticipation, traders can gain a competitive edge. Integrating market depth with technical analysis and real-time monitoring enhances trade execution and risk management.

Share your experiences with market depth strategies, comment on techniques that worked for you, and discuss how real-time depth analysis has influenced your trading performance!