===========================================================================================

The rise of perpetual futures contracts has revolutionized derivatives trading, especially in the crypto markets. Unlike traditional futures, perpetual contracts have no expiration date, making them highly flexible but also extremely volatile. To navigate this complex environment, algorithm solutions for perpetual futures developers play a crucial role. These solutions help traders optimize execution, manage risks, and design profitable strategies with speed and precision.

This in-depth guide explores different algorithmic approaches, compares their strengths and weaknesses, and provides actionable insights for both beginner and professional perpetual futures developers.

Understanding Perpetual Futures and the Role of Algorithms

What Are Perpetual Futures?

Perpetual futures are derivative contracts that allow traders to speculate on asset prices without worrying about contract expiry. They are:

- Cash-settled instead of physically delivered

- Maintained through funding rates to keep prices aligned with spot markets

- Highly liquid, especially in cryptocurrency exchanges

Why Algorithms Are Essential in Perpetual Futures

Given the speed and volatility of perpetual contracts, algorithms are indispensable. They:

- Automate execution with low-latency trading

- Reduce emotional decision-making

- Enhance risk management with systematic controls

- Identify micro-opportunities invisible to human traders

This highlights how algorithms impact perpetual futures strategy and why they’ve become a standard tool among institutions and retail traders alike.

Core Algorithm Solutions for Perpetual Futures Developers

Algorithm developers typically employ a mix of quantitative strategies and machine learning techniques. Below, we analyze two major solutions: market-making algorithms and momentum-based trading algorithms.

Market-Making Algorithms

Market-making involves continuously quoting buy and sell orders to capture the spread. Algorithms enable perpetual futures developers to:

- Provide liquidity to exchanges

- Earn profits from bid-ask spreads

- Hedge risks dynamically using inventory management models

Pros

- Generates consistent small profits

- Beneficial in high-liquidity environments

- Improves exchange fee structures (rebates for makers)

Cons

- Exposed to sudden market volatility

- Requires sophisticated risk controls to prevent inventory imbalance

- Vulnerable during flash crashes

Momentum-Based Trading Algorithms

Momentum strategies rely on price trends, exploiting short- to medium-term movements in perpetual futures markets. Algorithms typically use:

- Moving averages for trend confirmation

- Breakout detection for entry triggers

- Stop-loss automation for capital protection

Pros

- Highly profitable in trending markets

- Easier for beginners to implement compared to market-making

- Scalable across multiple assets

Cons

- Performs poorly in sideways or choppy markets

- High sensitivity to parameter settings (look-back periods, thresholds)

- Requires adaptive recalibration

| Topic | Details |

|---|---|

| Perpetual Futures Definition | Derivative contracts without expiration, allowing speculation on asset prices. |

| Role of Algorithms in Perpetual Futures | Automates execution, reduces emotional decisions, enhances risk management, and identifies opportunities. |

| Market-Making Algorithms | Provide liquidity, earn profits from bid-ask spreads, and dynamically hedge risks. |

| Momentum-Based Trading Algorithms | Use price trends, moving averages, breakout detection, and stop-loss automation. |

| Market-Making Algorithm Pros | Generates steady, small profits, beneficial in high-liquidity markets, improves fee structures. |

| Market-Making Algorithm Cons | Exposed to volatility, requires complex risk controls, vulnerable during flash crashes. |

| Momentum Algorithm Pros | Profitable in trending markets, beginner-friendly, scalable across assets. |

| Momentum Algorithm Cons | Performs poorly in sideways markets, sensitive to settings, needs recalibration. |

| Algorithm Comparison Criteria | Market conditions, risk level, complexity, profit potential, resource requirement. |

| Machine Learning in Algorithms | Reinforcement learning, neural networks, clustering models for market adaptation. |

| Risk Management Algorithms | Dynamic position sizing, automated stop-loss/take-profit, real-time funding monitoring. |

| Portfolio Diversification | Algorithms balance exposure across multiple assets to spread risk. |

| Best Practices for Developers | High-quality data, backtesting, forward testing, continuous optimization, efficient infrastructure. |

| Key Algorithm Tools | Python’s ccxt library, TradingView, low-latency servers, APIs for high-frequency orders. |

| Hybrid Algorithm Approach | Combining market-making and momentum strategies for consistent results. |

| FAQ - Algorithm Solutions | Market-making for liquidity, momentum for trends, funding rate adjustments, beginner strategies. |

| Criteria | Market-Making Algorithms | Momentum-Based Algorithms |

|---|---|---|

| Market Conditions | Best in stable, liquid markets | Best in strong trends |

| Risk Level | Moderate to high | High during sideways markets |

| Complexity | Advanced (inventory & hedging) | Intermediate |

| Profit Potential | Steady, smaller gains | Higher, but less consistent |

| Resource Requirement | High computational demand | Moderate |

From professional experience, many successful perpetual futures developers combine both methods, using market-making for baseline liquidity provision and momentum strategies for trend exploitation.

Advanced Algorithm Solutions for Perpetual Futures

Machine Learning Integration

AI-powered algorithms can adapt to changing market regimes by learning patterns from massive datasets. Key applications include:

- Reinforcement learning to optimize order placement

- Neural networks to predict funding rate shifts

- Clustering models to identify market regimes

Risk Management Algorithms

Since perpetual futures can involve high leverage, risk management is vital. Algorithms often include:

- Dynamic position sizing based on volatility

- Automated stop-loss and take-profit levels

- Real-time monitoring of funding payments

Portfolio Diversification with Algorithms

Developers also design strategies to spread risk across multiple perpetual pairs. Algorithmic portfolio allocation balances exposure between correlated assets like BTC/USDT and ETH/USDT.

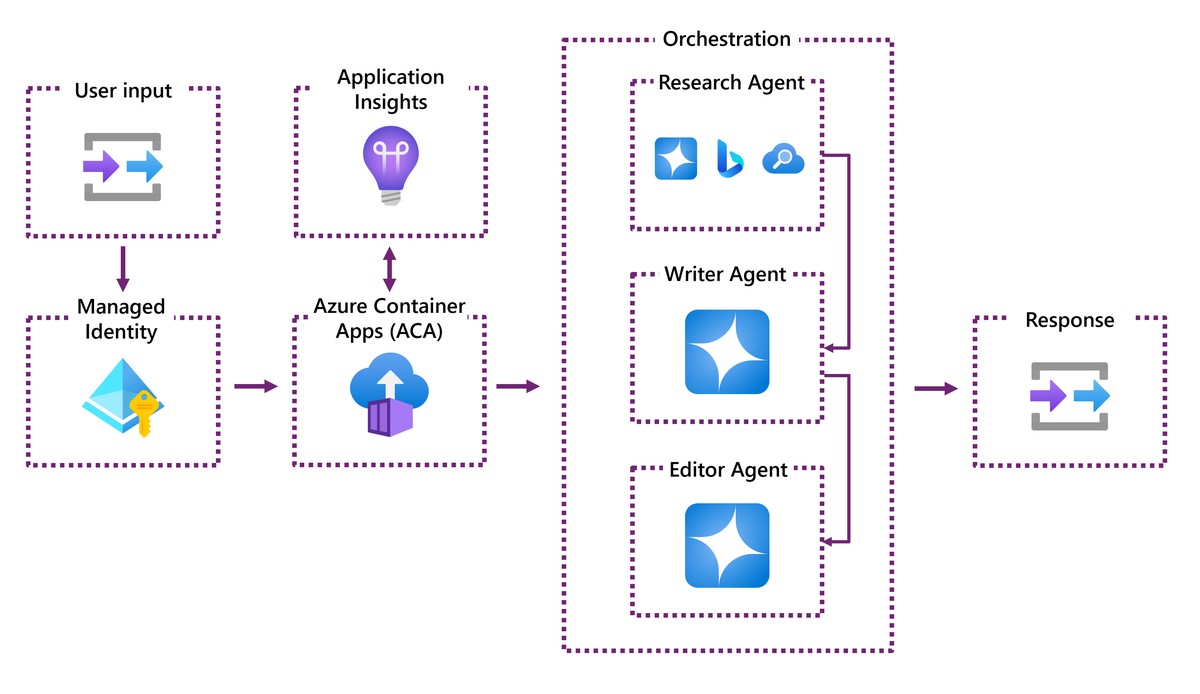

Visual Representation

Here’s a simplified diagram showing how algorithm workflows operate in perpetual futures:

An algorithmic trading workflow typically includes signal generation, order execution, risk monitoring, and feedback loops.

Best Practices for Developers

Data Quality Is Critical

Reliable market data is the foundation of any algorithm. Slippage, latency, or bad tick data can drastically distort results.

Backtesting and Forward Testing

Robust testing environments help avoid overfitting. Developers should always backtest on historical data, then validate strategies in forward/live simulations.

Continuous Optimization

Markets evolve quickly, especially in crypto. Developers must recalibrate models regularly to maintain profitability.

Infrastructure Considerations

Perpetual futures algorithms require:

- Low-latency servers close to exchange matching engines

- Efficient APIs for high-frequency order placement

- Fail-safe mechanisms for downtime protection

Internal Linking: Enhancing Strategy Depth

Developers often question how to use algorithm for perpetual futures effectively. The answer lies in combining technical expertise with strong infrastructure, ensuring algorithms can respond dynamically to market volatility. Similarly, knowing where to find best algorithms for perpetual futures trading—whether through proprietary development, open-source frameworks, or third-party vendors—gives developers a competitive edge in building scalable strategies.

FAQ: Algorithm Solutions for Perpetual Futures Developers

1. What is the best algorithm type for perpetual futures?

There is no universal “best” algorithm. Market-making algorithms excel in liquid, sideways conditions, while momentum-based strategies thrive in trending markets. A hybrid approach often delivers the most consistent results.

2. How do funding rates affect algorithm design?

Funding rates create unique challenges for perpetual futures. Algorithms must account for these payments to avoid eroding profits. Many developers design strategies that hedge or even exploit funding rate imbalances.

3. Can beginners develop effective perpetual futures algorithms?

Yes. Beginners often start with simple momentum or mean-reversion strategies before advancing to market-making or machine learning models. Tools like Python’s ccxt library or platforms such as TradingView make entry-level development accessible.

4. Are perpetual futures algorithms different from spot trading algorithms?

Yes. Unlike spot markets, perpetual contracts involve leverage, funding rates, and continuous settlement. Algorithms must include risk and funding management modules, making them more complex.

Conclusion: The Future of Algorithm Solutions in Perpetual Futures

As perpetual futures trading grows, algorithm developers play a central role in shaping the market. From market-making bots to AI-driven predictive models, the range of algorithm solutions continues to expand.

The best approach is multi-layered:

- Statistical models for stable filtering

- Momentum or market-making strategies for execution

- Machine learning algorithms for adaptive intelligence

For developers, this space offers both challenges and opportunities. By leveraging algorithm solutions effectively, perpetual futures traders can gain a significant edge in speed, precision, and profitability.

If this article helped you understand algorithm solutions for perpetual futures, share it with your network or comment with your own experiences. The community benefits most when developers collaborate and exchange ideas.