================================================

Introduction

For modern traders, perpetual futures have become one of the most exciting yet challenging derivatives products. They combine the flexibility of spot trading with the leverage of futures, but without an expiry date. For perpetual futures enthusiasts, using algorithm tips can make the difference between consistent profits and unnecessary losses.

Algorithms help automate decision-making, reduce emotional bias, and capitalize on small market inefficiencies. This article provides comprehensive insights into algorithm design, strategies, and optimization. We will explore multiple approaches, compare their strengths and weaknesses, and highlight how traders can apply them effectively. Along the way, we will naturally incorporate related insights such as How to use algorithm for perpetual futures and Ways to optimize algorithm for perpetual futures, so readers have a practical roadmap for success.

Why Algorithms Are Essential in Perpetual Futures

1. Speed and Efficiency

Markets move quickly, especially in crypto futures. Algorithms allow traders to act on opportunities within milliseconds, far faster than manual execution.

2. Emotion-Free Trading

Human traders often fall prey to fear and greed. Algorithms follow predefined rules, removing emotion from the equation.

3. Ability to Handle Complex Data

Algorithms can simultaneously analyze multiple trading pairs, funding rates, order books, and social sentiment—tasks nearly impossible for a human in real time.

4. Continuous Monitoring

Since perpetual futures trade 24⁄7, algorithms can monitor the market around the clock without fatigue.

| Technique | Best Use Case | Strengths | Weaknesses |

|---|---|---|---|

| Monte Carlo VAR | Options & derivatives portfolios | Flexible, models fat-tailed distributions | Computationally intensive, requires robust assumptions |

| GARCH VAR | High-frequency trading, volatile regimes | Captures time-varying volatility, realistic | Complex, parameter sensitive, may miss extreme tails |

| Copula VAR | Multi-asset correlation analysis | Models non-linear dependencies, joint tail events | Requires statistical expertise, limited data challenges |

| Stress-Testing VAR | Crisis preparedness & regulatory compliance | Adds robustness, tests extreme events | Subjective scenario selection, may miss unknown risks |

| Hybrid VAR Models | Dynamic volatility & fat-tail tracking | Combines Monte Carlo & GARCH strengths | Implementation complexity |

| VAR with Machine Learning | Predictive accuracy in large datasets | Uncovers hidden patterns, improves forecasts | High complexity, requires large quality data |

| Best Practices | Professional VAR application | Clean data, scenario updates, backtesting, transparency | Requires continuous monitoring and updates |

| Common Challenges | Tail risk, computation, regulatory pressure | Use copula/EVT, GPU acceleration, supplement with ES | High resource demand, complex compliance needs |

| Crypto Trading VAR | Digital asset volatility management | Monte Carlo + GARCH handles fat tails & clustering | Market extremes may still challenge models |

Strategy 1: Market-Making Algorithms

Market-making algorithms provide liquidity by continuously placing buy and sell orders around the current price.

How It Works:

- Place buy orders slightly below the mid-price.

- Place sell orders slightly above the mid-price.

- Profit from bid-ask spreads while adjusting to volatility.

Pros:

- Generates steady income if spreads are consistent.

- Improves liquidity for the exchange.

Cons:

- Vulnerable to sudden price spikes.

- Requires advanced risk management and capital.

Strategy 2: Trend-Following Algorithms

Trend-following is one of the most common algorithmic approaches in perpetual futures.

How It Works:

- Use moving averages (e.g., 20-day vs. 50-day) to detect trends.

- Enter long positions in uptrends and short positions in downtrends.

- Adjust leverage dynamically based on volatility.

Pros:

- Works well in strongly directional markets.

- Easy to implement for beginners.

Cons:

- Underperforms in sideways or choppy markets.

- Requires filters to avoid false signals.

Strategy 3: Arbitrage Algorithms

Arbitrage strategies exploit price discrepancies between markets or instruments.

Examples:

- Cross-Exchange Arbitrage: Buy perpetual futures on one exchange and sell on another at higher prices.

- Funding Rate Arbitrage: Earn from positive or negative funding rates by hedging with spot markets.

Pros:

- Low risk if executed properly.

- Consistent opportunities in fragmented markets.

Cons:

- Requires high-frequency execution.

- Profit margins are slim without scale.

Comparing Algorithmic Approaches

| Strategy | Best Use Case | Key Advantage | Main Risk |

|---|---|---|---|

| Market-Making | Providing liquidity in stable markets | Earns from spreads | Large price swings |

| Trend-Following | Strong trending environments | Simple, scalable strategy | False signals in ranging markets |

| Arbitrage | Exploiting inefficiencies across exchanges | Low directional risk | Requires speed and capital efficiency |

Recommendation: Start with trend-following algorithms for accessibility, then add arbitrage strategies as experience grows. Market-making should be reserved for advanced traders with robust infrastructure.

Optimizing Algorithms for Perpetual Futures

Data Quality Matters

Algorithms are only as good as the data they process. Use APIs from reputable exchanges and verify historical datasets before backtesting.

Risk Management Integration

Every algorithm must include position sizing, stop-losses, and leverage limits. For example, capping leverage at 5x may reduce liquidation risks significantly.

Dynamic Adjustments

Algorithms should adapt to volatility. For instance, widen stop-loss thresholds during high volatility periods to avoid premature exits.

Backtesting and Forward Testing

Before deploying, run simulations using past data, followed by small-scale live testing.

(See: Ways to optimize algorithm for perpetual futures for more advanced fine-tuning practices.)

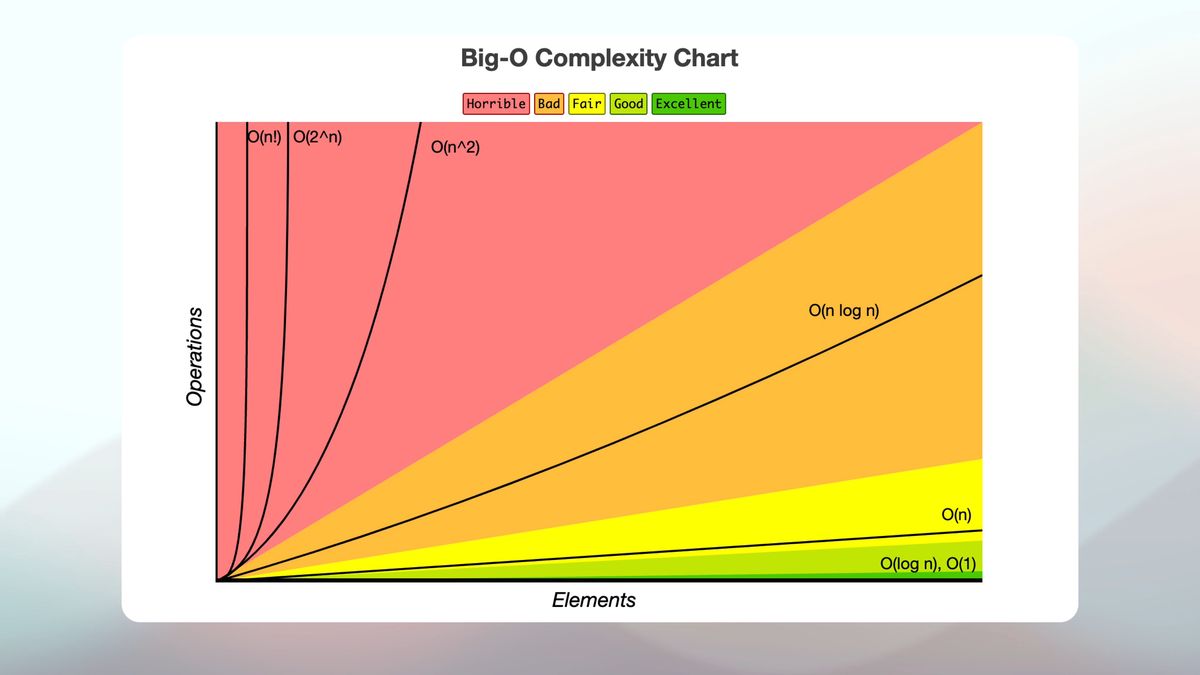

Images

Algorithmic trading flow: From market data to execution and risk management.

Example of perpetual futures price movements where algorithms can identify trading opportunities.

FAQ

1. How do I start using algorithms for perpetual futures as a beginner?

Start with simple strategies such as moving average crossovers or RSI-based signals. Many platforms allow backtesting and paper trading, which helps beginners refine their systems before committing real funds. (See: How to use algorithm for perpetual futures for a structured beginner’s guide.)

2. Can algorithms completely replace manual trading?

Not entirely. While algorithms excel at execution speed and consistency, manual oversight is crucial. Traders should periodically review performance, update parameters, and monitor for unexpected market events like exchange outages or flash crashes.

3. What infrastructure do I need to run perpetual futures algorithms effectively?

At a minimum, you’ll need:

- A reliable VPS or dedicated server for 24⁄7 uptime.

- Low-latency API access to exchanges.

- Risk management tools to prevent overleveraging.

Advanced traders may also integrate machine learning models or custom-built dashboards.

Conclusion

For perpetual futures enthusiasts, learning algorithm tips is not just optional—it’s essential for competing in today’s fast-moving markets. From market-making to trend-following and arbitrage, algorithms unlock unique opportunities while mitigating emotional bias.

The key is starting simple, optimizing over time, and gradually layering complexity as confidence builds. With a combination of robust data, disciplined risk management, and adaptive strategies, perpetual futures traders can harness algorithms to scale their success.

If you found this article helpful, share it with fellow traders, comment with your own experiences, and let’s build a stronger algorithmic trading community together. 🚀

Would you like me to expand this into a step-by-step coding guide for a basic perpetual futures algorithm, with backtest examples?