==========================================================

In the evolving landscape of crypto derivatives, algorithm use for professional perpetual futures investors has become a defining factor in maintaining consistent profitability and mitigating risk. Unlike traditional spot trading, perpetual futures operate with continuous funding rates, leverage mechanics, and higher liquidity volatility, making them fertile ground for algorithmic trading strategies. This article provides a comprehensive guide for professional investors, blending industry insights, proven techniques, and expert recommendations.

Why Algorithms are Essential in Perpetual Futures

Professional investors rely on algorithms to overcome the inefficiencies of manual execution. The perpetual futures market operates 24⁄7, requiring continuous monitoring that only automated systems can handle effectively.

Core reasons algorithms are essential:

- Speed: Millisecond-level order execution.

- Precision: Reduces slippage and human error.

- Scalability: Handles multiple instruments simultaneously.

- Consistency: Removes emotional bias from decision-making.

Algorithms are no longer optional—they are a competitive necessity. For further reading, many traders explore why algorithms are essential in perpetual futures as part of their strategy-building process.

Key Components of Algorithmic Trading in Perpetual Futures

1. Market Data Integration

Algorithms must process real-time order book data, funding rates, and cross-exchange price discrepancies. High-frequency feeds and low-latency APIs are crucial.

2. Risk Management Modules

Professional perpetual futures investors need algorithms that include margin tracking, liquidation alerts, and auto-deleveraging mechanisms.

3. Strategy Customization

Pre-built strategies (e.g., arbitrage, market making) can be enhanced with machine learning, adaptive stop-loss systems, and volatility forecasting models.

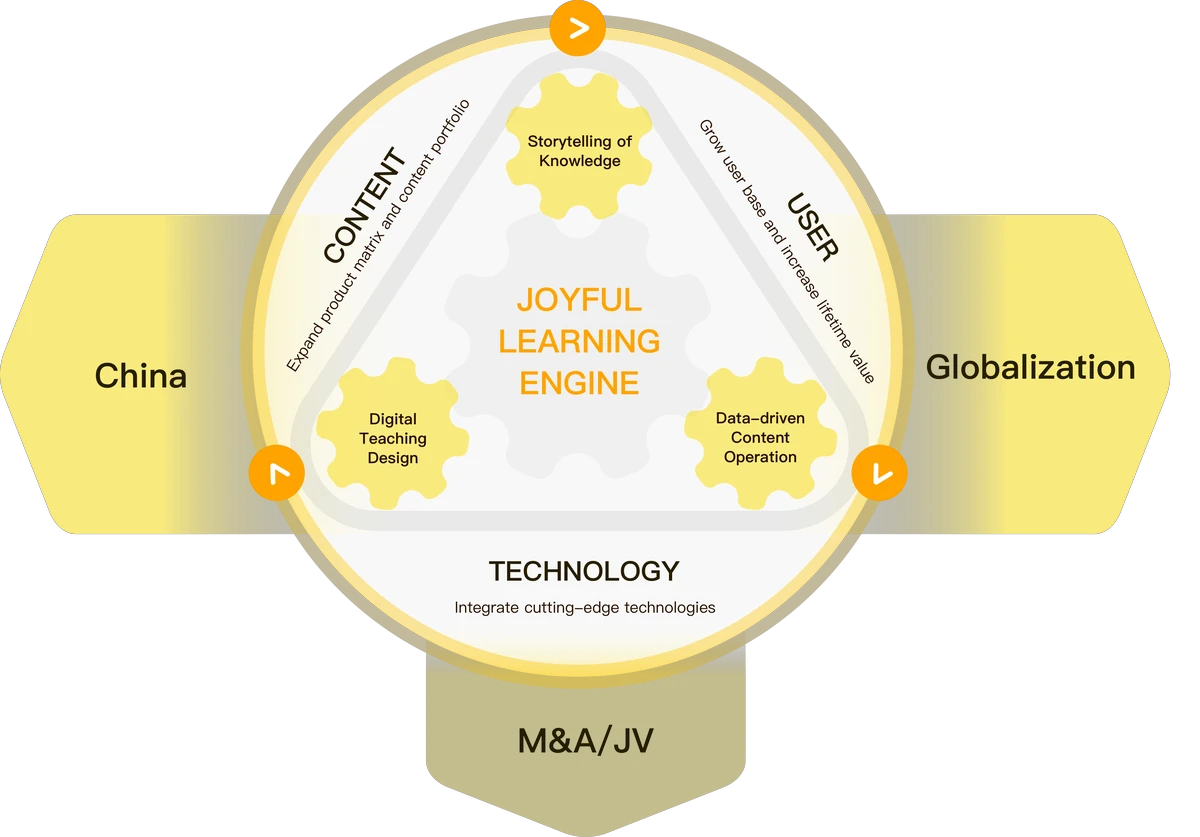

Algorithm-driven execution flow in perpetual futures trading.

| Section | Key Points | Details |

|---|---|---|

| Importance of Algorithms | Essential for speed, precision, scalability, consistency | Overcome manual inefficiencies in 24⁄7 perpetual futures |

| Key Components | Market data, risk modules, strategy customization | Use real-time feeds, margin tracking, adaptive strategies |

| Market Making Strategy | Provides liquidity, profits from spread, dynamic adjustments | Steady returns, high capital needs, infrastructure heavy |

| Trend-Following Strategy | Follows momentum, breakout signals, trailing stops | Captures large moves, susceptible to false breakouts |

| Strategy Comparison | Market Making vs Trend-Following | Market Making: high capital, consistent; Trend: moderate capital, volatile |

| Optimization Techniques | Adaptive engines, multi-exchange arbitrage, risk overlays | Adjust for liquidity, funding rates, stop-loss, VaR |

| Challenges | Overfitting, latency, regulations, infrastructure costs | Real-world deployment obstacles for professional traders |

| Future Trends | AI strategies, DeFi integration, quantum computing, sentiment data | Emerging technologies shaping algorithmic perpetual futures |

| FAQ Insights | Hybrid models recommended, algorithms enhance execution | Human oversight still necessary despite automation |

| Final Thoughts | Algorithms are strategic assets for professionals | Enable sustainable growth, risk management, advanced analytics |

Strategy 1: Market Making Algorithms

How it works:

- Provides liquidity by continuously quoting buy and sell orders.

- Profits from the bid-ask spread.

- Adjusts spreads dynamically based on volatility.

Advantages:

- Generates steady, incremental returns.

- Beneficial in highly liquid perpetual futures markets.

- Helps mitigate directional exposure.

Disadvantages:

- Requires deep technical infrastructure.

- Vulnerable to sudden market shocks.

- High capital requirements for sustained liquidity provision.

Strategy 2: Trend-Following Algorithms

How it works:

- Identifies momentum and breakout signals from price movements.

- Enters positions aligned with prevailing trends.

- Uses trailing stops to lock in profits.

Advantages:

- Captures large moves in volatile perpetual futures markets.

- Easier for professionals to implement with moderate infrastructure.

- Works well with leverage scaling.

Disadvantages:

- Susceptible to false breakouts in choppy conditions.

- Requires robust volatility filters to avoid overtrading.

- Higher drawdowns compared to market making.

Comparative Analysis: Market Making vs. Trend-Following

| Feature | Market Making Algorithms | Trend-Following Algorithms |

|---|---|---|

| Capital Requirement | High | Moderate |

| Infrastructure Need | Very High (low latency essential) | Medium (backtesting + risk modules) |

| Return Profile | Consistent, incremental | Volatile, with high upside potential |

| Risk Exposure | Neutral to directional risk | Strongly exposed to market movements |

Recommendation: Professional investors should adopt a hybrid approach, combining market making for steady income and trend-following for capturing large directional opportunities.

Optimizing Algorithm Use in Perpetual Futures

To maximize efficiency, professionals must integrate advanced practices:

Adaptive Execution Engines

Algorithms should adjust to funding rate shifts, liquidity depth, and volatility regimes.

Multi-Exchange Arbitrage

Cross-exchange algorithms exploit funding rate differences and mispriced perpetual contracts.

Risk Overlay Systems

Layered stop-loss systems, position limits, and VaR (Value at Risk) calculations reduce catastrophic losses.

For investors interested in refining their systems, it’s worth exploring ways to optimize algorithm for perpetual futures with real-time monitoring and risk analytics.

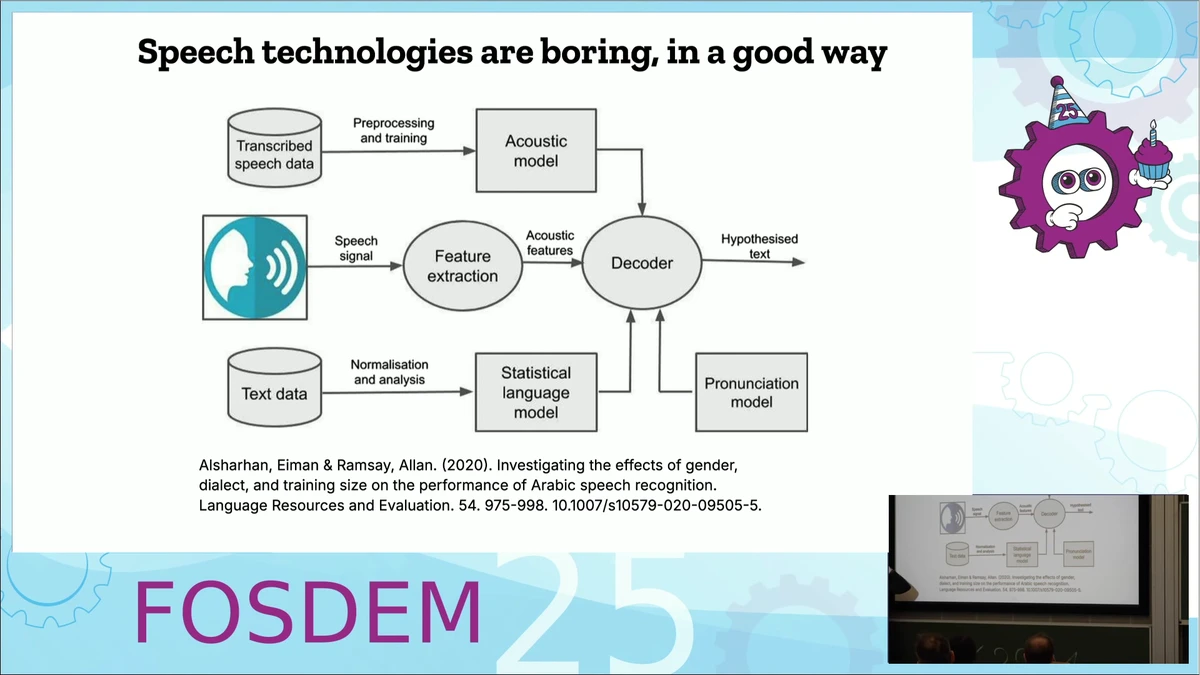

Professional investors often rely on algorithmic dashboards to monitor perpetual futures strategies.

Challenges in Algorithm Adoption

Even professional perpetual futures investors face challenges when deploying algorithms:

- Overfitting: Backtested strategies that fail in live trading.

- Latency issues: Slow execution leading to missed opportunities.

- Regulatory scrutiny: Institutions must comply with evolving frameworks.

- Infrastructure costs: High-performance servers and data subscriptions add up quickly.

Future Trends in Algorithm Use for Perpetual Futures

- AI-driven strategies: Machine learning models predicting funding rate shifts.

- DeFi-based perpetual futures: On-chain algorithms interacting with decentralized liquidity pools.

- Quantum computing potential: Faster optimization of risk-return profiles.

- Integration of sentiment data: Algorithms factoring in Twitter, Reddit, and news-driven volatility.

FAQ: Algorithm Use for Professional Perpetual Futures Investors

1. What is the best type of algorithm for perpetual futures?

There is no one-size-fits-all. Market making is ideal for firms with large capital and infrastructure, while trend-following suits professionals who want higher returns with manageable complexity. A hybrid model often delivers the most balanced outcomes.

2. How do algorithms impact perpetual futures strategy performance?

Algorithms improve execution precision, enhance risk management, and expand scalability. By removing human emotions, they allow professionals to stay disciplined even during extreme volatility.

3. Can professional investors rely solely on algorithms?

While algorithms handle execution, professionals should still monitor risk and market developments. Over-reliance on automation without human oversight can lead to systemic failures.

Final Thoughts

For professional perpetual futures investors, algorithms are not merely tools—they are strategic assets. Whether applied in market making, trend-following, or hybrid models, they unlock opportunities that manual trading cannot match. By optimizing execution, managing risk, and leveraging advanced analytics, investors can achieve sustainable growth in this competitive space.

If you found this guide insightful, share it with your trading community or leave a comment below. Your perspective could help refine algorithmic adoption in perpetual futures markets.

Would you like me to also build a visual case study comparing algorithmic PnL curves for perpetual futures strategies to make this article even more practical?