=================================================

Introduction

Perpetual futures have become one of the most traded products in the cryptocurrency market. Unlike traditional futures, they have no expiration date and allow traders to speculate on price movements with leverage. For professional traders, manual trading often falls short when it comes to speed, accuracy, and scalability. That’s where an API for professional traders in perpetual futures becomes essential.

This article will explore how APIs empower advanced market participants, showcase practical strategies, compare tools, and highlight key considerations for professionals. With first-hand experience in algorithmic trading and integration, I’ll share practical insights that can help both institutional and independent professional traders optimize their workflows.

What Is an API for Perpetual Futures?

Definition

An API (Application Programming Interface) is a set of protocols that allows software applications to communicate with trading platforms. In perpetual futures markets, APIs provide programmatic access to:

- Market data (real-time and historical).

- Account balances and positions.

- Order placement and execution.

- Risk management functions.

Why APIs Matter for Professional Traders

- Speed: Millisecond-level execution that manual trading can’t match.

- Automation: Enables bots and algorithms to trade 24⁄7.

- Scalability: Supports managing multiple accounts or large portfolios.

- Precision: Reduces human error in order execution.

For those wondering why API is essential for perpetual futures, the answer lies in competitive advantage: traders who use APIs gain superior speed, flexibility, and strategic execution compared to those relying only on manual trading.

| Topic | Details |

|---|---|

| What is an API for Perpetual Futures? | A set of protocols that allows software to communicate with trading platforms for market data, account management, order execution, and risk management. |

| Why APIs Matter for Professional Traders | Speed, automation, scalability, precision for competitive trading advantages. |

| Core Use Cases | Algorithmic trading, risk management, market-making. |

| Method 1: REST API | Simple, easy integration for non-time-sensitive tasks but slower than WebSocket. |

| Method 2: WebSocket API | Real-time, low-latency communication, preferred for high-frequency trading. |

| Method 3: FIX Protocol API | Ultra-low latency, institutional standard, robust for high-volume trading, requires expertise. |

| REST vs WebSocket vs FIX API | REST: moderate speed, low complexity; WebSocket: high speed, good for bots; FIX: very high speed, for institutional use. |

| Key Features for Traders | Low latency, security, comprehensive documentation, advanced order types, reliability. |

| Security Considerations | Use IP whitelisting, withdrawal restrictions, encrypted storage, regular key rotation. |

| Case Study | Hedge fund reduced latency by 80%, improved execution by 25%, generating $3M annually. |

| Future Trends | AI-driven APIs, decentralized perpetual futures APIs, cross-exchange aggregators, smart order routing. |

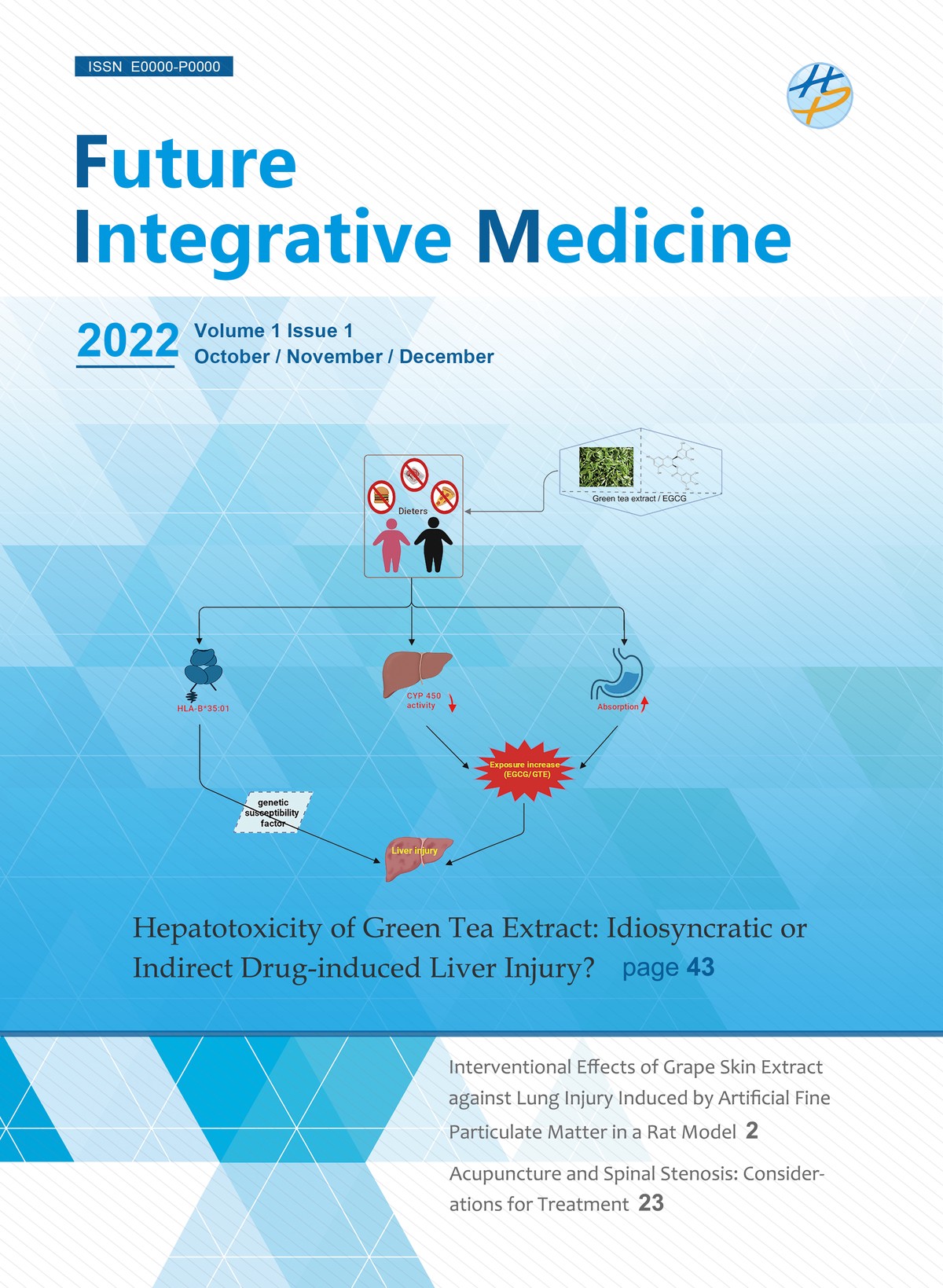

1. Algorithmic Trading

Professional traders often deploy custom algorithms through APIs to execute trades based on specific signals, such as moving averages, order book imbalances, or arbitrage spreads.

Example:

- An arbitrage bot identifies price discrepancies between BTC perpetual futures on Binance and Bybit.

- The API executes buy and sell orders simultaneously to lock in profits.

2. Risk Management and Hedging

APIs can automatically manage stop-loss orders, adjust position sizes, and trigger hedges based on volatility indicators.

Example:

- If Bitcoin’s implied volatility exceeds 70%, an API can hedge part of a portfolio by shorting perpetual contracts.

3. Market-Making

Liquidity providers use APIs to continuously place bid and ask orders. The goal is to profit from spreads while managing inventory risk.

Example:

- A market maker sets orders 0.05% above and below mid-price.

- The API cancels and replaces orders in milliseconds to stay competitive.

Workflow of using API for perpetual futures trading, from data collection to automated execution.

Methods of API Trading for Professionals

Method 1: REST API

Overview

The REST API is a widely used standard that allows communication over HTTP. It’s simple and reliable for sending requests and receiving responses.

Strengths

- Easy to integrate with most programming languages.

- Well-documented and beginner-friendly.

- Good for non-time-sensitive tasks (e.g., balance checks, order history).

Weaknesses

- Slower compared to WebSocket for real-time trading.

- Higher latency for frequent requests.

Method 2: WebSocket API

Overview

WebSocket provides a persistent two-way connection between trader software and exchange. It’s preferred for real-time market data and rapid execution.

Strengths

- Low latency and real-time updates.

- Essential for high-frequency trading.

- More efficient for continuous data streams.

Weaknesses

- More complex to implement.

- Requires robust error-handling and reconnection logic.

Method 3: FIX Protocol API

Overview

The Financial Information eXchange (FIX) protocol is a professional-grade API commonly used by institutional investors.

Strengths

- Ultra-low latency, institutional standard.

- Robust support for advanced order types.

- Designed for high-volume trading.

Weaknesses

- Steeper learning curve.

- Limited availability across crypto exchanges.

- Often requires institutional-level partnerships.

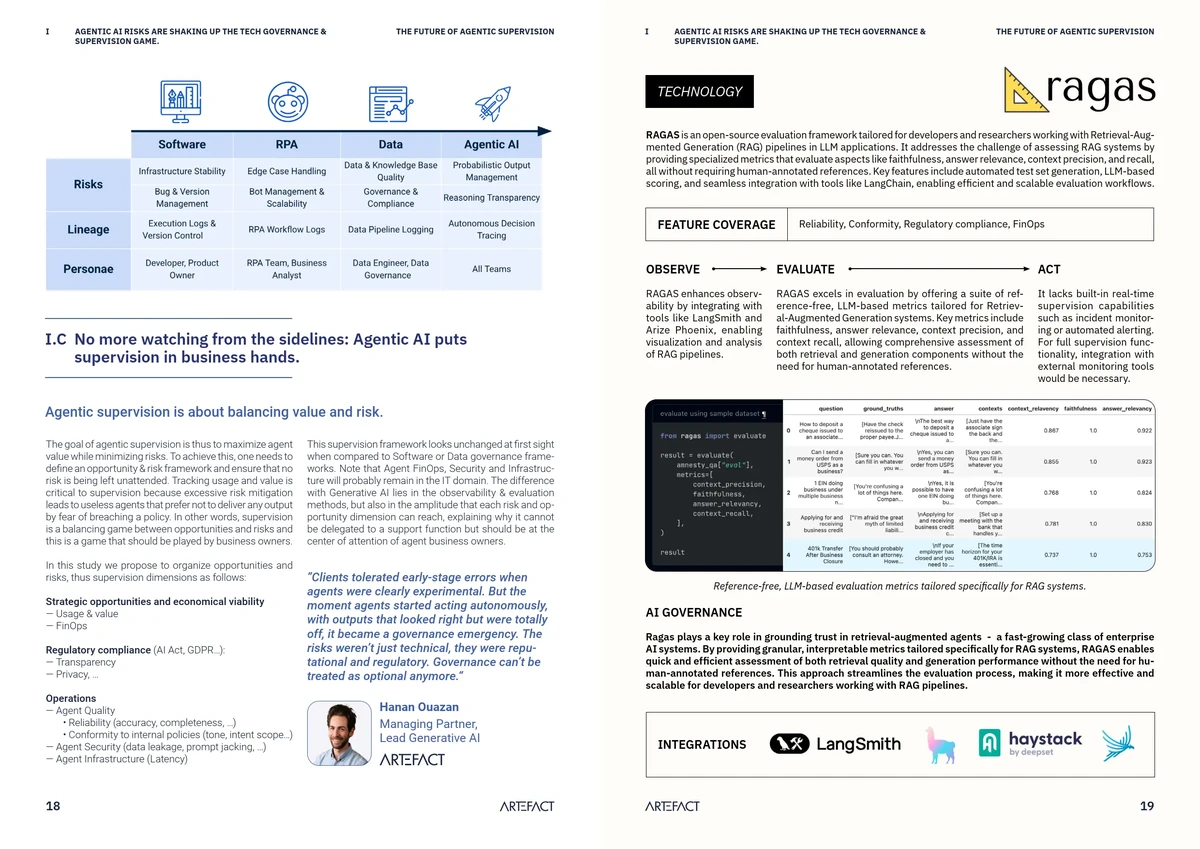

Comparing REST, WebSocket, and FIX APIs

| Feature | REST API | WebSocket API | FIX Protocol API |

|---|---|---|---|

| Speed | Moderate | High | Very High |

| Complexity | Low | Medium | High |

| Best For | Account management, data | Real-time trading, bots | Institutional investors |

| Accessibility | Widely available | Widely available | Limited |

Recommendation:

- Professional retail traders → WebSocket API for real-time execution.

- Institutional traders/hedge funds → FIX API for maximum performance.

- Hybrid users → Combine REST for account tasks and WebSocket for execution.

Key Features Professional Traders Should Look for in an API

- Low Latency – Execution must occur in milliseconds to avoid slippage.

- Robust Security – Endpoints should support encryption, rate-limiting, and strong authentication.

- Comprehensive Documentation – Exchanges must provide detailed guides. For traders wondering where to find the best API for perpetual futures, leading platforms like Binance Futures, Deribit, and OKX publish official API docs.

- Advanced Order Types – OCO (One Cancels the Other), trailing stops, and iceberg orders.

- High Reliability – Consistent uptime, even during market volatility.

- Customization Options – Ability to integrate with proprietary systems.

Comparison of different API types used in perpetual futures trading.

Security Considerations for API Trading

Professional traders must secure their API keys to prevent hacks and misuse:

- Use IP Whitelisting: Restrict API usage to specific IP addresses.

- Enable Withdrawal Restrictions: Disable fund withdrawals via API.

- Rotate Keys Regularly: Replace API keys periodically to reduce risks.

- Use Encrypted Storage: Keep keys safe in vaults or encrypted databases.

For deeper insights, explore how to secure API for perpetual futures trading, a crucial step for all professionals relying on automated systems.

Real-World Case Study: Professional API Trading

A hedge fund with $50 million AUM specializing in perpetual futures wanted to optimize execution.

- Challenge: Manual execution created latency and slippage.

- Solution: Integrated FIX API with co-located servers near the exchange’s data center.

- Result: Reduced latency by 80%, improved execution efficiency by 25%, and generated an additional $3 million annually through tighter spreads.

This highlights how APIs aren’t just tools—they’re competitive weapons in modern perpetual futures trading.

Future Trends in API Trading

- AI-Driven APIs: Integration of machine learning models for predictive order execution.

- Decentralized Perpetual Futures APIs: DeFi protocols offering on-chain APIs.

- Cross-Exchange Aggregators: APIs that route orders across multiple exchanges for best execution.

- Smart Order Routing (SOR): Automated API-based systems that dynamically find optimal liquidity.

These innovations will further empower professional traders in perpetual futures markets.

FAQ: API for Professional Traders in Perpetual Futures

1. How to use API for perpetual futures trading?

You can start by generating API keys on your chosen exchange, integrating them into your trading software, and coding strategies using REST or WebSocket endpoints. Professional traders often test in sandbox environments before deploying live capital.

2. What is the most reliable API type for professionals?

For real-time perpetual futures trading, WebSocket API is typically the most reliable due to low latency. For institutional-grade performance, the FIX protocol is preferred, but it may require special access.

3. Can I run multiple strategies simultaneously with one API key?

Yes, but it depends on exchange limitations. Many professionals generate multiple API keys per account to separate strategies, ensuring smoother operation and better risk control.

Conclusion

The API for professional traders in perpetual futures is more than just a convenience—it’s a necessity for competing in modern crypto markets. From REST to WebSocket to FIX, different options serve different needs. By leveraging APIs, professionals can achieve faster execution, smarter risk management, and scalable strategies.

For advanced traders, success lies in combining the right API type with robust security, tailored algorithms, and continuous optimization.

If this guide helped you, share it with your trading community, leave a comment about your favorite API integration, and let’s build a stronger professional trading network together.

Would you like me to create a step-by-step integration tutorial (with sample Python code) showing how to connect to a major exchange’s perpetual futures API?