==============================================================

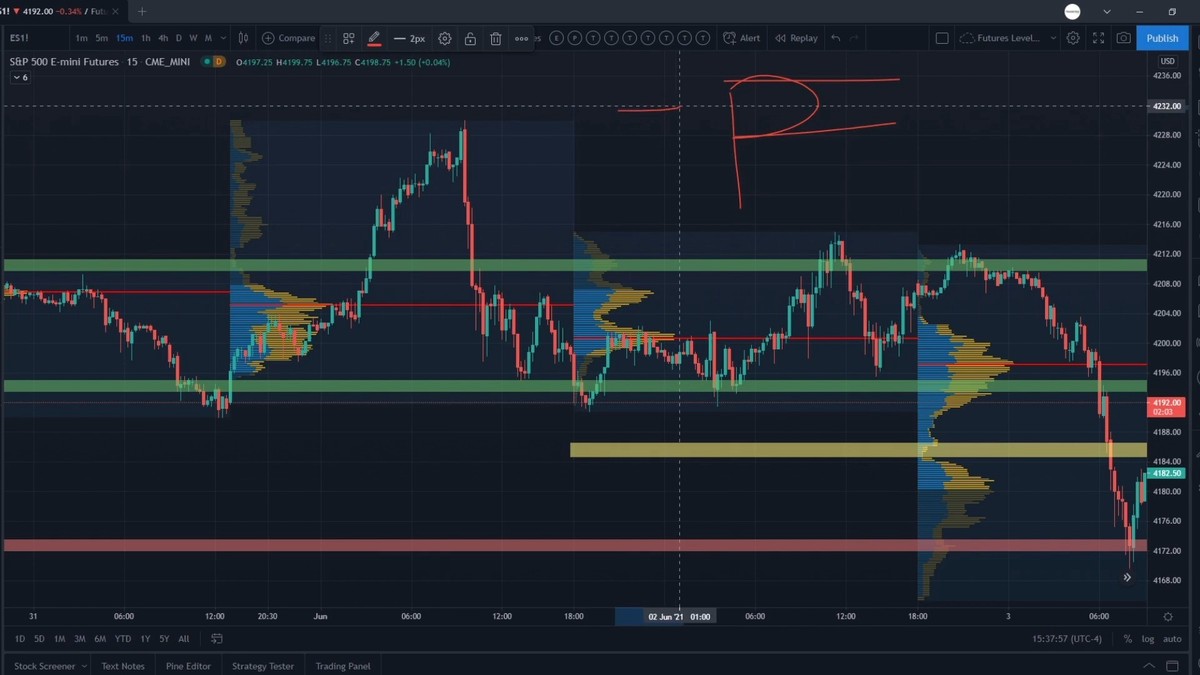

Day trading perpetual futures has become one of the most popular trading styles among cryptocurrency and derivatives traders. These instruments offer the flexibility of no expiry date, continuous funding payments, and high leverage. However, while the potential for profits is significant, the risk of loss is equally amplified. For this reason, understanding approaches to minimize losses in day trading perpetual futures is essential for both beginners and advanced traders who want to stay profitable in volatile markets.

This article explores proven methods to reduce losses, compares different strategies, and highlights the latest trends in risk management for perpetual futures traders. Drawing from professional trading practices, psychological insights, and market innovations, it delivers a full framework for sustainable day trading.

Understanding the Risk of Day Trading Perpetual Futures

Day trading perpetual futures involves entering and closing positions within the same trading day. Unlike spot trading, perpetual futures use leverage and continuous funding, making them highly sensitive to market volatility.

The main risks traders face include:

- Leverage-induced losses – even small price fluctuations can lead to liquidation.

- Funding fees – costs that can erode profits during high volatility.

- Emotional trading – impulsive decisions that ignore strategy.

- Overexposure – risking too much on a single trade.

To succeed, traders must adopt structured plans to minimize losses while maintaining opportunities for profit.

Key Approaches to Minimize Losses in Day Trading Perpetual Futures

1. Effective Risk Management Rules

The foundation of minimizing losses lies in strict risk management.

- Fixed Percentage Rule: Risk no more than 1–2% of your capital per trade. This ensures survival even during losing streaks.

- Leverage Adjustment: Lower leverage (3x–5x) significantly reduces liquidation risk compared to extreme levels (20x+).

- Stop-Loss Placement: Use technical indicators such as ATR (Average True Range) to set dynamic stop-losses that adapt to volatility.

Stop-loss orders help traders prevent catastrophic losses in leveraged markets

2. Diversification of Trading Strategies

Relying on a single strategy exposes traders to higher risk. A diversified approach involves:

- Combining trend-following and mean-reversion systems.

- Using both manual and automated trading tools for balance.

- Avoiding overconcentration in one asset (e.g., trading both BTC and ETH perpetual futures).

This helps reduce losses when one approach underperforms.

3. Scalping vs. Swing Day Trades

Different day trading styles offer varied risk–reward dynamics.

Scalping

- Pros: Quick profits from small moves, lower overnight risks.

- Cons: Requires intense focus, higher trading fees, psychological stress.

Intraday Swing Trading

- Pros: Fewer trades, better suited for trending markets.

- Cons: Higher exposure to volatility within the trading day.

Traders should test both and choose based on personality and risk tolerance.

4. Using Technical and Quantitative Tools

Modern day traders rely on data-driven tools to reduce losses:

- Risk calculators for position sizing.

- Volatility indicators (e.g., Bollinger Bands, ATR).

- Order flow analytics for perpetual futures exchanges.

- Balance tracking dashboards to monitor equity and margin usage.

These tools provide a structured decision-making framework, reducing emotional bias.

5. Psychological Discipline

Even the best strategy fails without discipline. Successful traders:

- Avoid revenge trading after losses.

- Stick to pre-planned setups.

- Accept small losses as part of the system.

Emotional stability is a hidden yet powerful method of loss minimization.

| Section | Key Points |

|---|---|

| Introduction | Day trading perpetual futures offers high leverage and profit potential but high risk |

| Understanding Risks | Leverage losses, funding fees, emotional trading, and overexposure are main risks |

| Risk Management Rules | Fixed 1–2% capital risk, lower leverage, dynamic stop-loss using ATR |

| Diversification | Combine trend-following and mean-reversion, manual/automated trading, multiple assets |

| Scalping vs Swing | Scalping: quick, lower overnight risk; Swing: fewer trades, more exposure |

| Technical Tools | Risk calculators, volatility indicators, order flow analytics, balance dashboards |

| Psychological Discipline | Avoid revenge trading, stick to setups, accept small losses |

| Conservative Strategy | Low risk per trade, low leverage, stop-loss always used, fewer trades |

| Conservative Pros/Cons | Pros: capital preservation, low stress; Cons: slower profit growth, requires patience |

| Active Hedging Strategy | Hedge correlated assets, limits downside, monitor correlations |

| Hedging Pros/Cons | Pros: reduces exposure, stay active; Cons: complex, may cap profits |

| Comparative Evaluation | Conservative: beginner-friendly, low complexity, strong sustainability; Hedging: high complexity, professional use |

| Risk Management Practices | Limit position size, withdraw profits, avoid low-liquidity hours, track performance |

| Industry Trends | AI bots, volatility-based margin, copy trading, dynamic stop-loss algorithms |

| FAQs | Beginners: use conservative strategy; Hedging for advanced traders; Handle emotional losses with structured plans |

| Conclusion | Structured risk strategies, tools, and discipline reduce losses and support long-term profitability |

Features

- Risk per trade: 0.5–1%.

- Leverage: 2x–5x.

- Stop-loss: Always used.

- Trading style: Fewer, high-confidence trades.

Pros

- Strong capital preservation.

- Low psychological stress.

- Sustainable for long-term growth.

Cons

- Slower profit growth.

- Requires patience and discipline.

Method 2: Active Hedging Strategy

Features

- Uses correlated assets to hedge (e.g., long BTC futures, short ETH futures).

- Limits downside during volatility spikes.

- Requires monitoring correlation shifts.

Pros

- Reduces net exposure.

- Allows traders to stay active during uncertain markets.

Cons

- Complex to execute.

- May cap potential profits.

Comparative Evaluation

| Criteria | Conservative Risk Strategy | Active Hedging Strategy |

|---|---|---|

| Capital Preservation | Excellent | Moderate |

| Complexity | Low | High |

| Best for Beginners? | ✅ Yes | ❌ No |

| Adaptability | Moderate | High |

| Long-Term Sustainability | Strong | Medium |

Recommendation: For most traders, especially beginners, the conservative strategy provides better long-term results. Hedging works best for professionals with strong market correlation knowledge.

How to Manage Risk in Day Trading for Perpetual Futures

Risk management is central to avoiding account blowouts. Traders should:

- Limit position sizes to a small percentage of account balance.

- Regularly withdraw profits to secure gains.

- Avoid trading during low-liquidity hours where volatility is erratic.

- Track performance with journals and analytics.

This principle aligns with the core theme of solutions for risk management in day trading perpetual futures, giving traders practical frameworks for consistency.

Latest Industry Trends in Loss Minimization

- AI-driven bots that adapt leverage in real time.

- Volatility-based margin requirements implemented by exchanges.

- Copy trading systems with built-in risk management templates.

- Dynamic stop-loss algorithms that adjust to order flow.

Market volatility requires dynamic approaches to minimize losses in perpetual futures day trading

FAQ: Minimizing Losses in Day Trading Perpetual Futures

1. What’s the safest way to minimize losses for beginners?

Start with a conservative risk strategy: low leverage (2x–3x), strict stop-losses, and risking no more than 1% per trade. Beginners should also use demo accounts before trading real capital.

2. Should I use hedging as a loss-minimization approach?

Hedging can be effective, but it’s more suitable for advanced traders. Beginners may struggle with correlation shifts and execution timing. For new traders, focus on simple risk rules before adding hedging.

3. How can I handle emotional losses in perpetual futures?

The best solution is structured trading: predefine entry, exit, and risk levels. Additionally, take regular breaks, avoid overtrading, and maintain a trading journal to identify emotional triggers.

Conclusion: Building a Sustainable Framework for Loss Minimization

Day trading perpetual futures offers both opportunity and danger. Without structured approaches, traders risk liquidation and emotional burnout. By adopting conservative risk strategies, active hedging methods, technical tools, and disciplined psychology, traders can significantly reduce losses and build long-term profitability.

Whether you’re a beginner learning how to practice day trading in perpetual futures or an advanced trader refining your system, the key lies in consistency and discipline.

Trader analyzing risk exposure in perpetual futures to minimize losses effectively

💬 Which strategies do you use to minimize losses in day trading perpetual futures? Share your insights in the comments below and help others build stronger trading plans. Don’t forget to share this article with fellow traders to spread knowledge and promote sustainable trading practices!