=================================================================================

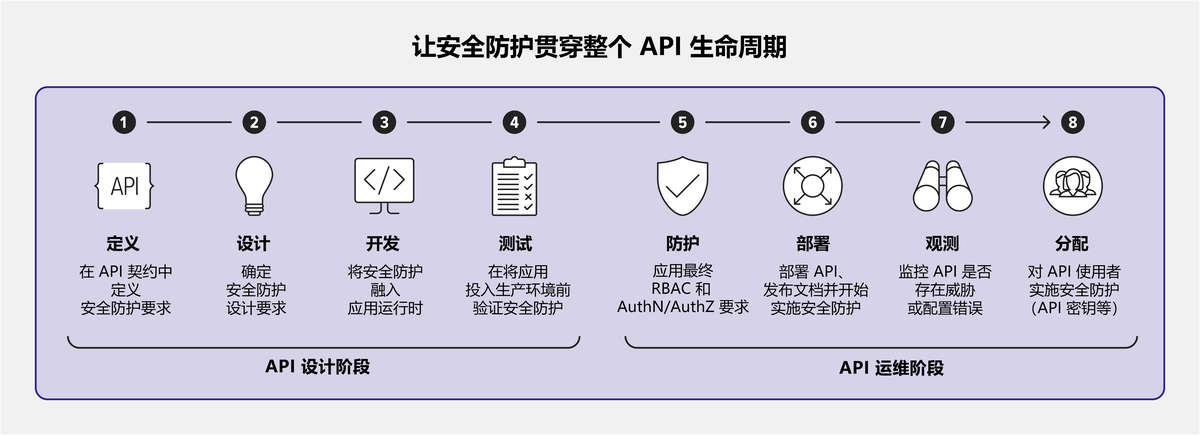

Introduction

The rise of perpetual futures trading has transformed the way institutions, professional traders, and retail investors manage risk and leverage opportunities. However, as more trading operations rely on APIs (Application Programming Interfaces) for automation, data integration, and algorithmic execution, security risks have grown significantly. From API key leaks to man-in-the-middle attacks, vulnerabilities can cost traders not only profits but also their entire capital base.

This article explores API security solutions for perpetual futures, evaluating multiple approaches, highlighting their pros and cons, and recommending best practices. It is designed for both technical and non-technical readers who want to secure their trading workflows while maintaining performance and flexibility.

Why API Security Matters in Perpetual Futures

The Growing Role of APIs

Modern perpetual futures platforms depend on APIs for everything from order placement to real-time market data streaming. Professional traders use them to deploy trading bots, hedge strategies, and connect with external analytics systems. For institutions, APIs are critical for scaling execution speed and maintaining liquidity operations.

Key Security Threats Traders Face

- API Key Theft – Attackers can hijack credentials to make unauthorized trades.

- Data Interception – Without encryption, sensitive order flows can be intercepted.

- DDoS and Rate Limit Abuse – Exploits can freeze or slow down trading systems.

- Malicious Bots – Fake API requests designed to drain liquidity or distort prices.

Without robust security, the same technology that enables efficient trading can become the biggest risk to trader funds.

| Section | Key Points |

|---|---|

| Introduction | Perpetual futures rely on APIs, raising security risks |

| Importance of API Security | APIs enable automation, speed, and liquidity management |

| Key Threats | API key theft, data interception, DDoS, malicious bots |

| Solution 1: MFA & Key Management | Use separate keys, IP whitelisting, rotate keys regularly |

| Solution 1 Pros | Easy, reduces key theft risk |

| Solution 1 Cons | Cumbersome for multiple bots, requires disciplined workflow |

| Solution 2: End-to-End Encryption | Encrypt market data, orders, logs, backups |

| Solution 2 Pros | Protects data, ensures compliance |

| Solution 2 Cons | Minor latency, needs proper configuration |

| Solution 3: Rate Limiting | Throttle requests to prevent overload and abuse |

| Solution 3 Pros | Ensures system stability, avoids penalties |

| Solution 3 Cons | May slow high-frequency trading if misconfigured |

| Solution 4: Zero-Trust Architecture | Validate all API requests, monitor behavior in real-time |

| Solution 4 Pros | Blocks unauthorized access, detects anomalies |

| Solution 4 Cons | High cost, complex setup |

| Strategy Comparison | Key Management + Encryption for retail, add Zero-Trust for institutions |

| Retail Workflow | Separate read-only keys, IP whitelist, encrypted vaults, monitor logs |

| Institutional Workflow | Zero-trust firewalls, TLS encryption, SIEM tools, staff training |

| Community Insights | APIs essential for automation, speed, and advanced strategies |

| FAQ 1 | Prevent hacks via separate keys, IP restrictions, secure storage |

| FAQ 2 | Minor latency, optimize feeds for high-frequency bots |

| FAQ 3 | Retail uses key management/encryption; institutions need Zero-Trust/SIEM |

| Conclusion | Layered API security protects funds; retail focus on keys/encryption, institutions add Zero-Trust |

1. Multi-Factor Authentication and Key Management

Most perpetual futures exchanges issue API keys with role-based permissions (read-only, trade, withdrawal). However, relying on just one API key is insufficient.

Best Practices:

- Use separate API keys for each application.

- Enable IP whitelisting to restrict key usage to specific servers.

- Rotate keys regularly to reduce exposure.

- Use separate API keys for each application.

Pros:

- Easy to implement.

- Strongly reduces risk of stolen keys.

- Easy to implement.

Cons:

- Can be cumbersome for traders managing multiple bots.

- Requires disciplined operational workflows.

- Can be cumbersome for traders managing multiple bots.

2. End-to-End Data Encryption

Encryption ensures that market data streams, trade orders, and execution confirmations cannot be intercepted. Using TLS/SSL connections is now standard, but traders should also consider encrypting logs and backups.

Pros:

- Protects sensitive trading data from surveillance.

- Essential for compliance in institutional environments.

- Protects sensitive trading data from surveillance.

Cons:

- Slight increase in latency (though negligible with modern networks).

- Requires proper configuration to avoid weak ciphers.

- Slight increase in latency (though negligible with modern networks).

3. Rate Limiting and Throttling Controls

APIs in perpetual futures often face bot abuse and overload attacks. Exchanges provide rate limits, and traders should implement throttling to prevent system failures.

Pros:

- Prevents overload and ensures stability.

- Helps avoid exchange penalties for abuse.

- Prevents overload and ensures stability.

Cons:

- Can limit speed for high-frequency traders if misconfigured.

- Can limit speed for high-frequency traders if misconfigured.

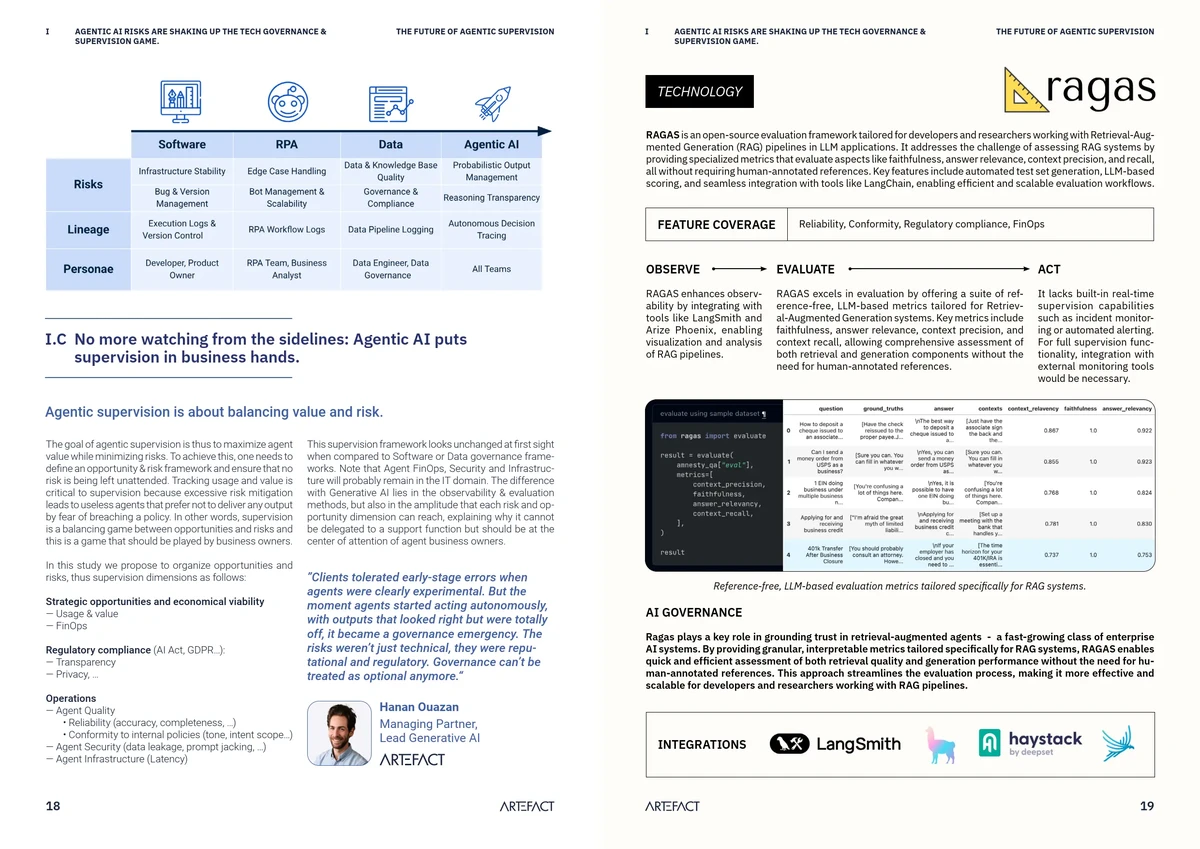

4. Zero-Trust Security Architecture

Instead of trusting any single API request, a zero-trust model validates each connection based on identity, behavior, and real-time monitoring.

Pros:

- Blocks insider threats and unauthorized third-party access.

- Detects unusual request patterns.

- Blocks insider threats and unauthorized third-party access.

Cons:

- Requires advanced monitoring infrastructure.

- Higher implementation cost for retail traders.

- Requires advanced monitoring infrastructure.

API Security Architecture for Perpetual Futures

Comparing API Security Strategies

| Strategy | Suitable For | Advantages | Limitations |

|---|---|---|---|

| API Key Management | All traders | Simple, cost-free, reliable | Manual overhead |

| Encryption | Institutions, Algo traders | Protects data, compliance-ready | Minor latency impact |

| Rate Limiting | Exchanges, Developers | Prevents overload, stabilizes API | Can slow high-frequency execution |

| Zero-Trust | Institutions, Hedge funds | Advanced anomaly detection | Costly, complex setup |

For most risk-averse traders, the best approach is to combine key management + encryption, while institutional players should consider adding zero-trust security monitoring.

Practical Integration: From Concept to Execution

Example Workflow: Retail Trader

- Create separate read-only API keys for data analysis.

- Use IP whitelisting for trading bots.

- Store keys in encrypted password vaults (e.g., HashiCorp Vault).

- Monitor API logs daily for anomalies.

Example Workflow: Institutional Desk

- Deploy zero-trust firewalls between trading apps and exchange APIs.

- Enforce TLS encryption for all inbound and outbound requests.

- Integrate SIEM (Security Information and Event Management) tools for auditing.

- Train staff on phishing and credential risks.

Related Insights from the Trading Community

A common question among new traders is: “Why API is essential for perpetual futures?” The answer lies in automation, speed, and flexibility. APIs reduce manual errors, enable advanced strategies, and integrate seamlessly with trading bots.

Similarly, professionals exploring advanced solutions often ask: “How to secure API for perpetual futures trading?” As highlighted above, security requires a layered approach—combining strong authentication, encryption, and monitoring for maximum protection.

Perpetual Futures API Workflow

FAQ: API Security in Perpetual Futures

1. How do I prevent my API keys from being hacked?

Use separate keys for different tasks, apply IP restrictions, and never share keys in public repositories. Tools like AWS Secrets Manager or HashiCorp Vault provide secure key storage.

2. Can API security slow down my trading bots?

Not significantly. While encryption and monitoring introduce minor latency, the trade-off is well worth the security. For high-frequency strategies, optimize requests and use low-latency data feeds.

3. What’s the difference between API security for retail vs. institutional traders?

Retail traders usually rely on API key management and encryption, while institutions need zero-trust frameworks, SIEM systems, and compliance audits due to larger exposure and regulatory requirements.

Conclusion

In perpetual futures trading, APIs are both the engine of innovation and the primary attack surface. By implementing API security solutions for perpetual futures, traders can protect their funds, data, and reputation.

For retail traders, focus on key management and encryption. For institutions, invest in zero-trust frameworks and monitoring. Ultimately, a layered defense strategy is the best way to safeguard against evolving threats.

🚀 If you found this guide valuable, share it with fellow traders, drop your experiences in the comments, and let’s build a more secure trading ecosystem together.

Would you like me to also create infographic-style visuals (flowcharts + checklist graphics) for this article so it looks more professional for publishing on blogs?