========================================================

Backtesting is one of the most critical steps for traders who want to develop profitable strategies in the cryptocurrency market. Unlike traditional assets, perpetual futures add an extra layer of complexity due to funding rates, high volatility, and around-the-clock trading. Understanding how to backtest perpetual futures strategies effectively can be the difference between consistent profits and painful losses.

This comprehensive guide explains the core principles, methods, and tools for backtesting perpetual futures strategies. It also compares different approaches, highlights real-world challenges, and provides a practical framework to ensure your results are both accurate and actionable.

What Is Backtesting in Perpetual Futures?

Backtesting is the process of simulating how a trading strategy would have performed in the past using historical data. In perpetual futures, it allows traders to measure risk, profitability, and execution performance before risking real capital.

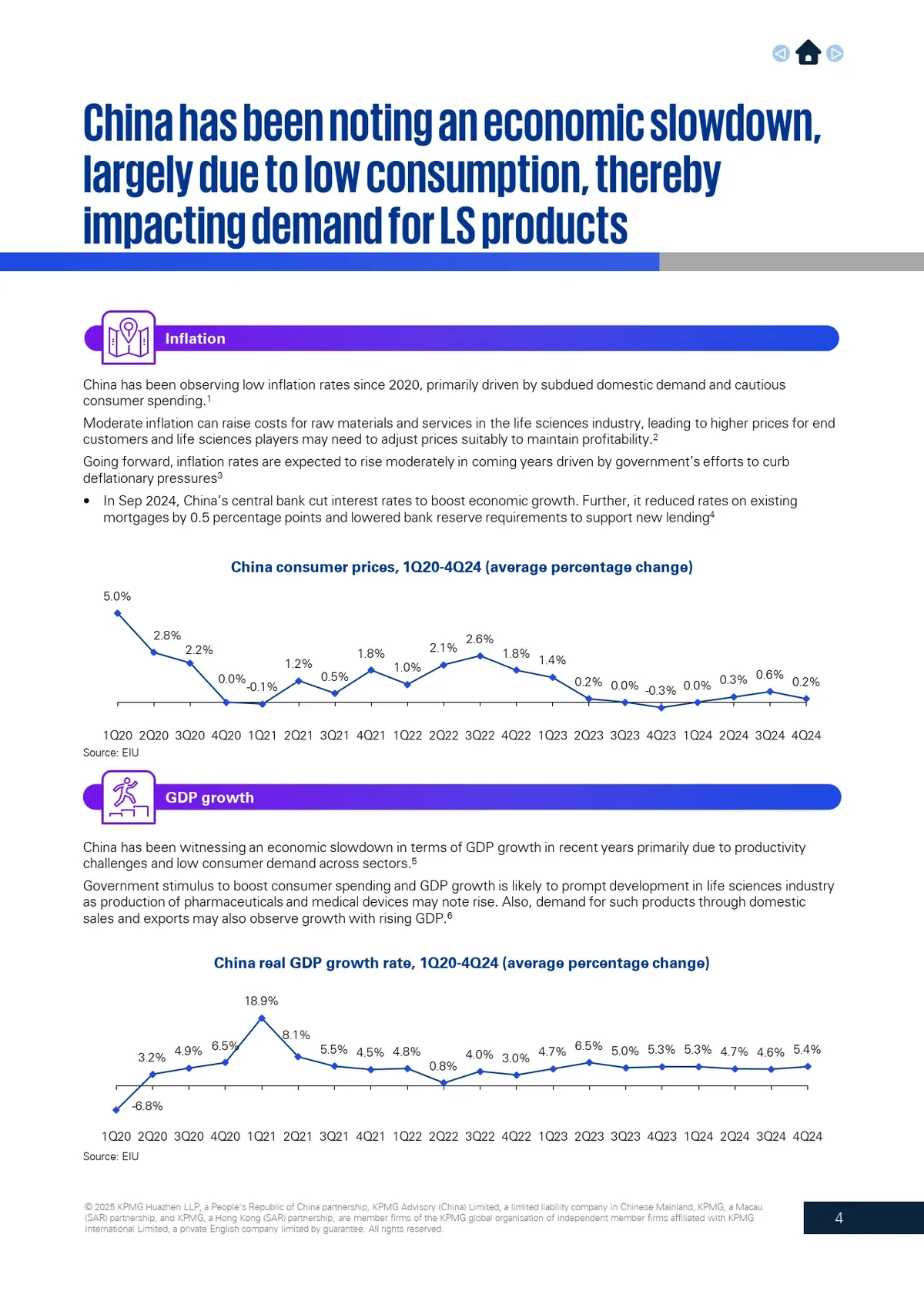

Why Backtesting Is Different in Perpetual Futures

- Funding Rates: Traders must account for periodic funding payments between longs and shorts.

- Continuous Trading: Unlike traditional futures, perpetual contracts never expire.

- High Leverage: Amplifies both profits and losses, making precise modeling essential.

- Market Microstructure: Order book depth and slippage affect real-world execution.

A typical backtesting workflow for perpetual futures strategies.

Why Backtesting Matters in Perpetual Futures

A well-structured backtest helps traders avoid costly mistakes. Here’s why it’s essential:

- Risk Management: Prevents over-leveraging by stress-testing strategies.

- Performance Validation: Confirms whether an edge exists or if results are random.

- Market Adaptation: Identifies how strategies perform under different conditions (bull, bear, sideways).

- Confidence Building: Reduces psychological stress during live trading.

Many traders explore resources on why use backtesting in perpetual futures strategy before committing serious capital, as it provides objective insights into strategy performance.

Steps to Backtest Perpetual Futures Strategies Effectively

1. Define Your Strategy Clearly

Before testing, specify:

- Entry and exit conditions.

- Stop-loss and take-profit levels.

- Position sizing rules.

- Leverage used.

A vague strategy cannot be tested effectively.

2. Choose the Right Data

High-quality data is the backbone of effective backtesting.

- Tick Data: Best for scalping or high-frequency strategies.

- Minute-Level Data: Ideal for intraday trading.

- Hourly/Daily Data: Useful for swing strategies.

Pro tip: Always include funding rate history, as it significantly affects long-term profitability.

3. Select a Backtesting Method

Historical Simulation

This method applies your strategy to historical price data.

- Pros: Easy to implement, widely available.

- Cons: May not capture slippage, liquidity, or order execution.

Monte Carlo Simulation

Randomly shuffles or perturbs data to test robustness.

- Pros: Helps avoid curve-fitting.

- Cons: More complex and computationally heavy.

Walk-Forward Analysis

Splits data into training and testing periods to mimic live trading.

- Pros: Reduces overfitting risk.

- Cons: Time-intensive, requires more coding.

4. Account for Trading Costs

- Funding Fees: Periodic payments depending on market imbalance.

- Trading Fees: Maker/taker fees charged by exchanges.

- Slippage: Price difference between intended and executed order.

Ignoring these can lead to unrealistic profitability projections.

5. Analyze Key Metrics

When reviewing results, focus on:

- Win Rate: Percentage of profitable trades.

- Profit Factor: Ratio of gross profit to gross loss.

- Max Drawdown: Largest peak-to-trough decline.

- Sharpe Ratio: Return relative to volatility.

- Annualized ROI: Long-term profitability.

6. Avoid Overfitting

Overfitting happens when your strategy works only on past data but fails in live markets.

- Use out-of-sample testing.

- Apply cross-validation across multiple market regimes.

- Keep strategies simple—complex doesn’t always mean better.

Key metrics traders must analyze when backtesting perpetual futures strategies.

Methods Compared: Manual vs. Automated Backtesting

Manual Backtesting

You replay charts and record trade outcomes manually.

- Pros: Builds deep understanding of market behavior.

- Cons: Time-consuming, prone to human bias.

Automated Backtesting

You run code that executes trades on historical data automatically.

- Pros: Fast, accurate, repeatable.

- Cons: Requires coding skills and reliable data sources.

For serious traders, how to automate perpetual futures backtesting is a crucial skill, often achieved with Python libraries like Backtrader, Zipline, or custom exchange APIs.

Real-World Backtesting Example

Suppose you design a mean-reversion strategy on BTC perpetual futures:

- Buy when price deviates -2% below 20-period moving average.

- Sell when price returns to mean.

- Use 3x leverage.

Backtest results (2019–2022):

- Win Rate: 62%.

- Profit Factor: 1.8.

- Max Drawdown: 18%.

- Annualized ROI: 45%.

However, after including funding fees and slippage, ROI dropped to 28%—still profitable, but highlighting the importance of realistic assumptions.

Challenges in Backtesting Perpetual Futures

- Data Quality Issues: Incomplete or inaccurate funding data.

- Execution Assumptions: Real-world liquidity may differ from backtest.

- Market Regimes: Strategies that work in bull markets may fail in bears.

- Psychological Gap: Traders may not execute strategies exactly as backtested.

Best Practices for Effective Backtesting

- Always include fees and funding rates.

- Test across multiple time periods and market regimes.

- Combine historical simulation with walk-forward testing.

- Validate results with out-of-sample data.

- Start with small live capital after backtesting success.

Many professionals emphasize how backtesting improves perpetual futures trading because it allows them to refine systems before real execution, reducing costly trial-and-error in live markets.

Best practices ensure realistic and reliable backtest results.

Personal Experience with Backtesting

When I first backtested perpetual futures strategies, I made the mistake of ignoring funding fees. My results looked outstanding on paper, but live trading was disappointing. After adjusting my models to include funding, my strategies became more realistic and stable.

Over time, I’ve found that combining automated backtesting with walk-forward validation provides the most reliable results. While slower, this method avoids overfitting and better prepares strategies for live conditions.

FAQ on Backtesting Perpetual Futures Strategies

1. What is the biggest mistake traders make when backtesting?

The most common mistake is ignoring trading costs like funding and slippage. This leads to over-optimistic results that fail in live markets.

2. Can beginners backtest perpetual futures strategies without coding?

Yes. Platforms like TradingView and specialized backtesting software offer point-and-click backtesting. However, coding provides more flexibility and accuracy.

3. How much historical data is enough for reliable backtesting?

At least 2–3 years of data is recommended, covering multiple bull and bear cycles. The more diverse the data, the better your strategy can adapt to changing conditions.

Conclusion

Learning how to backtest perpetual futures strategies effectively is one of the most valuable skills for crypto traders. Backtesting validates strategies, improves risk management, and provides confidence before trading live capital.

By combining solid data, realistic cost assumptions, and robust testing frameworks, traders can refine their systems to achieve long-term profitability in perpetual futures markets.

👉 Have you tried backtesting your perpetual futures strategies? Share your experiences in the comments, and don’t forget to share this guide with others who want to improve their trading edge.