======================================================

Introduction

In professional trading, success depends not only on intuition or market experience but also on robust data-driven validation. For perpetual futures, where leverage, volatility, and continuous funding mechanics create unique risks, backtesting for professional perpetual futures traders is indispensable. By simulating strategies on historical data, traders can evaluate profitability, manage risk exposure, and refine execution models before risking real capital.

This article provides a deep dive into backtesting solutions for perpetual futures, highlights advanced methodologies, compares strengths and weaknesses, and offers best practices from both industry experience and recent innovations.

Why Backtesting Matters in Perpetual Futures

Strategy Validation

Backtesting ensures that trading strategies are not just theoretically profitable but have been stress-tested across diverse market conditions.

Risk Management

By analyzing historical drawdowns, volatility, and risk-adjusted returns, traders can avoid strategies prone to catastrophic losses.

Efficiency and Confidence

Well-designed backtests improve trader confidence, accelerate decision-making, and reduce costly trial-and-error in live markets.

In fact, why use backtesting in perpetual futures strategy is simple: without empirical testing, even the most sophisticated models risk failing under real-world pressure.

Backtesting workflow illustration

Key Components of a Robust Backtesting Framework

1. Historical Data Quality

- Granularity: Tick-level or 1-second data for high-frequency strategies.

- Accuracy: Adjusted for contract specifications, corporate actions (if cross-asset), and exchange-specific nuances.

- Completeness: Includes funding rates, order book depth, and liquidity snapshots.

2. Execution Simulation

Backtests must account for:

- Slippage (price difference between expected and executed order).

- Latency in order placement.

- Liquidity constraints (order book depth, market impact).

3. Performance Metrics

Key measures include:

- Sharpe Ratio, Sortino Ratio

- Maximum Drawdown

- Win Rate & Profit Factor

- Annualized Volatility

4. Risk Scenarios

Professional traders stress-test strategies across bull, bear, and sideways markets, ensuring resilience in all conditions.

Two Backtesting Approaches for Professional Perpetual Futures Traders

1. Event-Driven Backtesting

This method processes market data sequentially, reacting to each tick, order, or trade in real time.

Advantages:

- High realism, mimicking live trading.

- Captures intraday volatility, slippage, and liquidity.

- Ideal for algorithmic and high-frequency perpetual futures traders.

Disadvantages:

- Computationally intensive.

- Requires well-structured coding frameworks (Python, C++, or proprietary platforms).

- Sensitive to incomplete or noisy data.

2. Statistical/Monte Carlo Backtesting

Instead of simulating tick-by-tick execution, Monte Carlo methods create randomized paths of historical returns to test robustness.

Advantages:

- Reveals strategy sensitivity to randomness.

- Identifies worst-case drawdowns not visible in historical-only simulations.

- Helps in portfolio-level risk management.

Disadvantages:

- Less accurate for execution-heavy strategies.

- Requires expertise in quantitative finance.

- Computationally complex for large datasets.

Comparing Event-Driven vs. Monte Carlo Backtesting

| Feature | Event-Driven | Monte Carlo |

|---|---|---|

| Realism | High | Moderate |

| Execution Modeling | Precise | Approximate |

| Computational Load | Heavy | Moderate |

| Risk Coverage | Limited to history | Expands beyond history |

| Best For | High-frequency & algorithmic traders | Institutional portfolio managers |

Recommendation: For perpetual futures, where execution, leverage, and volatility are critical, event-driven backtesting provides the most accurate results. However, supplementing with Monte Carlo analysis offers deeper risk insights.

Tools and Platforms for Professional Backtesting

- Python libraries: Backtrader, Zipline, QuantConnect (customizable for perpetual futures).

- Institutional software: AlgoTrader, MultiCharts, QuantHouse.

- Exchange APIs: Binance, Bybit, and CME provide direct data feeds for real-time backtesting.

- Custom frameworks: Many professional traders build proprietary engines for higher speed and tailored features.

For those just starting, exploring where to find perpetual futures backtesting tools can lead to both open-source frameworks and institutional-grade platforms.

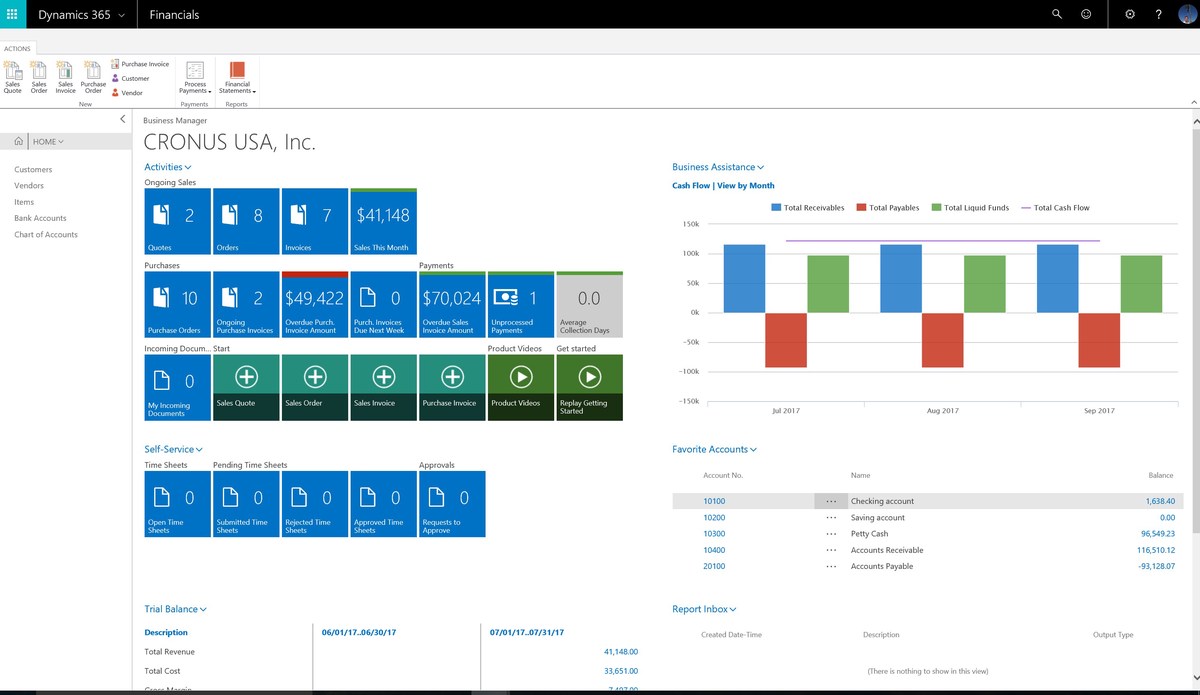

Backtesting software interface example

Industry Trends in Backtesting for Perpetual Futures

AI-Powered Backtesting

Machine learning models are increasingly used to simulate adaptive strategies and optimize position sizing.

Real-Time Backtesting

Streaming data solutions allow traders to test strategies on live tick data while markets operate.

Cloud-Native Systems

Scalable backtesting environments with distributed computing are reducing simulation time from days to hours.

Integration with Risk Engines

Advanced setups integrate VaR (Value at Risk) and expected shortfall directly into backtests.

Case Studies

Hedge Fund Example

A global hedge fund reduced strategy deployment errors by 40% after implementing event-driven backtesting across perpetual futures portfolios.

Proprietary Trading Desk

By incorporating slippage and funding costs in backtests, one prop desk avoided overestimating annual returns by 15%.

Crypto Quant Firm

A quant firm used Monte Carlo simulations to identify strategy failure points, helping limit leverage in high-volatility conditions.

FAQ: Backtesting for Professional Perpetual Futures Traders

1. How often should backtesting be performed?

Professional traders should backtest strategies before deployment and re-run tests whenever market conditions shift. Continuous revalidation is essential in perpetual futures due to volatile funding rates and evolving liquidity.

2. Can backtesting guarantee profitability?

No. Backtesting reveals historical feasibility and robustness, but real markets involve execution risks, regime changes, and black swan events. It should be combined with forward testing and paper trading.

3. What are the biggest mistakes professionals make in backtesting?

- Ignoring transaction costs and funding fees.

- Overfitting strategies to historical data.

- Using incomplete or low-quality datasets.

- Failing to stress-test across multiple market scenarios.

Conclusion

Backtesting is the cornerstone of professional perpetual futures trading. Whether using event-driven or Monte Carlo approaches, traders gain critical insights into profitability, drawdowns, and resilience. While event-driven backtesting delivers the most accurate results for execution-heavy strategies, Monte Carlo simulations enhance robustness checks.

The most effective professionals use a hybrid approach—rigorous event-driven testing for execution validation, combined with stochastic stress testing for risk resilience.

To expand your knowledge, explore how backtesting improves perpetual futures trading, which dives deeper into practical benefits across various market regimes.

🚀 If this guide helped you refine your trading process, share it with your network, drop a comment about your backtesting experiences, and let’s push professional trading standards higher together!