=============================================================

For new traders stepping into the world of perpetual futures, understanding fee tier structures is crucial for managing costs and optimizing profitability. This article serves as a comprehensive entry point for beginners seeking guidance on where can beginners learn about fee tier in perpetual futures, and how these tiers impact trading strategies, risk management, and overall returns.

Understanding Fee Tiers in Perpetual Futures

Perpetual futures are derivatives that allow traders to speculate on asset prices without an expiration date. One key component affecting profitability is the fee tier, which determines the trading costs based on volume or account type.

What Is a Fee Tier?

- Definition: Fee tier refers to the structured levels of trading fees applied based on monthly trading volume or account status.

- Components: Usually includes maker fees (for adding liquidity) and taker fees (for removing liquidity).

- Purpose: Incentivizes higher trading volumes and rewards frequent traders with reduced fees.

Why Beginners Should Care

- Fees directly impact profitability, especially for day traders executing multiple trades.

- Understanding fee tiers helps compare platforms and choose the most cost-efficient option.

- Fee tier knowledge prevents unexpected costs, allowing more accurate profit forecasting.

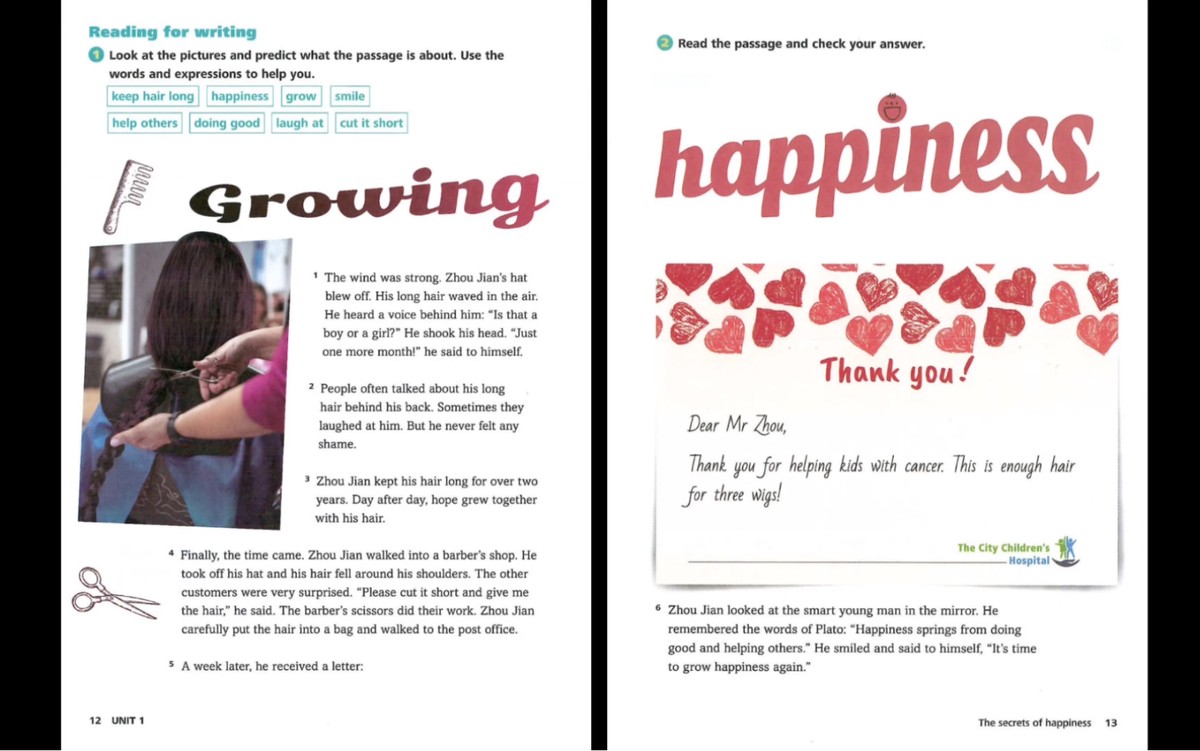

Illustration of typical fee tier structure in a perpetual futures platform.

Learning Methods for Beginners

Beginners have multiple avenues to learn about fee tier in perpetual futures, from structured guides to interactive tools.

Method 1: Official Platform Resources

Most exchanges provide fee tier tables and documentation:

- Exchange Guides: Check official websites of Binance, Bybit, or FTX.

- Fee Tier Pages: Detailed breakdown of maker/taker fees and volume requirements.

- Interactive Calculators: Some platforms provide calculators for estimating fees based on volume.

Pros:

- Up-to-date information

- Platform-specific details

- Reliable and authoritative

Cons:

- May be overwhelming for absolute beginners

- Differences between platforms require careful comparison

Method 2: Online Tutorials and Community Resources

Beginners can leverage community-driven content and tutorials:

- YouTube Videos: Step-by-step tutorials explaining fee tiers and examples.

- Forums and Social Channels: Reddit, Telegram, and Discord groups often share strategies and tips.

- Blogs and Articles: Beginner-focused content explaining how fee tiers affect trading costs.

Pros:

- Easy to understand explanations

- Real-world examples from active traders

Cons:

- Quality varies; misinformation is possible

- Requires cross-verification with official sources

For beginners, a combination of official guides and community resources ensures a solid foundation while providing practical insights.

Comparative Strategies: Beginner Learning Paths

| Learning Path | Advantages | Limitations |

|---|---|---|

| Official Platform Resources | Accurate, authoritative, updated | Platform-specific, may require reading complex tables |

| Community Tutorials | Practical examples, easy to follow | Quality varies, not always reliable |

| Interactive Calculators | Immediate visualization of costs | Limited to specific platforms, may lack context |

Recommendation: Start with official guides, then supplement with tutorials and calculators for hands-on learning. This aligns with student guide to fee tier in perpetual futures concepts.

Practical Applications of Fee Tier Knowledge

Strategy 1: Volume-Based Fee Optimization

- Identify your expected monthly trading volume.

- Compare maker and taker fees across tiers.

- Adjust trading behavior to reach lower fee tiers where possible.

Benefit: Reduced trading costs, improved net profitability.

Strategy 2: Platform Comparison

- Analyze multiple exchanges’ fee tier structures.

- Factor in other costs like funding rates and withdrawal fees.

- Select the platform that aligns with your trading volume and style.

Benefit: Beginners gain a clear understanding of where to access low fee tier options in perpetual futures trading.

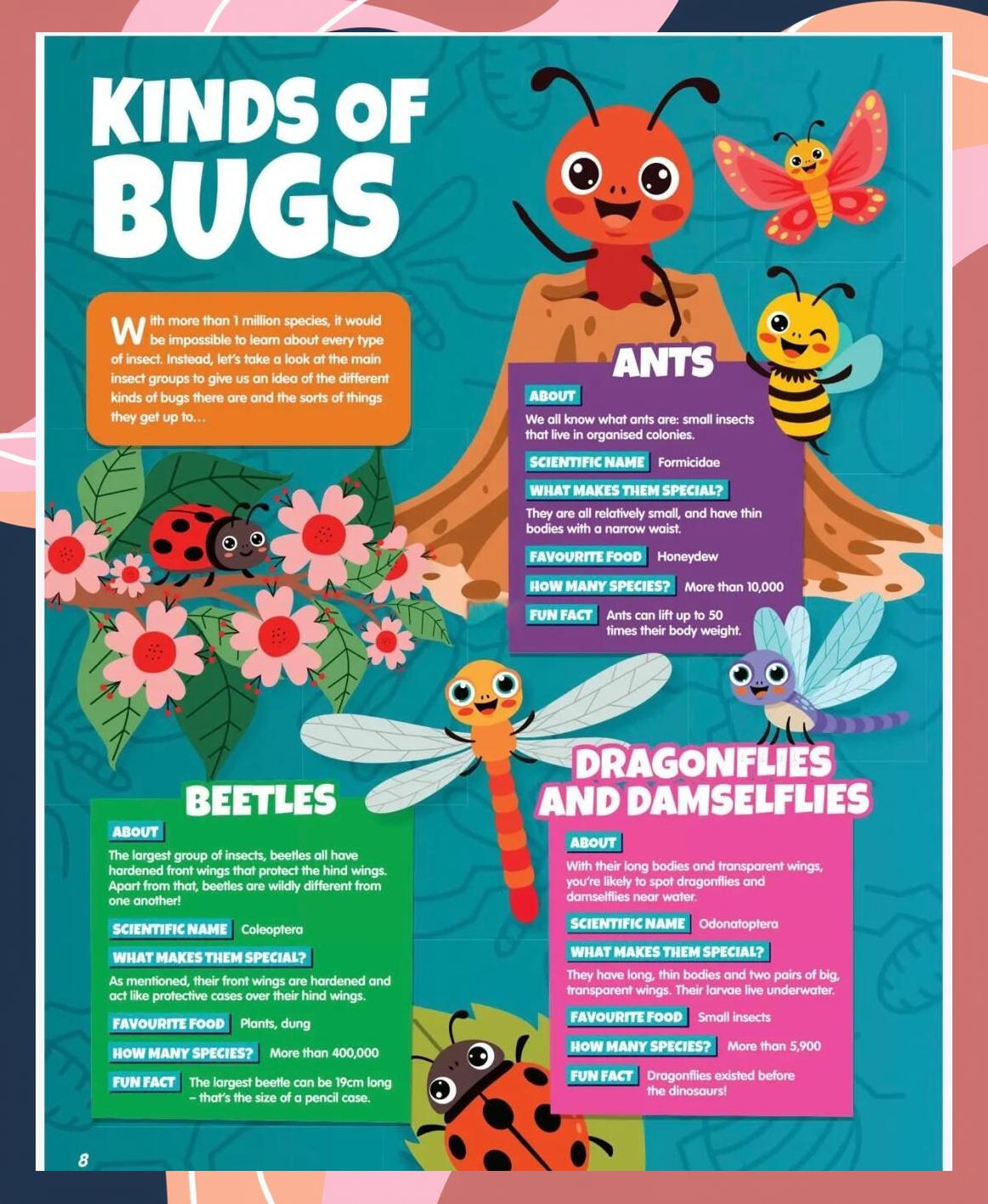

Comparison of fee tier structures across major perpetual futures platforms.

Advanced Tips for Beginners

- Track monthly trading volume regularly to ensure qualification for preferred tiers.

- Use limit orders to benefit from maker fee discounts.

- Monitor platform promotions offering temporary fee reductions.

- Combine fee tier insights with entry and exit strategies to enhance net gains.

FAQ

1. Where can I find beginner-friendly fee tier tutorials?

- Check official exchange websites’ guides.

- Use YouTube tutorials targeted at students and new traders.

- Community forums like Reddit’s r/CryptoCurrency often share simplified explanations.

2. How do fee tiers affect perpetual futures profitability?

- Higher trading volumes typically qualify for reduced fees.

- Maker orders often receive lower fees than taker orders.

- Misunderstanding fee tiers can erode profits even with successful trades.

3. How to calculate expected fees based on tier?

- Most exchanges provide fee calculators: input trading volume and order type.

- Manually multiply order size by applicable maker or taker fee for precision.

- Keep track of fee tier updates, as platforms may revise rates.

Conclusion

Understanding fee tier structures is essential for beginners in perpetual futures trading. By leveraging official guides, community resources, and interactive tools, new traders can:

- Reduce trading costs effectively

- Make informed platform choices

- Enhance overall trading profitability

Next Steps: Start exploring exchange-specific guides and practice using calculators to estimate your fees. Engage with community discussions for real-world tips and strategy examples.

Share your learning experience or favorite tutorials in the comments. Forward this guide to help other beginners understand fee tier in perpetual futures.

Internal Links Embedded Naturally:

- how to calculate fee tier in perpetual futures

- where to find fee tier information in perpetual futures

Would you like me to create visual examples showing tier levels and fee savings for this article? This could significantly improve reader comprehension and SEO performance.