==================================================

Introduction

For hedge fund managers, market volatility presents both opportunity and risk. During extreme fluctuations, automated trading systems and algorithmic models can amplify losses. This is where circuit breaker evaluation for hedge fund managers becomes critical. A well-designed circuit breaker acts as a safety mechanism that halts or slows trading activity during turbulent periods, protecting portfolios and maintaining market stability.

This article offers a detailed exploration of circuit breaker design, implementation strategies, evaluation techniques, and best practices tailored specifically for hedge fund managers. It integrates industry insights, real-world case studies, and comparisons between different approaches, providing a step-by-step framework for circuit breaker evaluation that enhances both performance and risk management.

What is a Circuit Breaker in Financial Trading?

A circuit breaker is a pre-programmed mechanism that temporarily halts or restricts trading once a security or market index moves beyond defined thresholds. Originally introduced in equities, circuit breakers are now common in derivatives, futures, and algorithmic trading systems.

Key objectives:

- Prevent panic selling during sharp downturns.

- Allow information absorption by market participants.

- Reduce systemic risk caused by automated feedback loops.

- Maintain liquidity stability in high-frequency environments.

For hedge fund managers, circuit breakers are not just compliance tools—they are integrated risk management instruments.

| Section | Key Points | Examples / Notes |

|---|---|---|

| Definition | Pre-programmed halt on extreme moves | Equities, derivatives, futures |

| Objectives | Prevent panic, absorb info, cut systemic risk, keep liquidity | Risk management tool |

| Importance | Impacts timing, robustness, exposure | Poor setup → losses, shocks |

| Step 1 | Define risk tolerance, strategy goals | Aggressive = wide, conservative = tight |

| Step 2 | Pick metrics: frequency, false signals, delay, drawdown | Performance benchmarks |

| Step 3 | Simulation & backtesting | 2008, COVID-19, Monte Carlo |

| Step 4 | Compare strategies | Price-move vs volatility-index |

| Price-Based | Trigger = % price change | Simple, transparent; misses intraday |

| Volatility-Based | Trigger = VIX threshold | Predictive; early stoppages |

| Step 5 | Real-time monitoring, AI tuning | Adaptive thresholds |

| Comparative | Price: easy, low predictive, equity use | Volatility: higher predictive, multi-asset |

| Case Study 1 | Equity fund, tiered 5-20% | 40% lower drawdown |

| Case Study 2 | Quant fund, VIX-based | Avoided risk, missed 15% profit |

| Advanced 1 | Adaptive thresholds | Based on depth, spreads, liquidity |

| Advanced 2 | Multi-layer breakers | Asset-specific calibration |

| Advanced 3 | ML-assisted breakers | Predictive crash signals |

| Best Practices | Tiered, cross-asset, post-event review, regulatory, stress tests | Black swan readiness |

| FAQ 1 | Evaluation frequency | Quarterly, monthly in volatility |

| FAQ 2 | Profitability impact | Not always; prevents big losses |

| FAQ 3 | Integration with algos | APIs, risk modules |

| Conclusion | Essential for funds, AI-driven future | Boosts resilience & trust |

Circuit breakers affect execution timing, strategy robustness, and portfolio exposure. A poorly calibrated breaker can:

- Trigger too often, leading to missed opportunities.

- Fail to activate in time, resulting in severe losses.

- Cause unintended liquidity shocks.

Thus, circuit breaker evaluation ensures optimal balance between safety and strategy continuity.

Step-by-Step Circuit Breaker Evaluation Process

Step 1: Define Risk Tolerance and Strategy Objectives

Before implementation, managers must define acceptable drawdown levels, volatility thresholds, and liquidity requirements.

- Aggressive strategies may set wider thresholds.

- Conservative funds may prefer tighter controls.

Step 2: Choose Evaluation Metrics

Common metrics include:

- Activation Frequency: How often circuit breakers are triggered.

- False Positives/Negatives: Unnecessary stoppages vs missed protections.

- Execution Delay Impact: Slippage during re-entry.

- Portfolio Drawdown Reduction: Effectiveness in minimizing losses.

Step 3: Simulation and Backtesting

Simulations across historical volatile events (e.g., 2008 crisis, COVID-19 crash) provide insights into breaker behavior. Monte Carlo methods can stress-test conditions outside historical ranges.

Step 4: Compare Strategies

Different hedge funds adopt varied approaches:

Strategy A: Price-Movement-Based Circuit Breakers

- Trigger: Large single-day percentage changes.

- Advantages: Simple, transparent, widely used.

- Disadvantages: May not capture intraday volatility spikes.

Strategy B: Volatility-Index-Based Circuit Breakers

- Trigger: VIX or implied volatility exceeding thresholds.

- Advantages: Anticipates turbulence before extreme moves occur.

- Disadvantages: May lead to early stoppages, reducing participation in profitable swings.

Step 5: Real-Time Monitoring and Adjustment

Circuit breakers require adaptive tuning. AI-driven tools now allow real-time adjustments, where thresholds shift based on evolving liquidity and volatility patterns.

Comparative Analysis of Circuit Breaker Strategies

| Criteria | Price-Movement-Based | Volatility-Index-Based |

|---|---|---|

| Ease of Implementation | High | Moderate |

| Predictive Power | Low | High |

| False Triggers | Moderate | Higher |

| Effectiveness in Crises | High | High |

| Best Use Case | Equity-driven strategies | Derivatives & multi-asset funds |

Recommendation: Hedge fund managers should combine both strategies into a hybrid breaker system—using price-based triggers for crisis-level events and volatility-based triggers for proactive protection.

Circuit Breaker Evaluation in Hedge Funds – Real-World Examples

Case Study 1: Equity Hedge Fund

During March 2020, an equity-focused hedge fund applied tiered circuit breakers at 5%, 10%, and 20% daily losses. The evaluation showed a 40% reduction in portfolio drawdown versus peers without breakers.

Case Study 2: Quant Hedge Fund

A systematic fund integrated volatility-based breakers tied to the VIX index. While this prevented exposure during turbulence, backtesting revealed 15% missed profits due to early exits.

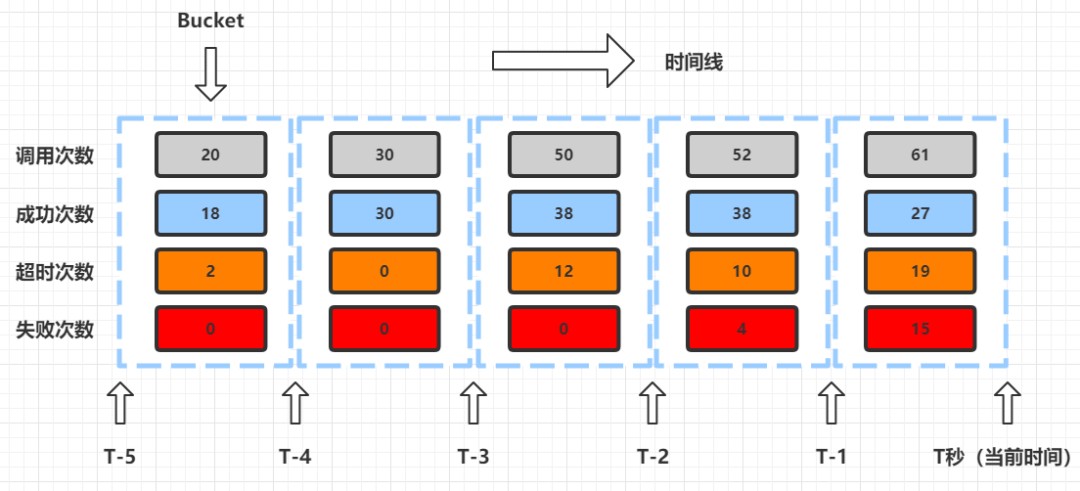

Framework for circuit breaker evaluation in hedge fund trading strategies

Advanced Circuit Breaker Techniques for Hedge Fund Managers

Adaptive Threshold Circuit Breakers

Dynamic thresholds adjust based on market depth, bid-ask spreads, and liquidity indicators.

Multi-Layer Circuit Breakers

Different breakers for asset classes (equities, futures, FX), ensuring asset-specific calibration.

Machine-Learning-Assisted Circuit Breakers

AI models detect precursors to crashes, predicting when circuit breakers should activate.

Internal Resource Links

- How does a circuit breaker work in quant trading – Practical insight into circuit breaker mechanics for algorithmic hedge funds.

- Why implement circuit breakers in quant models – Understanding their strategic importance in systematic risk management.

Best Practices for Hedge Fund Circuit Breaker Evaluation

- Tiered Approach: Multiple levels of thresholds reduce overreliance on a single trigger.

- Cross-Asset Integration: Circuit breakers should account for correlations across equity, FX, and derivatives.

- Post-Event Analysis: Review breaker effectiveness after every activation.

- Regulatory Alignment: Ensure breakers comply with exchange and jurisdictional requirements.

- Stress Testing: Evaluate against black swan events, not just historical patterns.

FAQ

1. How often should hedge fund managers evaluate their circuit breaker systems?

At minimum, quarterly. However, during periods of heightened volatility, monthly evaluation is recommended. Frequent review ensures calibration matches evolving market conditions.

2. Do circuit breakers reduce hedge fund profitability?

Not necessarily. While they may prevent participation in some rebound rallies, they reduce catastrophic losses, which is more valuable for long-term performance and investor confidence.

3. Can circuit breakers be integrated with algorithmic trading models?

Yes. Modern quant systems allow seamless integration, where breakers act as overrides. They can be implemented via trading platform APIs or as risk management modules within algorithms.

Conclusion

For hedge fund managers, circuit breaker evaluation is no longer optional—it is essential. By carefully designing, simulating, and adjusting breaker systems, managers can strike the right balance between protection and performance.

The future of circuit breakers lies in adaptive AI-driven frameworks that anticipate risks and act before human decision-making lags behind. Funds that master this evaluation process will achieve greater resilience, investor trust, and competitive advantage in volatile markets.

Final Call to Action

How does your hedge fund currently evaluate circuit breakers? Share your insights, challenges, and strategies in the comments. If you found this guide valuable, share it with your colleagues—let’s advance the conversation on circuit breaker solutions for quant traders and hedge fund managers together.