====================================================

In the world of high-frequency and algorithmic trading, circuit breakers are crucial tools used to prevent excessive price movements, minimize market manipulation, and protect investors from extreme volatility. For developers, understanding how to implement and optimize circuit breakers in trading systems is essential for creating robust, reliable platforms. This guide will walk you through the process of circuit breaker implementation, offering best practices, technical strategies, and real-world examples to help developers navigate the complexities of this essential mechanism.

What is a Circuit Breaker?

A circuit breaker is a safety mechanism in trading systems designed to temporarily halt trading when the market experiences extreme price movements or volatility. By setting predefined thresholds, a circuit breaker can automatically stop trading for a set period, allowing the market to stabilize before resuming. This mechanism is crucial for preventing panic-selling, flash crashes, and other disruptive behaviors.

Key Functions of Circuit Breakers:

- Volatility Control: Circuit breakers are primarily designed to manage excessive volatility and prevent panic-driven market behaviors.

- Price Protection: They prevent prices from moving beyond a certain range, providing a mechanism for market stability.

- Investor Confidence: By preventing extreme fluctuations, circuit breakers help maintain trust in the integrity of financial markets.

Best Practices for Circuit Breaker Implementation

For developers, implementing circuit breakers requires careful planning, clear thresholds, and integration into the trading algorithms. The following practices are essential for successful circuit breaker implementation:

1. Define the Thresholds for Circuit Breakers

The first step in implementing a circuit breaker is setting the price movement thresholds that will trigger a break in trading. These thresholds are typically defined as a percentage of price movement within a specific time frame. Depending on the asset type (stocks, futures, cryptocurrencies, etc.), these thresholds may vary.

Common Threshold Examples:

- 5% Price Movement in 1 Minute: A circuit breaker could be triggered if the price of an asset changes by more than 5% within a single minute.

- 10% Price Movement in 5 Minutes: For larger assets, a 10% price change in five minutes might trigger a break.

These thresholds can vary based on market volatility and should be adjusted according to the asset’s volatility profile. Developers must also account for market liquidity when setting these levels to avoid triggering circuit breakers too often or too soon.

2. Implementing the Time-Based Logic

Once the thresholds are defined, it’s important to implement the time-based logic that controls how long the circuit breaker should stay active. Typically, this could range from a few minutes to an hour, depending on the situation.

A well-designed time-based logic should:

- Pause Trading: When triggered, it should stop new orders from being placed.

- Allow for Market Reassessment: During the pause, algorithms should assess market data to decide when it’s safe to resume trading.

- Notify Stakeholders: Notifications can be sent to traders and risk managers to ensure awareness of the situation.

3. Optimizing for Multiple Asset Classes

One of the challenges when implementing circuit breakers is optimizing for different asset classes. Stocks, options, futures, and cryptocurrencies each have different volatility profiles, and the same circuit breaker logic might not work effectively across all of them.

Futures markets, for instance, tend to experience more volatility than stocks, so circuit breakers for futures markets might have tighter thresholds. In contrast, cryptocurrency markets are known for extreme volatility, so circuit breakers for crypto should be more aggressive.

4. Integrating Circuit Breakers in Trading Algorithms

For algorithmic traders, integrating circuit breakers within automated trading algorithms is a critical step. A well-integrated circuit breaker will not just halt orders but also ensure that trading systems can automatically resume operations once the market is stable.

Considerations for Integration:

- Data Feeds: Ensure that circuit breakers are connected to real-time price feeds and data streams.

- Automatic Recovery: Develop protocols to resume trading when conditions normalize.

- Testing in Different Scenarios: Test circuit breaker behavior in various market scenarios, including flash crashes and sharp price rallies.

| Topic | Details |

|---|---|

| What is Margin in Options Trading? | Collateral required to cover potential losses in an options position. |

| Why Margin Matters | Ensures traders have sufficient funds to honor obligations, like covered calls or naked puts. |

| Types of Margin | Initial Margin, Maintenance Margin, Portfolio Margin |

| Initial Margin | Upfront amount required to enter into an options position. |

| Maintenance Margin | Minimum balance required to keep a position open. Falling below triggers a margin call. |

| Portfolio Margin | Evaluates overall portfolio risk, leading to lower margin requirements but higher complexity. |

| Strategy-Specific Margin | Margin calculated based on individual strategies (e.g., covered calls, credit spreads). |

| Advantages of Strategy-Specific | Simple for beginners, clear rules for each strategy. |

| Disadvantages of Strategy-Specific | Capital-intensive, doesn’t account for portfolio-level risk offset. |

| Portfolio Margining | Evaluates net risk of entire portfolio, more efficient use of capital. |

| Advantages of Portfolio Margining | Efficient capital use, reflects realistic portfolio-level risk. |

| Disadvantages of Portfolio Margining | Requires approval, high account minimums, complex risk modeling. |

| Covered Calls Margin | Low margin requirement, as the stock is already owned. |

| Naked Calls Margin | High margin requirement due to unlimited risk exposure. |

| Credit Spreads Margin | Moderate margin, with capped risk defined by strike differences. |

| Iron Condors Margin | Margin equals the width of the widest spread, offering defined risk and limited margin usage. |

| Rolling Positions | Adjusting strikes or expirations reduces margin exposure without closing positions. |

| Spreads Instead of Naked Options | Spreads cap risk and reduce margin significantly compared to naked positions. |

| Diversification Across Strategies | Balancing strategies like credit spreads, covered calls, and protective puts ensures optimal margin. |

| Risks of Mismanaging Margin | Margin calls, forced liquidation, excessive leverage. |

| Industry Trends Affecting Margin | AI models for margin forecasting, regulatory changes, integration with margin calculators. |

| Best Practices for Margin Management | Maintain buffer above margin, use spreads, review broker rules, and employ stop-loss rules. |

| Avoiding Margin Calls | Keep a 10-20% cash buffer, use risk-defined strategies, monitor margin daily. |

| Margin for Options vs Stocks | Options margin varies by strategy, volatility, expiration, unlike fixed stock margin. |

| Retail Traders Using Portfolio Margin | Possible with broker approval and equity requirements (e.g., $100,000–150,000). |

There are several methods for implementing circuit breakers, each with its advantages and disadvantages. Below, we compare two common approaches: single-threshold circuit breakers and multi-tier circuit breakers.

Single-Threshold Circuit Breakers

Single-threshold circuit breakers are simpler and more straightforward. They trigger a halt when the price moves beyond a predefined percentage within a set timeframe.

Pros:

- Simplicity: Easy to implement and understand.

- Efficiency: Fast execution due to fewer conditions.

Cons:

- Over-sensitivity: They can be triggered too often in volatile markets, leading to unnecessary pauses.

- Missed Opportunities: Sometimes, price movements within the threshold are normal, and halting trading may cause missed opportunities.

Multi-Tier Circuit Breakers

Multi-tier circuit breakers involve multiple thresholds, with each tier triggering different actions. For example, the first tier might pause trading for 5 minutes, while the second tier could trigger a longer pause or a complete halt.

Pros:

- Granularity: More flexible and better suited for volatile markets.

- Progressive Halts: Allows for varying levels of intervention based on the severity of the price movement.

Cons:

- Complexity: More complex to implement and test.

- Resource Intensive: Requires more resources to monitor and manage multiple thresholds.

Recommended Strategy

For most markets, a multi-tier circuit breaker system is often the best solution. This approach allows for flexibility, gradual market intervention, and ensures that extreme volatility can be contained without unnecessarily stopping all trades.

Circuit Breaker Use Cases in High-Volume Trading

In high-frequency or high-volume trading, circuit breakers are essential tools to manage the massive influx of trades and prevent extreme market swings. Let’s explore a couple of use cases where circuit breakers prove invaluable.

1. Flash Crashes and Market Manipulation

Flash crashes are sudden, sharp declines in asset prices that happen in a very short period, often triggered by algorithmic trading or market manipulation. In these scenarios, circuit breakers can help stop trading before significant damage occurs.

2. Extreme Volatility in Cryptocurrency Markets

The cryptocurrency market is infamous for its extreme volatility. Circuit breakers are particularly useful in preventing large-scale crashes or manipulations, ensuring that price swings are contained and that there’s time for market reassessment.

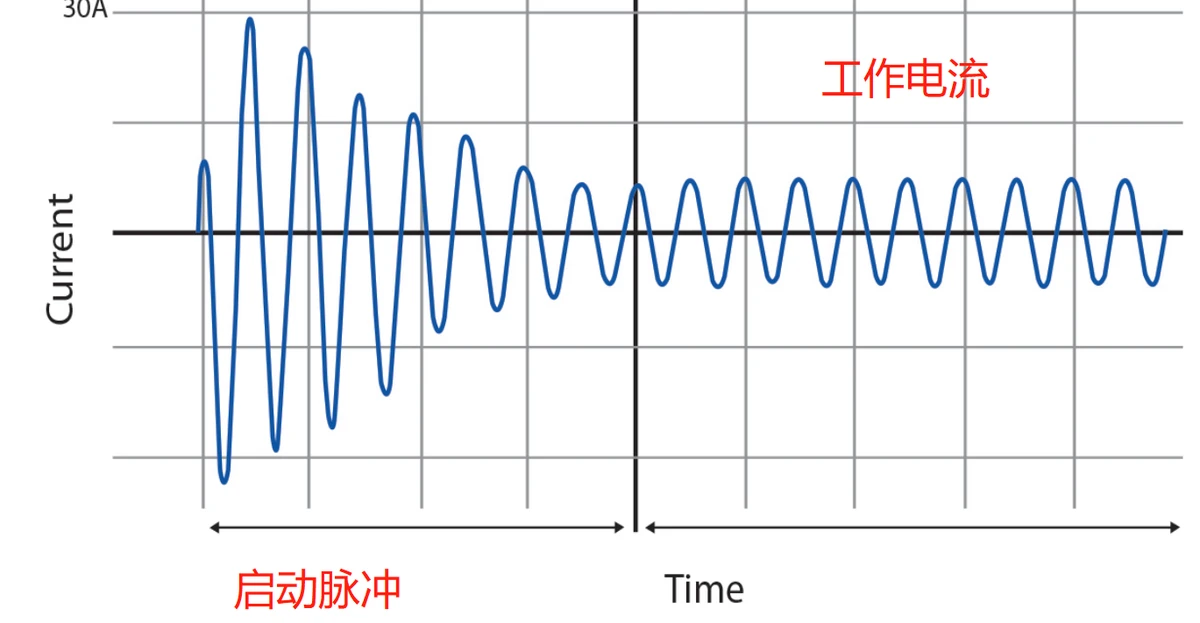

Example of extreme price volatility in the cryptocurrency market where circuit breakers can be triggered.

Frequently Asked Questions (FAQ)

1. How do circuit breakers work in trading platforms?

Circuit breakers in trading platforms are designed to pause or halt trading when the market experiences extreme price fluctuations. When a certain price threshold is exceeded, the system automatically stops trading, usually for a fixed period, allowing the market to stabilize.

2. Can circuit breakers prevent market crashes?

While circuit breakers cannot prevent a market crash, they can help prevent panic-driven sell-offs by halting trading temporarily, giving traders and investors time to reassess the situation and make informed decisions.

3. How do I implement circuit breakers in my algorithmic trading system?

To implement circuit breakers in your algorithmic trading system, you’ll need to:

- Set price thresholds based on historical market data.

- Integrate real-time data feeds for price monitoring.

- Program the logic to stop trading once the thresholds are reached and automatically resume when conditions stabilize.

Conclusion

Implementing circuit breakers in trading systems is an essential part of risk management, especially in high-frequency and volatile markets. By following best practices for setting thresholds, integrating time-based logic, and optimizing for different asset classes, developers can create more reliable and resilient trading platforms. Whether you’re working in traditional finance, cryptocurrency, or high-volume markets, circuit breakers play a critical role in maintaining market stability and investor confidence.

If you found this article helpful, don’t hesitate to share it with your peers, leave a comment, or ask further questions. Let’s continue the conversation on how circuit breakers can improve trading systems!