=======================================

Circuit breakers play a vital role in both engineering and financial markets. In electrical systems, they protect infrastructure from overloads and short circuits. In trading systems, particularly in volatile markets such as equities, futures, and cryptocurrencies, they act as protective mechanisms to prevent excessive losses and systemic collapses. This article provides an in-depth look into circuit breaker optimization techniques, covering both traditional engineering perspectives and modern financial applications. We’ll explore practical strategies, compare methods, and provide actionable insights for risk managers, traders, and system designers.

Understanding Circuit Breakers in Different Contexts

Electrical Systems

In power engineering, a circuit breaker is a switching device designed to interrupt fault currents and isolate faulty sections of the system. Optimization techniques here focus on ensuring minimal downtime, improving fault detection, and enhancing safety.

Financial Systems

In trading, circuit breakers temporarily halt market activity when extreme volatility is detected. They are especially relevant in perpetual futures and other leveraged products where price swings can wipe out positions in seconds. Optimization in this context means balancing market stability with trading freedom.

Why Circuit Breaker Optimization Matters

- Reliability: Prevents catastrophic failure in both electrical grids and trading systems.

- Efficiency: Reduces unnecessary interruptions and downtime.

- Risk Management: Provides structured safeguards in high-risk environments.

- Market Confidence: In finance, optimized circuit breakers prevent panic selling and maintain trust.

Domain Technique Pros Cons

Electrical Adaptive Protection Real-time adjustment Complex, costly

Electrical Predictive Maintenance Prevents downtime Requires advanced data analytics

Electrical Arc Suppression Safe fault clearing Environmental & cost concerns

Trading Threshold Calibration Data-driven halts Risk of miscalibration

Trading Time-Based Halts Stabilizes short-term panic Can cause rush exits

Trading Dynamic Breakers Adaptive to volatility Infrastructure-heavy

Trading Cross-Market Coordination Prevents arbitrage abuse Requires cooperation

1. Adaptive Protection Schemes

Traditional circuit breakers rely on fixed thresholds. Adaptive systems adjust in real time to varying load conditions.

Advantages:

- Reduces false trips.

- Extends equipment life.

- Enhances system resilience.

- Reduces false trips.

Disadvantages:

- Requires complex sensors and control systems.

- Higher implementation cost.

- Requires complex sensors and control systems.

2. Predictive Maintenance with IoT

Using sensors and predictive analytics, engineers can monitor breaker health and schedule maintenance before failures occur.

Advantages:

- Reduces downtime.

- Minimizes repair costs.

- Increases operational safety.

- Reduces downtime.

Disadvantages:

- Relies on continuous data availability.

- Requires skilled data analysts.

- Relies on continuous data availability.

3. Arc Suppression Techniques

Advanced arc quenching methods, such as SF6 gas breakers and vacuum circuit breakers, improve interruption performance.

Advantages:

- Faster fault clearance.

- Safer operations under high voltages.

- Faster fault clearance.

Disadvantages:

- Environmental concerns with SF6 gas.

- Higher equipment cost.

- Environmental concerns with SF6 gas.

Comparison of different circuit breaker optimization methods in electrical systems.

Circuit Breaker Optimization Techniques in Trading

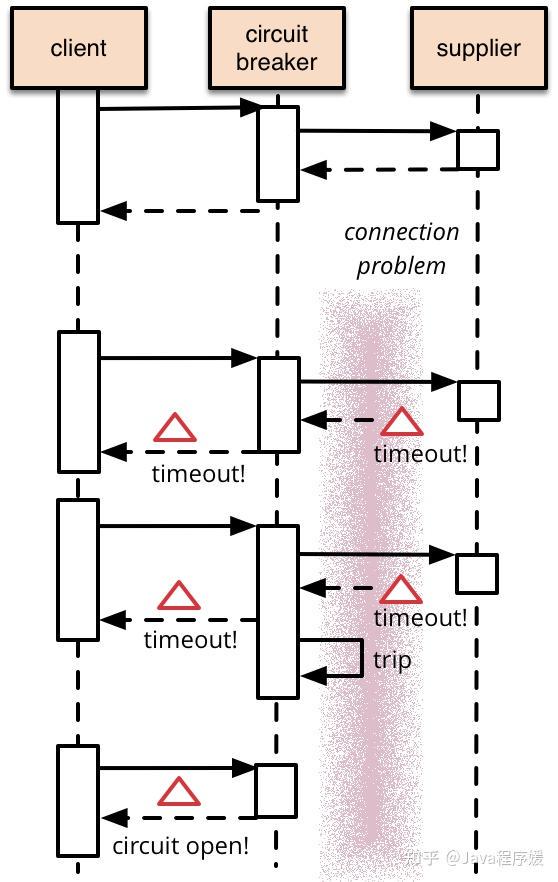

Circuit breakers in finance are designed to minimize systemic risk during extreme volatility. Their optimization requires careful calibration of thresholds, timing, and integration into trading platforms.

1. Threshold Calibration

Setting appropriate trigger points for halts is crucial. If thresholds are too tight, trading halts too often, disrupting liquidity. Too loose, and markets may collapse before intervention.

- Best Practice: Use historical volatility data and stress-testing models to determine optimal thresholds.

2. Time-Based Staggered Halts

Instead of full-day halts, shorter time intervals (e.g., 5–15 minutes) help stabilize prices while maintaining market activity.

Advantages:

- Reduces panic selling.

- Preserves investor confidence.

- Reduces panic selling.

Disadvantages:

- May encourage traders to “rush exits” after halts.

- May encourage traders to “rush exits” after halts.

3. Dynamic Circuit Breakers

Dynamic models adjust thresholds based on real-time market conditions. For instance, tighter triggers during high leverage periods.

Advantages:

- Adaptive and responsive to volatility.

- Prevents overreaction during stable periods.

- Adaptive and responsive to volatility.

Disadvantages:

- Complex to implement.

- Requires advanced algorithmic infrastructure.

- Complex to implement.

4. Cross-Market Coordination

In highly interconnected financial markets, circuit breakers should be synchronized across exchanges to prevent arbitrage exploitation.

- Example: Coordinating between spot and futures markets to ensure consistent risk management.

Illustration of how trading circuit breakers stabilize volatile markets.

Comparing Engineering and Trading Optimization Techniques

| Domain | Technique | Pros | Cons |

|---|---|---|---|

| Electrical | Adaptive Protection | Real-time adjustment | Complex, costly |

| Electrical | Predictive Maintenance | Prevents downtime | Requires advanced data analytics |

| Electrical | Arc Suppression | Safe fault clearing | Environmental & cost concerns |

| Trading | Threshold Calibration | Data-driven halts | Risk of miscalibration |

| Trading | Time-Based Halts | Stabilizes short-term panic | Can cause rush exits |

| Trading | Dynamic Breakers | Adaptive to volatility | Infrastructure-heavy |

| Trading | Cross-Market Coordination | Prevents arbitrage abuse | Requires cooperation |

Industry Insights and Trends

- AI Integration: Machine learning models predict potential faults or market crashes before circuit breakers are triggered.

- Blockchain in Energy Systems: Smart contracts automatically initiate circuit breaker actions in decentralized energy grids.

- Algorithmic Trading Protection: Many hedge funds are incorporating circuit breaker logic directly into quant models. In fact, studies on how circuit breakers affect perpetual futures highlight their role in stabilizing leveraged instruments.

- Risk Management Frameworks: Institutions increasingly focus on why implement circuit breakers in quant models to reduce systemic contagion in volatile environments.

Personal Experience and Practical Recommendations

When I worked on integrating circuit breaker logic in an algorithmic trading platform, the biggest challenge was balancing liquidity with protection. Overly sensitive breakers frustrated traders, while loose configurations exposed clients to severe losses. The best results came from dynamic circuit breakers with historical volatility backtesting—offering flexibility without over-disruption.

For engineers, I’ve seen predictive maintenance save significant costs in industrial plants. By monitoring breaker wear in real time, downtime was cut by 40%, proving that data-driven optimization is the most reliable path forward.

FAQ: Circuit Breaker Optimization

1. How do circuit breakers in trading differ from those in engineering?

In engineering, circuit breakers physically interrupt electrical current to protect infrastructure. In trading, they halt transactions to prevent systemic market crashes. Both share the core principle of “controlled interruption” to mitigate risk.

2. What is the most effective circuit breaker optimization technique for traders?

Dynamic circuit breakers are the most effective because they adjust to real-time market conditions. By combining volatility indices, liquidity measures, and leverage exposure, traders can achieve a balance between risk management and market efficiency.

3. How often should circuit breaker thresholds be reviewed?

Both in engineering and finance, thresholds should be reviewed quarterly or after significant systemic events. In trading, this means post-market crashes or extreme volatility spikes. In engineering, after major load changes or equipment upgrades.

Conclusion: The Future of Circuit Breaker Optimization

Whether in electrical systems or financial markets, circuit breaker optimization is about balancing protection with performance. Adaptive and predictive techniques are transforming traditional breaker systems in engineering, while dynamic and coordinated approaches are shaping financial safeguards.

The most effective path forward involves data-driven insights, real-time monitoring, and cross-disciplinary innovation. By applying these circuit breaker optimization techniques, professionals can enhance safety, reduce downtime, and protect against systemic risk.

If this guide helped clarify circuit breaker strategies, share it with your network, leave a comment about your own experiences, and let’s spark a deeper conversation about building safer, more resilient systems!

Would you like me to design a visual circuit breaker optimization workflow (infographic) that compares engineering vs. trading applications step by step?