================================================

In the world of high-speed trading, market volatility can cause dramatic price swings within seconds. This volatility is particularly evident in equities, futures, and crypto markets. To safeguard both traders and the integrity of exchanges, circuit breaker integration in trading platforms has become an essential mechanism. By automatically pausing trading when abnormal price movements occur, circuit breakers reduce systemic risk, prevent flash crashes, and give participants time to reassess decisions.

This article provides a deep dive into circuit breaker integration, exploring its importance, technical implementation, evaluation methods, and practical use cases. We will analyze at least two integration strategies, compare their advantages and drawbacks, and offer actionable insights for traders, risk managers, and platform developers.

What Are Circuit Breakers in Trading?

Circuit breakers are automated mechanisms that temporarily halt trading when an asset’s price moves beyond predefined thresholds. These rules can apply to individual instruments (like a stock or perpetual futures contract) or to entire markets (like major indices).

They serve three main purposes:

- Preventing panic selling – stopping market participants from exacerbating a crash.

- Ensuring fair trading – giving time for new information to be absorbed.

- Protecting liquidity providers – preventing algorithms from being exploited in extreme moves.

In modern platforms, especially those dealing with derivatives like perpetual futures, circuit breakers are tightly integrated with matching engines and risk management systems.

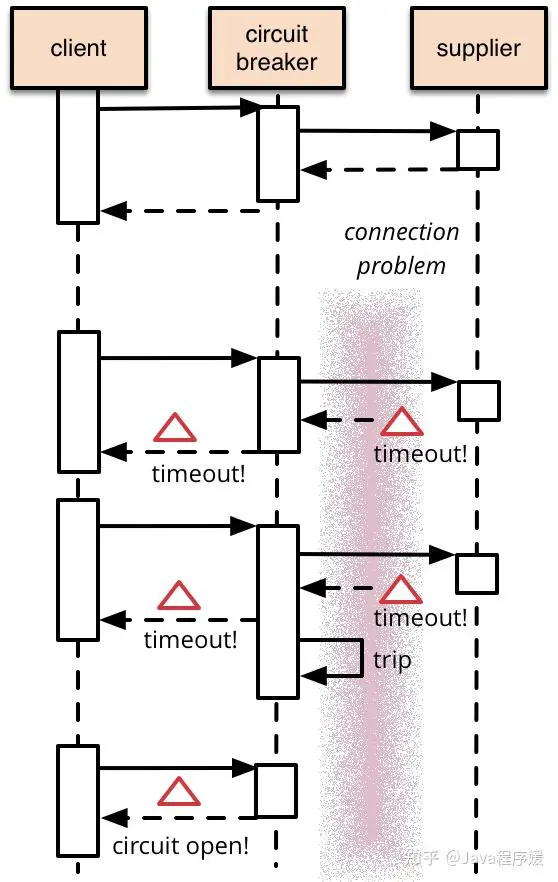

Circuit breaker integration process in trading platforms

Why Circuit Breaker Integration Matters

Without circuit breakers, markets risk extreme instability. Flash crashes like the May 2010 Dow Jones drop, where the index fell 9% in minutes, highlight why such mechanisms are necessary.

Key reasons for integration include:

- Market stability – reduces cascading failures.

- Investor confidence – shows protective measures are in place.

- Algorithmic safety – prevents trading bots from amplifying volatility.

- Compliance – regulators often mandate circuit breaker systems.

For perpetual futures in crypto, why circuit breakers are used in perpetual futures is especially relevant, as 24⁄7 trading and high leverage amplify risks.

| Aspect | Price-Triggered Circuit Breakers | Volatility-Based Circuit Breakers |

|---|---|---|

| Trigger Method | Price movement beyond a set percentage within a time window | Dynamic volatility calculations (e.g., standard deviation) |

| Implementation Difficulty | Simple | Complex |

| Transparency | High | Medium |

| Adaptability | Low | High |

| Best Use Case | Stable assets (stocks, crypto) | High-volatility markets, perpetual futures |

| Pros | Simple to implement, effective during crashes, easy to understand | Adjusts to market conditions, reduces false positives |

| Cons | False positives, potential for gaming thresholds | Complex to calculate, harder to anticipate trigger levels |

| Purpose | Prevent panic selling, ensure fair trading, protect liquidity | Adjusts to extreme volatility, safeguards algorithmic safety |

| Integration | Integrates with order matching engines and risk systems | Integrates with dynamic risk management systems |

| Challenges | Risk of false positives in normal volatility | Complex to monitor and calculate in real-time |

| Best Practices | Multi-level breakers, transparent communication, backtesting | Adaptive trigger thresholds, post-resume cooldown |

1. Price-Triggered Circuit Breakers

This method halts trading when an asset’s price moves beyond a set percentage within a given time window.

How It Works

- Example: If Bitcoin futures drop 10% in five minutes, trading halts for two minutes.

- Trading resumes when conditions stabilize.

Pros

- Simple to implement.

- Easy for traders to understand.

- Effective during sudden crashes.

Cons

- Can lead to false positives during normal volatility.

- May incentivize traders to game thresholds.

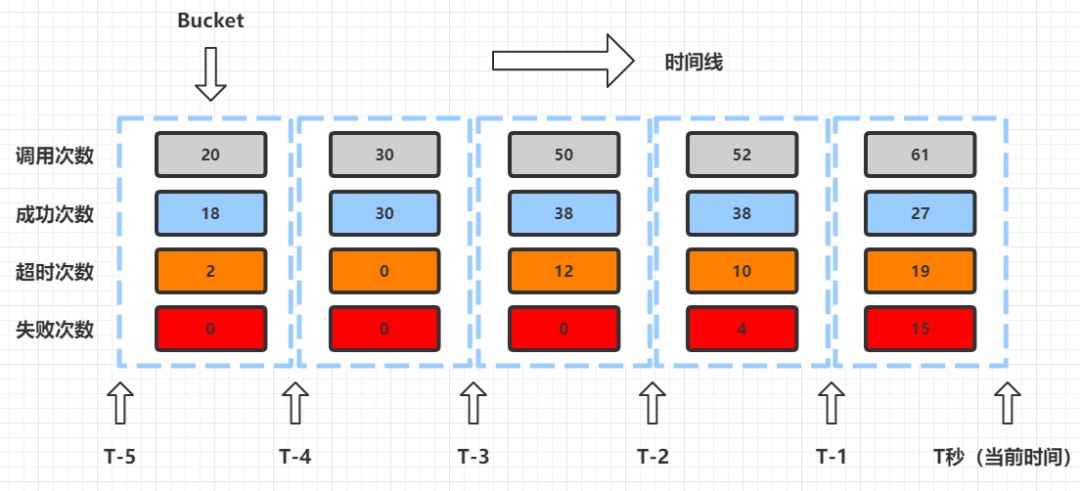

2. Volatility-Based Circuit Breakers

Instead of fixed thresholds, these use dynamic calculations of volatility (e.g., standard deviation of recent returns).

How It Works

- If volatility exceeds a statistical limit (like 6 standard deviations from the mean), trading pauses.

- More adaptive than price-based rules.

Pros

- Adjusts automatically to market conditions.

- Reduces unnecessary halts in high-volatility assets.

Cons

- Complex to calculate and monitor.

- Harder for traders to anticipate trigger levels.

Comparison of Circuit Breaker Methods

| Feature | Price-Triggered Circuit Breaker | Volatility-Based Circuit Breaker |

|---|---|---|

| Implementation Difficulty | Simple | Complex |

| Transparency | High | Medium |

| Adaptability | Low | High |

| Best Use Case | Stocks, crypto with stable baselines | Perpetual futures, high-volatility markets |

Different circuit breaker trigger models used in modern markets

Integration into Trading Platforms

Circuit breakers must be deeply embedded in the architecture of trading platforms. They typically integrate with:

- Order Matching Engines – halts order execution once triggered.

- Risk Management Systems – ensures margin calls and liquidations respect pauses.

- Market Data Feeds – communicates status changes to users and APIs.

Developers use circuit breaker implementation guides for developers to standardize integration. For quant traders, how to utilize circuit breakers in trading strategies is equally important, since automated strategies must adapt to interruptions.

Best Practices for Circuit Breaker Integration

- Multi-Level Breakers – introduce tiered halts (e.g., 5%, 10%, 20%) for better control.

- Transparent Communication – notify traders via dashboards and APIs.

- Post-Resume Cooldown – stagger order execution after a halt to avoid spikes.

- Backtesting & Simulation – test against historical data to avoid miscalibration.

Risks and Challenges

While circuit breakers protect markets, they also pose challenges:

- Liquidity Gaps – trading halts can create order book imbalances.

- Delayed Price Discovery – natural market corrections are postponed.

- Cross-Market Spillovers – halts in one market can trigger panic in correlated assets.

Therefore, evaluating where circuit breakers are applied in perpetual futures becomes crucial to ensure effectiveness without unintended side effects.

FAQ: Circuit Breakers in Trading Platforms

1. How do circuit breakers affect algorithmic trading?

Circuit breakers interrupt algorithms mid-trade, which can disrupt strategies relying on continuous execution. Smart algos should include fail-safe logic to pause and resume gracefully when halts occur.

2. Can circuit breakers prevent all market crashes?

No. They mitigate sudden drops but cannot stop longer-term sell-offs driven by fundamentals. Circuit breakers are like airbags: they reduce damage but do not eliminate risk.

3. How are circuit breakers set in perpetual futures markets?

In perpetual futures, circuit breakers are often linked to funding rates, leverage limits, and index price deviations. They are designed to prevent liquidation cascades caused by over-leveraged traders.

Conclusion

Circuit breaker integration in trading platforms is no longer optional—it’s a cornerstone of modern market design. Whether using price-triggered thresholds or adaptive volatility-based models, circuit breakers ensure stability, safeguard liquidity, and protect traders from catastrophic losses.

For developers, traders, and risk managers, the challenge lies in balancing protection with market efficiency. The future of circuit breakers will likely involve machine learning models that adapt dynamically, optimizing halts based on real-time conditions.

If you found this guide insightful, share it with your trading community and drop a comment below: Do you prefer fixed price circuit breakers or adaptive volatility-based ones in your trading systems?

Would you like me to create a visual flowchart of circuit breaker logic (from trigger detection to trade resumption) so the article has a more hands-on technical illustration?