Understanding fee structures is critical for any trader engaged in perpetual futures markets. The difference in fee tiers across platforms can significantly affect profitability, especially for frequent and high-volume traders. This guide offers a comprehensive analysis of where to compare fee tier in different perpetual futures platforms, including step-by-step strategies, practical tips, and insights from industry trends.

Understanding Fee Tiers in Perpetual Futures

What Fee Tiers Are

Fee tiers are structured pricing levels offered by exchanges based on trading volume, account type, or membership status. They typically include:

- Maker Fees: Charged when providing liquidity.

- Taker Fees: Charged when taking liquidity from the order book.

- Discounts: Offered for high-volume traders or users holding platform tokens.

Knowing why fee tier matters in perpetual futures trading can help traders optimize costs and increase net profitability.

Why Fee Tiers Differ Across Platforms

Exchanges adopt different fee structures due to:

- Liquidity Levels: High-volume platforms may offer lower fees to incentivize trading.

- Market Segmentation: Platforms target retail traders, professional traders, or institutional clients differently.

- Token Incentives: Some exchanges provide discounts for holding native tokens.

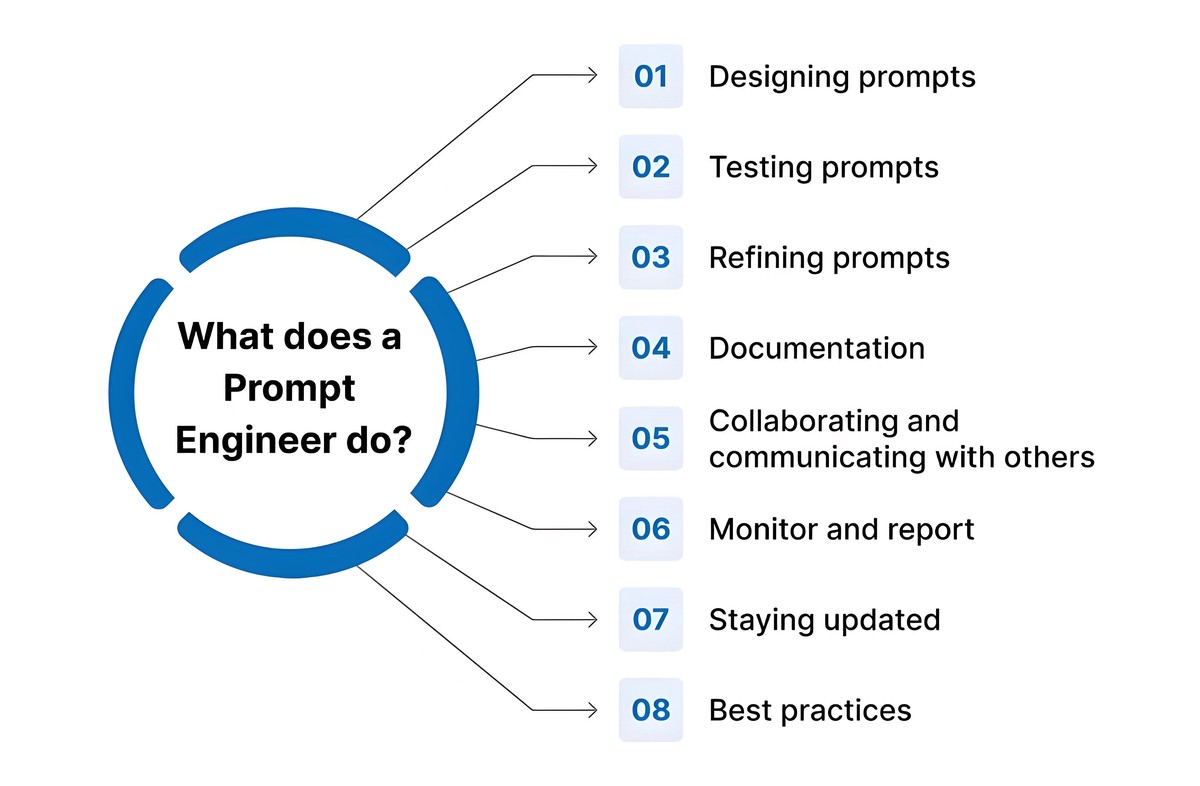

Visual representation of how fee tiers vary among top perpetual futures platforms.

Where to Find Fee Tier Information

Official Exchange Resources

Most exchanges publish fee tier information under their trading fees or support sections. Information usually includes:

- Taker and maker fees for each tier.

- Requirements to reach higher tiers (monthly volume, token holdings).

- Special promotions or temporary discounts.

Traders looking for where to find fee tier information in perpetual futures should always verify details on official sources to avoid outdated or inaccurate data.

Third-Party Aggregators

Third-party platforms and comparison websites offer:

- Aggregated fee data across multiple exchanges.

- Interactive tools to simulate fees based on trading volume.

- Reviews and updates from the trader community.

Pros: Saves time, easy visualization.

Cons: May lag behind official updates; verify before making decisions.

Community Forums and Social Channels

Reddit, Telegram, and Discord communities often share real-time insights about fee tiers and promotions. While useful, this information requires caution and cross-verification with official sources.

Methods to Compare Fee Tiers

Method 1: Volume-Based Fee Analysis

- Calculate monthly trading volume across multiple platforms.

- Map the corresponding fee tiers to determine which exchange offers the lowest effective fees.

- Consider both maker and taker fees for a comprehensive view.

Pros: Direct correlation between trading activity and cost efficiency.

Cons: Requires detailed tracking of volume and trades.

Method 2: Interactive Fee Calculators

- Many exchanges and third-party websites provide interactive fee tier calculators.

- Traders input expected volume to see potential fees and tier thresholds.

- Allows scenario testing for different trading strategies.

Pros: User-friendly, supports planning ahead.

Cons: May not reflect sudden promotions or token-based discounts.

Using calculators can help visualize potential cost savings across tiers.

Evaluating Fee Tier Plans

When comparing fee tiers, consider:

- Hidden Costs: Funding rates, withdrawal fees, and margin requirements.

- Liquidity Considerations: Lower fees may come with lower liquidity, affecting slippage.

- Platform Reliability: Fee savings are moot if platform performance is inconsistent.

Knowing how to calculate fee tier in perpetual futures allows traders to quantify cost implications accurately.

Advanced Strategies for Fee Optimization

1. Token-Based Discounts

- Some platforms offer discounts for holding native tokens (e.g., BNB for Binance, FTT for FTX).

- Traders can calculate whether buying tokens for discounts is cost-effective compared to fee savings.

2. High-Frequency Fee Optimization

- Split trades across multiple exchanges to leverage tier advantages.

- Schedule trades to maximize volume-based tier reductions.

- Use algorithmic strategies to manage maker/taker ratios efficiently.

3. Volume Consolidation

- Aggregating trading volume over monthly periods can help reach higher tiers faster.

- Consider using sub-accounts if supported by the exchange to consolidate trades without breaching compliance.

Combining token discounts and high-volume strategies can minimize trading costs.

Comparing Fee Tiers for Different Trader Types

| Trader Type | Best Approach | Notes |

|---|---|---|

| Retail | Focus on low-volume fee tiers | Often prioritize simplicity and promotions |

| Day Traders | Volume-based tier analysis | Frequent trades benefit most from maker/taker optimization |

| Institutional | Custom fee agreements | Negotiable fees based on size and liquidity provision |

| High-Frequency | Algorithmic tier management | Use multiple platforms and token incentives |

Best Practices

- Regularly Review Fees: Exchanges update tiers periodically.

- Simulate Trades: Use fee calculators before committing to large positions.

- Monitor Promotions: Take advantage of temporary fee reductions or token-based discounts.

- Cross-Platform Comparison: Maintain a spreadsheet comparing effective fees across preferred platforms.

FAQ

1. Where can I compare fee tiers across perpetual futures platforms?

You can compare fee tiers using official exchange pages, third-party aggregators, and interactive fee calculators. Always cross-check with official resources to ensure accuracy.

2. How does fee tier affect perpetual futures profitability?

Lower fees reduce overall trading costs, improving net returns, especially for high-frequency or high-volume traders. Even a small reduction in taker fees can significantly enhance profitability over time.

3. How can traders optimize fee tiers effectively?

- Track trading volume to achieve higher tiers.

- Utilize platform token discounts.

- Split trades or use multiple platforms strategically.

- Leverage interactive calculators to forecast costs under different scenarios.

Conclusion

Comparing fee tiers across perpetual futures platforms is a vital step for cost-conscious traders. By using official resources, third-party aggregators, and interactive tools, traders can optimize trading costs, improve profitability, and tailor their strategies to their trading style.

Sharing insights, commenting on fee optimization strategies, and forwarding this guide will help the trading community stay informed and maximize efficiency.